User Reviews

More

User comment

2

CommentsWrite a review

2024-02-27 23:25

2024-02-27 23:25 2023-03-23 18:18

2023-03-23 18:18

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.85

Risk Management Index0.00

Software Index4.00

License Index0.00

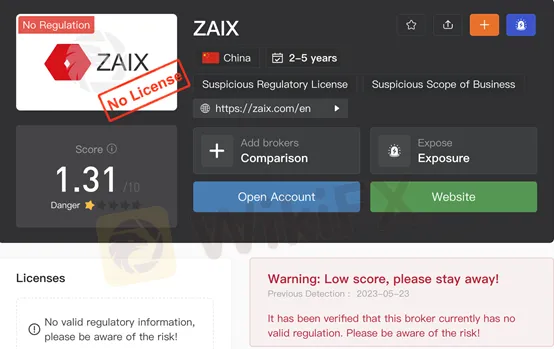

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

ZAIX Ltd

Company Abbreviation

ZAIX

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years ago |

| Company Name | ZAIX |

| Regulation | No Regulation |

| Minimum Deposit | Not specified |

| Maximum Leverage | 100:1 |

| Spreads | Vary depending on the instrument |

| Trading Platforms | MetaTrader 4 (MT4), ZAIX Trader mobile app |

| Tradable Assets | Foreign exchange, commodity CFDs, stock index CFDs, cryptocurrency CFDs |

| Account Types | Demo Account, General Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Available 24/7 |

| Deposit Methods | Domestic Bank Transfer, Cryptocurrency deposits (USDT) |

| Withdrawal Methods | Not specified |

| Educational Tools | Real-time price information, market news updates, trading tools |

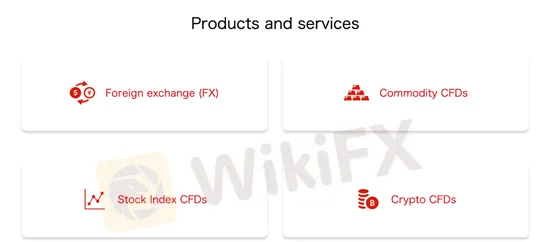

ZAIX is an online trading platform that offers investors the opportunity to access global markets and trade a variety of financial instruments. The platform provides a range of market options, including foreign exchange (FX) trading, commodity contracts for difference (CFDs), stock index CFDs, and cryptocurrency CFDs. With these diverse investment options, users can participate in the forex market, trade commodities such as precious metals and energy products, invest in stock indices from around the world, and engage in cryptocurrency trading.

Additionally, ZAIX aims to offer low transaction fees, further enhancing the cost-effectiveness of trading on the platform. To support traders in their investment activities, ZAIX provides a range of trading tools and resources. These include real-time price information for various financial instruments, market news updates to stay informed about the latest developments, and interest rate and exchange rate information. Moreover, ZAIX offers customer support services to assist users with their inquiries and provide assistance whenever needed.

Overall, ZAIX is a comprehensive online trading platform that provides investors with opportunities to diversify their portfolios and access various global markets.

ZAIX offers several advantages and disadvantages that should be considered when evaluating the platform. On the positive side, ZAIX provides a diverse range of market instruments, including foreign exchange trading, commodity CFDs, stock index CFDs, and cryptocurrency CFDs, allowing investors to access various global markets.. Additionally, ZAIX offers demo accounts for practice and learning, multiple trading platforms, various trading tools, and customer support services.

However, there are some drawbacks to be aware of. ZAIX is not regulated by any recognized regulatory authority, which may raise concerns about investor protection and oversight. Traders should exercise caution when engaging with an unregulated platform. Another potential disadvantage is the need to meet identity verification requirements for account opening, which may involve submitting personal identification documents. Additionally, transaction fees and deposit/withdrawal fees may apply depending on the chosen methods, and trading volatile markets, such as cryptocurrencies, carries inherent risks that investors should consider.

Here's a summary of the pros and cons of ZAIX:

| Pros | Cons |

| Diverse market instruments | Not regulated by recognized regulatory authority |

| Various trading tools | Identity verification requirements for account opening |

| Demo accounts for practice and learning | Transaction fees and deposit/withdrawal fees may apply |

| Multiple trading platforms | Risk associated with trading volatile markets |

ZAIX is not regulated by any recognized regulatory authority. As indicated by the information provided by WikiFX, there is no valid regulation in place for this broker. Traders should exercise caution and be aware of the potential risks associated with trading on an unregulated platform. The lack of regulation means that there may be limited oversight and protection for investors. It is essential for traders to thoroughly research and consider the implications before engaging with an unregulated broker like ZAIX.

ZAIX offers a range of market instruments for investors to access global markets and manage their assets. Here is a description of the market instruments provided by ZAIX:

1. Foreign Exchange (FX) Trading:

ZAIX Exchange provides a fair and secure environment for foreign exchange margin trading. Investors can trade in 60 foreign exchange pairs, including major currencies, with favorable pricing. The exchange selects the lowest selling price and the highest buying price from its network of 225 financial institutions, ensuring investors can trade at the best available prices. ZAIX minimizes credit risk by depositing margins directly with its trading partners, reducing the risk of customer refusal or company bankruptcy.

2. Commodity CFDs:

ZAIX Exchange offers Contract for Difference (CFD) trading on commodities such as energy and precious metals. Investors can trade products like gold/dollar (XAUUSD), WTI crude oil/dollar (XTIUSD), and natural gas/USD (XNGUSD). These CFDs provide investment opportunities in the commodity market, which has shown increased volatility in recent years.

3. Stock Index CFDs:

Investors can trade stock index CFDs on major global indices through ZAIX Exchange. The exchange offers representative stock index CFDs such as Japan 225 Stock Price Index (JP225), US 30 Stock Index (US30), UK 100 Stock Price Index (UK100), German 30 Stock Price Index (DE30), and Hong Kong 50 Index (HK50). These CFDs allow investors to participate in the performance of stock indices and build their assets over the long term.

4. Cryptocurrency CFDs:

ZAIX Exchange facilitates cryptocurrency trading through CFDs. Investors can trade selected and relatively stable cryptocurrencies, including Bitcoin/dollar (BTCUSD), Ethereum/dollar (ETHUSD), and Litecoin/dollar (LTCUSD). These cryptocurrency CFDs enable investors to participate in the next-generation finance market with simplified and easier-to-understand transactions.

Pros and Cons

| Pros | Cons |

| Provides access to a range of market instruments | Lack of regulation |

| Participation in the performance of stock indices | Identity verification requirements |

| Access to the cryptocurrency markets | Potential transaction fees and deposit/withdrawal fees |

| Reduces credit risk through direct margin deposits | Trading volatile markets carries inherent risks |

| Investment opportunities in commodity market |

ZAIX offers two types of accounts: demo accounts and general accounts.

1. Demo Account:

A demo account provided by ZAIX is a free account that allows users to practice trading and familiarize themselves with the platform without using real money. It is an invaluable tool for beginners to learn about the features and functionality of the platform, as well as to test different trading strategies in a risk-free environment. The demo account provides users with virtual funds to simulate real trading scenarios, enabling them to gain practical experience and confidence before transitioning to a general account.

2. General Account:

A general account is a live trading account that allows users to trade with real money on the ZAIX platform. To open a general account, users need to complete the registration process and meet the necessary requirements. With a general account, users can access a wide range of financial products and services offered by ZAIX, including foreign exchange, commodity markets, stock indices, and cryptocurrencies. General account holders can deposit and withdraw funds, engage in live trading, and take advantage of various trading tools and features provided by ZAIX.

Both account types serve different purposes: the demo account is for practice and learning, while the general account is for actual trading with real funds. Users can choose the account type that best suits their needs and objectives when engaging with the ZAIX platform.

Pros and Cons

| Pros | Cons |

| Practice environment for beginners to learn and improve trading skills. | Limited real-world impact, as trades on the demo account do not have real consequences. |

| Opportunity to test different trading strategies without risking actual money. | General account requirements may pose a barrier for some users during the registration process. |

| Provides practical experience and confidence before transitioning to live trading. | Potential costs such as transaction fees or charges that may impact overall profitability. |

To open a general account with ZAIX, follow these steps:

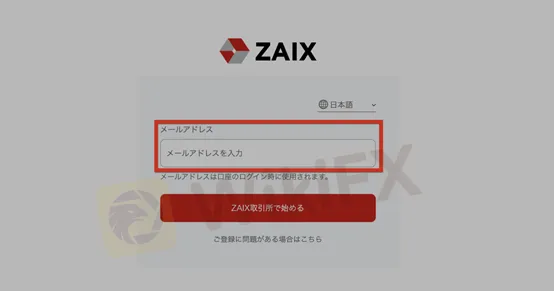

1. Email Address Registration:

- Register your email address, which can be a free address like Gmail or Yahoo, or a carrier address like SoftBank, docomo, or au.

- After entering your email address, click on “Start with ZAIX Exchange” to receive a “Registration Information Notification” email from ZAIX Exchange. Check your spam folder if you don't receive the email.

2. Login Information:

- Use the login information provided in the “Notice of registration information” email to log in to your general account.

- You can change the initial password after opening the account by visiting the designated page.

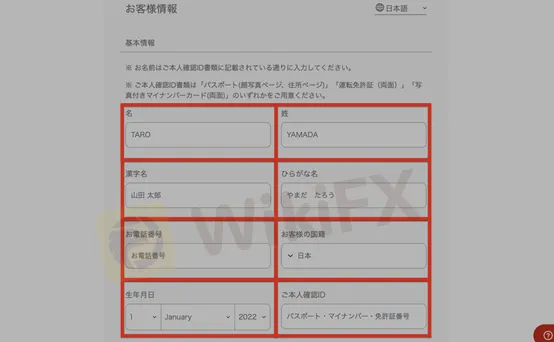

3. Enter Customer Information:

- Upon logging in, you will be prompted to enter customer information on the “customer information” input screen.

- Provide the requested identity verification ID, which can be the 12-digit number on your driver's license, the 16-digit personal number on your My Number Card, or the 2-digit number followed by 7 digits in the upper right corner of your passport.

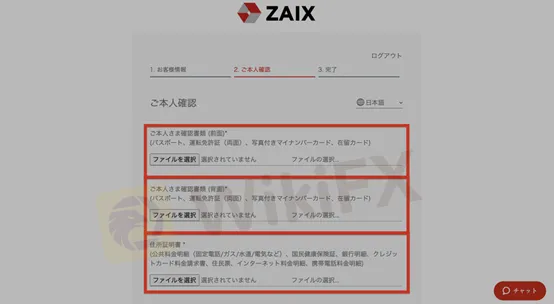

4. Submit Identity Verification Documents:

- You need to submit identity verification documents to complete the account opening process.

- Acceptable personal identification documents include a passport, driver's license, My Number card with a photo, or residence card.

- Acceptable address certificates include utility bills, national health insurance cards, credit card bills, certificates of residence, internet billing statements, or mobile phone bills.

- Select the required files for identity verification and proceed to the next step.

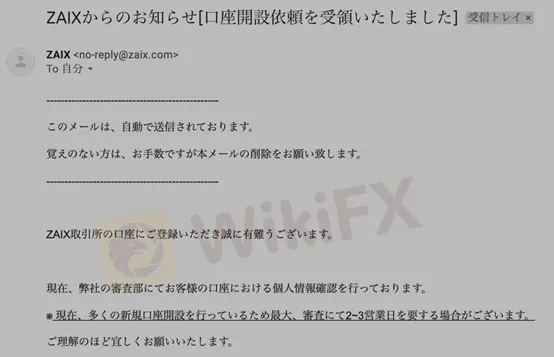

5. Completion of Registration Request:

- Once you have submitted the required documents and clicked “Next,” your registration request will be completed.

- You will receive an email from ZAIX stating, “Your request to open an account has been received.”

- It may take a couple of days for your account to be approved, as personal information will be verified.

For any further inquiries or support regarding opening an account, you can contact ZAIX Exchange Customer Support, which is available 24/7.

ZAIX Exchange aims to support investors with fair commissions and transparent pricing. As an exchange type, it ensures transparency in prices and fees, eliminating the opacity often associated with conventional transactions.

The exchange offers liquidity pool prices used by institutional investors and market makers, resulting in highly transparent and low transaction fees. The bid (selling price) and ask (buying price) spreads for various currency pairs are provided, ensuring fair and accurate pricing. For example, the spread for EURUSD is 0.5 pips, USDJPY is 0.8 pips, GBPUSD is 1.2 pips, AUDUSD is 0.8 pips, and USDCAD is 0.8 pips. The transaction fee, including tax, for trading a contract amount of 100,000 currency units (1 lot) is $11.

ZAIX Exchange also offers leverage options, allowing investors to trade with a hundredfold leverage. The minimum margin requirement is $0, and the minimum lot size is 0.01 lot. The forced settlement margin maintenance rate is set at 100%.

It's important to note that the fixed fee account type mentioned above is applicable to normal trading accounts, and conditions may vary for product management accounts based on the investment product. Additionally, the exchange provides information on leverage and how to handle margin calls and forced liquidation in their help center.

In terms of other fees, ZAIX Exchange offers free account opening and maintenance. Deposit fees depend on the chosen deposit method. If using the domestic bank transfer service, the transfer fee is borne by the customer. For virtual currency deposits, fees vary based on the type of virtual currency. Withdrawals from ZAIX Exchange are free of charge.

ZAIX provides convenient deposit and withdrawal services to facilitate transactions for its users. Here is a description of the deposit and withdrawal options available:

Deposit Options:

1. Payment by Domestic Bank Transfer:

Users can make deposits by transferring funds from their domestic bank accounts to ZAIX Exchange. It is important to ensure that the account number is entered correctly, and the name of the payer matches the name registered on the ZAIX transaction account. Payments made under different names, such as family members, may not be accepted. Deposits are typically reflected in the user's account balance within 15 minutes to 3.5 hours, depending on the number of deposits. Deposits confirmed by 16:59 will be reflected on the same day, while those confirmed after 17:00 will be reflected on the next business day. Please note that domestic banks do not accept deposits from overseas.

2. Deposits in Cryptocurrencies:

Users have the option to make instant-reflection deposits using USDT (Tether). These deposits can only be made through the TRC20 network. It is important to exercise caution when remitting cryptocurrencies to ensure they are sent to the correct network. For deposits exceeding 100,000 USDT, users are advised to contact customer support.

Withdrawal Options:

In order to withdraw funds, users are required to register a payment account in their general account. By registering a payment account, users can enjoy the benefits of improved security, faster processing times, and the elimination of the need to input payment information repeatedly.

Pros and Cons

| Pros | Cons |

| Elimination of repetitive payment information input | Deposit by domestic bank transfer may take time |

| Instant-reflection deposits with cryptocurrencies | Limited cryptocurrency option for deposits |

| Deposits from overseas are not accepted |

Trading Platforms

ZAIX offers trading platforms that cater to the needs of different traders. The primary trading platform utilized by ZAIX is MetaTrader 4 (MT4). MT4 is a widely recognized and popular trading platform known for its user-friendly interface and robust features. It provides traders with intuitive screens and the ability to develop trading strategies using indicators and expert advisors. With MT4, traders can access a wide range of trading instruments, including foreign exchange (FX), contracts for difference (CFDs) on major stock indices, and commodities.

ZAIX supports MT4 on various devices. For Windows (PC) users, there is a software version of MT4 available for download. Similarly, Mac OS (OSX) users can download the software version compatible with their operating system. Additionally, ZAIX offers its proprietary mobile app called “ZAIX Trader” for both iOS and Android devices. While the iOS version of MT4 is no longer available for download, traders can still use the ZAIX Trader app to log in to their MT4 accounts and engage in trading activities.

Pros and Cons

| Pros | Cons |

| 1. User-friendly interface | 1. Limited platform options |

| 2. Robust features | 2. Limited availability for iOS |

| 3. Wide range of trading instruments |

ZAIX provides various trading tools to support users in their trading activities. These tools include:

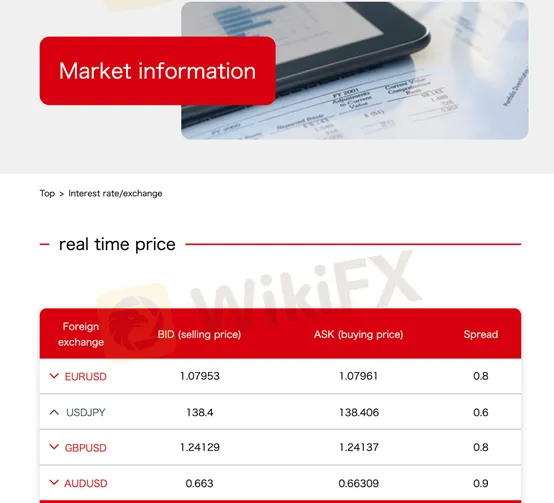

1. Real-time Price: ZAIX offers real-time price information for a range of financial instruments, including foreign exchange currency pairs, precious metals, energy commodities, stock indices, and virtual currencies. Users can access the bid (selling price) and ask (buying price) for each instrument, as well as the corresponding spread.

2. Market News: ZAIX provides market news updates to keep users informed about the latest developments and trends in the financial markets. These news articles cover various topics and can help users make informed trading decisions.

3. Interest Rate/Exchange: ZAIX offers information on interest rates and exchange rates. Users can access details about the foreign exchange (FX) interest rate system, which is relevant for trading currencies. Additionally, ZAIX provides information on the interest rate structure for Contracts for Difference (CFDs), which are derivative instruments.

By utilizing these trading tools, ZAIX users can stay updated on real-time prices, market news, and interest rate information. This enables them to monitor market movements, analyze trends, and make informed trading decisions.

ZAIX offers customer support services to assist users with their inquiries and provide assistance. One of the available support channels is through email communication. Users can reach out to the ZAIX customer support team by clicking on the “Support” button displayed at the bottom left of the service site. For smartphone users, the support button is represented by a round red button at the bottom left of the screen.

When contacting ZAIX's customer support via email, users may be required to provide their name and email address to verify their identity. This ensures that the support provided is personalized and relevant to the specific user's account or situation.

By utilizing the email support option, users can submit their questions, concerns, or requests for assistance to the ZAIX customer support team. The support team will then respond to these inquiries, providing guidance and resolving any issues or concerns raised by the users.

In conclusion, ZAIX is an online trading platform that offers investors access to global markets and a diverse range of financial instruments. The platform provides advantages such as a wide selection of market instruments, including foreign exchange, commodity CFDs, stock index CFDs, and cryptocurrency CFDs, along with demo accounts, multiple trading platforms, and various trading tools. However, it is important to consider the disadvantages, including the lack of regulation by recognized authorities, identity verification requirements for account opening, potential transaction and deposit/withdrawal fees, and the inherent risks associated with trading volatile markets. Traders should carefully weigh the pros and cons before engaging with ZAIX and conduct thorough research to make informed decisions regarding their investments.

Q: What market instruments are available on ZAIX?

A: ZAIX offers a range of market instruments, including foreign exchange (FX) trading, commodity CFDs, stock index CFDs, and cryptocurrency CFDs.

Q: What types of accounts does ZAIX offer?

A: ZAIX offers two types of accounts: demo accounts and general accounts. Demo accounts are for practice and learning, while general accounts are for actual trading with real funds.

Q: How can I open a general account with ZAIX?

A: To open a general account, you need to register your email address, receive the registration information, log in with the provided information, enter customer information, and submit identity verification documents.

Q: What are the spreads, commissions, and fees on ZAIX?

A: ZAIX aims to provide fair commissions and transparent pricing. Spreads for different currency pairs are provided, and transaction fees for trading are applied. Deposit and withdrawal fees may vary depending on the chosen method.

Q: How can I deposit and withdraw funds on ZAIX?

A: ZAIX provides options for depositing funds through domestic bank transfer and cryptocurrencies. Withdrawals can be made to registered payment accounts.

Q: What trading platform does ZAIX use?

A: ZAIX primarily uses the MetaTrader 4 (MT4) platform, which is available for Windows, Mac OS, and mobile devices through the ZAIX Trader app.

Q: What trading tools are available on ZAIX?

A: ZAIX offers real-time price information, market news updates, and information on interest rates and exchange rates to support users in their trading activities.

More

User comment

2

CommentsWrite a review

2024-02-27 23:25

2024-02-27 23:25 2023-03-23 18:18

2023-03-23 18:18