Mohicans markets:European Perspective

Abstract:On Tuesday, October 25, during the Asian session, spot gold narrowly oscillated, and is currently trading near $ 1648 per ounce; the market reduced expectations for the Federal Reserve to raise interest rates in December by 75 basis points, U.S. bond yields fell slightly, providing support to gold prices.

On Tuesday, October 25, during the Asian session, spot gold narrowly oscillated, and is currently trading near $ 1648 per ounce; the market reduced expectations for the Federal Reserve to raise interest rates in December by 75 basis points, U.S. bond yields fell slightly, providing support to gold prices; but the market is expected this week, the European Central Bank is likely to raise interest rates by 75 basis points, which is expected to come out this week, the U.S. third-quarter GDP will rise year-on-year 2.1%; U.S. PCE for September will also be at a high level, making the bulls wary; U.S. crude oil narrowly oscillated, and is currently trading near $84.77 per barrel; OPEC+ news this week is relatively small, the market wait-and-see sentiment is strong. On the one hand, the poor performance of PMI data for October in Europe and the United States on Monday increased market concerns about the global recession and the outlook for crude oil demand; but on the other hand, market expectations of a 75 basis point Fed rate hike in December weakened, and stock markets in Europe and the United States generally rose, again providing support for oil prices.

Mohicans Markets strategies are for information purposes only and are not intended as investment advice, please read the disclaimer at the end of the article. The following strategies were updated on October 25, 2022 at 15:30 BST.

Technical Analysis

CME Group options layout changes (December Futures Price):

20 Bullish decrease but the stock is large, bearish unchanged, key resistance

19.75 Bullish decrease slightly, bearish unchanged, resistance

19.5 Bullish increase slightly, bearish decreasing, long target

19.2 Bullish increase, bearish increase slightly, support

19 Bullish decrease, bearish increase slightly, short target and support

18.75 Bullish unchanged, bearish decrease slightly, support

Order flow key point marking (Spot Price):

19.9-20 Trend key resistance

19.7 Resistance in a day

19.38 Resistance

19 Key support in a day

18.6 First support level, break below 18-18.3 important support area

18-18.3 Important support area

Note: The above strategy was updated at 15:00 on October 25. The strategy is a daytime strategy, please note the strategy release time.

CME Group options layout changes (December Futures Price):

20 Bullish decrease but the stock is large, bearish unchanged, key resistance

19.75 Bullish decrease slightly, bearish unchanged, resistance

19.5 Bullish increase slightly, bearish decreasing, long target

19.2 Bullish increase, bearish increase slightly, support

19 Bullish decrease, bearish increase slightly, short target and support

18.75 Bullish unchanged, bearish decrease slightly, support

Order flow key point marking (Spot Price):

19.9-20 Trend key resistance

19.7 Resistance in a day

19.38 Resistance

19 Key support in a day

18.6 First support level, break below 18-18.3 important support area

18-18.3 Important support area

Note: The above strategy was updated at 15:00 on October 25. The strategy is a daytime strategy, please note the strategy release time.

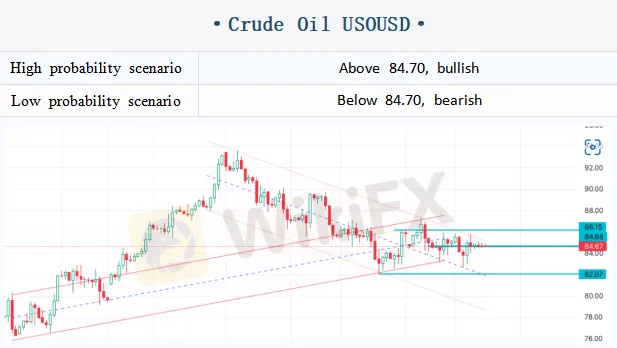

Key point marking of order flow (futures price in December):

90 Bullish increased significantly and stocks were large, while bearish decreased but stocks were large, with a long target

88 Bullish increased, bearish unchanged, long target and resistance

84.5-85 Bullish greatly reduced but the stock was large, put options+265 lots and the stock was large, and the resistance range

82 Bullish slightly reduced, bearish sharply increased, short target

80 Bullish decreased significantly but the stock was large; bearish decreased significantly but the stock was large, the key support

Order flow key point marking:

88.6-89 Key resistance during the day

87 Key resistance in short term, breakthrough look at88.6-89

86 First resistance during the day

84 First support

82.6 Support during the day

81.24-81.8 Key support, breakthrough likely to open a new round of downward movement

80 Key position

Note: The above strategy was updated at 15:00 on October 25. This policy is a daytime policy. Please pay attention to the policy release time.

1.00 Bullish sharply reduced, but the stock was large, while bearish slightly increased, with long target and resistance

0.995 Bullish decreased, bearish increased significantly, next resistance

0.99 Bullish slightly decreased, bearish slightly increased and stocks were large, the first resistance

0.985 Bullish slightly increased, bearish slightly decreased, but the stock was large, and the fall back target was also a support

0.98 Bullish unchanged, but the stock was large, and the bearish slightly reduced, the important support

0.975 Bullish slightly increased, bearish slightly decreased, but the stock was large, short target and support

Note: The above strategy was updated at 15:00 on October 25. This policy is a daytime policy. Please pay attention to the policy release time.

Changes of CME Group's option layout:

1.15 Bullish decreased but stock was large, bearish unchanged, and long target and resistance

1.14 Bullish unchanged, bearish slightly increased, and the next resistance

1.135 Bullish slightly reduced but the stock was large, bearish unchanged, rebound target and resistance

1.132 Bullish unchanged, bearish slightly increased, the first resistance

1.125-1.127 Bullish slightly decreased, but the stock was large. Bullish slightly increased, and the support was weakened

1.12 Bullish unchanged, bearish reduced but the stock was large, and the short target was also supported

1.11 Bullish decreased, bearish slightly increased and the stock was large, the next short target

Note: The above strategy was updated at 15:00 on October 25. This policy is a daytime policy. Please pay attention to the policy release time.

Special explanations:

This paper involves the key point marking and technical analysis of spot gold, spot silver and US crude oil. Refer to the change data of options positions published on the official website of CME and the average order flow change data of large brokers in the industry. Starting from the market chip distribution, it is more accurate to mark the market trading sentiment within the important price range.

The order flow mainly refers to the following Oder Book data updated every 20 minutes, taking XAUUSD international gold as an example:

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

Read more

Mohicans markets:MHM European Market

Spot gold weakened slightly during the Asian session on Thursday (April 6), hitting a two-day low of $2007.89 per ounce and now trading near $2014.15. A series of weak economic data has fueled fears of an impending recession in the US, giving safe-haven support to the dollar. And some dollar shorts took profits, and gold bulls also took profits ahead of Good Friday and the non-farm payrolls data, putting pressure on gold prices.

Mohicans markets:MHM Today News

On Wednesday, as the less-than-expected March "ADP" data and non-manufacturing PMI data fueled market concerns about an economic slowdown and spurred bets that the Federal Reserve could slow interest rate hikes. Spot gold continued to brush a new high since March last year, which was the highest intraday to $2032.13 per ounce, and then retracted most of the day's gains, finally closing up 0.01% at $2020.82 per ounce; spot silver hovered around $25 during the day, finally closing down 0.21% at $2

Mohicans markets:MHM European Market

Spot gold oscillated slightly lower during the Asian session on Tuesday (April 4) and is currently trading around $1980.13 per ounce. The dollar index rebounded mildly after a big drop overnight, putting pressure on gold prices. However, this week will see the non-farm payrolls report, there is no important economic data out on Tuesday, and the market wait-and-see sentiment is getting stronger.

Mohicans markets :MHM Today News

On Monday, in OPEC + members unexpectedly cut production reignited market concerns about long-term inflation and sparked uncertainty about the Fed's response, the dollar index once up to the 103 mark, and then on a "vertical roller coaster", giving back all the gains of the day and once lost 102 mark, finally closed down 0.53% at 102.04; U.S. 10-year Treasury yields rose and then fell, as data showed that the U.S. economy continues to slow, it fell sharply in the U.S. session, and once to a low

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc