TradeDirect365-Overview of Minimum Deposit, Spreads & Leverage

Abstract:TradeDirect365, operated by Trade Nation Australia Pty Ltd, is an Australian-based brokerage firm established in 2014. The company's regulatory status with ASIC is labeled as "Suspicious Clone," indicating potential concerns about its regulatory compliance. The company is located at Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia.

| TradeDirect365 Review Summary | |

| Company Name | Trade Nation Australia Pty Ltd |

| Founded | 2014 |

| Registered Country/Region | Australia |

| Regulation | ASIC (Suspicious Clone) |

| Market Instruments | Commodities, Cryptocurrencies, Indices, Stocks, Forex |

| Demo Account | Yes |

| Leverage | 1:200 (Pro Account) |

| Spread | 0.4 pips (AUD/USD), 0.9 pips (Australia 200 & Germany30), 0.6 pips (UK100) |

| Commission | No Commission Charged for Indices, Cryptos, Commodities and FX; Commission Charged for Stocks (Trade ASX stocks from $5 or 0.07% commission (above $7,150 notional) |

| Trading Platform | MT4 and CloudTrade CFD Platform |

| Minimum Deposit | N/A |

| Customer Support | 24/5 - Tel: +61 2 8310 4713(outside)/1800 886 514(local), Email: support@TradeDirect365.com.au, Live Chat |

| Company Address | Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia |

What Is TradeDirect365?

TradeDirect365, operated by Trade Nation Australia Pty Ltd, is an Australian-based brokerage firm established in 2014. The company's regulatory status with ASIC is labeled as “Suspicious Clone,” indicating potential concerns about its regulatory compliance. The company is located at Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

Live Chat Available: TradeDirect365 offers live chat support, providing immediate assistance and enhancing customer service accessibility.

MT4 Supported: TradeDirect365 supports MetaTrader 4 (MT4), a widely used and popular trading platform known for its advanced features and functionality.

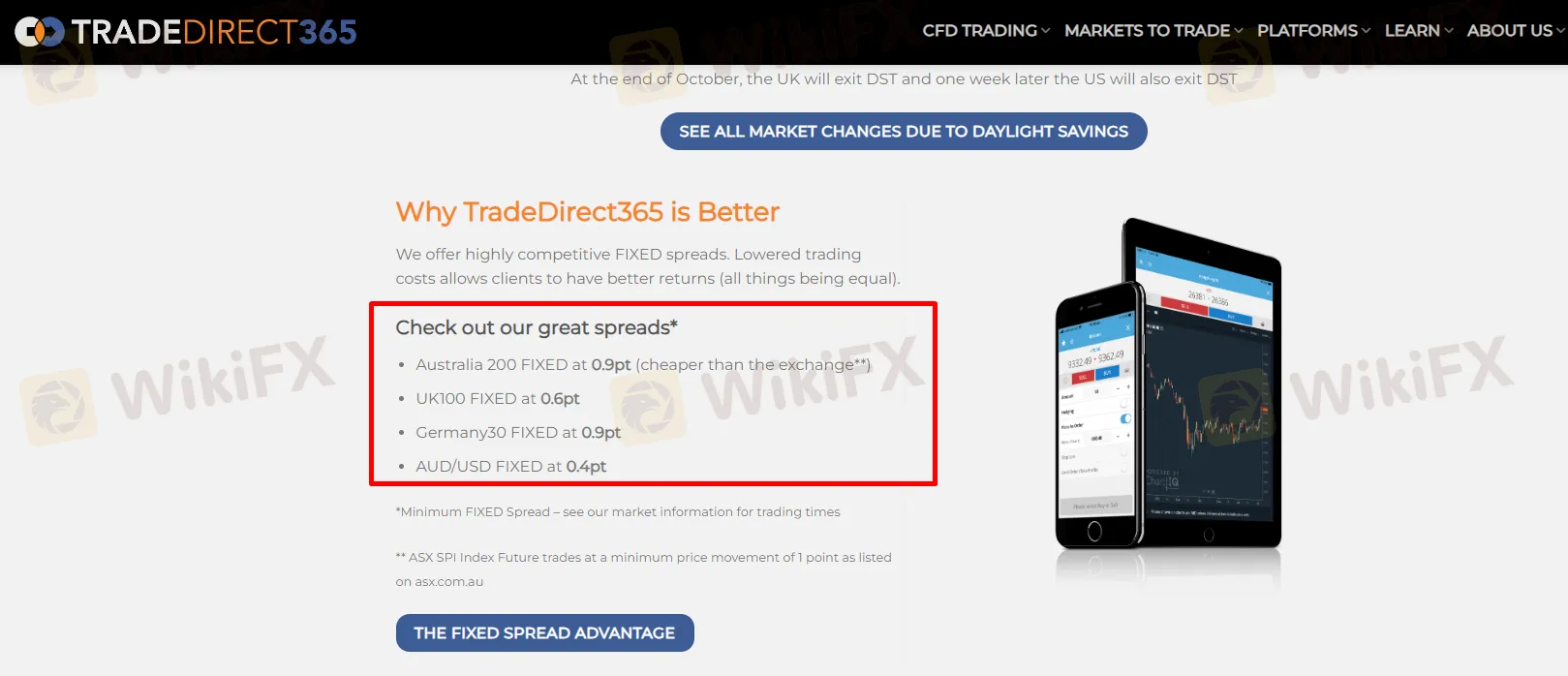

Tight Spreads: The spreads offered by TradeDirect365 are tight and competitive (0.4 pips (AUD/USD), 0.9 pips (Australia 200 & Germany30), 0.6 pips (UK100)), which can be very cost-saving for traders.

Demo Account Offered: TradeDirect365 offers a demo account, allowing traders to practice trading strategies and familiarize themselves with the platform before committing to real funds.

Cons:

Suspicious Clone Regulatory License: TradeDirect365's regulatory license has been flagged as suspicious, potentially raising concerns about the reliability and oversight of the broker.

Is TradeDirect365 Safe or Scam?

Regulatory Sight: TradeDirect365's regulatory status with the Australia Securities & Investment Commission (ASIC) is marked as “Suspicious Clone.” This designation raises concerns about the legitimacy and authenticity of the broker's regulatory license. The license type listed is Market Making (MM), with license number 422661, indicating TradeDirect365's role in facilitating trading activities.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: All client-deposited funds of TradeDirect365 are held in segregated accounts with a top-tier Australian bank, Westpac Bank, ensuring they are not used for hedging or other business purposes. These segregated accounts comply with Australian client money regulations, providing clients with assurance that their funds are protected and not exposed to any operational or trading risks associated with TradeDirect365's business activities.

Market Instruments

TradeDirect365 offers a diverse range of trading products, catering to various investment preferences and strategies. These include commodities, cryptocurrencies, indices, stocks, and forex. With access to commodities, traders can engage in the dynamic markets for precious metals, energies, agricultural products, and more. Cryptocurrency enthusiasts can trade popular digital assets like Bitcoin, Ethereum, and Ripple. Indices provide exposure to broader market trends, allowing traders to speculate on the performance of stock market indices worldwide. Stocks enable investors to directly participate in the equity markets of leading companies. Additionally, the forex market offers opportunities to trade currency pairs, facilitating speculation on global exchange rate fluctuations.

Account Types

Demo Account:

The Demo Account is a risk-free option for traders to practice trading strategies and familiarize themselves with the TradeDirect365 platform.

It provides access to virtual funds and allows users to trade under real market conditions without risking their capital.

Traders can experience the trading environment, test different instruments, and hone their skills before transitioning to live trading.

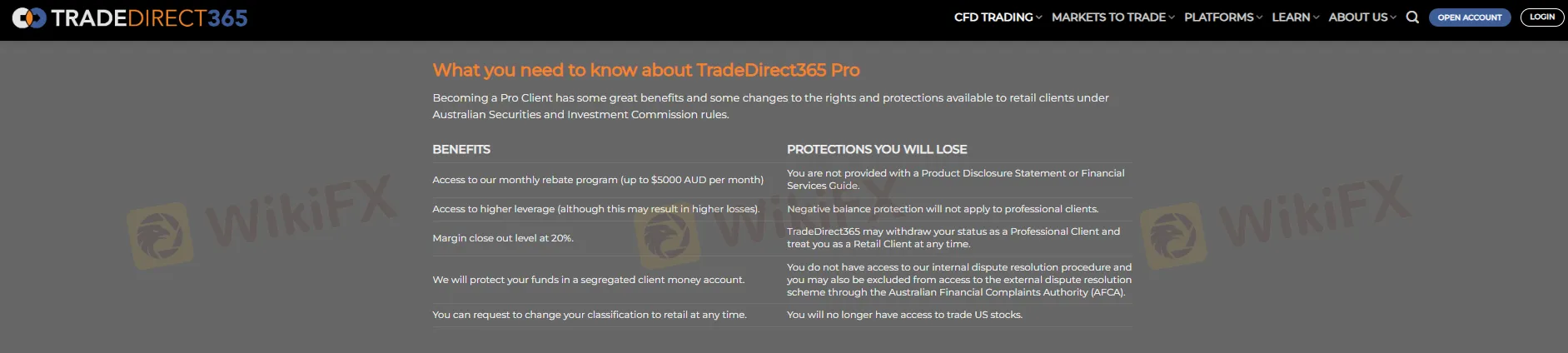

Pro Account:

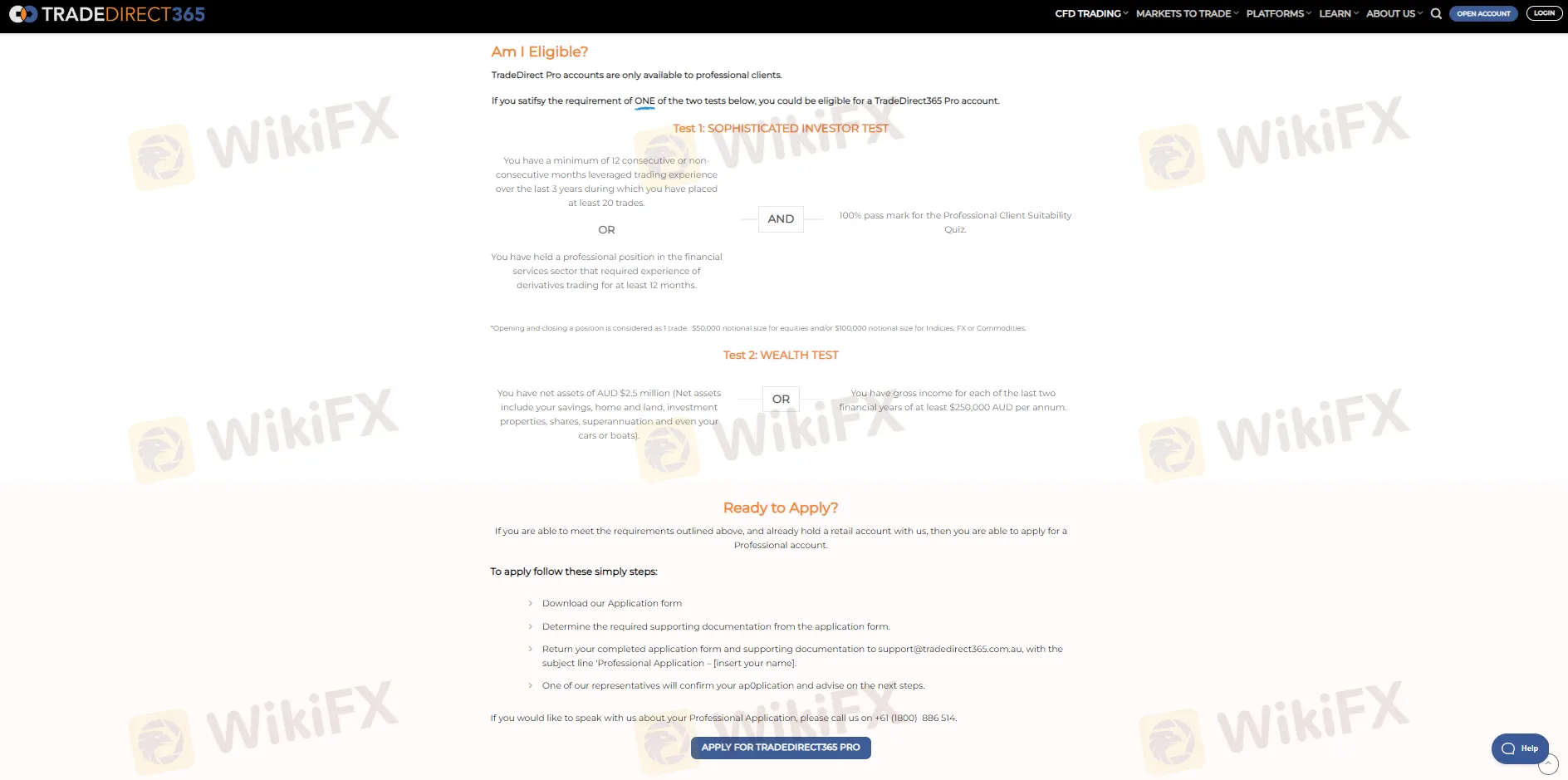

The Pro Account is designed for experienced traders who qualify as professional clients under the Australian Securities and Investment Commission (ASIC) rules.

Pro clients enjoy benefits such as access to monthly rebate programs, higher leverage options, and a margin close-out level of 20%.

However, becoming a Pro Client entails losing certain protections available to retail clients, such as negative balance protection and access to trade US stocks.

Eligibility for the Pro Account is determined through two tests: the Sophisticated Investor Test and the Wealth Test, each with specific criteria regarding trading experience, financial assets, and income levels. As long as users satisfy the requirement of one of the two tests, they could be eligible for a TradeDirect365 Pro account.

Prospective Pro Account holders must complete an application process and provide relevant documentation to demonstrate their eligibility.

Spreads & Commissions

| Instrument | Spread (Fixed) |

| Australia 200 (AUS200) | 0.9 pips |

| Germany 30 (GER30) | |

| UK 100 | 0.6 pips |

| AUD/USD | 0.4 pips |

TradeDirect365 provides traders with tightfixed spreads, allowing higher transparency and predictability in trading costs. The spreads offered by TradeDirect365 are lower than the industry average(which is about 1.5 pips), making them relatively competitive.

As for commissions, TradeDirect365 does not charge any for trading indices, cryptocurrencies, commodities, and forex (FX). However, for stock trading, a commission is applied. When trading ASX (Australian Securities Exchange) stocks, traders are charged a commission starting from $5 or 0.07% of the trade value, whichever is higher, for trades above $7,150 notional. This commission structure provides a certain level of transparency and allows traders to know exactly what costs they will incur when executing stock trades.

Trading Platforms

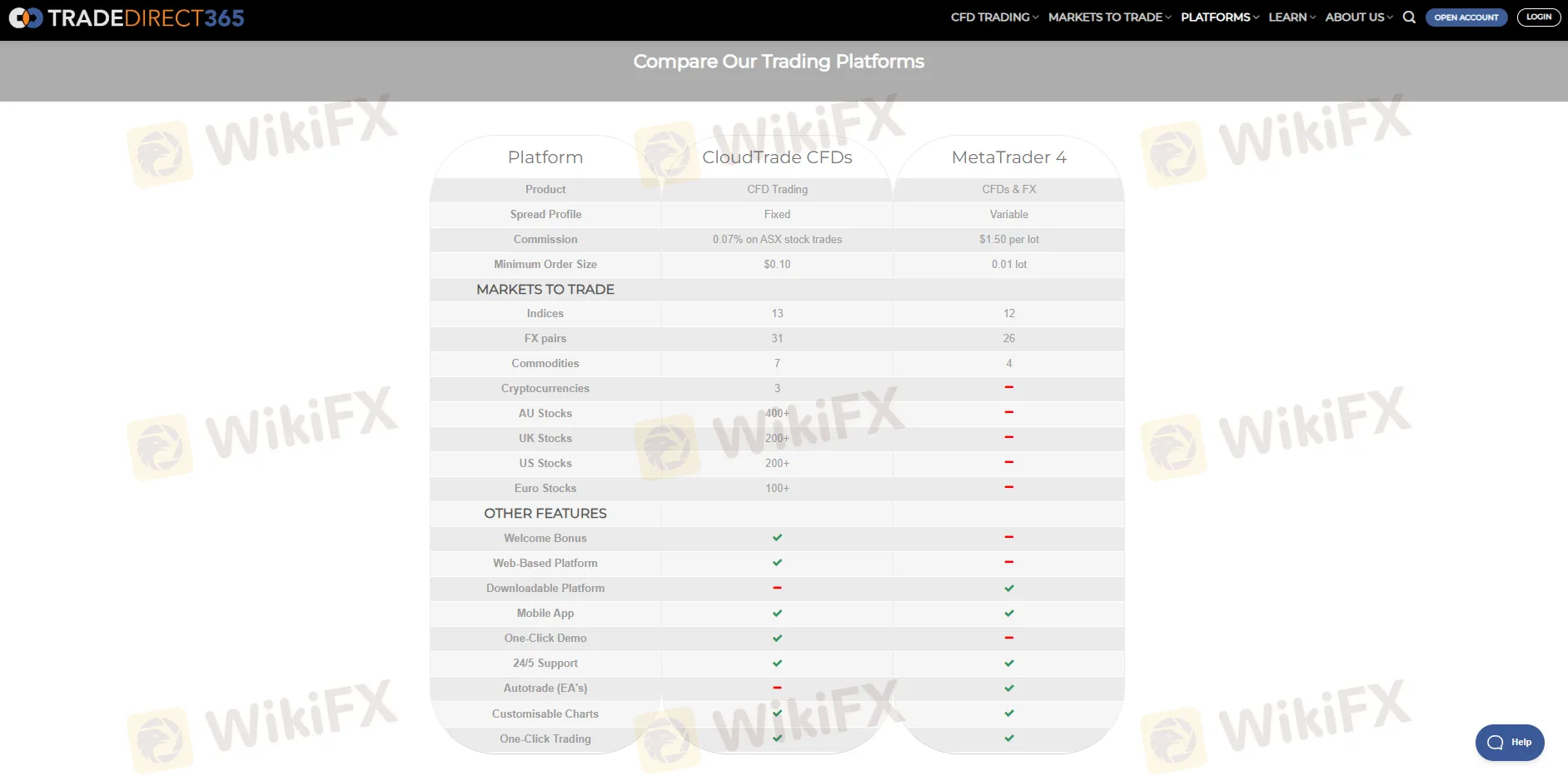

TradeDirect365 offers two trading platforms to cater to the diverse needs of traders: CloudTrade and MetaTrader 4 (MT4).

CloudTrade: CloudTrade is TradeDirect365's web-based and app-based CFD trading platform, providing access to thousands of markets, including indices, FX, stocks, commodities, and cryptocurrencies. It offers tight fixed spreads 24/5, ensuring competitive pricing for traders. The platform is user-friendly and accessible via web browsers and mobile apps, making it convenient for traders to access the markets anytime and anywhere with internet connectivity. CloudTrade is equipped with various features such as live pricing, trading charts, order types, account history, and real-time market data to assist traders in making informed trading decisions.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is a widely recognized and popular trading platform known for its comprehensive features and flexibility. TradeDirect365's MT4 platform offers tight variable spreads and low commissions across indices, commodities, and FX markets. MT4 comes with advanced trading tools, including Expert Advisors (EAs), allowing traders to automate their trading strategies based on predefined parameters. The platform is available for download on PC, Mac, and mobile devices, providing traders with the flexibility to trade from their preferred devices. MT4's compatibility with various operating systems makes it a versatile choice for traders seeking a robust and feature-rich trading platform.

From the comparison table below, you can compare the differences between these two trading platforms by yourself, and decide which one to choose according to your needs.

Deposit & Withdrawal

TradeDirect365 offers multiple payment methods for depositing and withdrawing funds:

Bank Transfer/Wire:Traders can deposit and withdraw funds using bank transfers or wires. This method allows for secure transactions directly between the trader's bank account and the TradeDirect365 trading account. It takes a few business days for the funds to be processed and reflected in the trading account.

Credit or Debit Card (AUD deposits only):TradeDirect365 accepts credit and debit card payments for deposits in Australian Dollars (AUD) only. Traders can use their Visa or Mastercard to fund their trading accounts instantly. However, it's essential to note that withdrawals to credit or debit cards may not always be available, and alternative withdrawal methods may need to be used.

Poli:Poli is an online payment method widely used in Australia and New Zealand. Traders can securely transfer funds from their bank accounts to their TradeDirect365 trading accounts in real time using Poli. It offers a convenient and straightforward payment option for Australian traders.

Transferwise:Transferwise is a global money transfer service that allows traders to deposit and withdraw funds in various currencies. It offers competitive exchange rates and low fees, making it an attractive option for international traders. Traders can transfer funds from their Transferwise accounts directly to their TradeDirect365 trading accounts, providing a seamless and cost-effective way to manage their funds.

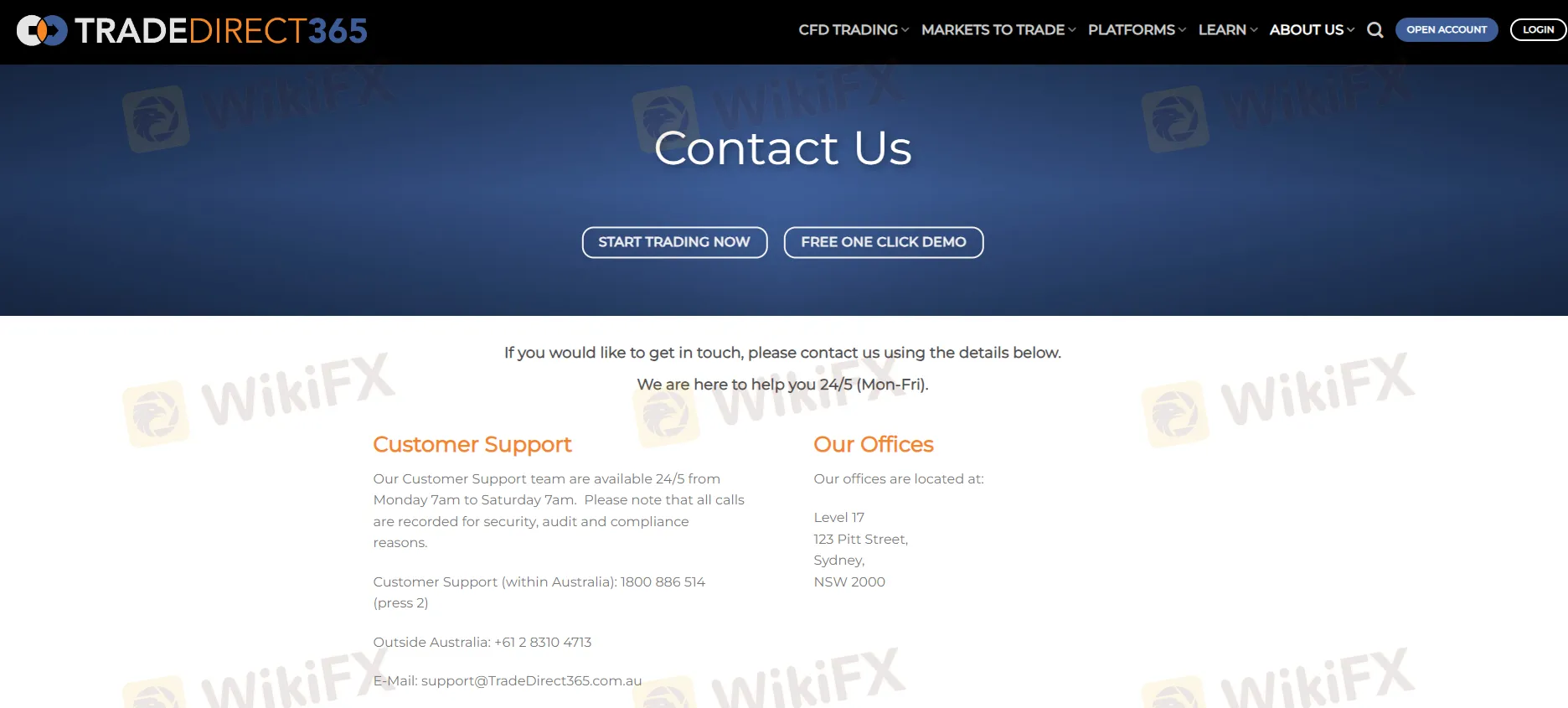

Customer Support

Availability: The Customer Support team is available 24/5, from Monday 7 am to Saturday at 7 am (GMT). This ensures that traders can reach out for assistance during most trading hours, providing prompt support when needed.

Contact Options: Traders can contact the Customer Support team via multiple channels - Telephone: +61 2 8310 4713(outside)/1800 886 514(local); Email: support@TradeDirect365.com.au; Live Chat. Telephone support is available with both local and international numbers, offering accessibility for traders worldwide. Additionally, traders can reach out via email to address any non-urgent inquiries or issues. The live chat feature offers real-time assistance for immediate support and resolution of queries.

Physical Address: TradeDirect365 provides transparency by listing its company address, located at Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia. This allows traders to have confidence in the legitimacy and accessibility of the brokerage.

Conclusion

TradeDirect365 offers a comprehensive trading experience with its diverse range of market instruments, tight spreads, and user-friendly trading platforms. However, concerns about its regulatory status and the need for improvement in customer support transparency remain. Traders should carefully consider these factors when choosing TradeDirect365 as their brokerage.

Frequently Asked Questions (FAQs)

Q: What trading platforms does TradeDirect365 offer?

A: TradeDirect365 offers two trading platforms: CloudTrade and MetaTrader 4 (MT4).

Q: Are there any commissions charged for trading indices?

A: No, TradeDirect365 does not charge any commissions for indices trading.

Q: Is there any commission charged?

A: Yes, if you would like to participate in trading stocks, there will be a commission starting from $5 or 0.07% of the trade value, whichever is higher, for trades above $7,150 notional.

Q: Does TradeDirect365 offer a demo account?

A: Yes, it does.

Q: Is the customer support available on Sunday?

A: No, it is not. The Customer Support team at TradeDirect365 is available 24/5, from Monday 7 am to Saturday at 7 am (GMT).

Q: Is TradeDirect365 regulated or not?

A: Yes, it is. However, the regulatory license of TradeDirect365 is suspected to be a clone.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Star-Studded Jury Panel Unveiled as WikiFX Golden Insight Award’s Expert Judging Commences

Following the successful conclusion of the global public voting phase, the WikiFX Golden Insight Award has now officially entered its final evaluation stage—the expert judging. This marks a critical juncture in the 2025 Golden Insight Award selection process, ushering in the most authoritative and rigorous phase of professional assessment and industry consensus-building.

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

GivTrade Secures UAE SCA Category 5 Licence

GivTrade gains UAE SCA Category 5 licence, enabling advisory, arrangement, and consulting services under strict regulatory oversight.

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

What Is a Liquid Broker and How Does It Work?

What Is a Forex Expert Advisor and How Does It Work?

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Rate Calc