Amana Capital

Abstract: Based in the United Arab Emirates, Amana is an online trading platform, offering 6,000+ tradable products, including Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, and Metals. It claims to offer leverage up to 1:100 and a spread 70% lower. This company holds multiple licenses from various authorities, while most of the licenses are effective, some of the licenses are revoked, exceeded, or suspected to be a fake clone.

| amana Review Summary | |

| Founded | 2021 |

| Registered Country/Region | United Arab Emirates |

| Regulation | DFSA, CMA, LFSA, BDL (Revoked), SCA (Exceeded), CYSEC/FCA (Suspicious Clone) |

| Market Instruments | 6,000+, Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, Metals |

| Demo Account | / |

| Leverage | Up to 1:100 |

| Spread | 70% Lower Spread |

| Trading Platform | amana App, amana Web, MT4, MT5 |

| Minimum Deposit | / |

| Customer Support | Live chat |

| Email: support@amana.app | |

| Social Media: Facebook, Twitter, Instagram, YouTube, LinkedIn, TikTok, Messenger, Telegram, WhatsApp | |

amana Information

Based in the United Arab Emirates, Amana is an online trading platform, offering 6,000+ tradable products, including Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, and Metals. It claims to offer leverage up to 1:100 and a spread 70% lower. This company holds multiple licenses from various authorities, while most of the licenses are effective, some of the licenses are revoked, exceeded, or suspected to be a fake clone.

Pros and Cons

| Pros | Cons |

| Various market offerings | Some licenses are exceeded, revoked or suspected to be a fake clone |

| No commissions | |

| MT4 and MT5 supported | |

| Three account types | |

| Various payment methods | |

| Live chat support |

Is amana Legit?

amana operates under various regulatory frameworks across different jurisdictions. However, when it comes to regulatory status, while most entities are regulated, some have had their licenses revoked or are flagged as “Suspicious Clone” by certain authorities.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Dubai Financial Services Authority (DFSA) | Regulated | Amana Financial Services (Dubai) Limited | Retail Forex License | F003269 |

| Capital Markets Authority LEBANON (CMA) | Regulated | Amana Capital SAL | Retail Forex License | 26 |

| BANQUE DU LIBAN (BDL) | Revoked | Amana Capital S.A.L. | Financial Service | 60 |

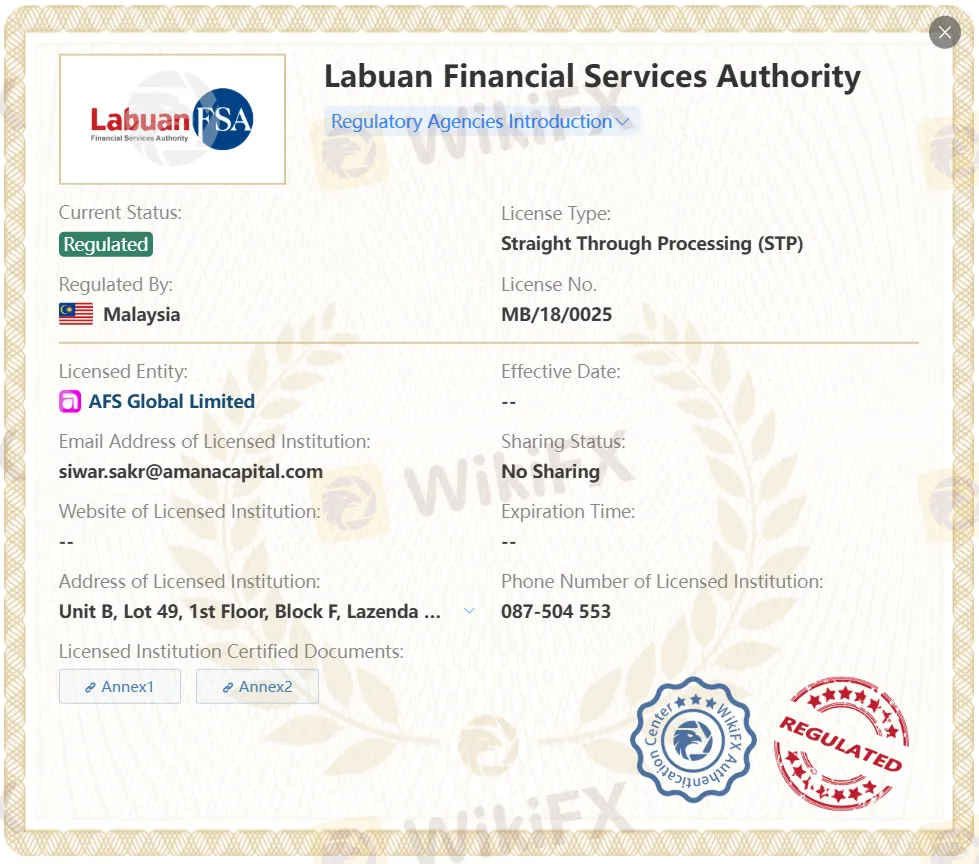

| Labuan Financial Services Authority (LFSA) | Regulated | AFS Global Limited | Straight Through Processing (STP) | MB/18/0025 |

| Securities and Commodities Authority (SCA) | Exceeded | Amana Mena Promotional Services L.L.C | Investment Advisory License | 20200000255 |

| Cyprus Securities and Exchange Commission (CySEC) | Suspicious Clone | Amana Capital Ltd | Market Maker (MM) | 155/11 |

| Financial Conduct Authority (FCA) | Suspicious Clone | Amana Financial Services UK Limited | Straight Through Processing (STP) | 605070 |

What Can I Trade on amana?

amana asserts to offer over 6,000 types of market instruments, including Forex, Commodities, Stocks, Cryptocurrencies, ETFs, Indices, and Metals.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| ETFs | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

Account Type

There are three types of car available on this platform, Meta Trader 4 (Hedged), Meta Trader 5 (Hedged), and Meta Trader 5 (Netting), each comes with different trading conditions.

| Account Type | MetaTrader 4 (Hedged) | MetaTrader 5 (Hedged) | MetaTrader 5 (Netting) |

| Trading Assets | 100+ assets | 3,700+ assets | 3,700+ assets |

| Expert Advisors for automated trading | ✔ | ✔ | ✔ |

| Advanced indicators and analysis tools | ✔ | ✔ | ✔ |

| Multi chart support | ✔ | ❌ | ❌ |

| One-click trading | ❌ | ✔ | ✔ |

| Ticket-based trading | ✔ | ✔ | ✔ |

| MENA exchange-traded stocks | ❌ | ✔ | ✔ |

| US exchange-traded stocks | ❌ | ❌ | ❌ |

| Fractional trading | ❌ | ❌ | ❌ |

| Net-based positions | ❌ | ❌ | ✔ |

Leverage

Amana offers distinct leverages based on the asset class. 1:100 is the maximum leverage on this platform. Traders can contact the customer support team to request more leverage.

| Asset Classes | Standard Leverage | High Leverage |

| Major Forex | 25x | 100x |

| Minor Forex | 20x | |

| Gold | ||

| Silver | 10x | |

| Index Future Derivatives | 20x | |

| Energy Futures Derivatives | 10x | 50x |

| Commodity Futures Derivatives | 25x | |

| Spot Index Derivatives | 20x | 20x |

| Spot Energy Derivatives | 10x | 50x |

Fees

The spread on this platform is committed to being 70% lower. According to amana, traders are allowed to enjoy commission-free on all assets.

However, amana charges overnight financing fees on US Stock Derivatives (OTC), US ETFs derivatives, Regional stock Derivatives, Leveraged crypto, Forex Derivatives (OTC), International Stock derivatives (OTC), and Spot market derivatives (OTC).

Plus, amana charges a clearing fee on Regional stocks (exchange traded/OTC) and Regional stock derivatives (OTC).

Trading Platform

Traders on this platform get access to amana App, which is an all-in-one trading app that grants access to 5,500+ commission-free assets across global and regional markets. From stocks, cryptocurrencies, forex, metals, and indices to ETFs, commodities, and more.

In the meantime, amana also provides access to MT4 and MT5, which are popular trading platforms widely used for forex, CFDs, and other financial markets trading.

- MT4 is simpler and highly popular for forex trading.

- MT5 offers more advanced features, supports more markets, and is more flexible for algorithmic trading.

| Trading Platform | Supported | Available Devices | Suitable for |

| amana App | ✔ | Desktop, Mobile, Web | / |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

Deposit and Withdrawal

These are the payment options available on this platform: Visa, Mastercard, amana Prepaid Card, Apple Pay, Wire Transfer, UAE instant banking, Neteller, Whish Money (Lebanon), Skrill, and digital currencies.

Amana claims that traders can enjoy zero fees on all card deposits and withdrawals.

Read more

Rebelsfunding Exposed: Unfair Account Blockage, Frequent Platform Freeze, Unethical Operations

Facing serious safety concerns with the Rebelsfunding trading account? Does the Slovakia-based forex broker surprise you by blocking your account? Does the platform freeze frequently and stop you from placing trades? Does the buy/sell button deactivate once you hit profits? Facing app loading issues and detail errors? You need to reach the higher authorities ASAP. Failure to do so may result in fund losses. Many of its clients have complained about the broker online. In this article, we have shared their complaints. Take a look.

ADCB Faces Customer Backlash on All Fronts: Check Top Complaints

Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

FX Live Capital Review: Regulation Status & 4 Facts You Must Know

This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

Forex Market Time Converter Explained: Trading Hours, Sessions & More

The forex market is full of opportunities for traders with operations spanning 24 hours a day, five days a week. You might be in India or Russia but you can always trade on forex globally. Forex trading sessions usually overlap globally, allowing you to maximize your trade potential. The major trading centres are Tokyo, London, New York and Sydney. But how will you know the forex trading sessions across different zones? Simple, use the forex market time converter tool. It lets you know the trading hours (open and close times) globally.

WikiFX Broker

Latest News

Axi CCO Louis Cooper to Retire in Sept 2025

Pros, Cons & Reality of Investing in Forex

WikiEXPO 2025 Cyprus “Welcome Party” Kicks Off Tonight in Limassol

Revealing the Binany Scam: Withdrawal Denials, Deposit Credit Issues & More

Vault Markets Review: Complaints, Withdrawal & Regulation Concerns Revealed!

Firstrade Review 2025: Login, Regulation, and Risk

Colmex Pro Review: Regulation, Fees, Platform Logins, and Safety

GO Markets Launches Signal Centre with Acuity

Drawdown in Forex Trading Explained: Definition, Concept & Importance

Kanak Capital Markets Exposed: Mounting Fraud Allegations Leave Traders Unsafe

Rate Calc