Capitalcore-Some Important Details about This Broker

Abstract:Registered in the United Kingdom, Capitalcore is an unregulated service provider. It offers access to a diverse range of market instruments, including forex, binary options, cryptocurrencies, indices, and stocks. The platform provides a demo account for practice trading and supports high leverage of up to 1:2000. Trading is conducted through dedicated platforms for binary options and forex. However, details about spreads are not provided.

| CapitalcoreReview Summary | |

| Founded | 2009 |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Market Instruments | Forex, Binary Options, Cryptocurrencies, Indices, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | / |

| Trading Platform | Binary Options Platform, Forex Trading Platform |

| Minimum Deposit | $10 |

| Customer Support | Live Chat, Contact Form |

| Email: info@capitalcore.com | |

| Phone: +1 (623)920-0100 | |

| Social Media: Facebook, Instagram, YouTube, Twitter | |

Capitalcore Information

Registered in the United Kingdom, Capitalcore is an unregulated service provider. It offers access to a diverse range of market instruments, including forex, binary options, cryptocurrencies, indices, and stocks. The platform provides a demo account for practice trading and supports high leverage of up to 1:2000. Trading is conducted through dedicated platforms for binary options and forex. However, details about spreads are not provided.

Pros & Cons

| Pros | Cons |

| Demo account available | No regulation |

| Diverse trading products | Unknown spreads |

| Various contact channels | Withdrawal fee charged |

| Four account types | |

| 40% deposit bonus |

Is Capitalcore Legit?

Capitalcore operates as an unregulated platform. Trading activities on this platform may not be safe for you.

What Can I Trade on Capitalcore?

Capitalcore offers trading opportunities in Forex, Indices, Stocks & Equities, and Cryptocurrencies. Additionally, the platform provides binary options, a fixed-reward trading instrument where traders predict the next price movement by choosing between two outcomes, whether the price will be above or below a specified level.

| Tradable Instruments | Supported |

| forex | ✔ |

| cryptocurrencies | ✔ |

| indices | ✔ |

| stocks | ✔ |

| options | ✔ |

| commodities | ❌ |

| funds | ❌ |

| ETFs | ❌ |

| bonds | ❌ |

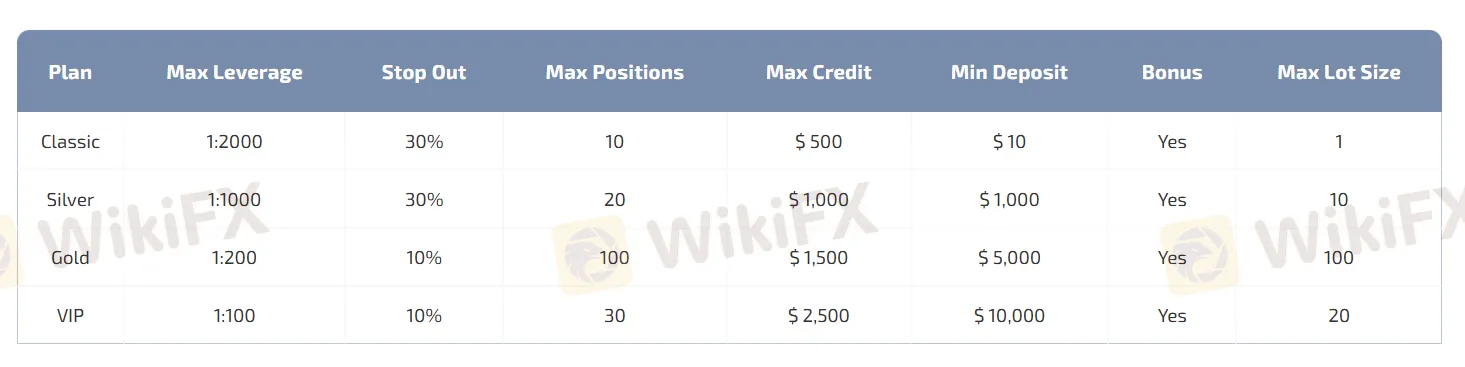

Account Types

There are four account types available on Capitalcore: Classic, Silver, Gold, and VIP. Each comes with distinct features. Capitalcore also offers a demo account for traders to test out the platform without risking any money.

| Classic | Silver | Gold | VIP | |

| Minimum Deposit | $10 | $1,000 | $5,000 | $10,000 |

| Maximum Leverage | 1:2000 | 1:1000 | 1:200 | 1:100 |

| Stop Out | 30% | 30% | 10% | 10% |

| Maximum Credit | $500 | $1,000 | $1,500 | $2,500 |

| Bonus | Yes | Yes | Yes | Yes |

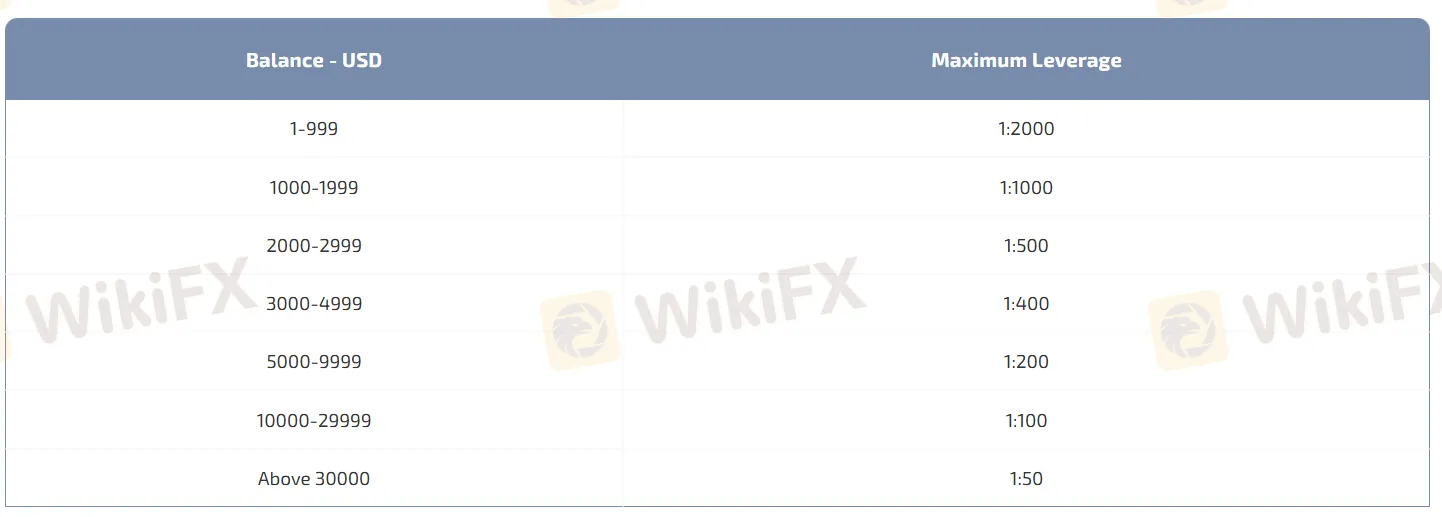

Leverage

Capitalcore provides varying levels of leverage, depending on the asset class and the trader's account balance, with a maximum leverage of up to 1:2000.

| Balance - USD | Maximum Leverage |

| 1-999 | 1:2000 |

| 1000-1999 | 1:1000 |

| 2000-2999 | 1:500 |

| 3000-4999 | 1:400 |

| 5000-9999 | 1:200 |

| 10000-29999 | 1:100 |

| Above 30000 | 1:50 |

Trading Platform

Capitalcore claims to offer multiple trading platforms, including a Binary Options Platform and a Forex Trading Platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| Binary Options Platform | ✔ | Desktop, Mobile | / |

| Forex Trading Platform | ✔ | Desktop, Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

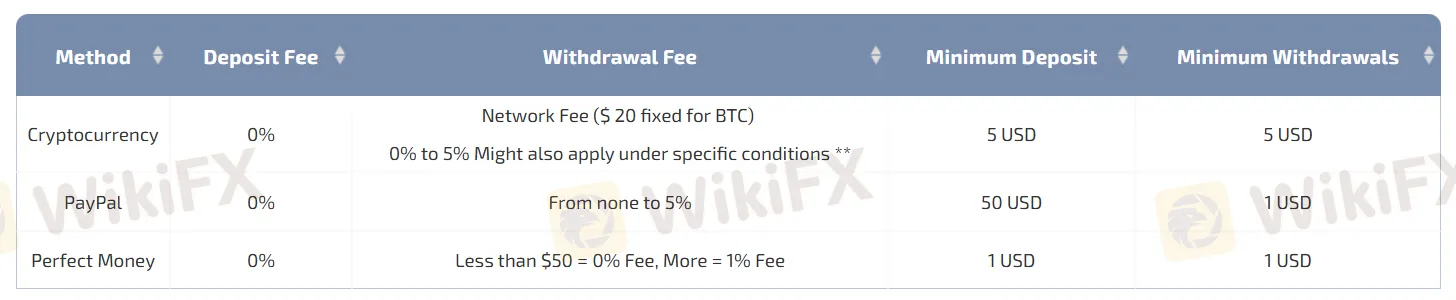

Deposit and Withdrawal

Here are all the payment methods available on this platform: Mastercard, Visa, PayPal, Perfect Money, Bitcoin (BTC), and Ethereum (ETH).

| Payment Options | Minimum Deposit | Deposit Fee | Minimum Withdrawals | Withdrawal Fee |

| Cryptocurrency | 5 USD | 0% | 5 USD | Network Fee ($20 fixed for BTC) 0% to 5% Might also apply under specific conditions |

| PayPal | 50 USD | 0% | 1 USD | From none to 5% |

| Perfect Money | 1 USD | 0% | 1 USD | Less than $50 = 0% Fee, More = 1% Fee |

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

Eurozone Economy Stalls as Demand Evaporates

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Rate Calc