QuickTrade Spreads, leverage, minimum deposit Revealed

Abstract:QuickTrade is a forex broker based in South Africa, during this review we will be looking into the service being offered by QuickTrade but as a word of warning, there is very little information available on the website so there may be some questions you have let unanswered by the time we finish.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | South Africa |

| Found | 2014 |

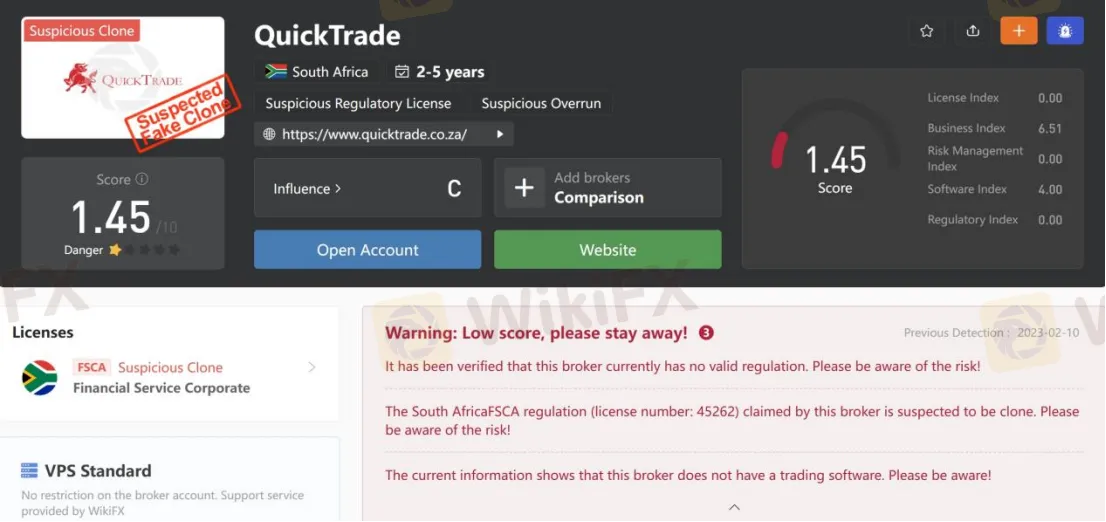

| Regulation | Suspicious clone |

| Market Instrument | indices, US CFDs, commodities, and currencies |

| Account Type | N/A |

| Demo Account | N/A |

| Maximum Leverage | 1:500 |

| Spread | From 1.2 pips |

| Commission | N/A |

| Trading Platform | MT5 |

| Minimum Deposit | N/A |

| Deposit & Withdrawal Method | Skrill, OZOW and payfast |

QuickTrade is a forex broker based in South Africa, during this review we will be looking into the service being offered by QuickTrade but as a word of warning, there is very little information available on the website so there may be some questions you have let unanswered by the time we finish.

Here is the home page of this brokers official site:

The broker claimed to be regulated by the local Financial Services Conduct Authority (FSCA). However, the FSCAs guidelines are slightly more permissive in other ways. South Africa, for example, is one of the last regulatory centres where traders can still enjoy unlimited leverage, which is a significant benefit and incentive.

Besides this, QuickTrade is a registered FSP with a FAIS Category I licence. QuickTrade is authorized to provide advisory and intermediary services about shares, derivative instruments and warrants, certificates, and other instruments under the conditions of its FSP licence.

The brokers obligations to you under FAIS legislation and applicable FSCA laws are unaffected by the execution of its Client Agreement between you and QuickTrade.

QuickTrade has also applied to the FMA to be authorized as such. QuickTrade is thus subject to the FMA‘s regulations for OTC derivatives providers and the FSCA’s laws that apply to OTC derivative providers.

It is important to highlight that CFD transactions are conducted on a principal-to-principal basis and are not regulated by FAIS.

Note: The screenshot date is February 10, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

QuickTrade advertises that it offers access to a wide range of trading instruments in financial markets, including indices, US CFDs, commodities, and currencies.

Account Types

There isnt any account-specific information available on the website. It seems that QuickTrade offers a single account type.

TRADE SIZE

Trades start at 0.01 lots and go up in increments of 0.01, so the next available trade size is 0.02 lots and then 0.03 lots. There is no mention of the maximum trade size however with most brokers this is between 50 lots and 100 lots but we would not recommend trading over 50 lots at the time as it can make it harder for liquidity providers and the market to execute the trade quickly without any slippage.

Leverage

1:100 is the default for all accounts, while the leverage is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

Spreads start at 1.2 pips and are floating which means that they change depending on the market conditions. If the market is volatile then the spreads will be a little higher, however, they will not fall below 1.2 pips. It is also worth mentioning that certain assets naturally have higher spreads and so may always be seen about 1.2 pips or even over 2 pips, but this is normal for all brokers.

Trading Platform

QuickTrade only offers one trading platform, the good news is that the available platform is MetaTrader5.

MetaTrader5 (MT5) is the younger brother of MetaTrader4 (MT4) developed by MetaQuotes Software and released in 2010. MT5 is used by millions and offers plenty of trading and analysis features in your trading. Additional services expand the functionality of the platform making its capabilities almost limitless.

MetaTrader5 offers the built-in Market of trading robots, the Freelance database of strategy developers, Copy Trading and a Virtual Hosting service (Forex VPS). Use all these services from one place, and access new trading opportunities. MetaTrader 5 is also highly accessible with it being available as a desktop download, application for iOS and Android devices and even as a WebTrader where you can trade from within your internet browser.

Deposit & Withdrawal

QuickTrade accepts deposits and withdrawals via Skrill, OZOW and payfast.

Customer Support

QuickTrades customer support can be reached by Phone: +27 11 315 1000, Email: hello@quicktrade.co.za, Live chat, WhatsApp or send messages online to get in touch. You can also follow this broker on social networks such as Twitter, Facebook, Instagram, YouTube and LinkedIn. Company address: Co-working office 3-109, The Link, 173 Oxford Rd, Rosebank, Johannesburg, Gauteng, 2196 RSA.

Pros & Cons

| Pros | Cons |

| • Wide range of trading assets | • Suspicious clone |

| • MT5 supported | • Only South African residents available |

| • Limited funding options | |

| • Lack of transparency |

Frequently Asked Questions (FAQs)

| Q 1: | Is QuickTrade regulated? |

| A 1: | No. QuickTrade holds a suspicious clone Financial Sector Conduct Authority (FSCA) license. |

| Q 2: | At QuickTrade, are there any regional restrictions for traders? |

| A 2: | Yes. QuickTrades website is directed only at residents of the Republic of South Africa. |

| Q 3: | Does QuickTrade offer the industry-standard MT4 & MT5? |

| A 3: | Yes. QuickTrade supports MT5. |

| Q 4: | Is QuickTrade a good broker for beginners? |

| A 4: | No. QuickTrade is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency. |

Latest News

WikiEXPO Global Expert Interview Spyros Ierides:Asset management and investor resilience

US Deficit Explodes In August Despite Rising Tariff Revenues As Government Spending Soars

MultiBank Group — recent exposures, complaints, and who runs the firm

Glancing at the Top 5 Forex Risk Management Tools

Everyone's Mad! | MultiBank Group's Havoc

How to Trade Forex on Your Phone: A Complete Beginner's Guide

Thinking About Investing in Trinity Capitals? Beware, It’s an Unregulated Broker!

Malaysian Traders: Stay Away From MTrading!

GMZ Global Exposed: Investors Cry Foul Play as Investment Scams Take Precedence

Disadvantages of Investing with Bulenox! Must Read

Rate Calc