User Reviews

More

User comment

21

CommentsWrite a review

2024-09-10 11:59

2024-09-10 11:59

2024-07-31 18:06

2024-07-31 18:06

Score

Above 20 years

Above 20 yearsRegulated in Japan

Market Making License (MM)

MT4 Full License

Global Business

High potential risk

Capital Ratio

Influence

Add brokers

Comparison

Quantity 10

Exposure

Score

Regulatory Index8.38

Business Index8.00

Risk Management Index0.00

Software Index9.72

License Index8.40

Single Core

1G

40G

More

Danger

Sanction

Warning

More

Company Name

Rakuten Securities Hong Kong Limited

Company Abbreviation

Rakuten Securities

Platform registered country and region

Japan

Number of employees

Company website

X

YouTube

(852) 6547-2442

Company summary

Pyramid scheme complaint

Expose

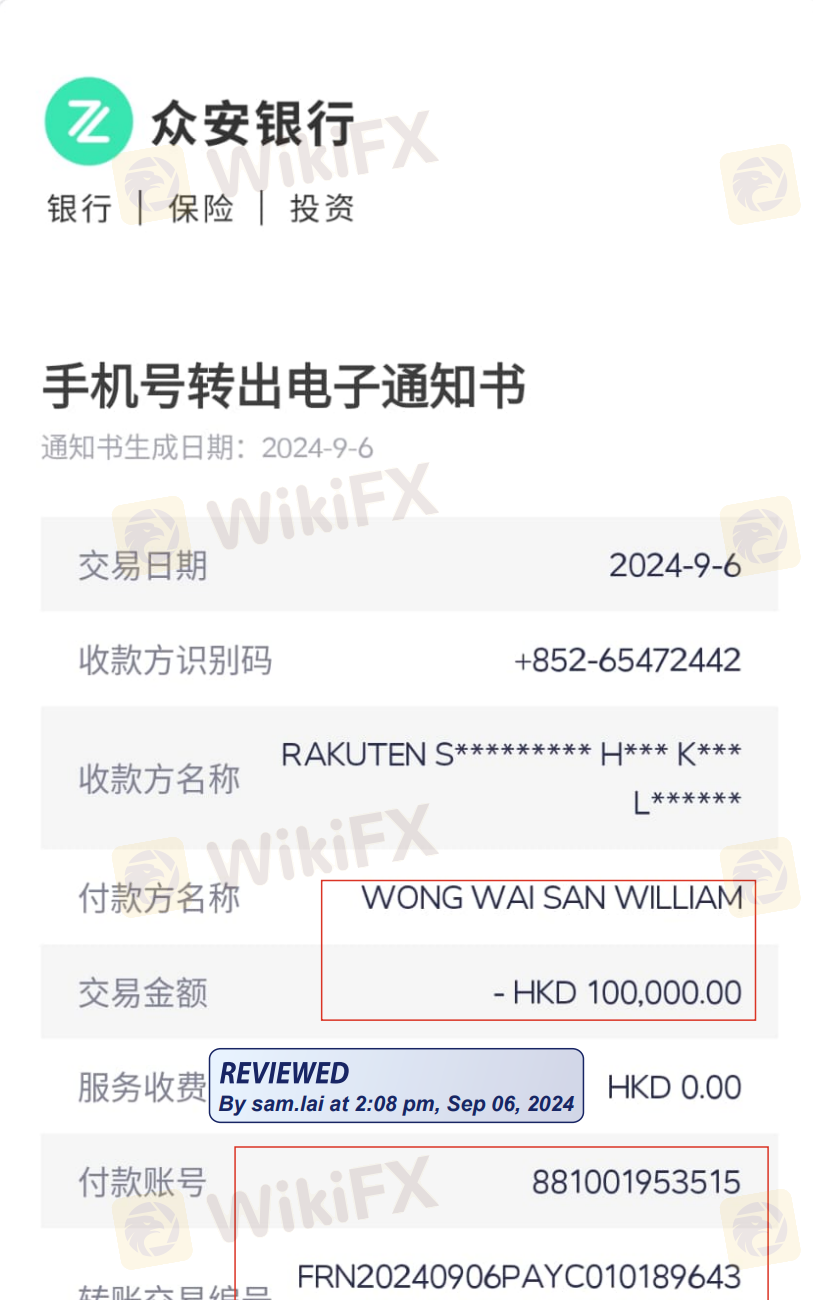

Have to pay 20% tax to the broker but you can't withdraw funds. I was cheated of a hundred thousand yuan.

I made a GDPUSD sell stop order with a price of 1.30475 At 13:59, September 13, 2018, and the stop loss was set at 1.30555. The final order was closed at 13:59:47, and the stop loss was closed at a price of 1.30846 at 13:59:47 (the price was 30 points higher than the stop loss price, and 17 points higher than the highest price in this period). At the moment of transaction, the difference was increased, making the closing of the pending order and the stop loss completed at the same time.

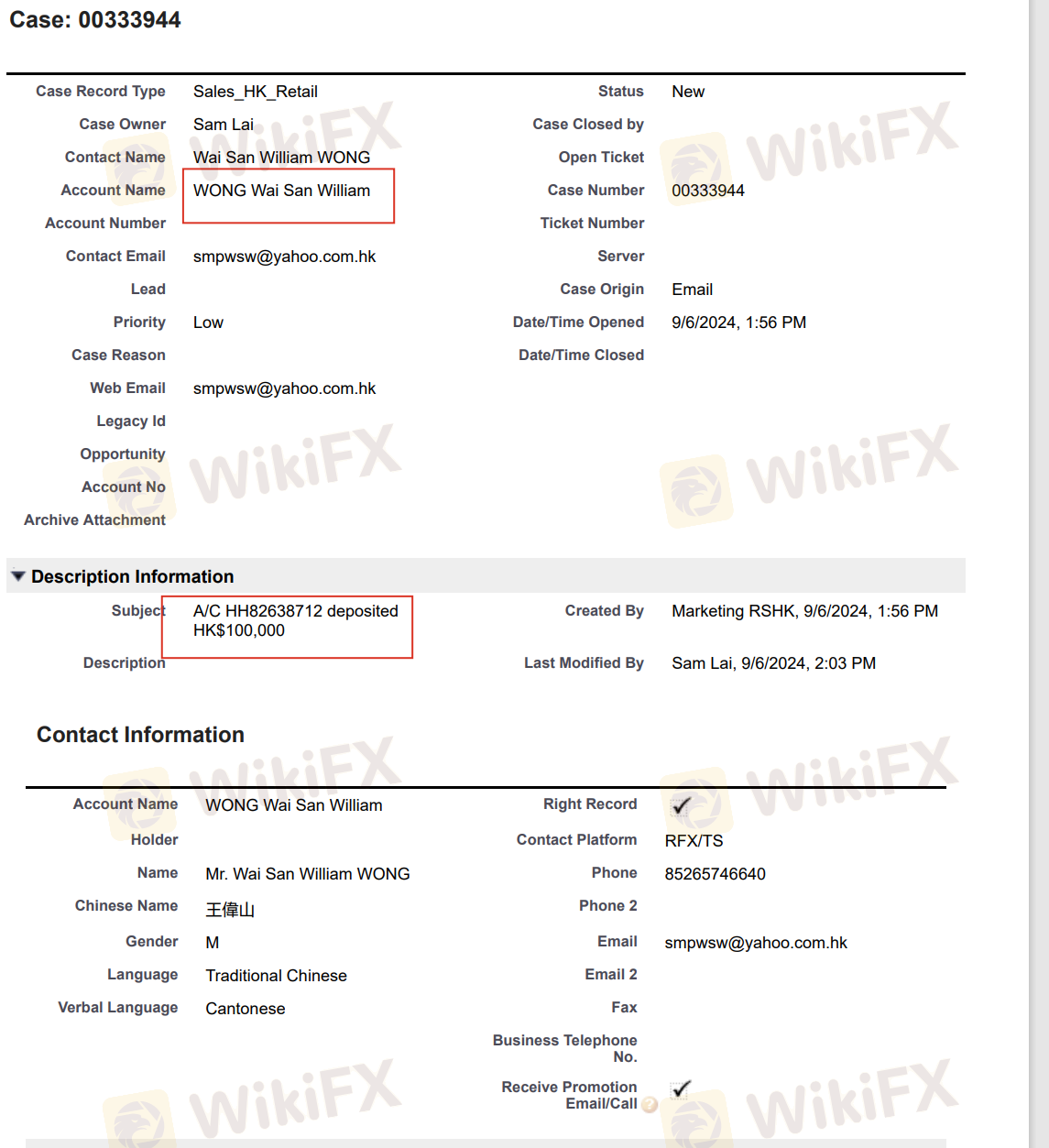

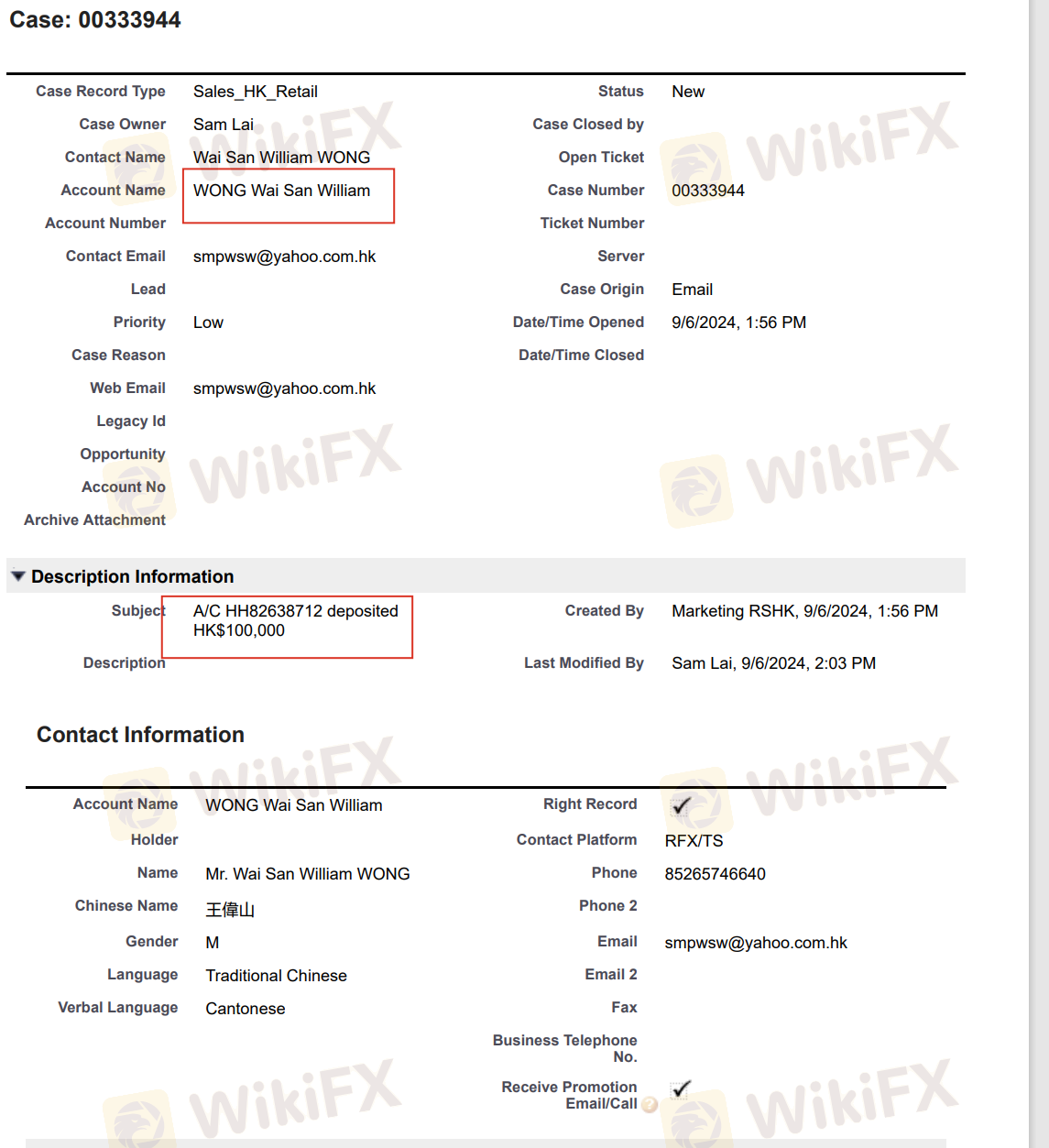

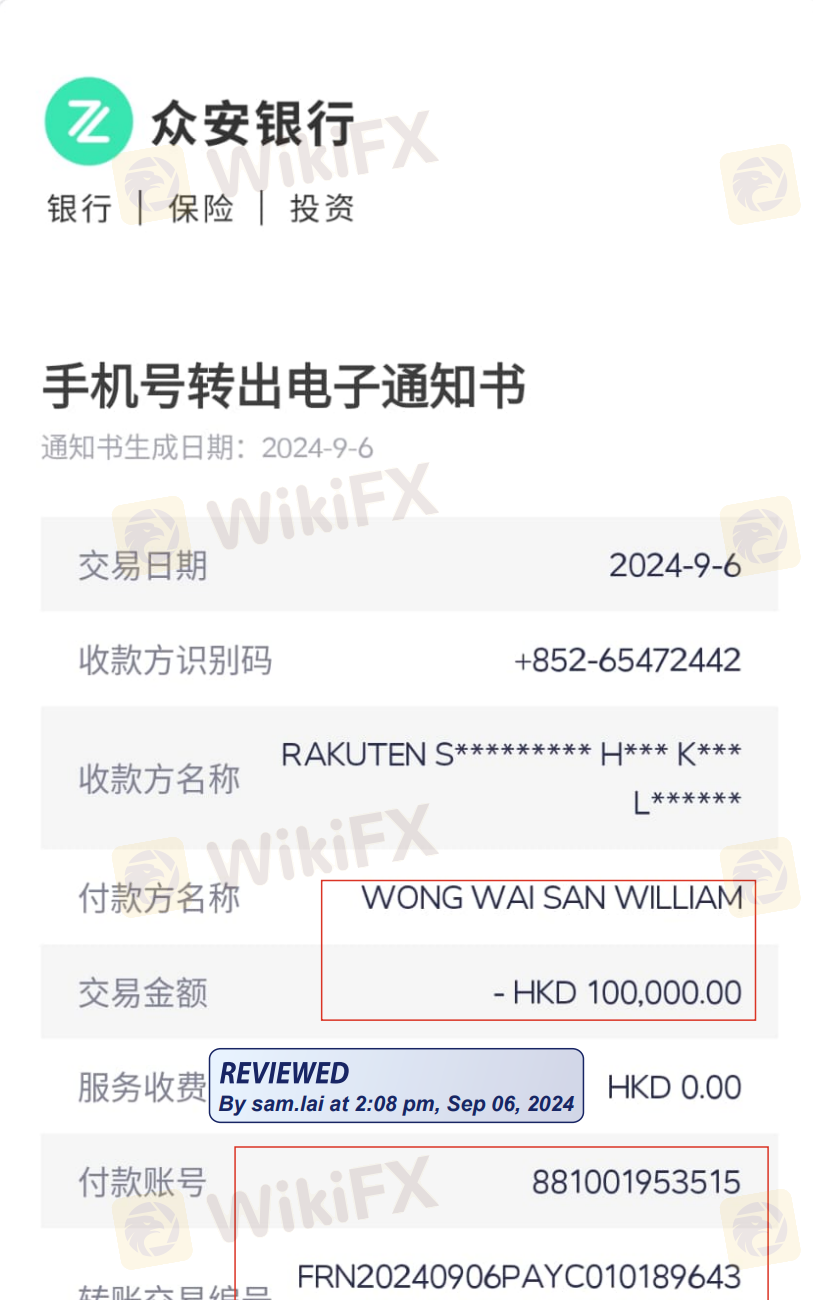

Rakuten refuses to withdraw funds for me and even leaks my personal information. Many of my friends have encountered the same situation. Not only did they not release the funds, but they also leaked my personal information. Below is the personal information I submitted that was leaked.

You even can't withdraw funds after paying the tax. Cheat you into depositing money again and again. You can't get the money back. Is there anybody who has the same experience as me.

I made a deposit of 500 dollars last night and it has not been credited till today. There is no customer service. Return my money

At first I invested in Rakuten because I thought they were big brands, having financial security and stable platform. I was very optimistic about it. I opened an account in August 2018 and started trading. There was a time when depositing money process was smooth, but this situation had basically recovered after the Spring Festival. That customer service was not bad. But last week, I was very angry. On the evening of February 27th, I used my five trading accounts to buy long GBP/JPY (including EToro, Jiasheng, Anda and TradeMax) on five trading platforms. Only Rakuten raised a dozen pips, causing my position to be liquidated. When I saw the position liquidation, I quickly took the screenshot and kept the evidence and sent an email to Rakuten. After this week's negotiations, Rakuten internally agreed that the stop loss was caused by the normal spread of the market at that time and did not give me compensation. I don't ask much, just want to get back the stop loss money. A week passed, they ignored it, just saying that it was the normal spread of the market. I want to ask, why the other platforms didn’t liquidate my position but Rakuten? And after the stop loss the platform did not show that the highest price has reached my stop loss. Rakuten’s conduct is a scam. I’ve been trading for years. Such a situation really made me puzzled. Will you still trade on it?

They contacted me through WhatsApp to work from home and evaluate links that they sent me through the Telegram app. Then they asked me for deposits to complete some tasks so that they could pay me commission. They demanded an amount that I could not pay and now they do not want me refund my money. They tell me that I have to deposit. The money is on the page and can be withdrawn. But they do not give me the withdrawal code.

On the Rakuten platform, I can’t withdraw when I want to, and the company dealing with is also a fraudulent company. It’s not reliable at all. They’re all liars. Can’t withdraw even keep paying.

I agree if I should pay individual income tax. But why I should transfer the tax to a personal account? And my account will be frozen in 48 hours if I don't pay the money

I didn’t want to expose the platform at first, but I am really angry when I saw Rakuten Securities’ s score rank at No. 7. I would like to share you my sad story related to this platform. I deposited in the account on 2 Jan., 2019, when the server have been offline for several hours. When I asked for explanations, the employees made no reply. The server went back to normal on 3 Jan. before the market opened and when the market opened, a mega JPY move showed up. Now I should tell you what shameless things they did. First, the platform said there was a fixed spread in 95% of a day. However, pay attention to the rest of 5% when spreads were unfixed and big movement happened with unimaginable big spreads. I mean, when the market opened on 3 Jan., you had to pay a service fee of over 1,500 dollars if you traded one hand USDJPY. Is it exciting? This is the first shameless thing they did. Second, When there were big movements in the market, they would close trading. It is impossible for them to stop doing something before wipe out your account. When you got profits, you didn’t expected to sale orders, and when you lost, you couldn’t cover and lock position. There was nothing you could do. When your account wiped out, the platform could close out the orders. The market movement depends on its will. Third, They will give you cold shoulder when you are caught into problems. They will pass the buck with an excuse of mobility. Is it shameless for the platform to deny the evidence? The trading journal won’t tall lies. The above are enough. Keep away from it, everyone!

| Rakuten Securities Review Summary in 10 Points | |

| Founded | 1999 |

| Headquarters | Tokyo, Japan |

| Regulation | ASIC, FSA, SFC |

| Market Instruments | forex, stock indices and metals |

| Demo Account | Available |

| Leverage | 30:1 for retail/400:1 for pro |

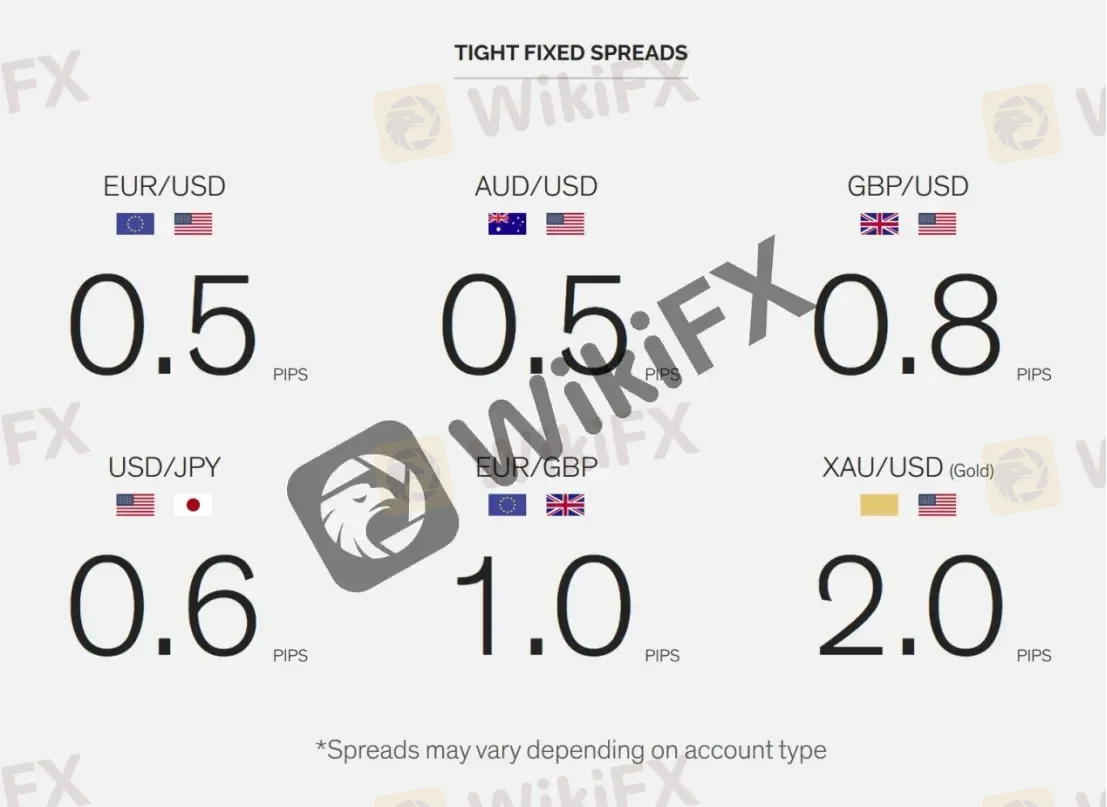

| EUR/USD Spread | 0.5 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/7 live chat, phone, WhatsApp, email |

Rakuten Securities is a subsidiary of Rakuten Group, a Japanese electronic commerce and online retailing company. Rakuten Securities is a financial services provider that offers online trading services for forex, commodities, indices, and stocks. The company was founded in 1999 and is headquartered in Tokyo, Japan. Rakuten Securities operates in several regions, including Japan, Hong Kong, Malaysia and Australia.

Rakuten Securities is a reputable broker with many advantages, such as user-friendly MT4 trading platform, advanced charting and analysis tools, and low fees for certain services. However, there are also some potential drawbacks to consider, including limited product portfolios and trading platform options. As with any broker, it's important to carefully weigh the pros and cons before deciding whether or not to use their services.

| Pros | Cons |

| • Low fees and commissions | • Limited product portfolio |

| • Regulated by ASIC, FSA, SFC | • Limited research and educational tools |

| • User-friendly MT4 trading platform | • Not available for US clients |

| • Efficient customer service | • Limited trading platform options |

| • Advanced charting and analysis tools available |

Note: These pros and cons are subjective and may not be exhaustive. Different users may have different experiences and opinions.

There are many alternative brokers for Rakuten Securities depending on the specific needs and preferences of the trader. Some popular options include:

Interactive Brokers: A US-based broker that offers low commissions and access to a wide range of financial instruments, including stocks, options, futures, and forex.

Saxo Bank: A Danish investment bank that offers a range of trading products and platforms, including forex, stocks, options, futures, and bonds.

TD Ameritrade: A US-based broker that offers a user-friendly trading platform and access to a variety of investment products, including stocks, options, futures, and forex.

Swissquote: A Swiss-based broker that provides access to a wide range of financial products, including forex, stocks, options, and futures.

Oanda: A global forex broker that offers competitive spreads, low trading costs, and access to a variety of trading platforms and tools.

Rakuten Securities is a subsidiary of the Rakuten Group, a well-known Japanese company with a strong reputation. It is also regulated by several financial authorities, including the Japanese Financial Services Agency (FSA), the Australian Securities and Investments Commission (ASIC), and Hong Kong Securities and Futures Commission (SFC). This suggests that Rakuten Securities is a legitimate broker.

| Protection Measure | Description |

| Regulatory Oversight | ASIC, FSA, SFC |

| Segregated Accounts | protect client funds in the event of insolvency or other financial difficulties |

| SSL Encryption | protect client data and transactions from unauthorized access or interception |

| Two-Factor Authentication | provides an extra layer of security by requiring a second form of authentication |

| Risk Management Tools | such as stop-loss orders and limit orders, which can help clients manage their exposure to market risk and limit potential losses |

It's important to note that while these measures can help mitigate risks for clients, no trading or investment platform can guarantee complete protection against all potential risks and losses.

Based on the information provided regarding the regulation, safety measures, and overall reputation of Rakuten Securities, it can be concluded that the broker is a reliable and trustworthy option for traders. However, as with any investment, there are always risks involved, and traders should conduct their own due diligence before investing with any broker.

Rakuten Securities provides traders with some popular financial tradable instruments, mainly forex, stock indices and metals. Other asset classes such as commodities and cryptocurrencies are not available.

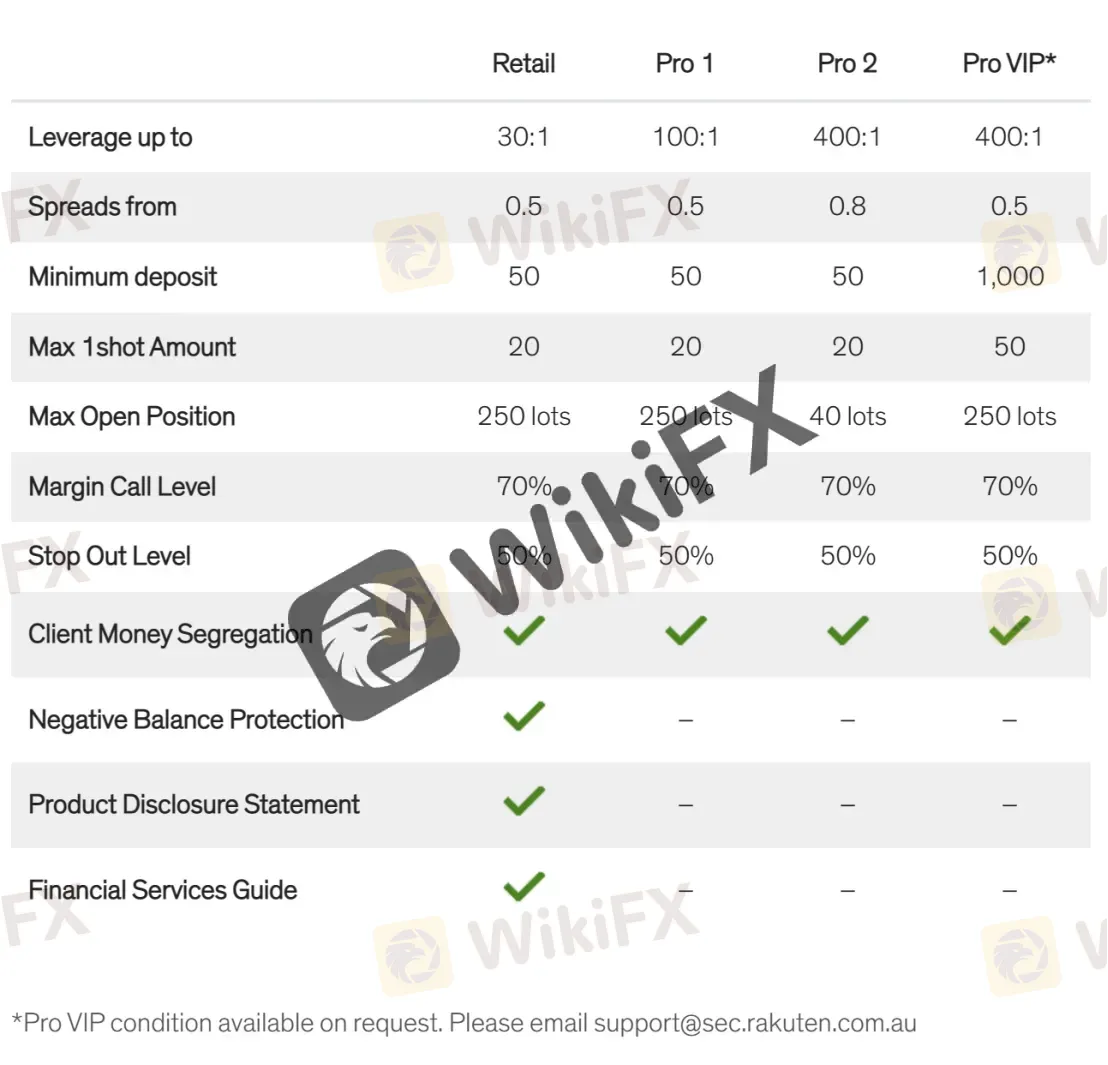

In total, you can open one of four distinct accounts with Rakuten Securities. The Retail Account, the Pro 1 Account, the Pro 2 Account, and the Pro VIP Account. The minimum deposit is $50 for the Retail Account, the Pro 1 Account, the Pro 2 Account, and $1,000 for the Pro VIP Account. Free demo accounts are also available.

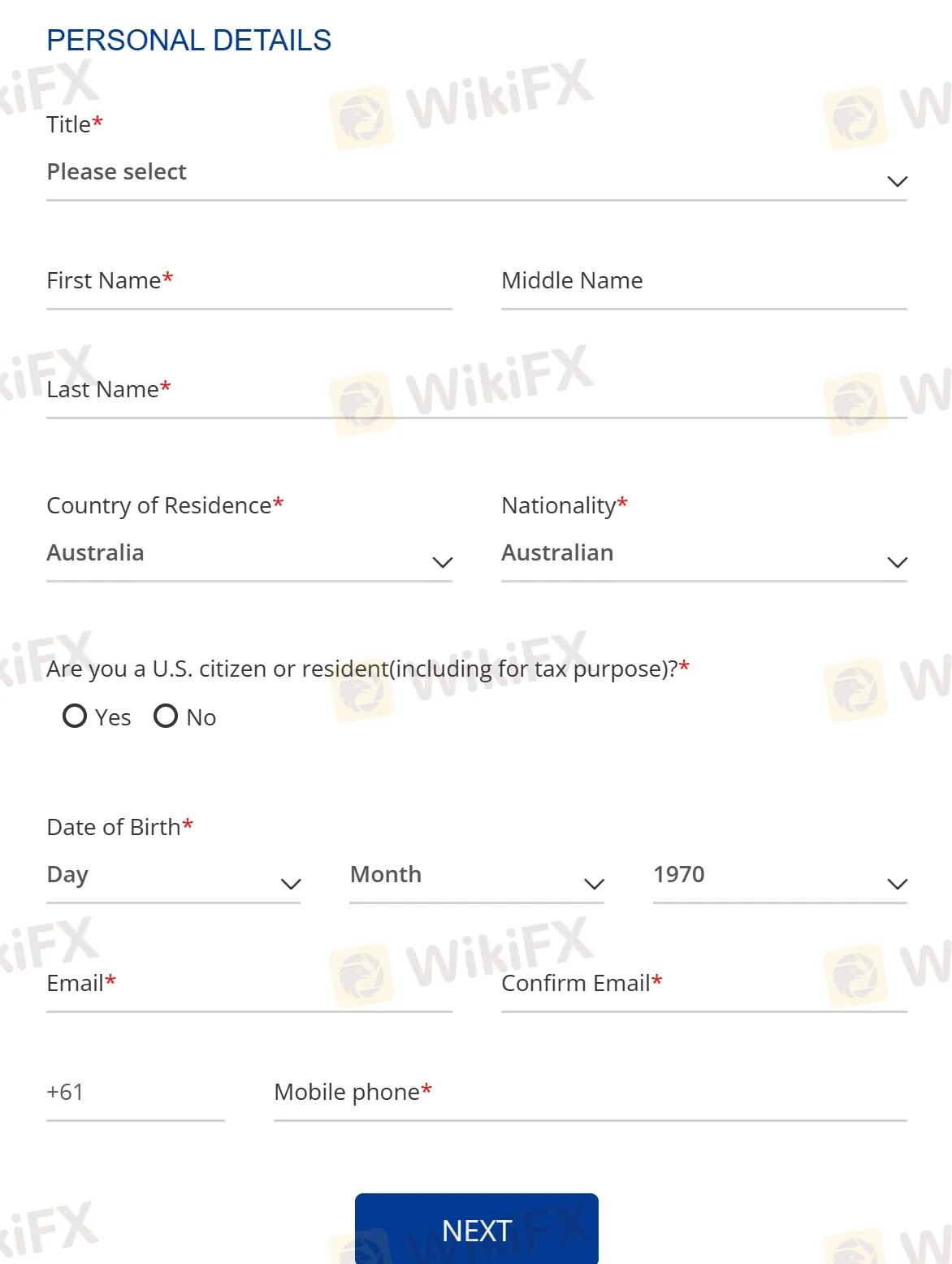

People interested in opening a forex trading account must first complete the registration process. When you apply for an account with Rakuten Securities, you'll be asked a series of questions designed to provide the broker with all the information they need to get started.

The Rakuten Securities demo account is funded with virtual currency and given access to the MetaTrader4 platform. The demo account will include the following capabilities:

• More than 50 products (Forex, Metals, and Indices) tradable;

• Real-time spreads, rapid execution, and leverage of up to 30:1 for Retail and 400:1 for Professional clients;

• Demo accounts utilize the identical price feed as our live MT4 platform;

• Practice trading with your mobile device and computer.

Rakuten Securities account opening is easy and fully digital. The online application takes roughly 10-15 minutes, and the account approval took one business day.

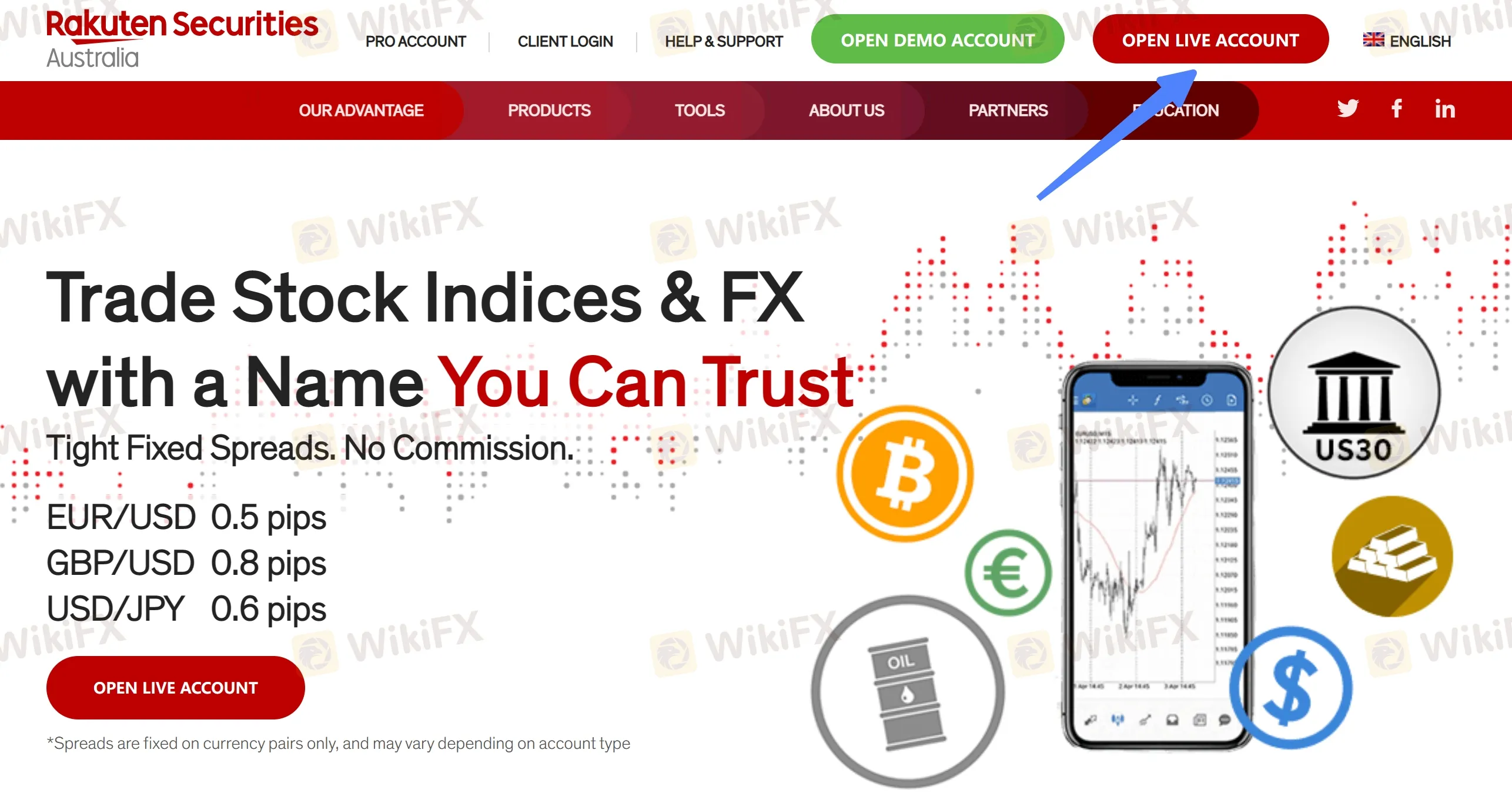

Step 1: Visit Rakuten Securities website and click “OPEN LIVE ACCOUNT”. Navigate to the Rakuten Securities website's account registration section. This is accessible by clicking the Begin trading link at the top of the landing page.

Step 2: Complete the brief online registration form to apply for a live trading account. You must include your name, title, last name, birth date, country of residence, nationality, email address, and mobile number.

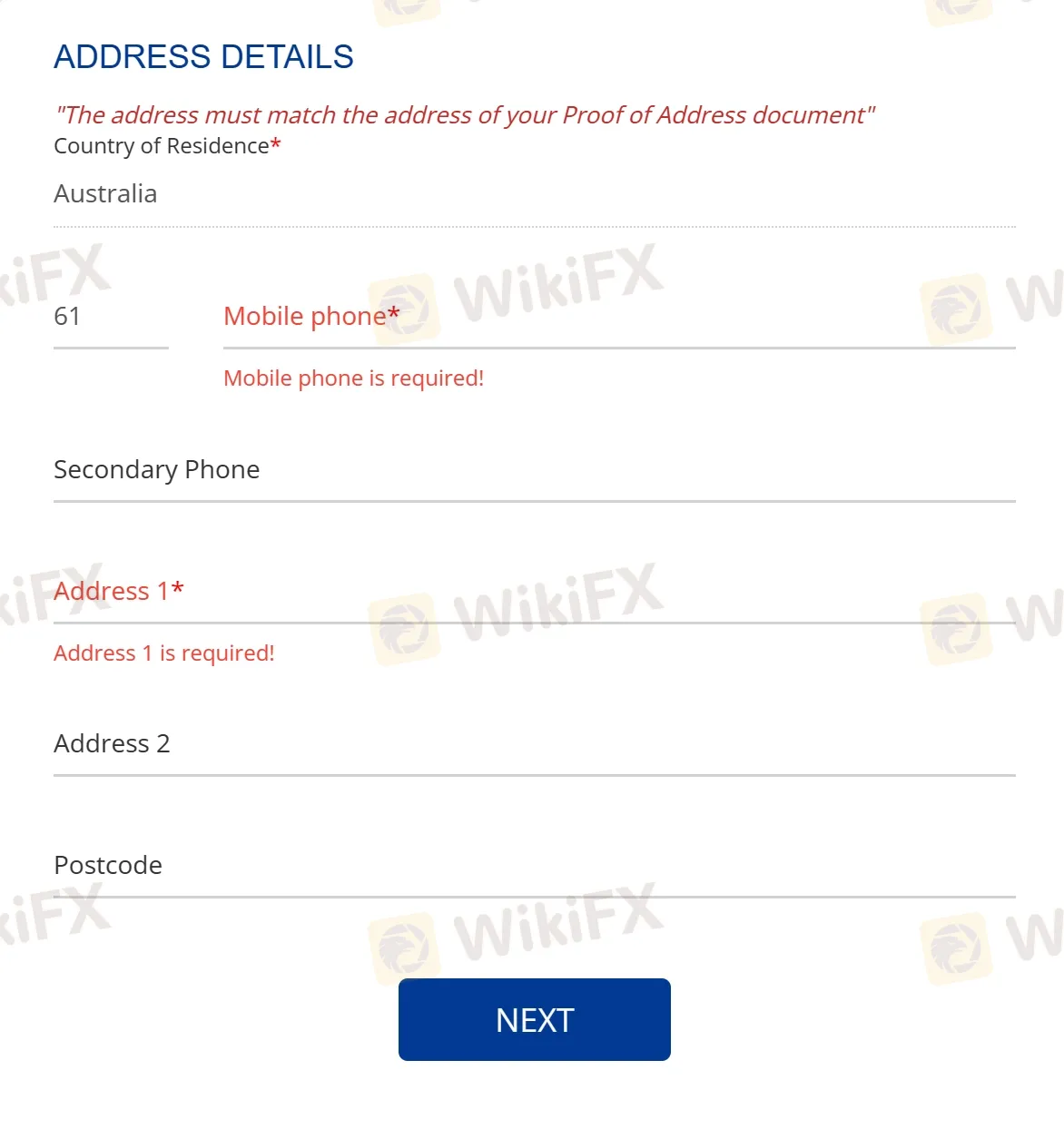

Step 3: Complete the form by entering the requested address, cell phone number, and postal code.

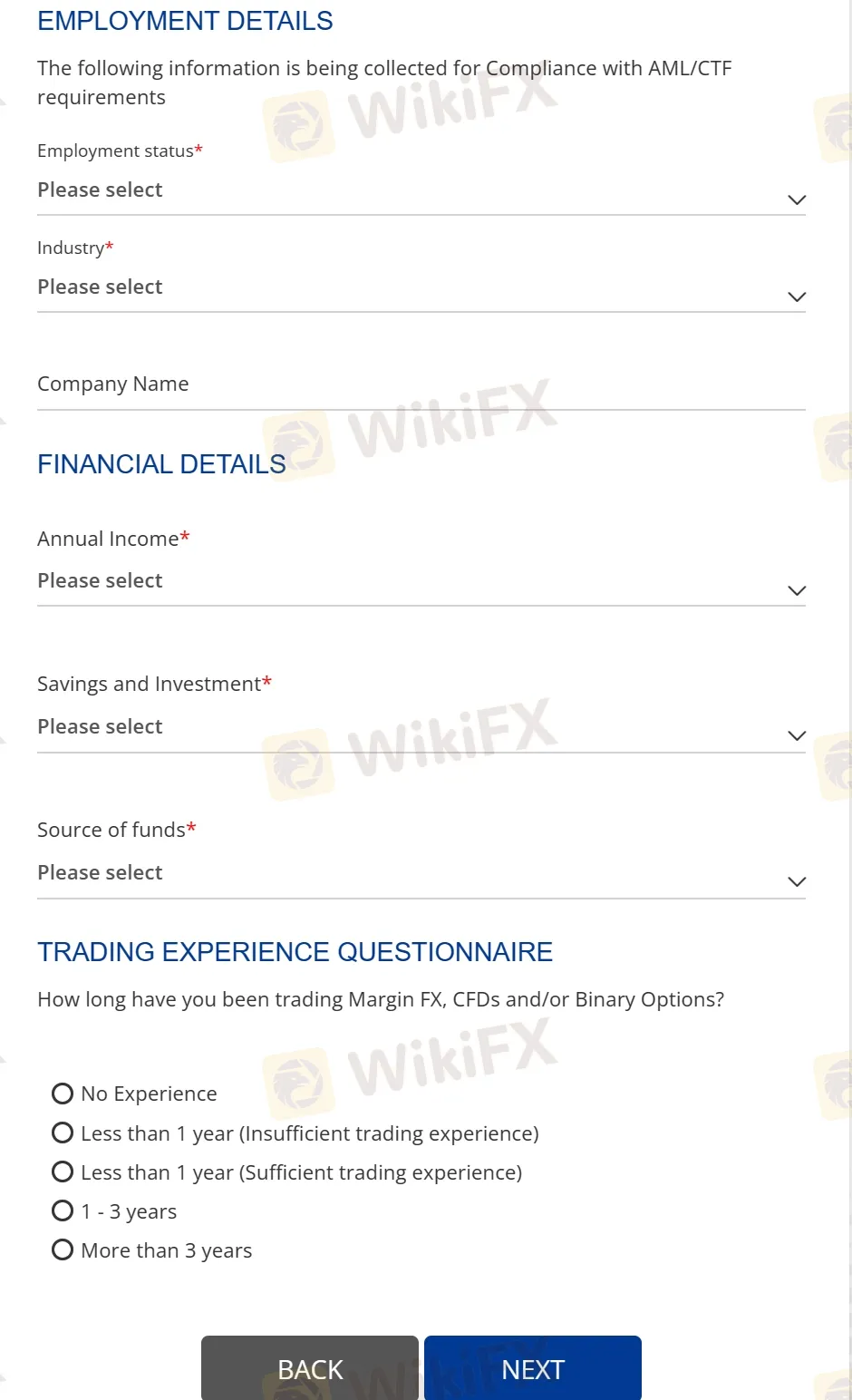

Step 4: Provide information such as employment status and financial information, and complete a brief questionnaire on your trading experience.

Step 5: Select the swap type for trading as well as the account's currency. Read and accept the disclaimer, then click Next to proceed.

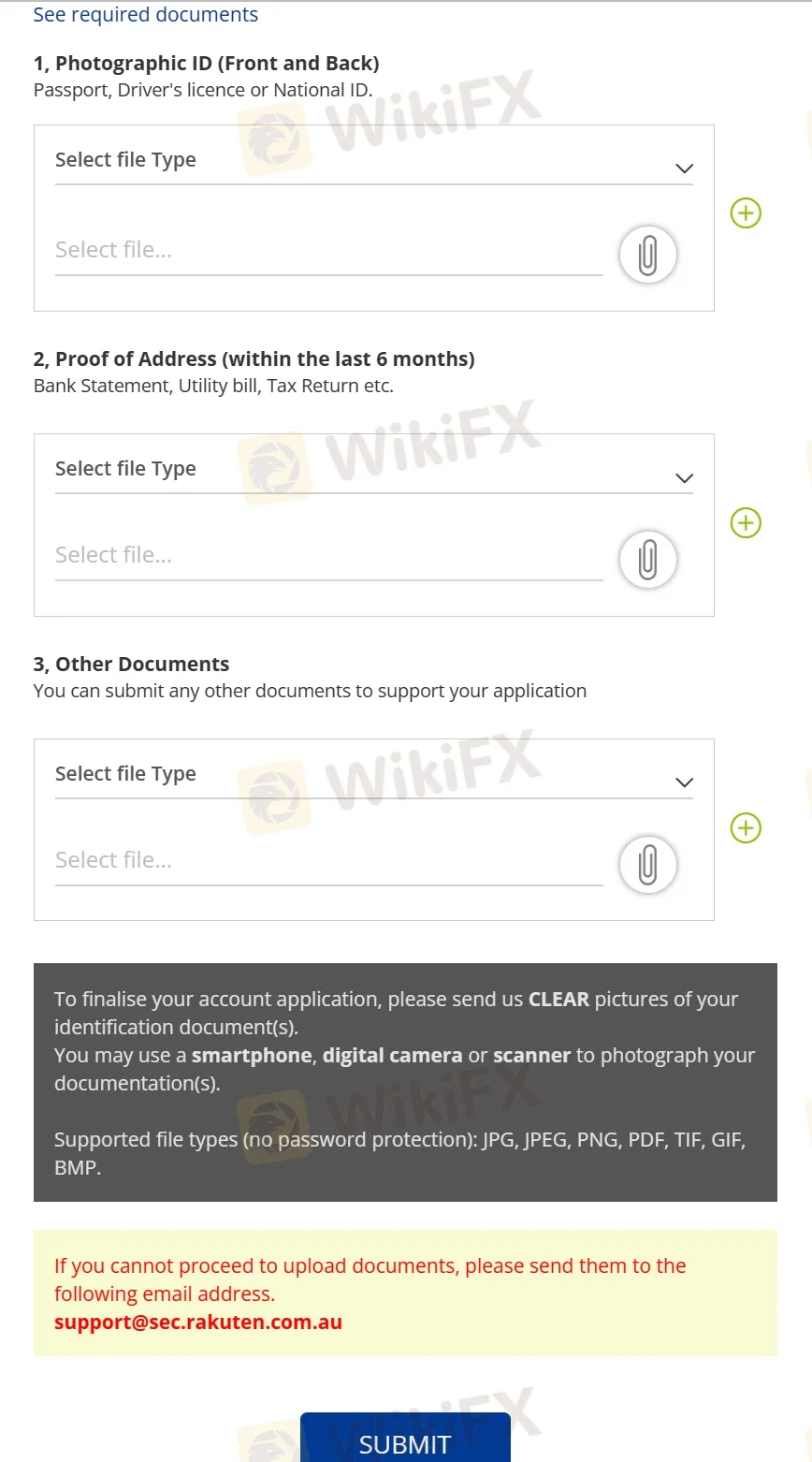

Step 6: Upload a photograph of your passport, driver's license, or national id card, together with your proof of address (within the last 6 months). Additional material can be uploaded to support the application for Rakuten Securities. Click Submit to apply.

Leverage is 1:30 for major currency pairs, 1:20 for minors, 1:10 for commodities, 1:2 for cryptocurrencies, and 1:5 for stocks. While up to 1:400 for professionals.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Rakuten Securities offers tight, commission-free fixed spreads. The broker's pricing originates directly from its headquarters, which has access to an extensive network of top-tier liquidity providers, allowing clients to trade with competitive spreads on the global market. As a result, the average spread for major currency pairs such as EUR/USD is 0.5 pips.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Rakuten Securities | 0.5 pips | $0 |

| Interactive Brokers | 0.1 pips | $0.20 per 1,000 traded |

| Saxo Bank | 0.6 pips | $0 |

| TD Ameritrade | 1.3 pips | $0 |

| Charles Schwab | 1.2 pips | $0 |

| E*TRADE | 1.3 pips | $0 |

Note that the commission structure for Interactive Brokers is based on a tiered system, where the commission per 1,000 traded decreases as the volume traded increases. The above commission rate is for clients trading less than 300,000,000 USD notional per month. Additionally, brokers may have different spreads and commissions for other currency pairs and trading instruments.

Rakuten Securities offers traders the flexibility to choose from the market-leading and highly acclaimed MT4 trading platform and MT4 for Android, MT4 for iOS, and MT4 for Windows. MT4 is the ideal platform for the forex trading industry, with an intuitive user-friendly interface, robust data analysis, and technical indicator tools. MT4 allows traders of all levels to develop appropriate trading strategies to help them get ahead in the financial markets. Rakuten Securities offers a social trading service through MyFXBook, a third-party service provider. This service allows traders to copy others' trades.

Overall, Rakuten Securities' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| Rakuten Securities | MetaTrader4 |

| Interactive Brokers | Trader Workstation |

| Saxo Bank | SaxoTraderGO |

| TD Ameritrade | thinkorswim |

| Charles Schwab | StreetSmart Edge |

| E*TRADE | Power E*TRADE |

Note: This table only includes the primary trading platform offered by each broker. Some brokers may offer additional platforms with different features or functionality.

Rakuten Securities welcomes various convenient deposit and withdrawal methods, mainly NAB, credit/debit cards (VISA/MASTERCARD), POLi, NETELLER, Skrill, China Union Pay, Instant Transfers, and TransferWise.

The minimum deposit required to open an account is 50 units of your base currency.

| Rakuten Securities | Most other | |

| Minimum Deposit | $50 | $100 |

NAB withdrawals are charged A$25.00, $25.00, €20.00 or £15.00. The domestic AUD Withdrawal fee will be waived. Traders who withdraw funds via NETELLER & Skrill are subject to a 2% fee. While other deposits and withdrawals are free of charge.

Regarding deposit currencies, you can add funds to your account using the US dollar (USD), the Australian dollar (AUD), the Euro (EUR), or the British pound (GBP) (GBP). You may open many accounts, each of which can be funded with a different currency. When you fund your account for the first time, you must select one of the four base currencies. Traders who deposit in non-listed currencies, such as ZAR/Rand, may suffer conversion fees.

To withdraw funds from Rakuten Securities, you can follow these steps:

Step 1: Log in to your Rakuten Securities account.

Step 2: Click on “Withdrawal” under the “My Page” section.

Step 3: Select the account you wish to withdraw funds from.

Step 4: Enter the amount you wish to withdraw.

Step 5: Choose your preferred withdrawal method (bank transfer or credit card).

Step 6: Fill in the necessary information for your chosen withdrawal method.

Step 7: Submit your withdrawal request.

Note that Rakuten Securities may require additional verification documents before processing your withdrawal request, and processing times may vary depending on the chosen withdrawal method.

Rakuten Securities charges various fees related to inactivity fee, currency conversion fees, and overnight financing fees. Here are some of the fees:

Inactivity fee: Rakuten Securities charges an inactivity fee if the account is not used for trading or does not have any open positions for a certain period of time. The fee amount and the inactivity period vary depending on the type of account.

Currency conversion fees: Rakuten Securities charges a currency conversion fee for trades that involve currency conversion. The fee amount depends on the currency pairs being traded and the currency conversion method used.

Overnight financing fees: Rakuten Securities charges overnight financing fees for holding positions overnight. The fee amount varies depending on the instrument being traded.

It's important to note that the fee structure and fee amounts may change over time. Clients should check Rakuten Securities' website or contact their customer support for the latest fee information.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Rakuten Securities | Free | Free | $35/month after 1 year of inactivity |

| Interactive Brokers | Free (certain methods) | $1 per withdrawal | $10/month after 3 months of inactivity |

| Saxo Bank | Free | Free (certain methods) | €100 after 6 months of inactivity |

| TD Ameritrade | Free | Free | $0 |

| Charles Schwab | Free | Free (certain methods) | $0 |

| E*TRADE | Free | Free | $0 |

Note: Fees may vary based on account type, country of residence, and other factors. It's important to check with the broker directly for the most up-to-date fee information.

Rakuten Securities provides customer service to its clients through multiple channels, including phone, WhatsApp, email, and live chat. The customer support team is available 24/7 and is known for its prompt response times and helpfulness. You can follow them on some social networks such as Twitter, Facebook, YouTube, LinkedIn.

In addition to traditional customer service methods, Rakuten Securities also offers a comprehensive online Help Center on its website. This includes a variety of resources and educational materials, such as video tutorials, FAQs, and a glossary of trading terms.

Overall, Rakuten Securities has a strong reputation for its customer service, with many clients praising the company for its helpful and knowledgeable support staff.

| Pros | Cons |

| • 24/7 customer support | • Limited phone support in some regions |

| • Multilingual support | |

| • Email and phone support | • No dedicated account manager |

| • Online help center with extensive resources | • No physical branch locations |

| • Active social media presence | • No support for social trading platforms |

Note: The pros and cons listed may vary based on the region and specific services offered by Rakuten Securities.

Rakuten Securities provides educational resources for traders through its website. The broker offers various educational materials, including articles, tutorials, webinars, and videos.

The articles cover a range of topics, including technical analysis, fundamental analysis, trading strategies, and risk management. The tutorials and videos cover the basics of trading and the features of the broker's trading platform.

The webinars are conducted by industry experts and cover a variety of topics, including market analysis, trading strategies, and risk management. They are free for clients and non-clients of Rakuten Securities.

Overall, Rakuten Securities offers a decent range of educational resources for traders of all levels. However, educational materials could be more organized and easier to navigate.

Based on the information available, Rakuten Securities appears to be a reputable online broker with a wide range of investment options and advanced trading platforms. The company is regulated by several major financial authorities, providing a level of security for clients' funds. Rakuten Securities offers competitive pricing with low spreads and no hidden fees. Additionally, the broker offers extensive educational resources and responsive customer support. Overall, Rakuten Securities is a solid choice for traders looking for a reliable and comprehensive brokerage service.

| Q 1: | Is Rakuten Securities regulated? |

| A 1: | Yes. It is regulated by ASIC, FSA, and SFC. |

| Q 2: | Does Rakuten Securities offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Rakuten Securities offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Rakuten Securities supports MT4. |

| Q 4: | What is the minimum deposit for Rakuten Securities? |

| A 4: | The minimum initial deposit to open an account is $50. |

| Q 5: | Is Rakuten Securities a good broker for beginners? |

| A 5: | Yes. Rakuten Securities is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Rakuten Securities will discontinue its trial “Basic Advice” chat service at 5:00 PM on August 22, 2025, while keeping online advisor consultations available.

WikiFX

WikiFX

Rakuten Securities’ AI investment reports soar with 3 million views in 24 hours, powered by the BridgeWise StockWise platform in Japan. A game-changer for retail investors.

WikiFX

WikiFX

Rakuten Securities Inc., one of Japan’s leading online brokerage firms, has ramped up its identity verification measures after falling victim to a wave of fraudulent transactions.

WikiFX

WikiFX

Rakuten Securities hits a new milestone with over 11 million customer accounts, reflecting a significant interest in investment in Japan.

WikiFX

WikiFX

More

User comment

21

CommentsWrite a review

2024-09-10 11:59

2024-09-10 11:59

2024-07-31 18:06

2024-07-31 18:06