ATG-Some important Details about This Broker

Abstract: Algorithmic Trading Group (ATG) Limited is an electronic proprietary trading firm with offices in Amsterdam and Hong Kong. Established in 2009 in Hong Kong, the company engages in trading major futures and equity markets across Europe, Asia, and America, operating nearly 24 hours a day, five days a week.

| ATG Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Hong Kong |

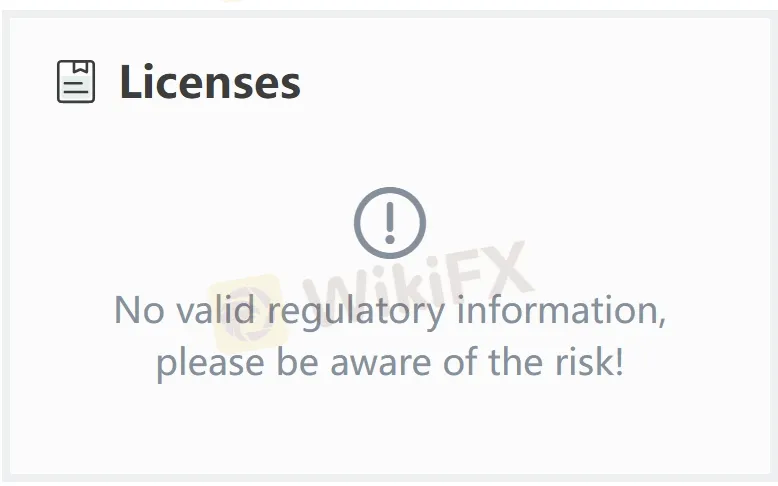

| Regulation | No regulation |

| Market Instruments | Futures, equities |

| Customer Support | Tel: +(31) 205 782 180 |

| Email: emailus@algorithmictradinggroup.com | |

| Amsterdam Office: Beursplein 5, 1012 JW Amsterdam, The Netherlands | |

| Hong Kong Office: Unit 2, 13/F, Java Road 108 Commercial Centre 108 Java Road, Hong Kong | |

ATG Information

Algorithmic Trading Group (ATG) Limited is an electronic proprietary trading firm with offices in Amsterdam and Hong Kong. Established in 2009 in Hong Kong, the company engages in trading major futures and equity markets across Europe, Asia, and America, operating nearly 24 hours a day, five days a week.

However, ATG's website is quite simplistic with limited transparency about its background and business scope. What's worse, the company is not being regulated by any official authorities so far, which should raise your attention due to less credibility and trustworthiness.

Pros and Cons

| Pros | Cons |

| None | No regulation |

| Limited transparency on its background and business scope |

Is ATG Legit?

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. ATG is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose ATG with caution.

What Can I Trade on ATG?

We can only learn from a few words from its non-informative website the company primarily engages in major futures and equity markets across Europe, Asia, and America, operating nearly 24 hours a day, five days a week.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

Merin Review (2025): Is it Safe or a Scam?

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc