Hantec Financial: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Hantec Financial and its licenses.

Hantec Financial is a forex broker operating under multiple regulatory licenses. It holds a WikiScore of 8.61 out of 10 on WikiFX, a global platform that assesses brokers based on regulatory status, platform performance, and user feedback.

Hantec Financial is licensed in several jurisdictions, including both tier-one and offshore regulatory environments.

In Australia, the broker is regulated by the Australian Securities and Investments Commission (ASIC) under License No. 000326907. ASIC is considered a major financial regulator that oversees financial service providers in Australia.

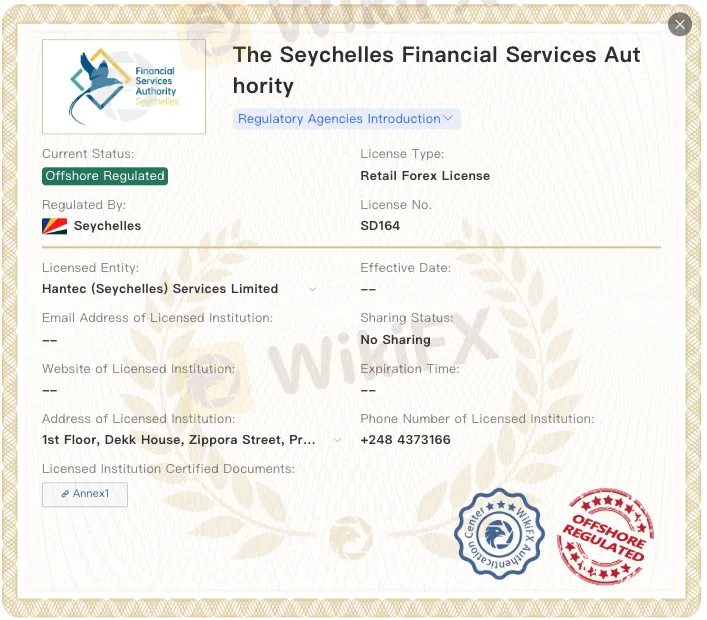

The broker also holds a Retail Forex License issued by the Seychelles Financial Services Authority (FSA), under License No. SD164. The FSA provides regulatory oversight for non-bank financial institutions operating in Seychelles.

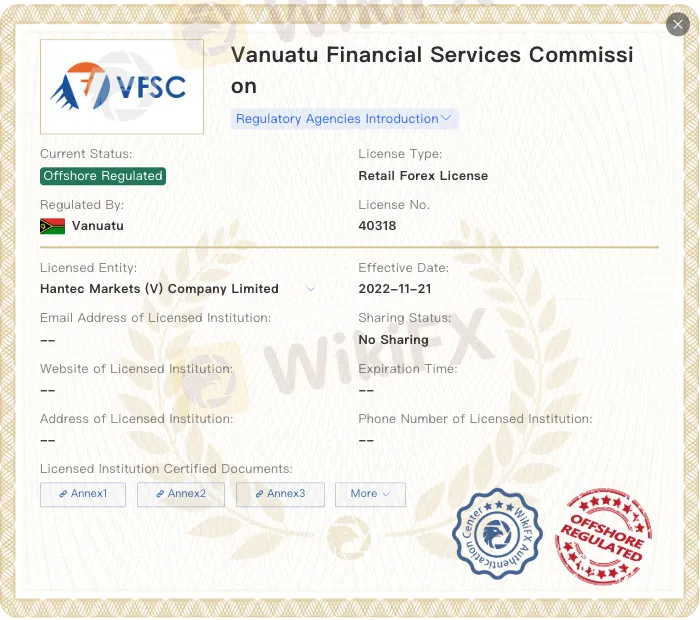

Additionally, Hantec is licensed by the Vanuatu Financial Services Commission (VFSC) under License No. 40318. Like Seychelles, Vanuatu is classified as an offshore jurisdiction and imposes a formal set of requirements for licensed entities.

With both tier-one and offshore licenses, Hantec Financial is positioned to serve a broad international client base. Its ASIC license enables it to operate in highly regulated markets, while its offshore licenses support access to other regions where regulatory requirements may differ.

The brokers WikiFX score of 8.61 is based on factors such as trading environment, platform stability, customer service, and regulatory compliance. The score reflects publicly available information and third-party evaluations.

Conducting due diligence carefully before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Read more

Moomoo Involved Again? Investor Loses RM600,000

A 74-year-old American consultant in Kuala Lumpur lost over RM600,000 after being lured into a fraudulent investment scheme via messaging apps. The scam involved multiple platforms, staged fund transfers to numerous bank accounts, and ultimately blocked withdrawals, highlighting the growing sophistication of online investment fraud and the importance of verification and caution.

Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group UAE & Azerbaijan Scam Case – LATEST

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

BCEL Review 2026: Comprehensive Safety Assessment

Rate Calc