Neptune Securities-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Neptune Securities, a trading name of Neptune Securities LTD, is allegedly an STP broker and financial provider involving online financial and trading services. It is established in 2009 and is located in Sydney, Australia. The broker claims to provide its clients with various trading financial instruments with leverage up to 30:1 and the leading MetaTrader4 trading platforms, as well as a choice of two different live account types.

General Information & Regulation

Neptune Securities, a trading name of Neptune Securities LTD, is allegedly an STP broker and financial provider involving online financial and trading services. It is established in 2009 and is located in Sydney, Australia. The broker claims to provide its clients with various trading financial instruments with leverage up to 30:1 and the leading MetaTrader4 trading platforms, as well as a choice of two different live account types. Here is the home page of this brokers official site:

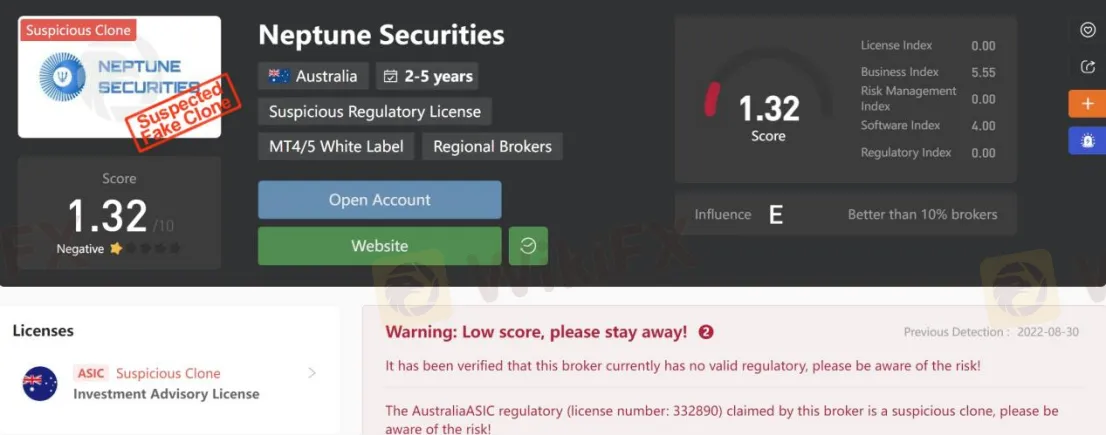

As for regulation, Neptune Securities presents it is authorized and regulated by the Australian Securities & Investments Commission (ASIC), and currently holding an Australian Financial Services Licensee (License No: 332890). However, it has been verified that the license Neptune Securities holds is suspicious clone. That is why its regulatory status on WikiFX is listed as “Suspected Fake Clone” and it receives a relatively low score of 1.32/10. Please be aware of the risk.

Market Instruments

Neptune Securities advertises that it mainly offers access to three different asset classes, including forex, commodities and indices.

Account Types

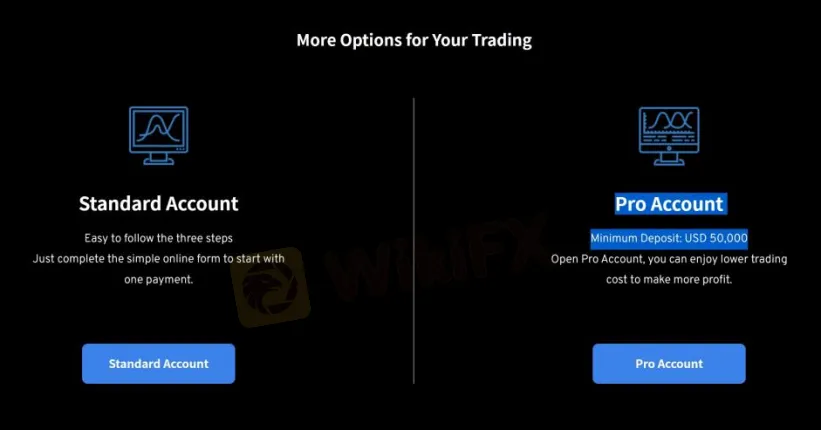

Neptune Securities claims to offer two types of trading accounts, namely Standard and Pro. The minimum initial deposit amount to open a Standard account is unrevealed, while the Pro account requires the minimum initial capital requirement of $50,000.

Leverage

A leverage ratio of up to 30:1 is offered by Neptune Securities. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Trading Platform Available

The platform available for trading at Neptune Securities is the worlds most widely-used MetaTrader4, compatible with PC, iOS, Mac and Android terminals. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Customer Support

Neptune Securities customer support can be reached by WhatsApp (Neptune FX) or email: service@neptunefx.com.au. Company address: Suite 706, 1-5 Railway Street, Chatswood NSW 2067.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

UFX Partners Review: Traders Allege Fund Scams and Withdrawal Issues

UFX Partners, a UK-based forex broker, has been flagged by many traders as a scam forex broker. Frequent reports of profit deletions, withdrawal blocks, and alleged fund scams are trending on several broker review platforms. Some traders reportedly lost all of their life savings due to the broker’s illegitimate trading activities. In this UFX Partners review article, we have highlighted numerous allegations against the broker. Read on!

DeltaFX Scam Alert: Withdrawal Issues Exposed

DeltaFX Scam Alert: User reviews reveal fraud and withdrawal issues. Protect your capital—read the full warning.

Australian Dollar Strengthens on Robust Jobs Data, US Dollar Holds Steady

The Australian Dollar (AUD) advanced against the US Dollar on Thursday after stronger-than-expected employment data reinforced expectations that the Reserve Bank of Australia (RBA) may maintain a tighter monetary policy stance for longer. Meanwhile, the US Dollar remained steady as easing trade tensions offset reduced expectations for near-term Federal Reserve rate cuts.

Angel Broking Review 2026: Is Angel Broking a Safe Broker or a High-Risk Platform?

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc