eXcentral Review 2021 - Login & Start Trading Online

Abstract:eXcentral EU is an international broker offering instruments on its web trader and MT4. See our review for withdrawals, demo accounts & more.

eXcentral EU and eXcentral International offers trading on everything from global currencies to Bitcoin on its web trader platform and MT4. But while the broker provides attractive features, is it safe to trade with or could it be a scam? Find the answers here, where we review the login process, regulation, customer support, withdrawal methods, and more.

eXcentral Headlines

eXcentral is a brand name of Mount Nico Corp Ltd and is based in Cyprus. The company is regulated by the Cyprus Securities and Exchange Commission (CySEC) and primarily offers services within the European Economic Area and Switzerland. The brokers global website, eXcentral International, also serves traders from outside the EEA, such as the Philippines, Singapore and Romania.

Trading Platforms

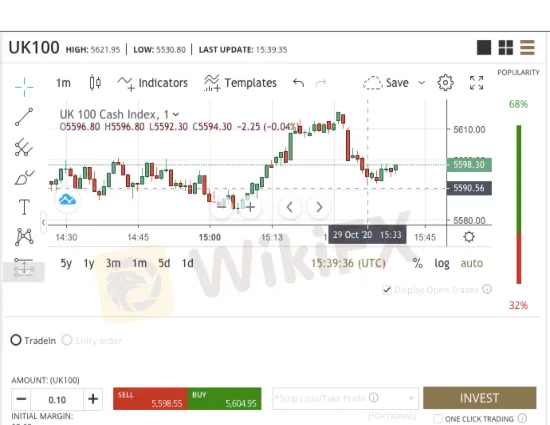

eXcentral Web Platform

eXcentrals proprietary trading platform was built with convenience in mind, offering web-browser compatibility and no download requirement. The platform offers the full range of trading assets on a user-friendly dashboard. Features include:

Over 100 technical indicators and dozens of drawing tools

Trade directly from the chart with one-click executions

7 chart types, including Candlestick and Heiken Ashi

9 timeframes, from one minute to one month

Stop-loss and take profit functions

MetaTrader 4

For those who wish to employ automated trading strategies, the MT4 platform is the number one choice. The platform supports personalised Expert Advisors (robots) and strategy testing. Traders also enjoy 30 pre-included indicators, 9 timeframes, 3 execution modes, and 4 order types.

The MT4 trading platform is ready to download once you sign up for a live account and set up your client portal credentials.

Markets

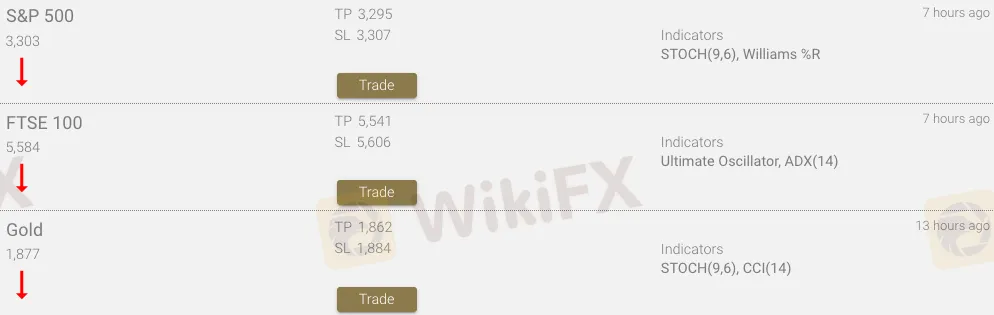

eXcentral offers over 160 assets, including 46 major, minor and exotic pairs plus 5 cryptocurrencies, including Bitcoin. There are also 12 indices such as the S&P 500 and FTSE 100, as well as over 75 company shares including Facebook and Tesla. Traders can also diversify their portfolio with a selection of 19 commodities, including precious metals, energies, and agricultural assets.

Spreads & Commission

Commissions are included in the spread at eXcentral, apart from equities and cryptocurrencies, which are charged at 0.8% of the assets notional value. Spreads are around 2.5 pips for EUR/USD in the Classic account and $0.10 for crude oil. Spreads drop to around 0.9 pips with the VIP account.

Other charges include swap fees, which is the interest added or deducted when a position is held overnight. Theres also a 10 USD/EUR/GBP monthly maintenance fee, as well as an 80 USD/EUR/GBP inactivity fee if an account is left dormant for over 2 months.

eXcentral Leverage

The maximum retail leverage available for forex is 1:30. Indices and some commodities can be leveraged up to 1:20, shares up to 1:5, and cryptocurrencies up to 1:2. Professional clients can leverage up to 1:400 on forex products.

Mobile Trading Review

The broker offers the eXcentral Mobile Trader, available for iOS and Android devices. Users enjoy the freedom of trading on the move, whilst still experiencing powerful features.

Mobile traders get access to all the necessary fundamental and technical analysis tools, real-time estimated profit and loss limit calculations, instant market execution on all orders, and complete transaction history. Traders also benefit from the high mobility between assets and transactions, as well as assistance from a dedicated account manager.

eXcentral also offers the MT4 mobile app, which is also available from the Apple App Store and Android Google Play. Traders can access many of the same features and tools as the desktop solution, plus financial news and full account management.

Payments

Funding is available in USD, GBP, or EUR via credit/debit card, wire transfer, Skrill, and Neteller. The minimum deposit for all methods is 250 in the chosen currency. eXcentral does not charge any deposit fees.

Withdrawals must be made via the same method used to deposit. The minimum withdrawal amounts are 100 EUR/USD/GBP for bank wire and 10 EUR/USD/GBP for cards. There is no minimum withdrawal for e-wallets, though it must cover the transfer cost. As per the withdrawal policy, fees are charged at 3.5% for cards and Neteller, 30 in the chosen currency for wire transfer, and 2% for Skrill.

Bank transfers generally take 3 – 5 working days once processed, whilst cards take 5 – 7 working days.

Demo Account

eXcentral does not offer a demo account, which is disappointing as most brokers offer this feature to new traders. Demo solutions are a useful way of practicing trading skills in a safe environment. The broker does, however, provide direct access to their web trading platform from the website where you can browse the dashboard and some of the features.

eXcentral Bonuses

eXcentral does not offer any bonuses. In order to protect individuals from incentivised trading schemes, regulatory bodies such as CySEC impose tight restrictions on bonus deals and promotional offers.

Licensing Review

Mount Nico Corp Ltd (eXcentral) is a Cyprus Investment Firm (CIF) and is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 226/14. As a regulated broker, eXcentral complies with EU regulation, which includes the Markets in Financial Instruments Directive (MiFID).

As per licensing requirements regarding trader safety, eXcentral segregates client money with reliable financial institutions and is also a member of the Investor Compensation Fund.

The global entity of eXcentral (OM Bridge Pty Ltd) is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa.

Additional Features

eXcentral offers a comprehensive selection of educational resources. The main interactive forex courses contain informative videos covering various levels of forex strategies. There are also MT4 video tutorials, as well as live weekly webinars, a blog and daily signals. The economic calendar on the main website page is also a useful tool for keeping up with the latest global events.

eXcentral Accounts

There are four account types offered at eXcentral: Classic, Silver, Gold, and VIP. It is free to open an account, though the broker requires a minimum 250 USD/EUR/GBP deposit to begin trading.

Aside from more competitive spreads in the VIP account, the only real difference between the accounts is the addition of tools such as webinars, account managers, and trading signals. In fact, the Classic and Silver accounts are virtually the same, with just the addition of educational videos with the Silver.

Overall, the four different accounts are a little unnecessary based on user opinions. Given that the minimum deposit is the same across all the options, the VIP account would surely be the sensible choice.

Benefits

Trading with eXcentral comes with several benefits:

Bitcoin assets

CySEC regulated

MetaTrader 4 available

Good educational resources

Drawbacks

Traders might be limited by a few factors:

Some bad online international and EU broker reviews

No demo account

Zero bonus codes

Withdrawal fees

Accepted Countries

eXcentral accepts traders from Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use eXcentral from United States, Canada, Japan, Australia, Israel.

Alternatives to eXcentral

If you are looking for alternatives to eXcentral we have compiled a list of the top 5 brokers that are similar to eXcentral below. This list of brokers like eXcentral is in order of similarity and only includes companies that accept traders from your location.

Global Prime – Global Prime is a multi-regulated trading broker offering 100+ markets.

Fortrade – Fortrade is a multi-asset broker offering a simple live account with advanced tools.

RoboForex – RoboForex is a multi-asset online broker offering powerful trading aides.

FXPrimus – Trade the markets with MT4 trading tools alongside CySEC regulation.

Trade.com – Trade.com offers thousands of tradable assets on desktop and mobile platforms.

FAQ

What is the minimum deposit requirement at eXcentral?

It is free to open an account at eXcentral but you will need to deposit at least $250 to trade.

How can I make a withdrawal at eXcentral?

You can make a withdrawal from within your main live account by following the instructions on the withdrawal page. Please see the brokers payment policy for details of withdrawal terms.

How can I delete my eXcentral account?

You can close your account by contacting the customer support team via telephone or email.

Where is eXcentral based?

eXcentral is headquartered in Limassol, Cyprus. The global website, eXcentral International, is registered and regulated in South Africa.

Is eXcentral a scam or legit?

Both the EU and global entities of eXcentral are legitimate and registered companies based in Cyprus and South Africa. Traders should check for any complaints or bad reviews online if they are concerned about trading scams.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Rate Calc