AlphaFXC -Overview of Minimum Deposit, Spreads & Leverage

Abstract:AlphaFXC is allegedly a crypto broker based in Dominica that provides its clients with a web-based trading platform, leverage up to 1:100, variable spreads on cryptocurrencies, as well as a choice of five different account types.

General Information

AlphaFXC is allegedly a crypto broker based in Dominica that provides its clients with a web-based trading platform, leverage up to 1:100, variable spreads on cryptocurrencies, as well as a choice of five different account types.

Market Instruments

AlphaFXC is a crypto broker and the only trading instrument available for trade is cryptocurrency.

Account Types

There are five live trading accounts offered by AlphaFXC, namely Basic, Silver, Gold, Platinum and VIP. Opening a Basic account requires the minimum initial deposit amount of $250, while the other four account types with the much higher minimum initial capital requirements of $2,500, $10,000, $75,000 and $150,000+ respectively.

Leverage

Traders holding different account types can experience quite different maximum leverage ratios. Clients on the Basic account can only experience the leverage of 1:50, while the other four accounts can enjoy the maximum leverage as high as 1:100. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads & Commissions

Spreads and commissions are influenced by what type of accounts traders are holding. AlphaFXC reveals that the minimum spread in the Basic account is 2.4 pips with 5% commission, the Silver account enjoys 2.1 pips with 4% commission, the Gold account enjoys 1.8 pips with 3% commission, the Platinum account enjoys 0.6 pips with 2.5% commission, and the VIP account enjoys 2.2 pips with 1.5% commission.

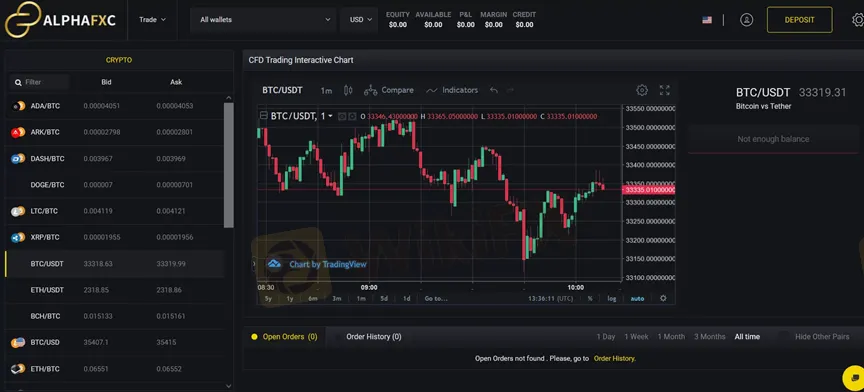

Trading Platform Available

When it comes to trading platforms available, instead of the worlds most widely-used MetaTrader4 and MetaTrader5 platforms, AlphaFXC only gives traders a web-based platform. MT4 and MT5 are both packed with advanced tools such as Expert Advisors, many complex indicators, sophisticated charting tools and a marketplace featuring more than 10,000 apps. While this web-based trading platform is not equipped with these great features.

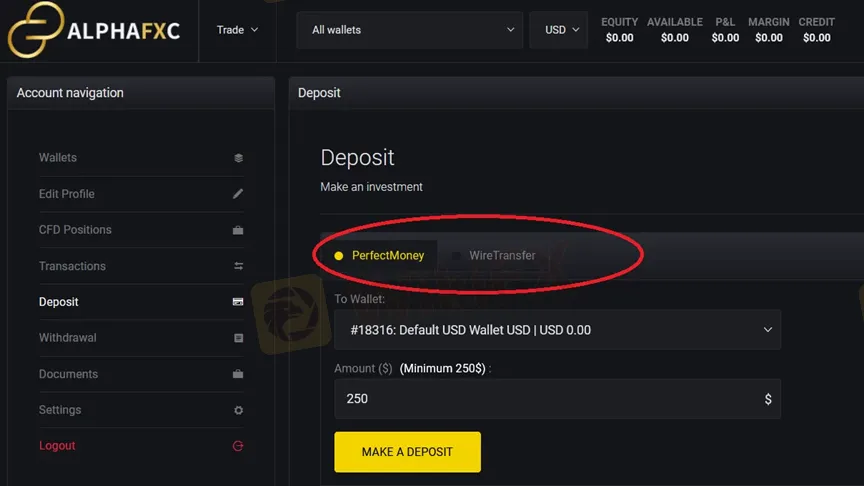

Deposit & Withdrawal

AlphaFXC only accepts payment methods via bank wire and Perfect Money. The minimum deposit amount is $250, while the minimum withdrawal is 100 UST. The broker says that all withdrawal requests will be subject to a 5% fee from the requested withdrawal amount.

Fees

AlphaFXC also takes an inactivity fee. If your trading account does not have trades for two months, it becomes dormant and will be charged an inactivity fee of 10% of the balance or 100 UST.

Customer Support

AlphaFXC‘s customer support can be reached through telephone: 442039894318, email: cs@alphafxc.com. Besides, you can also follow this broker on some social media platforms like Facebook and Twitter. However, this broker doesn’t disclose other more direct contact information like company address while most brokers offer.

Read more

FirewoodFX Review: Investigating Complaints Concerning Bonus & Withdrawals

Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc