Everyone's Mad! | MultiBank Group's Havoc

Abstract:MultiBank Group’s employee(s) and clients are mad at it, whilst MultiBank Group blames WikiFX. What is all this drama about?

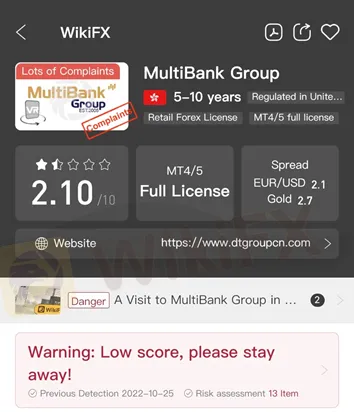

WikiFX has deemed MultiBank Group an unreliable broker after conducting careful and thorough reviews from various dimensions in terms of the validity of its licenses and business operations while considering the overwhelming negative customer reviews.

WikiFX has deemed MultiBank Group an unreliable broker after conducting careful and thorough reviews from various dimensions in terms of the validity of its licenses and business operations while considering the overwhelming negative customer reviews. MultiBank Group does not like such a public airing of their dirty laundry.

MultiBank Group does not like such a public airing of their dirty laundry.In conjunction with WikiFXs warning posts and articles, MultiBank Group lashed back at us defensively.

Another dirty act of MultiBank Group is not paying its employee in China.

According to the employee in concern, he had been working in the Shenzhen office of MultiBank Group as a Forex analyst since 2019. In January 2022, he received a notice that the office would be shut down as MultiBank Group planned to exit the China market. The employee agreed to the promised compensation package and left the company in February. Unfortunately, he did not receive a single penny from the company. This dragged on for 10 months until he decided to expose the truth through Sohu Business. For the full article (in Mandarin), read here: https://business.sohu.com/a/593641554_100122350.

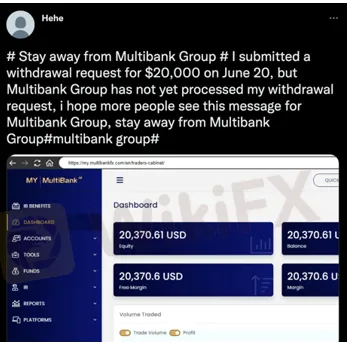

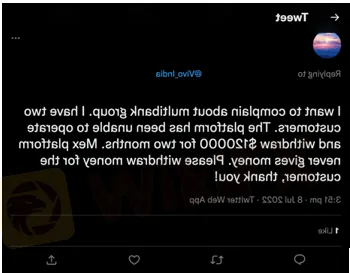

This employee also revealed that MultiBank Group had not responsibly settled its clients funds which could be further explained by the complaints uploaded on Twitter.

Not only does MultiBank Group received complaints from its employee, but also trading clients, it is justifiable that this is a forex broker that should be flagged.

Read more

InterTrader Exposed: Traders Report Unfair Account Blocks, Profit Removal & Additional Fee for Withd

Does InterTrader block your forex trading account, giving inexplicable reasons? Does the broker flag you with latency trading and cancel all your profits? Do you have to pay additional fees for withdrawals? Did the UK-based forex broker fail to recognize the deposit you made? Does the customer service fail to address your trading queries? In this InterTrader review article, we have shared such complaints. Read them out.

Grand Capital Doesn’t Feel GRAND for Traders with Withdrawal Denials & Long Processing Times

The trading environment does not seem that rosy for traders at Grand Capital, a Seychelles-based forex broker. Traders’ requests for withdrawals are alleged to be in the review process for months, making them frustrated and helpless. Despite meeting the guidelines, traders find it hard to withdraw funds, as suggested by their complaints online. What’s also troubling traders are long processing times concerning Grand Capital withdrawals. In this Grand Capital review segment, we have shared some complaints for you to look at. Read on!

EmiraX Markets Withdrawal Issues Exposed

EmiraX Markets Review reveals unregulated status, fake license claims, and withdrawal issues. Stay safe and avoid this broker.

ADSS Review: Traders Say NO to Trading B’coz of Withdrawal Blocks, Account Freeze & Trade Issues

Does ADSS give you plenty of excuses to deny you access to withdrawals? Is your withdrawal request pending for months or years? Do you witness account freezes from the United Arab Emirates-based forex broker? Do you struggle to open and close your forex positions on the ADSS app? Does the customer support service fail to respond to your trading queries? All these issues have become a rage online. In this ADSS Broker review article, we have highlighted actual trader wordings on these issues. Keep reading!

WikiFX Broker

Latest News

Consob Targets Political Deepfake “Clone Sites” and Unlicensed Platforms in Latest Enforcement Round

WikiEXPO Global Expert Interviews: Gustavo Antonio Montero: ESG in Finance

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Israeli Arrested in Rome Over €50M Forex Scam

Scam Alert: GINKGO-my.com is Draining Millions from Malaysians!

New FCA Consumer Alert 2025: Important Warning for All Consumers

EmiraX Markets Withdrawal Issues Exposed

Polymarket Onboards First US Users Since 2022 Shutdown: Beta Relaunch Signals Major Comeback

US Seizes US15 Billion in Bitcoin as Prince Group Rejects Crypto Scam Allegations

INGOT Brokers Regulation 2025: ASIC vs Offshore License - What Traders Must Know

Rate Calc