IS BRENT CRUDE OIL PREPARING FOR A LOWER LOW?

Abstract:Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

Brent Crude is a major trading classification of sweet light crude oil that serves as a benchmark price for purchases of oil worldwide.

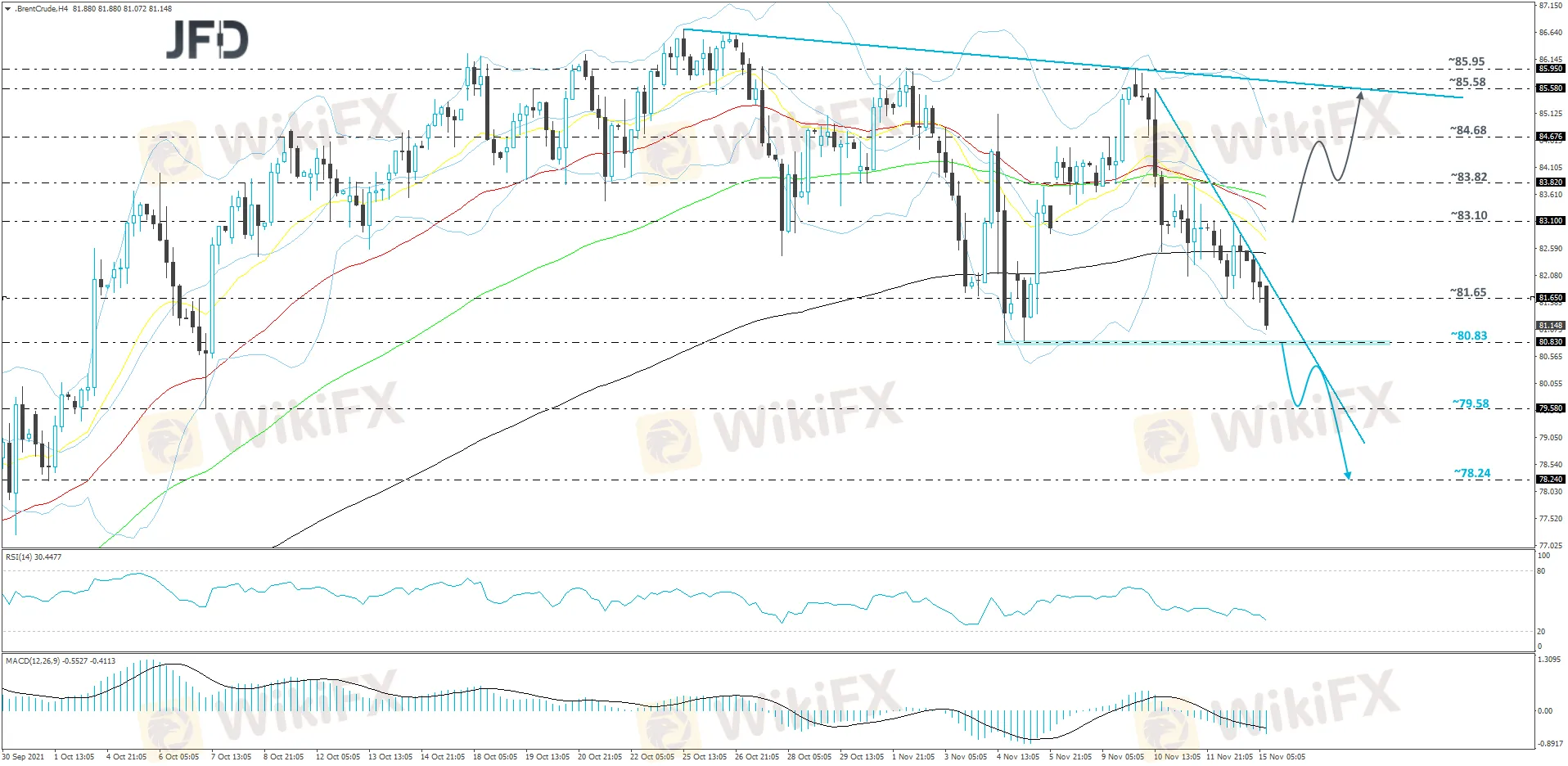

Taking look at the technical picture of Brent crude oil on the 4-hour chart, it can be observed that currently the commodity is trading below a steep short-term downside resistance line taken from the high of November 10th. The price is also near the 80.83 hurdle, which is the current lowest point of November. Even though Brent oil is showing willingness to move lower, as suggested preferably needs to wait for a break below that hurdle first, in order to get comfortable with lower areas after some Hours.

As the expected drop happens, and Brent oil moves below 80.83, this will confirm a forthcoming lower low, potentially opening the door towards lower areas. The commodity may drift to the 79.58 obstacle, marked by the low of October 7th, where a temporary hold-up might occur. Nevertheless, if the selling pressure remains strong, the price could continue sliding, possibly aiming for the 78.24 level, marked by the lowest point of October. The RSI and the MACD are currently pointing lower. In addition to that, the RSI sits below 50 and the MACD continues to run below zero and the trigger line. The two indicators show negative price momentum, which supports the above-discussed scenario.

In other way round, when the price breaks above the aforementioned downside line and then climbs above the 83.10 barrier, marked by the high of November 12th, that could attract a few more buyers into the game. Brent oil might then travel to the 83.82 obstacle, or even to the 84.68 territory, which is marked near an intraday swing high of November 9th and an intraday swing low of November 10th. If the buying fails to stop there, the next possible target could be the 85.58 level, marked by an intraday swing high of November 10th. Over there the commodity may test a short-term uncertain downside resistance line drawn from the high of October 25th, and it may likely provide an additional hold-up.

Read more

Key To Markets Review: Unregulated Broker Risk Alert

Is Key To Markets safe? Revoked regulation, user complaints, and withdrawal issues raise red flags. Read this WikiFX review before you deposit.

VORBIX MARKETS Review: No License, Withdrawal Risk

Is VORBIX MARKETS safe? Read this WikiFX review on no license status, withdrawal issues, and trader complaints before you deposit. Download now.

CySEC Put Cyprus Brokers on Notice in Last Week’s Conflict-of-Interest Sweep

CySEC has told Cyprus brokers to prepare for on-site inspections and desk reviews focused on conflicts of interest and retail product sales.

Amana Review: Regulation, Complaints, Withdrawal Risk

Read this amana review covering broker regulation, user complaints, and withdrawal risk signals on WikiFX before you deposit. Check the facts now.

WikiFX Broker

Latest News

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Oil prices jump above $100 for first time in four years

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Forex Brief: Yen Weakens Past 157.75 as BoJ Policy Hopes Dim

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Rate Calc