VIBHS Review

Abstract:VIBHS Financial Ltd, established in the UK in 2013 and regulated by the UK FCA, offers trading in forex, indices, commodities, and ETF CFDs through the MT4 platform. They provide Standard and Pro account types, along with a demo account, with leverage up to 1:30 and varying spreads and commissions.

| VIBHS Review Summary | |

| Founded | 2013 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | Forex, Indices, Commodities, and ETF CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:30 |

| EUR/USD Spread | 1.6 pips (Standard account) |

| Trading Platform | MT4 |

| Minimum Deposit | / |

| Customer Support | Email: sales@vibhsfinancial.co.uk |

| Tel: +44 (0)20 7709 2038 | |

| Live chat | |

VIBHS Information

VIBHS Financial Ltd, established in the UK in 2013 and regulated by the UK FCA, offers trading in forex, indices, commodities, and ETF CFDs through the MT4 platform. They provide Standard and Pro account types, along with demo accounts, with leverage up to 1:30 and varying spreads and commissions.

Pros and Cons

| Pros | Cons |

| Regulated by FCA | Deposit and withdrawal fees |

| Demo accounts available | Applies swap fees |

| Diverse tradable assets | Unclear information on minimum deposit |

| MT4 supported | |

| Live chat support | |

| Long operation time |

Is VIBHS Legit?

VIBHS has a Straight Through Processing (STP) license regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 613381.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Conduct Authority (FCA) | Regulated | VIBHS Financial Ltd | UK | Straight Through Processing (STP) | 613381 |

What Can I Trade on VIBHS?

VIBHS offers trading in various markets, including forex, indices, commodities, and ETF CFDs, providing access to many financial instruments.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| ETF CFDs | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type & Fees

VIBHS offers Standard Account with spreads and no commission, and Pro Account which charges commission fees. They also offer demo accounts.

| Account Type | Maximum Leverage | EUR/USD Spread |

| Standard Account | 1:30 | 1.6 pips |

| Pro Account | / |

Leverage

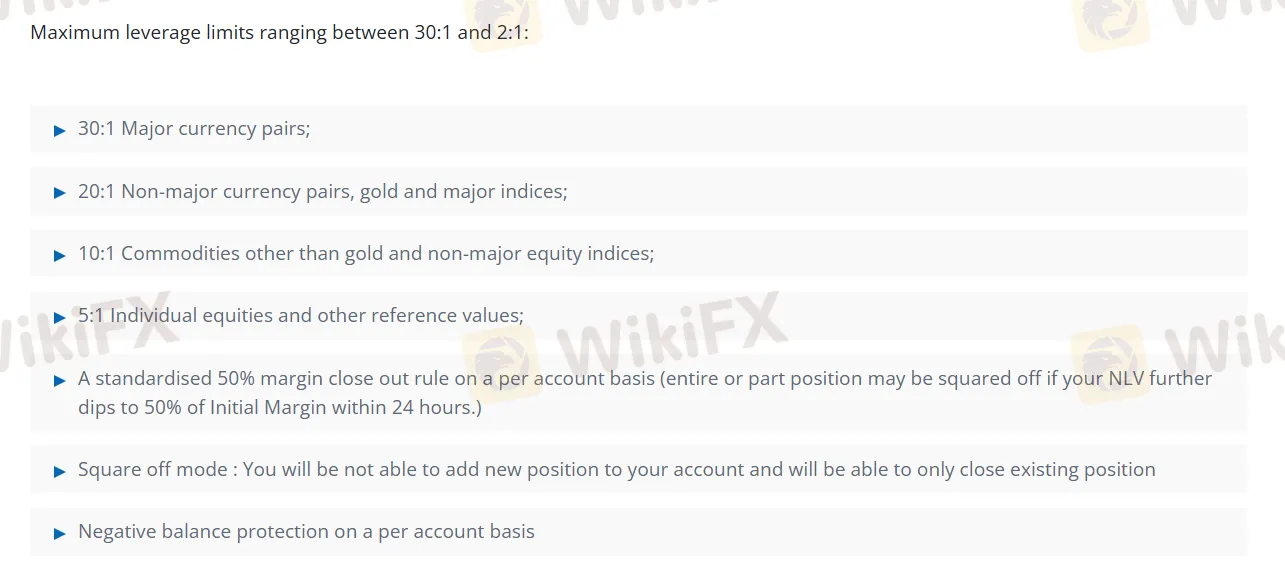

VIBHS offers leverage up to 1:30. Traders need to consider carefully before investing and bear in mind that high leverage is likely to bring high potential risks.

| Assets | Maximum Leverage |

| Major currency pairs | 30:1 |

| Non-major currency pairs, gold and major indices | 20:1 |

| Commodities other than gold and non-major equity indices | 10:1 |

| Individual equities and other reference values | 5:1 |

VIBHS Fees

- Spread & Commission:

VIBHS offers Standard accounts with variable spreads and no commission, while Pro accounts feature tighter spreads plus a commission fee.

| Assets | Standard Account | Pro Account |

| Spreads | Commission | |

| EUR/USD | 1.6 pips | $10 |

| EUR/GBP | 1.9 pips | |

| GBP/USD | ||

| FTSE 100 | 2 pips | $1 |

| US 500 | 1.5 pips | |

| Oil Brent Crude | 2 pips | |

| Oil US Crude | 2.5 pips | |

| Natural Gas | 5 pips | |

| Gold | 0.5 pips | $10 |

- Overnight Financing Charges:

VIBHS applies swap fees to positions held past the daily rollover time (5 pm NY / 10:59 pm London), which can be positive or negative based on the trade direction, and non-activity fees may also apply. Contract specifications in the trading terminal detail symbol contract sizes.

- Deposit & Withdrawal Fees:

VIBHS charges varying fees for deposits and withdrawals, including potential bank/card transaction fees, 1.50% for EU transactions, 1.80% for non-EU transactions, and bank transfer fees ranging from £15 to £40.

| Payment | Fees |

| EU transactions | 1.50% |

| Non-EU transactions | 1.80% |

| Bank Transfer | From £15 to £40 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC and Mobile | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

VIBHS has varying deposit/withdrawal fees (e.g., 1.5-1.8% for EU/non-EU transactions, £15-£40 for bank transfers) and typically processes these within 24 hours, offering UK clients bank transfers (including GBP, USD, EUR, PLN, AUD via Barclays) and card options.

Read more

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

When traders ask, "Is GLOBAL GOLD & CURRENCY CORPORATION Legit?" They want a clear answer about whether their capital will be safe. After looking into this company carefully, the answer is clear: GLOBAL GOLD & CURRENCY CORPORATION (GGCC) is an extremely risky broker that shows many signs of being unsafe and illegitimate. The company operates without proper regulation, has been officially warned by financial authorities, and has received many serious complaints from users. Read on!

GLOBAL GOLD & CURRENCY CORPORATION Regulation: A Complete Guide to Its Unregulated Status and Risks

When choosing a forex broker, the most important thing to check is whether it has proper regulation. This article answers a key question: Is GLOBAL GOLD & CURRENCY CORPORATION (GGCC) regulated? After looking at detailed data and public records, the answer is clear: GGCC operates without a valid financial services license from any trusted authority. This broker is registered in Saint Lucia and shows warning signs that should make any potential investor very careful. Checking a broker's license isn't just paperwork - it's the most important step to protect your capital from unnecessary risks.

Headway Scam Alert: Saudi Arabia & Iraq Traders Defrauded

Headway defrauded Saudi & Iraq traders: fake excuses, profit thefts, bonus vanishes, and slippage. Read scam exposure & protect your funds now!

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

Before investing in the GLOBAL GOLD & CURRENCY CORPORATION (GGCC) platform, you need to know about the serious risks. This is not a safe broker for anyone who wants to protect their capital. All the evidence shows this is a very risky company with no proper oversight and many user complaints. This warning is your most important protection. Read on as we share more details.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc