User Reviews

More

User comment

8

CommentsWrite a review

2025-11-19 21:24

2025-11-19 21:24

2024-08-01 18:26

2024-08-01 18:26

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT4 Full License

High potential risk

Benchmark

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.60

Risk Management Index0.00

Software Index9.40

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

KEY TO MARKETS INTERNATIONAL Limited

Company Abbreviation

KEY TO MARKETS

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| KEY TO MARKETS Review Summary | |

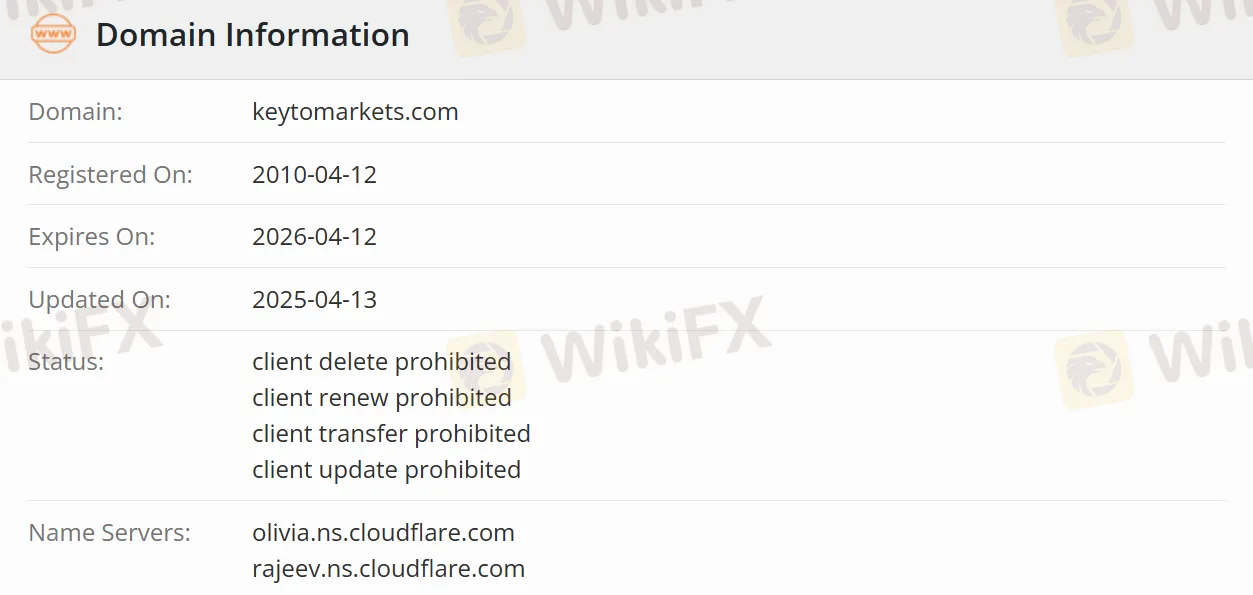

| Registered On | 2010-04-12 |

| Registered Country/Region | Mauritius |

| Regulation | Revoked |

| Market Instruments | Over 400 CFDs across Forex, Stocks, Indices, Commodities, and Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips (ECN) |

| Trading Platform | MT4 (Windows, iOS, Android, Mac), MT5 (Windows, WebTrader, iOS, Android, Mac) |

| Min Deposit | $50 |

| Customer Support | +230 215 8020 |

| Facebook, Twitter, YouTube, Instagram, LinkedIn | |

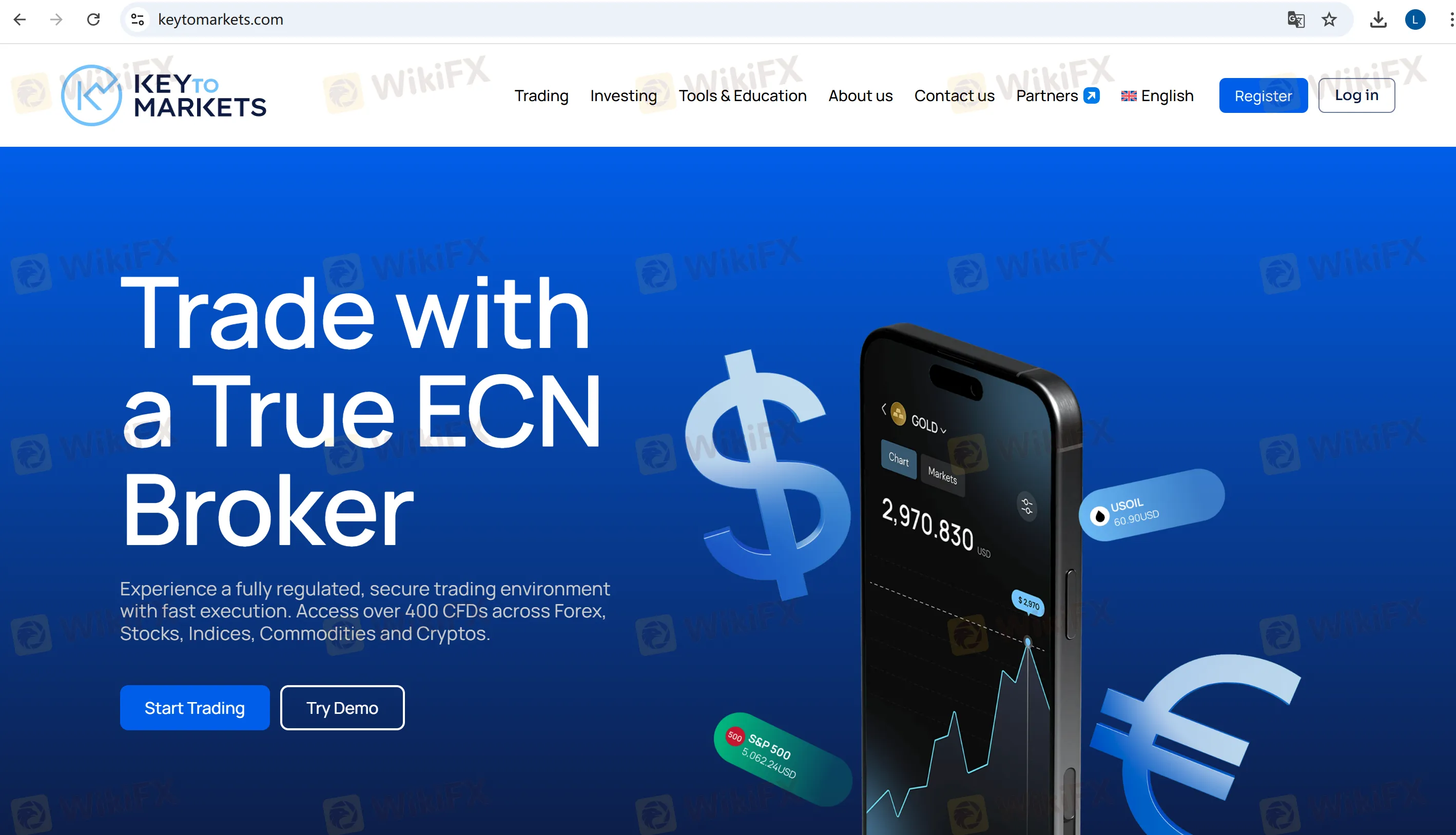

KEY TO MARKETS is an ECN broker that allows trading of over 400 CFDs (Contracts for Difference) via third-party platforms MT4 and MT5, covering forex, stocks, indices, commodities, and cryptocurrencies. ECN spreads start as low as 0.0, with leverage of up to 1:500. A 3% annual interest rate is offered on deposits in savings accounts.

| Pros | Cons |

| 400+ trading available | Revoked |

| MT4, MT5 available | No 24/7 customer support |

| Demo account available | No bonus information |

| Spread from 0.0 pips | |

| Leverage up to 1:500 |

The Financial Conduct Authority regulates KEY TO MARKETS with license No.527809. The license type is 527809. However, the 'Revoked' current status is less safe than a regulated one.

KEY TO MARKETS offers over 400 trading instruments, including Forex, Commodities, Stocks, Indices, and Cryptos.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

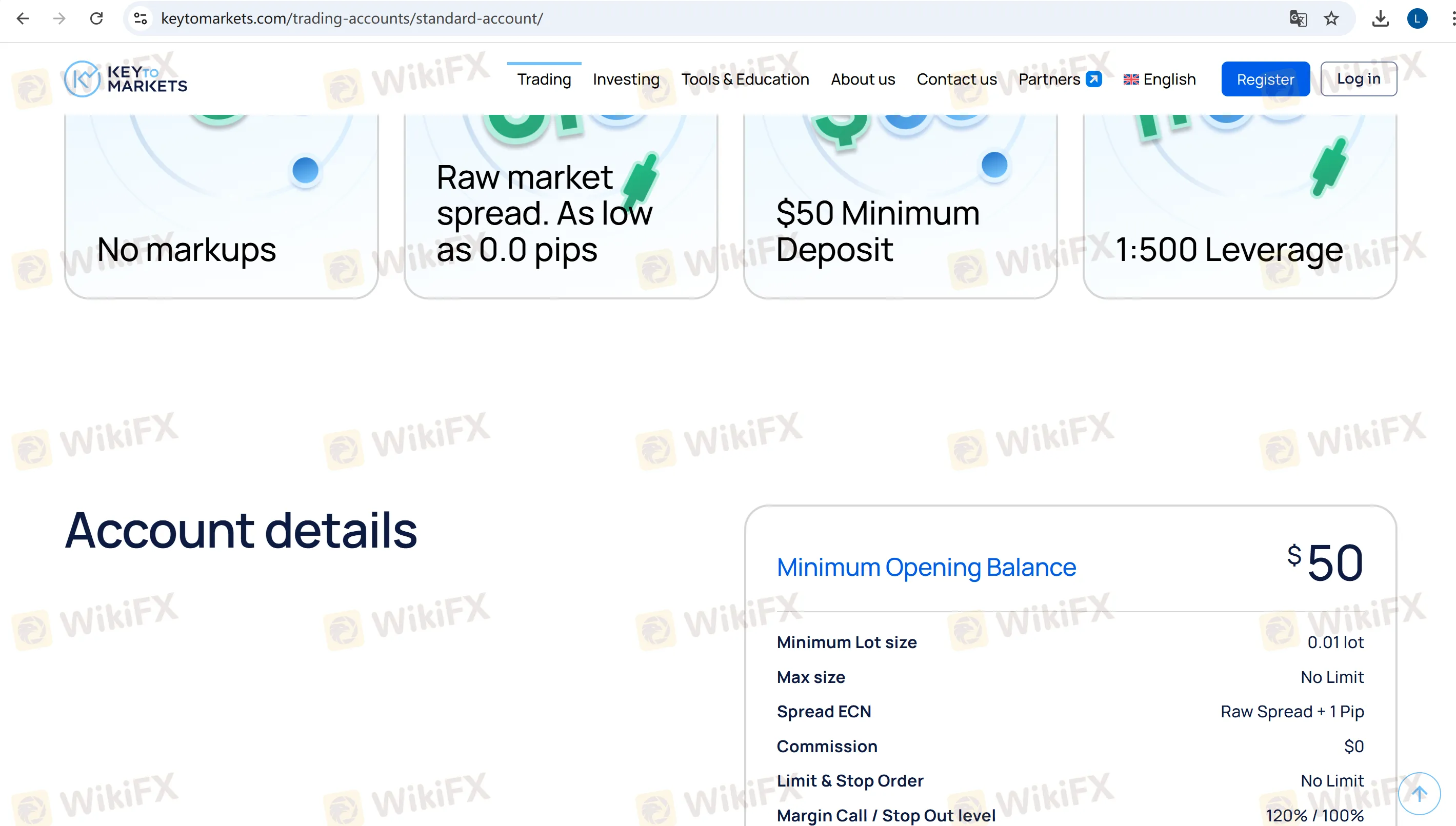

| Account Type | Standard | Pro |

| Leverage | 1:500 | 1:500 |

| Minimum Deposit | $50 | $50 |

| Minimum Opening Balance | $50 | $50 |

| Minimum Lot size | 0.01 lot | 0.01 lot |

| Max size | No Limit | No Limit |

| Raw market spread | From 0.0 pips | From 0.0 pips |

| Spread ECN | Raw Spread + 1 Pip | Raw Spread + 1 Pip |

| Commission | $0 | $0 |

| Limit & Stop Order | No Limit | No Limit |

| Margin Call / Stop Out level | 120% / 100% | 120% / 100% |

| Scalping / News Trading | No Limit | No Limit |

KEY TO MARKETS charges no account inactivity fees. Trades are executed with ECN raw pricing and the raw spread can be as low as 0. No commissions are charged for accounts.

The maximum leverage is 1:500, meaning that profits and losses are magnified xx times.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, iOS, Android, Mac | Beginners |

| MT5 | ✔ | Windows, WebTrader, iOS, Android, Mac | Experienced Traders |

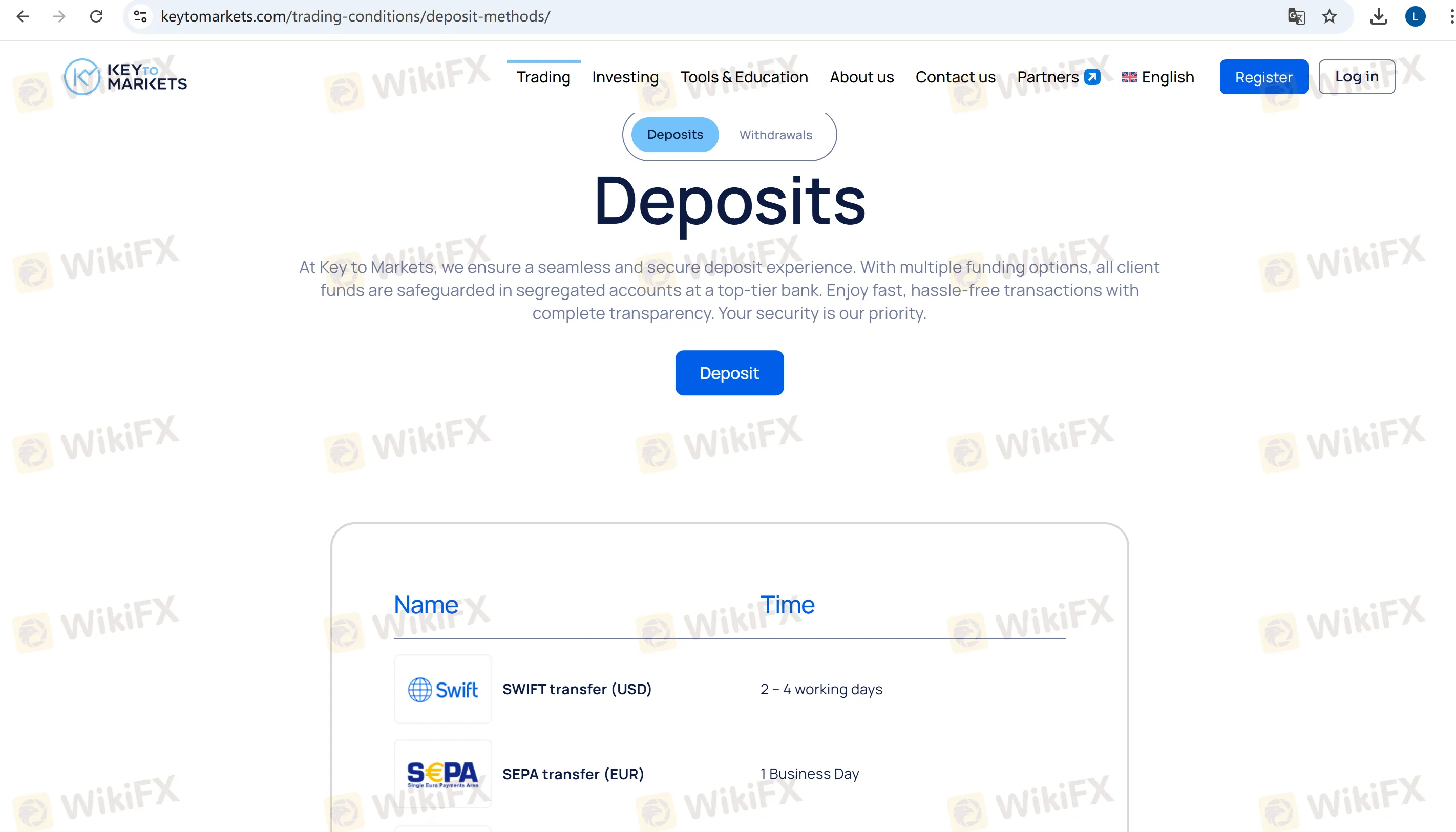

| Payment Methods | Deposit Time | Withdrawal Time |

| SWIFT transfer (USD) | 2 – 4 working days | 2 – 4 working days |

| SEPA transfer (EUR) | 1 Business Day | 1 Business Day |

| MasterCard | Instant | - |

| VISA | Instant | - |

| SKRILL | Instant | 1 Business Day |

| STICPAY | Instant | 1 Business Day |

| UNION PAY | Instant | Instant |

| Crypto | Up to 30 minutes | Up to 30 minutes |

| PayRetailers | Instant | Instant |

KEY TO MARKETS provides copy trading that allows traders to track and replicate the strategies of experienced traders, which is suitable for beginners.

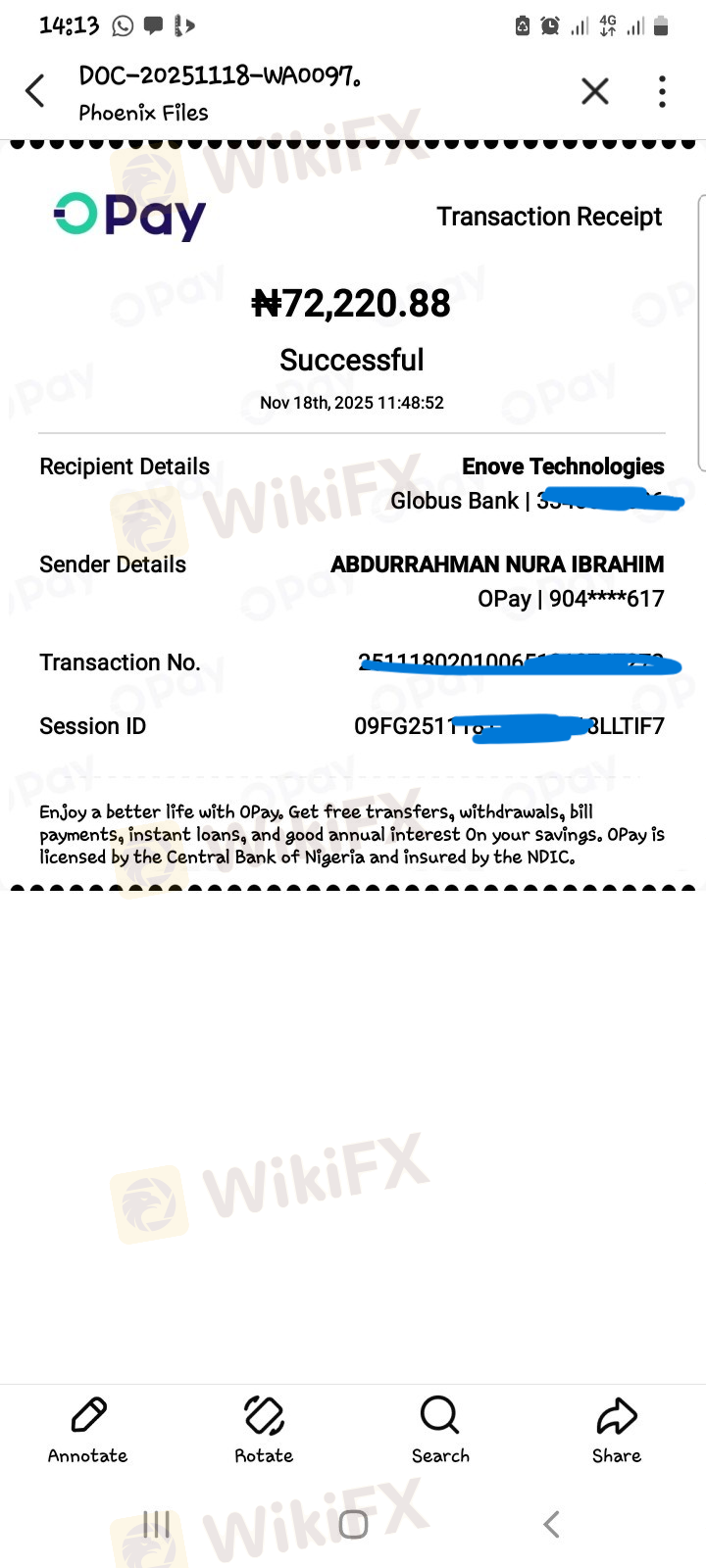

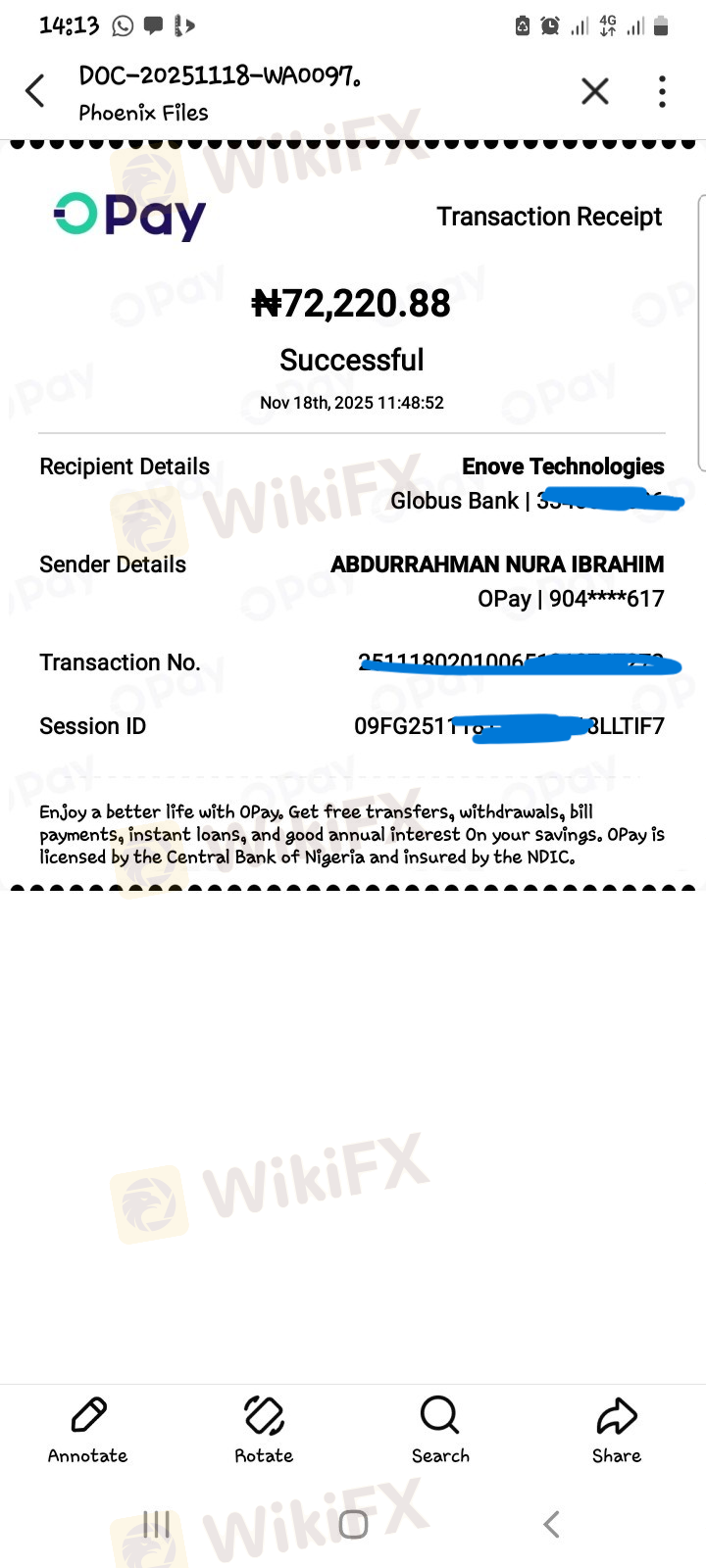

Did your deposits in KEY TO MARKETS’ forex trading fail to reflect despite numerous follow-ups with the broker? Are you facing margin lock up and withdrawal issues due to stuck limit orders? Do you find losses due to wide spreads on the KEY TO MARKETS login? Similar issues have been expressed by many traders online. In this KEY TO MARKETS review article, we will take a close look at the complaints. Read on!

WikiFX

WikiFX

This week major US stock indexes experienced a significant decline, following Federal Reserve Chairman Jerome Powell’s speech regarding sticky inflation and the likelihood of an unchanged interest rate at the November meeting.

WikiFX

WikiFX

US treasury selloff intensified. Longer-term US yields rose to a fresh 16-year high this week before easing lower. Bill Ackman warned that the 10-year yield could soon hit 5%.

WikiFX

WikiFX

Market Trends Last week saw intensive stock market fluctuations influenced by the growing US inflation and the quarterly rollovers. The following week is likely to bring forward significant macroeconomic data, drawing attention from investors and economists alike.

WikiFX

WikiFX

More

User comment

8

CommentsWrite a review

2025-11-19 21:24

2025-11-19 21:24

2024-08-01 18:26

2024-08-01 18:26