HashTrade-Overview of Minimum Deposit, Leverage, Spreads

Abstract:HashTrade is a broker engaged in various tradable instruments including forex, CDFs, indices, and commodities. The broker also provides 4 major accounts with a minimum deposit of $500. HashTrade is still risky due to its unregulated status, inaccessible official website, and bad reviews about difficulty withdrawing money.

| HashTradeReview Summary | |

| Founded | 2020-12-17 |

| Registered Country/Region | Dominic |

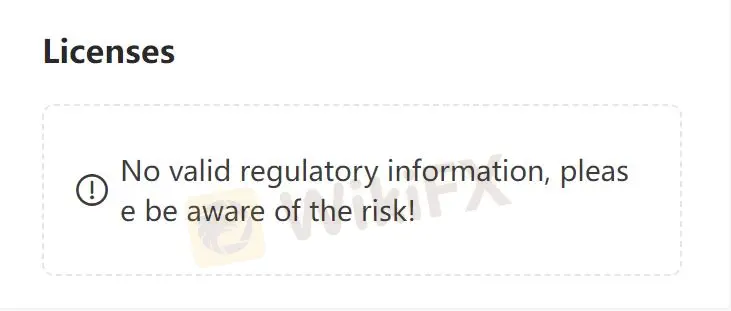

| Regulation | Unregulated |

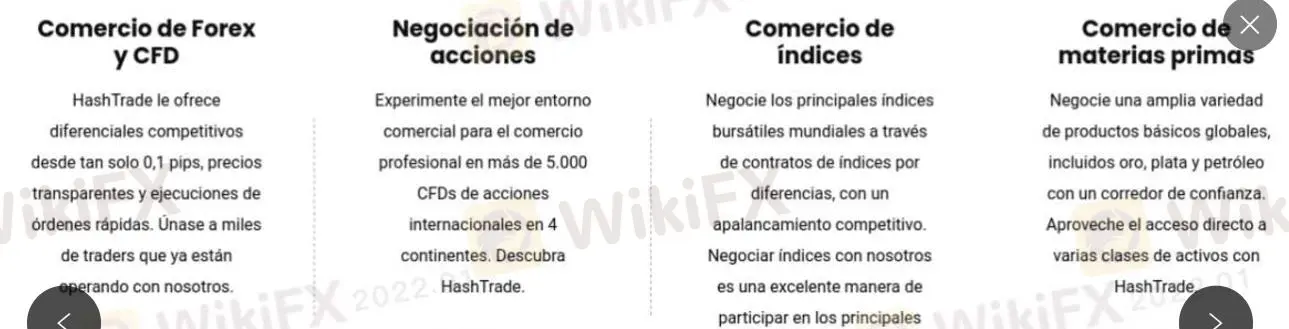

| Market Instruments | Forex, CDFs, Indices, and Commodities |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Min Deposit | $500 |

| Customer Support | Email: compiiance.es@hashtrade.pro |

HashTrade Information

HashTrade is a broker engaged in various tradable instruments including forex, CDFs, indices, and commodities. The broker also provides 4 major accounts with a minimum deposit of $500. HashTrade is still risky due to its unregulated status, inaccessible official website, and bad reviews about difficulty withdrawing money.

Is HashTrade Legit?

HashTrade is not regulated, making it less safe than regulated brokers.

What Can I Trade on HashTrade?

Traders can choose different investment directions because the broker provides forex, CDFs, indices, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| CDFs | ✔ |

| Precious Metals | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

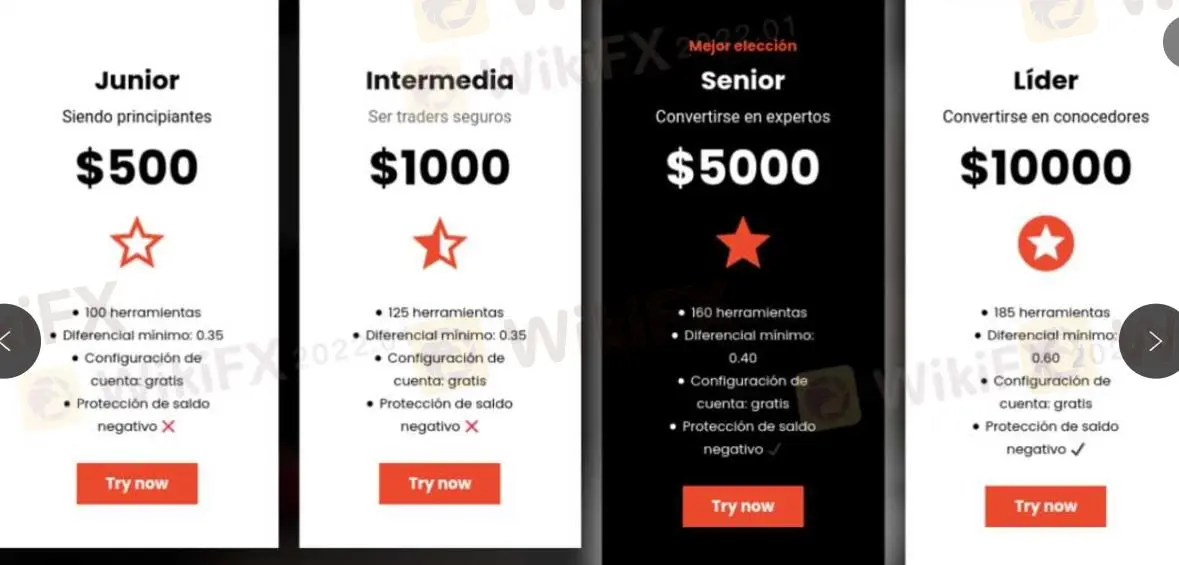

Account Type

HashTrade has four account types with different deposits: Junior, Intermedia, Senior, and Leader. Traders with a small budget can choose a junior account and professional traders can open a leader account.

| Account Type | Junior | Intermedia | Senior | Leader |

| Minimum Deposit | $500 | $1000 | $5000 | $10000 |

Deposit and Withdrawal

The minimum deposit is $500. Deposit and withdrawal methods include MasterCard, VISA, Wire transfer, and more.

Customer Support Options

Traders can contact HashTrade via email instead of phone, which will reduce consultation efficiency because the email responds slowly.

| Contact Options | Details |

| compiiance.es@hashtrade.pro | |

| Supported Language | Kyrgyz, Italian, Spanish |

| Website Language | Kyrgyz, Italian, Spanish |

| Physical Address | / |

Read more

Saxo Launches Margin Financing Accounts in Singapore: What Investors Need to Know

Copenhagen-based multi-asset online broker SAXO Bank has introduced Margin Financing Accounts (also known as margin lending accounts) in its Singapore entity, SAXO Capital Markets. This new feature allows clients to manage investments purchased via margin lending separately from their other trading and investment assets—bringing enhanced flexibility, transparency, and control to active investors and long-term portfolio builders.

UIIC Broker Review: Is It Legit or a Fraud?

In this article, we want to discuss the broker named UIIC, as it recently caught our eye. UIIC is a UK-based broker. This broker, registered in the United Kingdom, claims more than 20 years of operation, a long history in the financial industry, and regulatory oversight from UK authorities. But is UIIC truly safe and trustworthy? How is the regulation? Or are there red flags you should know? This article may offer you clues.

Interactive Brokers UAE Equities Now Live on ADX, DFM

Interactive Brokers UAE equities access unlocks Abu Dhabi Securities Exchange (ADX) trading and Dubai Financial Market (DFM), Interactive Brokers opportunities for global investors. Trade AED-supported stocks with low fees from one platform in the UAE’s booming market.

Pepperstone Secures SCA Category 5 Licence, Expands Dubai Office

Pepperstone gains SCA Category 5 licence in the UAE and expands its Dubai office, reinforcing its position as a regulated forex broker in the Gulf region.

WikiFX Broker

Latest News

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

The TikTok Scam That Cost a Retiree Nearly RM470,000

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

FCA Waning list of Unauthorised firms

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

CommSec Regulation, Login Information & User Review : A Comprehensive Review

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

OneRoyal Review 2025: Multiple Licenses Yet Flooded with Scam Complaints

Rate Calc