EminiFx-Overview of Minimum Deposit, Leverage, Spreads

Abstract:EminiFx is allegedly an investment company, whose website domain “eminifx.com” was privately registered on the 20th of September, 2021 in New York, the USA, claiming to provide its clients with cryptocurrency and forex trading using a Robo-Advisor called RA3, as well as a choice of twelve different investment packages.

Note: Since EminiFxs official site (https://eminifx.com) is not accessible at the time of writing this introduction, only a cursory understanding can be obtained from the Internet.

General Information & Regulation

EminiFx is allegedly an investment company, whose website domain “eminifx.com” was privately registered on the 20th of September, 2021 in New York, the USA, claiming to provide its clients with cryptocurrency and forex trading using a Robo-Advisor called RA3, as well as a choice of twelve different investment packages.

Market Instruments

EminiFx advertises that it mainly offers cryptocurrency and forex trading in financial markets.

Investment Packages

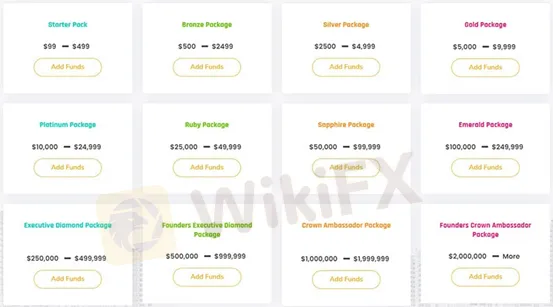

There are twelve investment packages offered by EminiFx, namely Starter, Bronze, Silver, Gold, Platinum, Ruby, Sapphire, Emerald, Executive Diamond, Founders Executive, Crown Ambassador and Founders Crown Ambassador packages. Starting a Starter account requires the minimum investment amount of $99, while the other eleven investment packages with the much higher minimum initial capital requirements of $500, $2,500, $5,000, $10,000, $25,000, $50,000, $100,000, $250,000, $500,000, $1,000,000 and $2,000,000 respectively. Note that all investment packages have a $29.99 fee monthly and from that 30% of the returns are charged from the fees. And if you trade through your account, another $3 to $25 per trade will be charged.

Commissions

EminiFX offers a 9-level referral program for members to earn referral commissions on. Besides, commissions can be earned on Auto Trading (trading revenue), Auto Trading (monthly fee commissions), investment packages, Auto Trading recruitment bonus, Auto Trading Rank Achievement Bonus, Auto trading quarterly profit sharing pool and your account trading commissions.

Trading Platform Available

When it comes to trading platforms available,EminiFX claims to give traders the world‘s most trusted and popular MetaTrader4 platform. However, the broker didn’t offer any real accessible links. The MT4 is known as one of the most successful, efficient, and competent forex trading software, offering an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options.

Deposit & Withdrawal

EminiFX didnt directly disclose any deposit and withdrawal options. The only useful information we get from the Internet is that the broker will charge a 0.5% fee on all deposits and withdrawals.

Fees

Apart from deposit and withdrawal fees, EminiFX also charges some other fees. In particular, the broker will charge a service fee of $49.99 monthly, just like an account maintenance commission.

Customer Support

EminiFxs customer support can be reached by telephone: +6466685538, +447830301375, +12527772131, email: info@eminifx.com. Company address: 31 West 34th Street, New York NY 10001.

Read more

Never Heard of Dynasty Trade? Here's Why You Should Be Worried

Have you heard this name before? No , it’s time you do because staying unaware could cost you. This platform is currently active in the forex trading and has been linked to several suspicious activities. Even if you’ve never dealt with it directly, there’s a chance it could reach out to you through ads, calls, messages, or social media. That’s why it’s important to know the red flags in advance.

Want to Deposit in the EVM Prime Platform? Stop Before You Lose It ALL

Contemplating forex investments in the EVM Prime platform? Think again! We empathize with those who have been bearing losses after losses with EVM Prime. We don't want you to be its next victim. Read this story that has investor complaints about EVM Prime.

WEEKLY SCAM BROKERS LIST IS OUT! Check it now

If you missed this week's fraud brokers list and are finding it difficult to track them one by one — don’t worry! We’ve brought together all the scam brokers you need to avoid, all in one place. Check this list now to stay alert and protect yourself from fraudulent brokers.

Catch the Latest Update on BotBro & Lavish Chaudhary

BotBro, an AI-based trading platform, became popular in India in 2024—but for negative reasons. Its founder, Lavish Chaudhary, who gained a huge following by promoting it heavily on social media. Since then, he has become well-known, but for many controversies. Let’s know the latest update about Botbro & Lavish Chaudhary.

WikiFX Broker

Latest News

Asia-Pacific stocks fall as investors weigh recent trade developments

Is Your Forex Strategy Failing? Here’s When to Change

FSMA Warns That Some Firms Operate as Pyramid Schemes

Apex Trader Funding is an Unregulated Firm | You Must Know the Risks

LVMH shares jump 2.5% after reporting better-than-feared earnings, Texas factory plans

What WikiFX Found When It Looked Into Vestrado

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

eToro Joins Hands with Premiership Women’s Rugby

OctaFX Was Fined $37,000 for Operating Without a License

Hantec Financial: A Closer Look at Its Licenses

Rate Calc