EasyTrade-Overview of Minimum Deposit, Spreads & Leverage

Abstract:EasyTrade is an unregulated forex and CFD broker, against which there is a recent warning by the Bulgarian Financial Supervision Commission (FSC) and a court order to block the access to the website form the territory of Bulgaria. EasyTrade says to be owned and operated by the Estonian Grau International OU and regulated by an organization called The International Financial Services Commission (IFSC). Have in mind, however, that IFSC is nothing more than an anonymous website without legitimacy whatsoever.

| Registered Country | Australia |

| Regulation | No license |

| Establishment | 2-5 years |

| Minimum Spreads | From 0.0 pips |

| Maximum Leverage | 1:500 |

| Account Types | Standard, Raw accounts |

| Minimum Deposit | N/A |

| Trading assets | N/A |

| Customer support | Telephone: +61 3 8373 4800Email: support@etfxi.com |

General Information

EasyTrade is an

Regulation

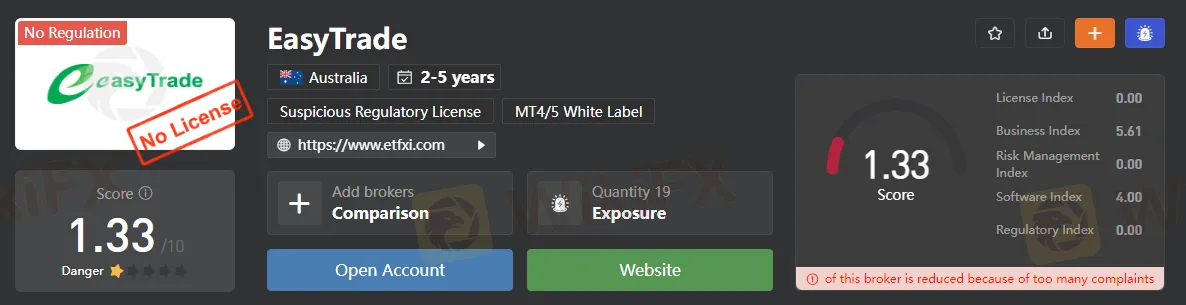

When it comes to regulation, EasyTrade let us know, for it does not hold any license to support its operation. Here we can see that EasyTrade only gets a very low score of 1.33/10 (The Screenshot was taken on 02/09/2023).

Market Instruments

EasyTrade says to be offering CFDs with “more than 1000 financial assets”, including forex pairs, stocks, commodities, indices and major crypto coins like Litecoin, Ethereum, Dash and Bitcoin and Ripple.

Minimum Deposit

EasyTrade offers quite a few trading accounts, with the minimum initial deposit for a basic account is $250. Although this is the reasonable amount, traders are not advised to register real trading accounts here given the fact that EasyTrade is not subject to any regulation.

Leverage

While a leverage up to 1:400 may actually be a negative for unexperienced traders, some professional ones like having the ability to use high leverage ratios like this. It gives them the opportunity to open much larger trades, while depositing small sums.

Spreads & Commissions

Spreads, however disappoint – as tested with a demo account the benchmark EURUSD spread was fixed at 4 pips, which is roughly three times higher than the levels traders usually expect with a standard account.

Trading Platform Available

EasyTrade uses a web based trading platform, which is overly simplified and lacks lots of features, supported by well-known platforms like the MetaTrader4 (MT4). For example, this platform has no technical analysis indicators, nor the automated trading option via EAs.

Deposit & Withdrawal

EasyTrade accepts all kinds of payment methods including major cards like VISA and MasterCard, e-wallets including PaySafe, Neteller, Skrill, WebMoney, QIWI, Yandex and AstroPay, as well as bank wire. There is a minimum 30 USD withdraw fee, monthly maintenance fee and a profit clearance fee, all of which, we should note are highly unusual.

Customer Support

Clients with any inquiry can get in touch with EasyTrade through email and telephone.

Here is the detailed contact information:

Telephone: +61 3 8373 4800

Email: support@etfxi.com

Pros & Cons

| Pros | Cons |

| Generous leverage up to 1:400 | No regulation |

| Weak trading platform | |

| Poor customer support | |

| High minimum deposit requirement |

Frequently Asked Questions

What trading platform does EasyTrade offer?

EasyTrade offers a web-based trading platform.

What is the maximum trading leverage offered by EasyTrade?

The maximum trading leverage offered by InvestMarket is up to 1:500.

How can I contact EasyTrade?

EasyTrade can be reached through telephone or email.

Read more

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

Is NEWTON GLOBAL Safe or a Scam? A Deep Look at User Reviews & NEWTON GLOBAL Complaints

When you look up information about a financial broker, you have one main worry: Is my capital safe? For NEWTON GLOBAL, the facts point to a clear answer. After looking at its regulatory status, user feedback and how transparent it is, NEWTON GLOBAL presents a very high risk to all traders. This conclusion isn't based on opinion, but on real data collected by platforms designed to protect investors. The main problems—no valid regulation and a pattern of serious user complaints—show major warning signs that can't be ignored. A broker's reputation depends on two things: regulatory oversight and positive user experiences. As we will show, NEWTON GLOBAL fails badly on both. We encourage traders to always check information on independent platforms. You can see the full data we are analyzing on the official WikiFX page for NEWTON GLOBAL. This article will break down its regulatory standing, look at real user complaints, and give you a clear verdict to help you make an informed decision.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc