GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

Abstract:When traders ask, "Is GLOBAL GOLD & CURRENCY CORPORATION Legit?" They want a clear answer about whether their capital will be safe. After looking into this company carefully, the answer is clear: GLOBAL GOLD & CURRENCY CORPORATION (GGCC) is an extremely risky broker that shows many signs of being unsafe and illegitimate. The company operates without proper regulation, has been officially warned by financial authorities, and has received many serious complaints from users. Read on!

When traders ask, “Is GLOBAL GOLD & CURRENCY CORPORATION Legit?” They want a clear answer about whether their capital will be safe. After looking into this company carefully, the answer is clear: GLOBAL GOLD & CURRENCY CORPORATION (GGCC) is an extremely risky broker that shows many signs of being unsafe and illegitimate. The company operates without proper regulation, has been officially warned by financial authorities, and has received many serious complaints from users.

The broker's extremely low score of 1.36 out of 10 on WikiFX, a global broker verification platform, immediately shows there are serious problems with how it operates and how safe it is. This isn't just an opinion - it is a conclusion backed up by real evidence. This conclusion comes from a detailed investigation of publicly available information, which you can check yourself on its complete WikiFX profile here. Throughout this analysis, we will examine the data that leads to this strong warning.

The Most Important Red Flag

The most important factor in determining if a broker is legitimate is whether they are properly regulated. This isn't just a preference - it's the foundation of investor protection in financial markets. For traders, working with a regulated company is the main protection against fraud, manipulation, and losing capital when companies fail.

Why Regulation Cannot be Ignored

Top financial regulators, like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), create strict rules for brokers to protect client capital and ensure fair market practices. These protections aren't optional extras - they are basic rights for investors. Key benefits of trading with a regulated broker include:

· Separated Client Capital: Regulators require brokers to keep client funds in accounts separate from the company's operating funds. This prevents the broker from using client deposits for their own business expenses and protects the capital if the company goes bankrupt.

· Protection Programs: In many countries, regulated brokers are part of an investor protection fund (like the FSCS in the UK). If the broker fails, this fund can pay back eligible clients up to a certain amount, providing an important safety net.

· Fair Practice Monitoring: Regulators watch brokers to ensure fair trade execution, clear pricing, and honest marketing. They have the power to investigate complaints, issue fines, and cancel licenses for bad behavior such as price manipulation or blocking withdrawals.

· Negative Balance Protection: Many regulators require brokers to ensure that clients cannot lose more than they have put into their accounts.

GGCC's Regulatory Status: Not Regulated

GLOBAL GOLD & CURRENCY CORPORATION has no valid regulatory licenses from any reputable financial authority. The WikiFX investigation confirms “No forex trading license found.” The company is registered in Saint Lucia, a popular offshore location known for very little financial oversight and easy company registration requirements. While offshore registration isn't illegal, it is a huge red flag when a broker uses it to offer financial services globally without supervision from a credible regulator. This means that any trader investing in GGCC does so without any of the important protections mentioned above. Their capital is not separated, not insured by a protection program, and there is no official body to turn to for help with disputes.

Official Warnings Given

The lack of regulation isn't just a missing piece - it has led to active warnings from government bodies. The Central Bank of Russia (RU CBR) has officially placed GLOBAL GOLD & CURRENCY CORPORATION on its warning list for showing “signs of illegal activities in the financial market.”

> *Official Warning: RU CBR has flagged GGCCFX.COM for signs of illegal financial market activities as of July 23, 2024.*

This is a third-party, official statement from a national financial institution that GGCC's operations are suspicious. When a central bank issues such a warning, it serves as one of the most serious accusations against a broker's legitimacy. It confirms that the risks are not just theoretical but have been observed and identified by official sources.

A Deep Look into Complaints

Beyond regulatory status, the most powerful evidence of a broker's character comes from the collective voice of its users. A careful review of trader complaints filed against GGCC reveals a disturbing pattern of behavior that matches perfectly with the risks expected from an unregulated company. These are not isolated incidents but a chorus of consistent, damaging reports.

Widespread Slippage and Manipulation

A recurring theme in user complaints is severe and abnormal slippage, which traders claim is a form of price manipulation designed to create losses for clients and profits for the broker. Slippage is the difference between the expected price of a trade and the price at which the trade is actually completed. While minor slippage can happen in fast-moving markets, the examples reported for GGCC are extreme and highly suspicious.

> *One trader from India reported: “my 25 pip stop-loss got hit when I was in a 30 pip profit, that's a 55 pip spike in the spread on a major currency pair! And then, something even crazier happened - my BUY trade was closed 72 pips BELOW my stop-loss!!...When I asked them about it, they just said it was 'slippage'!! Are you kidding me? 72 pips of slippage on a running trade with a 1.1 pip spread? That's not slippage, that's robbery!”*

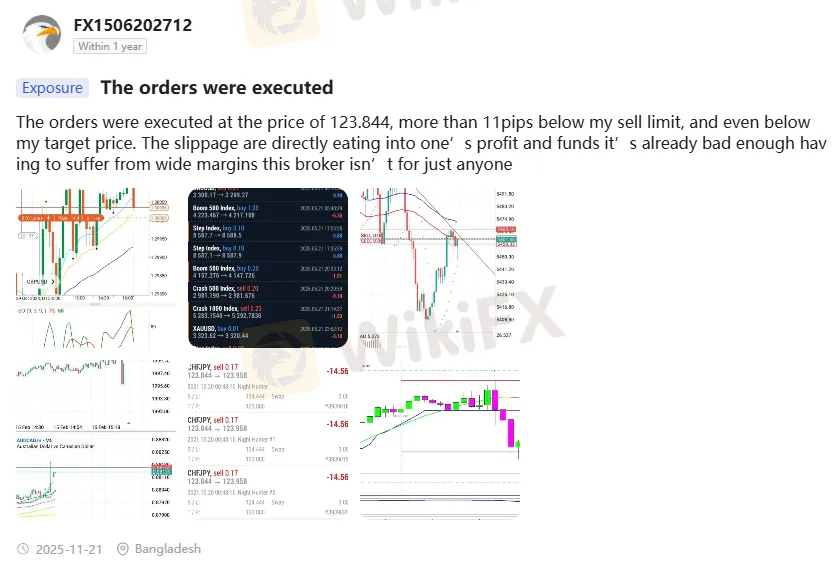

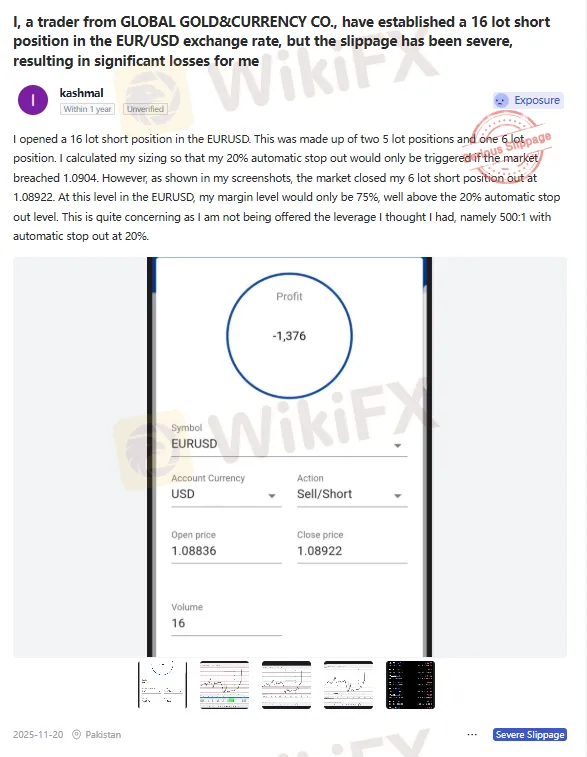

This account is not unusual. Another user from Bangladesh noted that their orders were executed more than 11 pips below their sell limit, directly reducing profits. A trader from Pakistan described how their stop-out was triggered at a margin level of 75%, far above the advertised 20% automatic stop-out level, suggesting the leverage and margin rules were not being followed. This consistent pattern of stop-loss hunting, extreme spikes in spread, and execution far from the market price points toward a system that may be rigged against the trader.

The Nightmare of Withdrawals

If investing is easy but taking it out is impossible, you are not dealing with a legitimate broker. The user experiences with GGCC paint a grim picture of withdrawal processes that seem designed to prevent clients from accessing their money.

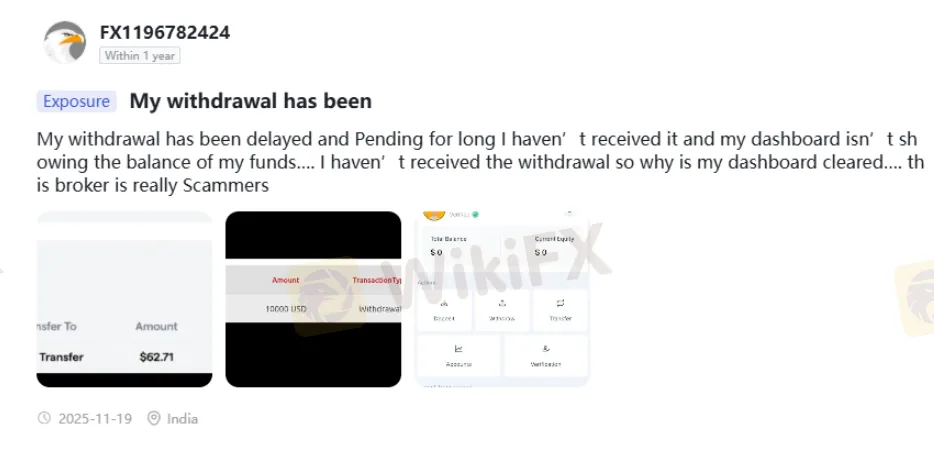

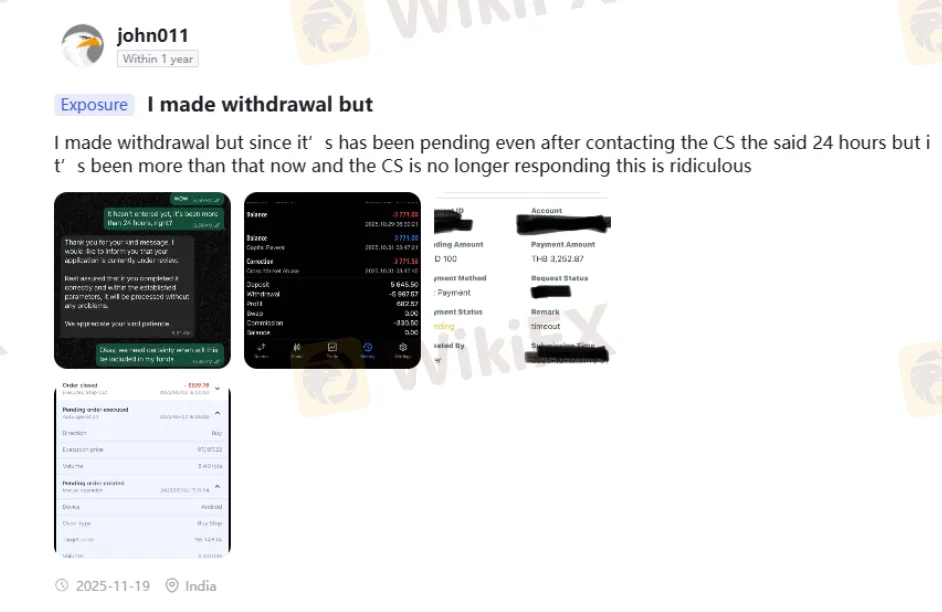

> *A trader from India stated: “My withdrawal has been delayed and pending for a long time. I haven't received it, and my dashboard isn't showing the balance of my funds…. I haven't received the withdrawal, so why is my dashboard cleared…. This broker is really a scammer.”*

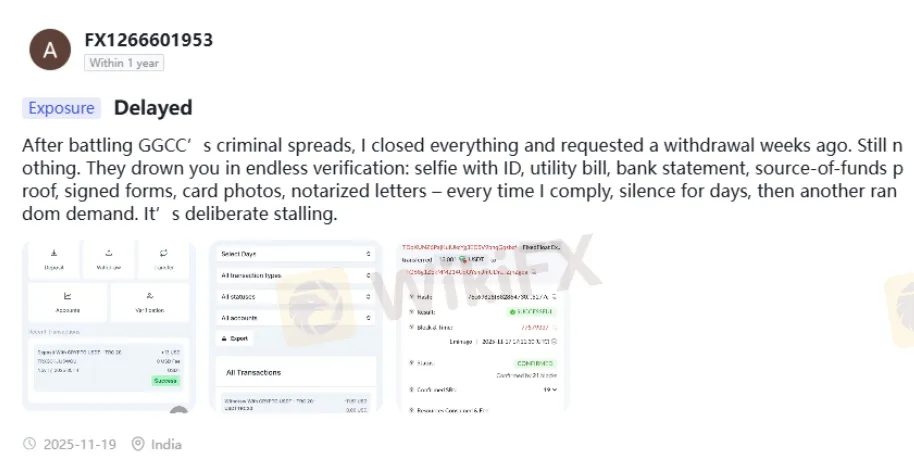

This is a classic tactic used by fraudulent operations. Other complaints detail a process of deliberate stalling. One user described being trapped in an endless verification loop after requesting a withdrawal:

> *“They drown you in endless verification: selfie with ID, utility bill, bank statement, source-of-funds proof, signed forms, card photos, notarized letters – every time I comply, silence for days, then another random demand. It's deliberate stalling.”*

Other users simply report that customer service becomes unresponsive after a withdrawal is requested. The common thread is that once a client tries to get their capital back—whether profit or principal—they face a wall of silence, impossible demands, or disappearing funds.

Suspicious Account Issues

The most severe complaints involve clients being completely locked out of their accounts. This represents a total loss of funds with no way to recover them.

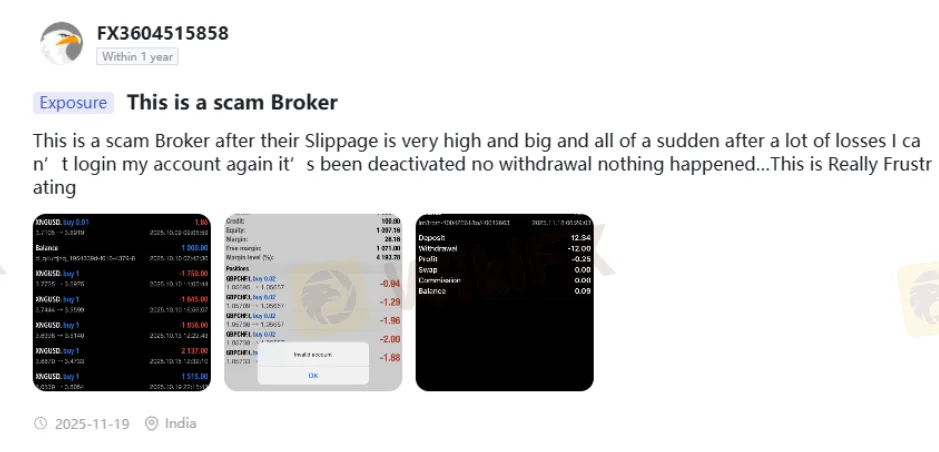

> *An Indian trader reported: “This is a scam Broker after their Slippage is very high and big and all of a sudden after a lot of losses I can't login my account again it's been deactivated no withdrawal nothing happened…This is Really Frustrating.”*

When a broker can unilaterally shut down a user's account without explanation, especially after a period of losses, it removes any pretense of legitimacy. It is the ultimate form of control and demonstrates that the client's funds are entirely at the mercy of the broker.

Analyzing GGCC's Offerings

High-risk brokers often use attractive marketing claims to lure unsuspecting traders. GGCC is no exception, offering features that seem appealing on the surface but become dangerous traps when viewed through the lens of its unregulated status and user complaints. A critical analysis is necessary to understand the hidden risks.

The Appeal of High Leverage

GGCC advertises leverage up to 1:600. High leverage allows traders to control large positions with a small capital, increasing potential profits. However, it also increases potential losses at the same rate. With a legitimate, regulated broker, this is a tool for experienced traders who understand risk management. With an unregulated broker like GGCC, which is plagued by reports of price manipulation and extreme slippage, high leverage becomes a weapon against the client. A sudden, artificial price spike of 50-70 pips, as reported by users, can instantly wipe out a highly leveraged account.

The Low Deposit Trap

The broker offers a “Micro” account with a minimum deposit of just $10. This low barrier to entry is a common tactic to encourage new traders to “test the waters” without a large financial commitment. However, given the overwhelming evidence of withdrawal failures, this strategy is deceptive. The goal is not for you to test the platform; it is for them to get your financial details and a foot in the door. Even a $10 deposit is at high risk of being lost, and it serves to draw the trader into an unsafe environment where they may be pressured to deposit more later.

The Promise of the MT5 Platform

GGCC provides the MetaTrader 5 (MT5) platform, which is a well-respected and powerful trading terminal used by millions of traders worldwide. However, the quality of the platform does not guarantee the integrity of the broker. A dishonest broker can still manipulate the price feed displayed on MT5, execute trades unfairly, and, most importantly, refuse to process withdrawals. The platform is merely the interface; the broker controls the execution, the funds, and the rules of the game. Using a legitimate platform is a veneer of credibility that means nothing when the company behind it is untrustworthy.

| GGCC's Claim | The Hidden Risk with an Unregulated Broker |

| High Leverage (up to 1:600) | Increases losses instantly, especially with reported price manipulation and slippage. A small, artificial price move can liquidate an entire account. |

| Low Minimum Deposit ($10) | An easy way to lose funds. It's a low-risk entry point for the trader that becomes a high-probability loss due to documented withdrawal issues. |

| Advanced MT5 Platform | The platform is legitimate, but the broker controls the price feed, trade execution, and, critically, access to your funds. |

| Multiple Account Types | This creates a false sense of progression, designed to encourage traders to deposit larger sums into a fundamentally unsafe and unregulated environment. |

The Verdict and Protection

After a thorough review of the evidence, a clear and decisive conclusion emerges. It is important for traders to understand the full spectrum of risks before even considering a broker like GLOBAL GOLD & CURRENCY CORPORATION.

Summary of Red Flags

To make the findings as clear as possible, here is a checklist of the critical red flags associated with GGCC. The presence of even one of these would be cause for concern; the combination is a definitive warning to stay away.

· No Valid Regulation: The most significant deal-breaker. The broker operates outside the oversight of any credible financial authority.

· Official Warning from a Central Bank: Flagged by Russia's Central Bank (RU CBR) for signs of illegal activity.

· Extremely Low WikiFX Score: A score of 1.36/10 reflects a consensus of severe issues across multiple evaluation metrics.

· Overwhelming Negative User Reviews: A consistent pattern of complaints detailing severe slippage, price manipulation, and withdrawal failures.

· Offshore Registration: Based in Saint Lucia, a jurisdiction with weak financial oversight, enabling evasion of strict regulatory standards.

· Contradictory Company Information: The broker was established in 2023, yet some data on WikiFX claims a “2-5 year” operating period, indicating inconsistent and potentially misleading information.

The Final Verdict on GGCC

Based on the overwhelming evidence—the complete lack of regulation, an official warning from a central bank, and a vast number of credible user complaints detailing financial harm—we can state clearly that GLOBAL GOLD & CURRENCY CORPORATION is not a legitimate or safe trading partner. We strongly advise all traders, from beginners to experienced professionals, to avoid this broker entirely. The risks to your capital are unacceptably high.

Your First Line of Defense

The issues identified with GGCC highlight a universal truth in online trading: careful research is not optional; it is essential. The most important step any trader can take before depositing funds is to verify the broker's credentials.

You can see GLOBAL GOLD & CURRENCY CORPORATION's complete regulatory status, user reviews, and official warnings all in one place. Always check the full report on a verification platform like WikiFX before sending any funds.

Conclusion: Putting Your Capital's Safety First

In the fast-paced world of forex and CFD trading, the appeal of high leverage and quick profits can be powerful. However, these potential rewards can never outweigh the fundamental need for security, transparency, and regulation. The case of GLOBAL GOLD & CURRENCY CORPORATION serves as a strong reminder that the broker you choose is the single most important decision you will make in your trading journey.

The question is not just “Is GLOBAL GOLD & CURRENCY CORPORATION Legit?” but “How can I ensure *any* Is the broker I choose legitimate?”. The answer lies in a simple, repeatable process of verification. By putting regulatory status first and reviewing independent data over marketing promises, you can protect yourself from the most significant risks in the market.

The trading world has natural risks, but choosing an untrustworthy broker shouldn't be one of them. Before you consider depositing with *any* broker, check its profile on a trusted verification platform first. Protect your capital by doing your research here.

Read more

GLOBAL GOLD & CURRENCY CORPORATION Regulation: A Complete Guide to Its Unregulated Status and Risks

When choosing a forex broker, the most important thing to check is whether it has proper regulation. This article answers a key question: Is GLOBAL GOLD & CURRENCY CORPORATION (GGCC) regulated? After looking at detailed data and public records, the answer is clear: GGCC operates without a valid financial services license from any trusted authority. This broker is registered in Saint Lucia and shows warning signs that should make any potential investor very careful. Checking a broker's license isn't just paperwork - it's the most important step to protect your capital from unnecessary risks.

Headway Scam Alert: Saudi Arabia & Iraq Traders Defrauded

Headway defrauded Saudi & Iraq traders: fake excuses, profit thefts, bonus vanishes, and slippage. Read scam exposure & protect your funds now!

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

Before investing in the GLOBAL GOLD & CURRENCY CORPORATION (GGCC) platform, you need to know about the serious risks. This is not a safe broker for anyone who wants to protect their capital. All the evidence shows this is a very risky company with no proper oversight and many user complaints. This warning is your most important protection. Read on as we share more details.

Baazex Forex Scam Exposed: Trader Loses $6K

Baazex, an offshore-regulated forex broker, is a confirmed scam. A trader deposited funds, earned profits, but had $5940.69 + $75.88 stolen under a fake policy violation. Stay safe: check WikiFX exposure before trading. Avoid Baazex today!

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc