City Index

Abstract: City Index, a trading name of StoneX Financial Ltd, is allegedly a global Spread Betting, FX and CFD provider established in the United Kingdom in 1983, offering 13,500+ markets with variable spreads from 0.5 points on the Mobile trading app, WebTrader, TradingView and MT4 trading platforms, as well as a choice of two different account types and 24/5 customer support service.

| Quick City Index Review Summary | |

| Founded | 1983 |

| Registered Country/Area | United Kingdom |

| Regulation | FCA |

| Tradable Assets | 13,500+, indices, shares, forex, gold/silver, commodities, futures, bonds, options, interest rates, thematic indices |

| Demo Account | ✅ (£10,000 in virtual funds for 12 weeks) |

| Account Types | Standard, MT4 |

| Min Deposit | $0 |

| Leverage | Up to 1:500 for clients outside the UK and Australia |

| EUR/USD Spread | Floating around 1.3 pips |

| Trading Platforms | Mobile trading app, WebTrader, TradingView, MT4 (web, desktop, mobile) |

| Payment Methods | Visa, MasterCard, Maestro and Electron, Bank transfer |

| Deposit Fee | ❌ |

| Withdrawal Fee | ❌ |

| Inactivity Fee | £12 charged if inactive for 12 months or more |

| Customer Support | 24/5 |

City Index Information

City Index, a trading name of StoneX Financial Ltd, is allegedly a global Spread Betting, FX and CFD provider established in the United Kingdom in 1983, offering 13,500+ markets with variable spreads from 0.5 points on the Mobile trading app, WebTrader, TradingView and MT4 trading platforms, as well as a choice of two different account types and 24/5 customer support service.

Pros and Cons

| Pros | Cons |

| Regulated by FCA (Financial Conduct Authority) | Limited contact options |

| Wide range of tradable assets | |

| Demo accounts available | |

| MT4 platform | |

| Advanced trading tools and features | |

| No minimum deposit requirement | |

| No fees for deposits and withdrawals |

Is City Index Legit?

Yes. City Index is regulated by Financial Conduct Authority (FCA).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | StoneX Financial Ltd | Market Making(MM) | 446717 |

Market Instruments

City Index advertises that it offers spread betting, forex and CFD trading and it can give access to 13,500+ markets including indices, shares, forex, gold/silver, commodities, futures, bonds, options, interest rates, and thematic indices.

| Asset Class | Supported |

| Indices | ✔ |

| Shares | ✔ |

| Forex | ✔ |

| Gold/Silver | ✔ |

| Commodities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| Options | ✔ |

| Interest Rates | ✔ |

| Thematic Indices | ✔ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

Account Types/Fees

City Index offers two account types, Standard and MT4. Both are available for demo accounts.

| Account Type | Spread | Commission |

| Standard | From 0.8 points | From 0.5 points |

| MT4 | ❌ | ❌ (except shares) |

How to Open an Account?

To open an account with City Index, you can follow these steps:

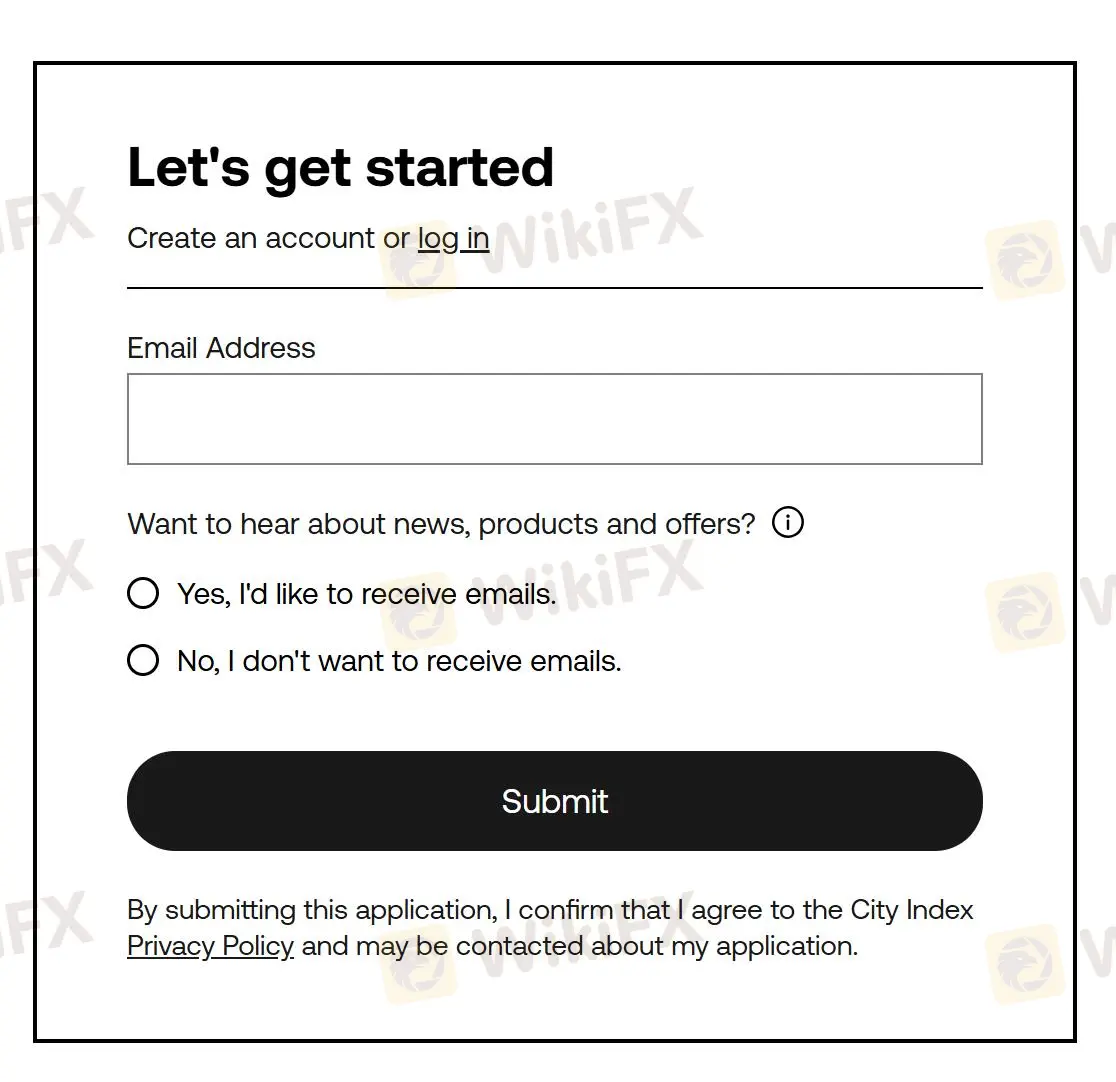

Step 1: Click “Open account” button on City Index's homepage.

Step 2: Now you need to fill in your email address. Additionally, there is an option to subscribe to receive news, product updates, and offers via email. You can choose whether you'd like to receive these emails or not.

Step 3: After entering your email address and making your email preferences selection, you will need to confirm your agreement to the City Index Privacy Policy and the possibility of being contacted about your application.

Step 4: The next steps typically involve providing personal details, such as your name, address, and additional information about yourself, as requested on the application form.

Step 5: Complete the application form by filling in all the required fields with accurate information.

Step 6: Review the information you have provided to ensure its accuracy and completeness.

Step 7: Once you are satisfied with the details you have entered, click on the “Complete Application” button or a similar option to submit your application.

Leverage

The maximum leverage provided by City Index is as high as 1:500 (for clients outside the UK and Australia). It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Trading Platforms

Platforms available for trading at City Index are the Mobile trading app and WebTrader, as well as the world's most advanced and popularly-used MetaTrader4 and TradingView.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile trading app | ✔ | Mobile | / |

| WebTrader | ✔ | Web, Mobile, Desktop | / |

| TradingView | ✔ | Web, Desktop | / |

| MT4 | ✔ | Web, Mobile, Desktop | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

City Index accepts payments via Visa, MasterCard, Maestro and Electron, and Bank transfer.

No fees charged for deposits and withdrawals.

Read more

Plus500 Allegations Exposed in Real Trader Cases

Plus500 allegations revealed: trader complaints, withdrawal delays, and regulatory oversight explained in detail.

Upway Broker Scam: Trade Manipulation Exposed!

Upway Scam Alert: Broker faces backlash for backend manipulation, severe slippage, and withdrawal blocks. Real trader exposures uncovered.

ACY SECURITIES Review: Do Traders Face Withdrawal Discrepancies, Forced Liquidation and Poor Support

Does ACY SECURITIES wipe out your trading gains in the name of scalping arbitrage? Do you find their demand for inventory fees illegitimate? Do you sense a Ponzi scam-like investment when trading through the broker? Have you faced a forced liquidation of your forex positions by ACY SECURITIES? There have been a plethora of forex trading complaints against the broker. Read on as we share the ACY SECURITIES review in this article.

Wayone Capital Exposed: Withdrawal Denials, Poor Refundable Policy & Fund Scams Take Centrestage

Failed to receive funds despite initiating the Wayone Capital withdrawal request? Have you found the broker’s refundable policy manipulative? Did Wayone Capital block your investment fund? Do you constantly face technical issues at Wayone Capital? Many traders have vehemently opposed these scam-like tactics on broker review platforms. In this Wayone Capital review article, we have shared many such complaints. Take a look!

WikiFX Broker

Latest News

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Plus500 Allegations Exposed in Real Trader Cases

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

HEADWAY: The Fast Track to Financial Dead-Ends?

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

Capital.com Applies for South Africa Trading Licence

RM1.3Mil Gone in Days: JB Kinder Boss Falls for Online “Investment”

SupremeFX Review 2025: Regulatory Status, License Check, and User Complaints

The US Manufacturing Sector Wins While Net Zero Destroys Industry Elsewhere

Rate Calc