Rad Forex

Abstract:Rad Forex is allegedly a forex broker registered in Seychelles.

Note: Rad Forex is to operate via the website - https://www.rad-forex.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

Rad Forex is allegedly a forex broker registered in Seychelles.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its trading assets, leverage, spreads, trading platforms, minimum deposit, etc.

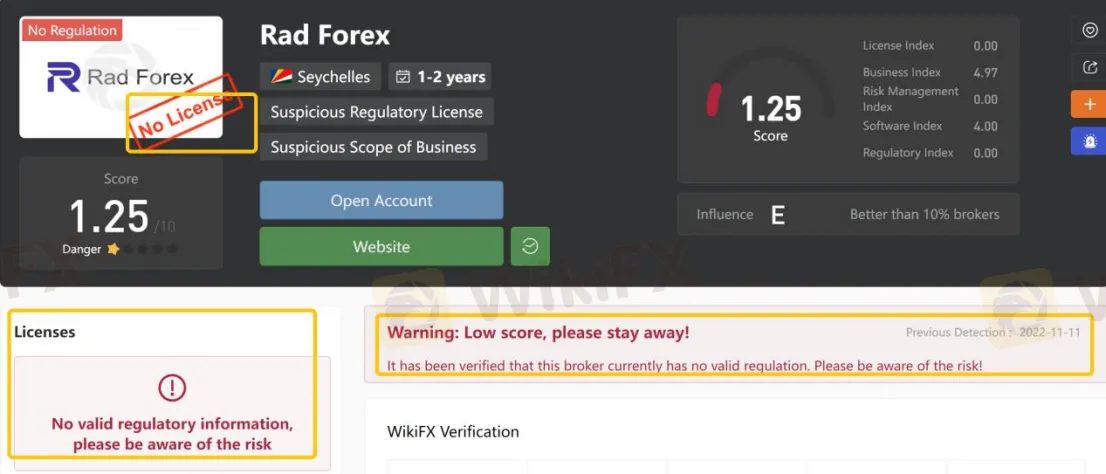

As for regulation, it has been verified that Rad Forex currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.25/10. Please be aware of the risk.

Market Instruments

Rad Forex advertises that it is a forex broker that mainly offers forex trading. However, more specific information about tradable assets cannot be found on the Internet.

Customer Support

Unluckily, we didn‘t find any useful information about Rad Forex’s customer support on the Internet. Generally, regulated brokers will reveal their telephone numbers, email or company address to let their clients get in touch with them.

Pros & Cons

| Pros | Cons |

| N/A | • No regulation |

| • Website inaccessible |

Frequently Asked Questions (FAQs)

| Q 1: | Is Rad Forex regulated? |

| A 1: | No. It has been verified that Rad Forex currently has no valid regulation. |

| Q 2: | Is Rad Forex a good broker for beginners? |

| A 2: | No. Rad Forex is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Read more

IronFX Review 2025: Is This Broker Trustworthy or a Scam?

Discover our comprehensive 2025 IronFX review. Explore account types, trading performance, regulation, and user feedback to determine if this broker is trustworthy or a potential scam. Updated June 13, 2025.

Forex Trading Challenges in India

Explore this guide to understand the challenges that deter India's forex market from unleashing its true potential.

The Deepening Roots of Forex Scams in India

Check out how forex scams in India have expanded beyond banks and unregistered brokers to include the informal gang racket duping investors every day.

Important Statement on the Authenticity of WikiFX Score and Broker Reviews

WikiFX is committed to enhancing transparency and security in the forex industry through technological means and publicly available data. We firmly believe that fair information disclosure and a scientific evaluation system can genuinely safeguard investors’ rights and boost the healthy development of the industry.

WikiFX Broker

Latest News

Safe-Haven Surge: Gold Shines Amid Market Turmoil

Why Your Stop Loss Keeps Getting Hit & How to Fix It

Indian "Finfluencer" Asmita Patel Banned: SEBI Slaps Charges on Her Company, AGSTPL

HDFC Bank's Green Push: Empowering 1,000 Villages with Solar Energy

MetaQuotes Rolls Out MT5 Build 5120 with Enhanced Features and Stability Fixes

Advantages of Using EA VPS for Trading - Detailed Guide

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

Eightcap Secures Dubai License to Expand in MENA Operation

Important Statement on the Authenticity of WikiFX Score and Broker Reviews

The Deepening Roots of Forex Scams in India

Rate Calc