Mohicans markets:December 6-European Perspective

Abstract:On Tuesday, December 06, Beijing time, during the Asian and European session, spot gold rally blocked and is currently trading at $ 1770.11 per ounce. After the US non-farm payrolls data for November came out last week, the US ISM non-manufacturing PMI data for November came out on Monday with a very strong performance, intensifying market concerns that the Federal Reserve may accelerate interest rate hikes.

Market Overview

On Tuesday, December 06, Beijing time, during the Asian and European session, spot gold rally blocked and is currently trading at $ 1770.11 per ounce. After the US non-farm payrolls data for November came out last week, the US ISM non-manufacturing PMI data for November came out on Monday with a very strong performance, intensifying market concerns that the Federal Reserve may accelerate interest rate hikes. This helped the dollar index hold on to key support near the nearly five-month low of 104.63. In the short term, there are opportunities for the dollar index to rebound further, which puts gold prices at risk of further pullbacks.

U.S. crude oil shocks slightly lower and is currently trading near $77.40 per barrel. The favorable impact of the relaxation of epidemic control by Asian powers has receded and the rebound of the dollar has put oil prices under pressure; OPEC+ did not expand the scale of production cuts at the end of last week, and the EU has a higher oil price ceiling for Russia, and concerns about crude oil supply disruptions due to the Russian export price ceiling have receded, exposing oil prices to further downside risks in the short term.

This trading day is less on economic data, keep an eye on API crude inventory series, the US trade data for October, the EU finance ministers meeting and news related to the Russia-Ukraine geopolitical situation.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on December 5, 2022 Beijing time.

Technical Analysis

CME Group options layout changes (February Futures Price):

1850 Bullish decreased sharply, bearish increased, strong resistance

1825 Bullish increased, bearish unchanged, resistance

1800 Bullish increased slightly, bearish increased sharply, resistance

1750 Bullish decreased, bearish increased, short target

1740 Bullish unchanged, bearish decreased sharply, support

1700 Bullish unchanged, bearish increased sharply, short target

Order flow key point marking (Spot Price):

1806-1810 Double top resistance area

1794 Support turned to resistance

1785 PM data after the release of the starting point, the strong side

1778 Last Friday's NFP low, hourly M-top neckline level

1773-1766 Important defensive zone

1747 Low end of fluctuating range, Powell's speech rally level, key support

1730-1735 Key support

Note: The above strategy was updated at 15:00 on December 6. This policy is a daytime policy. Please pay attention to the policy release time.

CME Group options layout changes (February Futures Price):

23 Bullish increased sharply and the stock was large, bearish increase slightly, long target

22.5 Bullish increased slightly, bearish increased sharply, resistance level

22 Bullish decreased slightly, bearish increased sharply, short target and support

21.5 Bullish decreased slightly, bearish decreased sharply and the stock was large, key support

Order flow key point marking (Spot Price):

24.85-25 Long target

24.45-24.57 Secondary resistance

24-24.17 March double top neckline level, key resistance area

23.4-23.6 Resistance range during the day

23 Resistance level

22.6 Data release starting point

22.2-22.3 Key support, loss will break uptrend

21.55 Powell's speech starting point, key support

21.3 Support level

Note: The above strategy was updated at 15:00 on December 6. This policy is a daytime policy. Please pay attention to the policy release time.

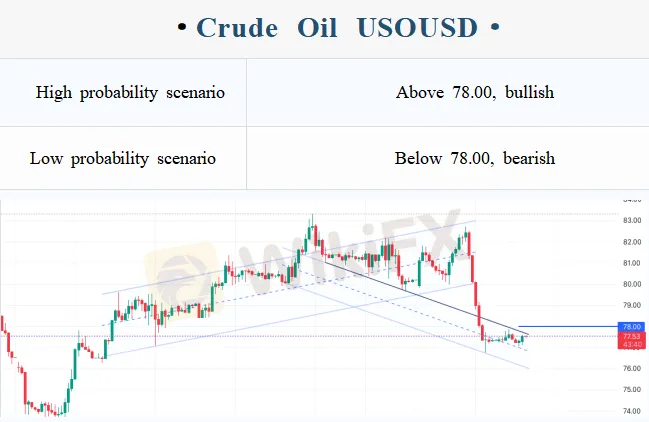

Change of CME Group's option layout (Futures price in January):

82.5 Bullish increased significantly, bearish decreased slightly, long target

80-82 Bullish and bearish increased significantly, with long short competition and resistance zone

78 Bullish increased significantly, bearish decreased, and breakthroughs can be made

76.5-77 Bullish slightly increased, bearish sharply reduced, weakening the ability to take action

75 Bullish slightly increased, bearish sharply decreased, support level

73.5-74 Bullish slightly increased, bearish sharply increased, short target area

Key point marking of order flow (Futures price in January):

82.4 Resistance level

79.6-80 Top bottom transition, from support position to resistance position

78.2 Short line resistance at the lower edge of the early stage shock interval

77-77.2 Strong support area

76.3 Support position

74.7-75.2 Key support

73.6 Low support in November

Note: The above strategy was updated at 15:00 on December 6. This policy is a daytime policy. Please pay attention to the policy release time.

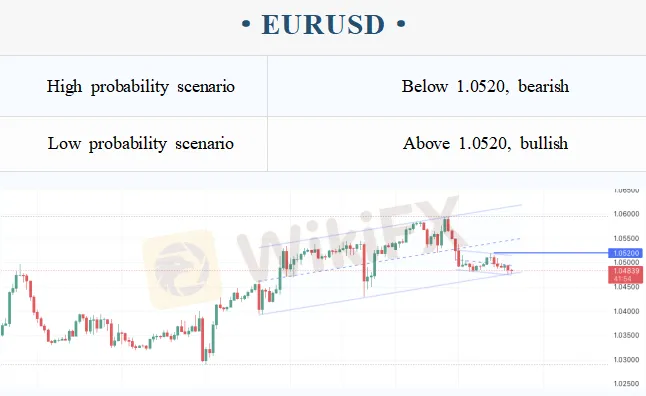

CME Group data today:

1.06 Bullish slightly reduced, but the stock was large, and bearish increased. Bullish targets and resistance

1.0525 Bullish increased significantly, bearish increased, rebound target and resistance

1.05 Bullish sharply reduced, bearish slightly increased and the stock was large, the first resistance

1.045 Bullish slightly decreased, bearish significantly increased, and fell back on the target

1.04 Bullish slightly increased and stocks were large, while bearish sharply decreased, which was an important support

1.035 Bullish unchanged, bearish increased, short target

Note: The above strategy was updated at 15:00 on December 6. This policy is a daytime policy. Please pay attention to the policy release time.

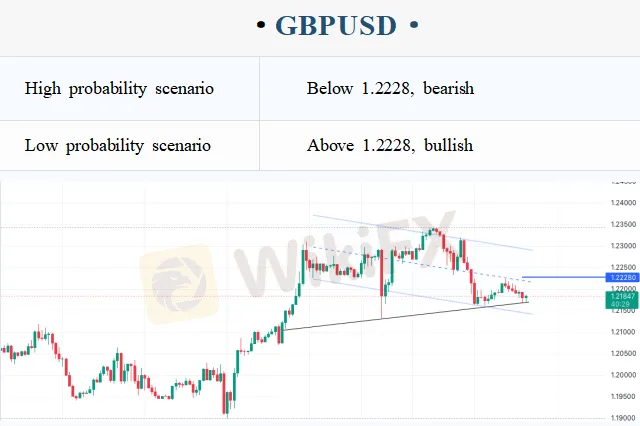

CME Group data today:

1.235 Bullish slightly increased, bearish unchanged, long target

1.23 Bullish unchanged, bearish slightly increased, next resistance

1.225 Bullish slightly decreased, bearish slightly increased, resistance level

1.22 Bullish slightly increased, bearish increased, competing for position

1.215 Bullish unchanged, bearish decreased slightly, and the fall back target

1.21 Bullish unchanged, but the stock was large, and bearish slightly increased, with short target and support

1.205 Bullish unchanged, bearish increased, next short target

Note: The above strategy was updated at 15:00 on December 6. This policy is a daytime policy. Please pay attention to the policy release time.

Statement|Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:MHM European Market

Spot gold weakened slightly during the Asian session on Thursday (April 6), hitting a two-day low of $2007.89 per ounce and now trading near $2014.15. A series of weak economic data has fueled fears of an impending recession in the US, giving safe-haven support to the dollar. And some dollar shorts took profits, and gold bulls also took profits ahead of Good Friday and the non-farm payrolls data, putting pressure on gold prices.

Mohicans markets:MHM Today News

On Wednesday, as the less-than-expected March "ADP" data and non-manufacturing PMI data fueled market concerns about an economic slowdown and spurred bets that the Federal Reserve could slow interest rate hikes. Spot gold continued to brush a new high since March last year, which was the highest intraday to $2032.13 per ounce, and then retracted most of the day's gains, finally closing up 0.01% at $2020.82 per ounce; spot silver hovered around $25 during the day, finally closing down 0.21% at $2

Mohicans markets:MHM European Market

Spot gold oscillated slightly lower during the Asian session on Tuesday (April 4) and is currently trading around $1980.13 per ounce. The dollar index rebounded mildly after a big drop overnight, putting pressure on gold prices. However, this week will see the non-farm payrolls report, there is no important economic data out on Tuesday, and the market wait-and-see sentiment is getting stronger.

Mohicans markets :MHM Today News

On Monday, in OPEC + members unexpectedly cut production reignited market concerns about long-term inflation and sparked uncertainty about the Fed's response, the dollar index once up to the 103 mark, and then on a "vertical roller coaster", giving back all the gains of the day and once lost 102 mark, finally closed down 0.53% at 102.04; U.S. 10-year Treasury yields rose and then fell, as data showed that the U.S. economy continues to slow, it fell sharply in the U.S. session, and once to a low

WikiFX Broker

Latest News

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc