User Reviews

More

User comment

13

CommentsWrite a review

2025-09-09 08:43

2025-09-09 08:43

2025-08-26 22:23

2025-08-26 22:23

Score

10-15 years

10-15 yearsRegulated in Cyprus

Market Making License (MM)

White label MT4

Regional Brokers

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index6.72

Business Index8.00

Risk Management Index9.79

Software Index9.81

License Index6.75

Single Core

1G

40G

Danger

More

Company Name

RoboMarkets Ltd.

Company Abbreviation

RoboMarkets

Platform registered country and region

Cyprus

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| RoboMarkets Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Forex, Stocks, Indices, Soft Commodities, Energies, Metals |

| Demo Account | Available |

| Leverage | 1:30/1:300 |

| EUR/USD Spread | Floating from 0 points |

| Trading Platforms | MetaTrader4, MetaTrader5, RWebTrader, RMobileTrader, R StocksTrader |

| Minimum Deposit | $/€/£100 |

| Customer Support | 24/7 multilingual live chat, phone, email, online messaging |

Established in 2012, RoboMarkets Ltd (ex. RoboForex (CY) Ltd) is a European broker offering investors access to over 12,000 trading instruments across 6 asset classes including stocks, indices, commodities, metals, forex, and cryptocurrencies through the popular trading platforms such as MetaTrader4 and MetaTrader5. As for regulation, Robomarkets Ltd. is currently authorized and regulated by CySEC in Cyprus (License No. 191/13).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

RoboMarkets offers a range of advantages and disadvantages that traders should consider before choosing the broker. On the positive side, RoboMarkets is a regulated broker, providing clients with a secure and transparent trading environment. They offer a wide range of financial instruments across multiple asset classes, allowing traders to diversify their portfolios. The availability of multiple trading account types and platforms, including MetaTrader 4 and MetaTrader 5, caters to the diverse needs and preferences of traders. RoboMarkets also provides excellent customer service with 24/7 multilingual support and a comprehensive FAQ section.

On the downside, there have been a report of difficulty with withdrawals, which is an area of concern.

| Pros | Cons |

| • CYSEC-regulated | • A report of difficulty with withdrawals |

| • Wide range of financial instruments | • Commission charged |

| • Multiple trading account types | • Limited trading tools and educational resources |

| • Demo accounts available | |

| • MT4 and MT5 supported | |

| • Multiple payment methods | |

| • Excellent customer service with 24/7 multilingual support |

There are many alternative brokers to RoboMarkets depending on the specific needs and preferences of the trader. Some popular options include:

Z.com Trade - a reputable broker known for its reliable trading platforms and competitive pricing, making it a recommended choice for traders looking for a trusted trading experience.

AETOS - a reliable broker that offers a wide range of trading instruments, competitive spreads, and excellent customer support, making it a recommended option for traders of all levels.

Equit - a well-regulated broker with a global presence, offering advanced trading platforms, tight spreads, and a wide range of trading instruments, making it a recommended choice for traders seeking a professional and transparent trading environment.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

RoboMarkets, being a European regulated broker with a CySEC license and offering features such as Negative Balance Protection, Segregated accounts in major banks, and being a member of the Investor Compensation Fund (ICF), is generally considered to have a higher level of safety and reliability compared to unregulated brokers. The regulations and safeguards provided by CySEC and the inclusion in the ICF provide an additional layer of protection for traders.

However, it's important to note that no broker is completely risk-free, and trading always carries some inherent risks. Traders should conduct their own research, assess their risk tolerance, and carefully consider the terms and conditions before engaging in any trading activities.

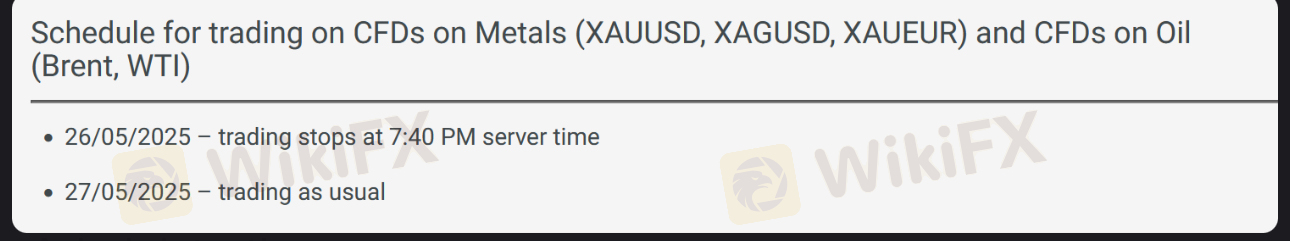

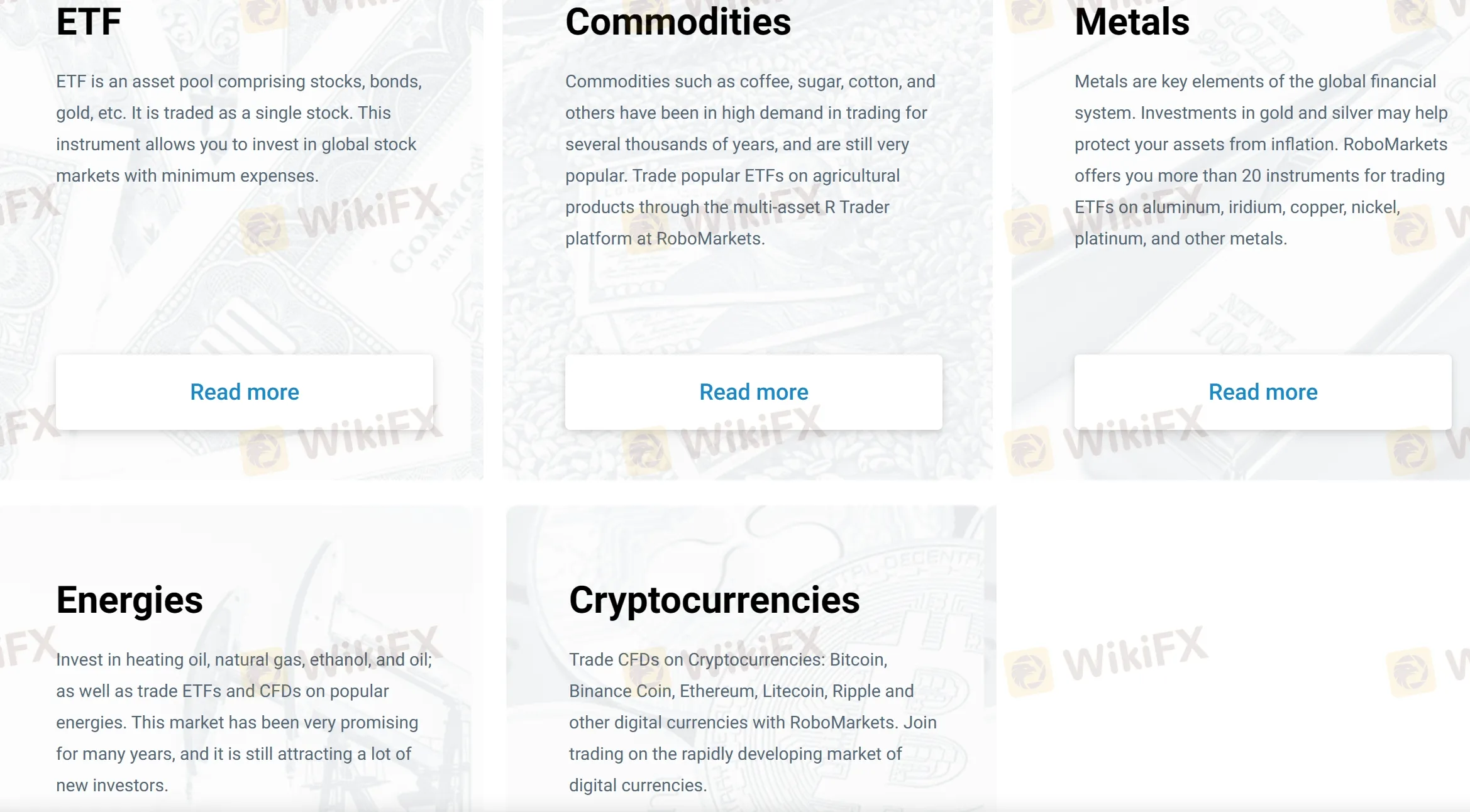

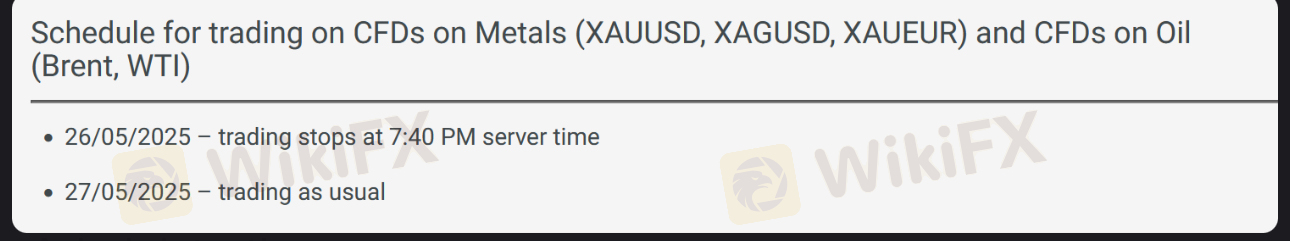

RoboMarkets offers a wide range of market instruments across various asset classes. Traders have access to over 12,000 instruments, allowing them to diversify their trading portfolio.

In the Stocks category, traders can find a selection of stocks from different exchanges, enabling them to trade popular companies and benefit from price movements. The Indices category provides opportunities to trade on major global stock indices, such as the S&P 500, FTSE 100, and DAX 30, allowing traders to speculate on the performance of entire markets.

For those interested in commodities, RoboMarkets offers both Metals and Energy Commodities. This includes precious metals like gold and silver, as well as energy commodities such as oil and natural gas. Soft Commodities include agricultural products like corn, wheat, and coffee. The Forex category allows traders to engage in currency trading, with a wide range of currency pairs available for trading.

Lastly, RoboMarkets offers access to cryptocurrencies, allowing traders to speculate on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

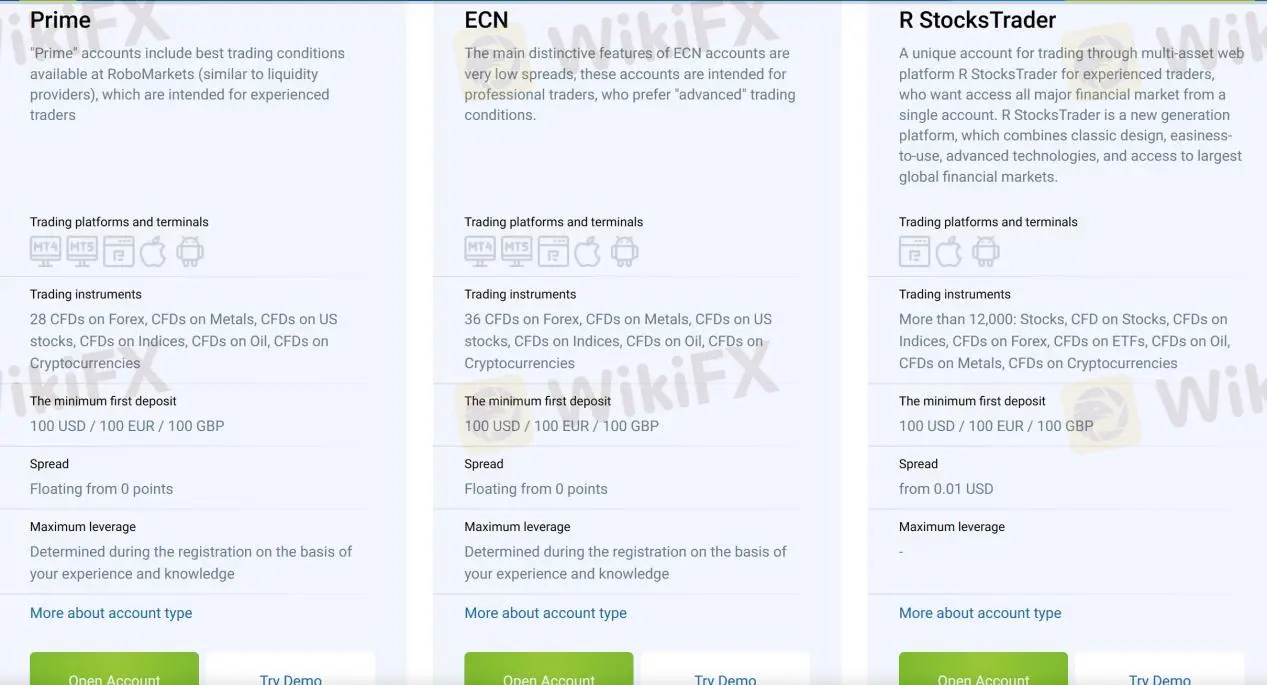

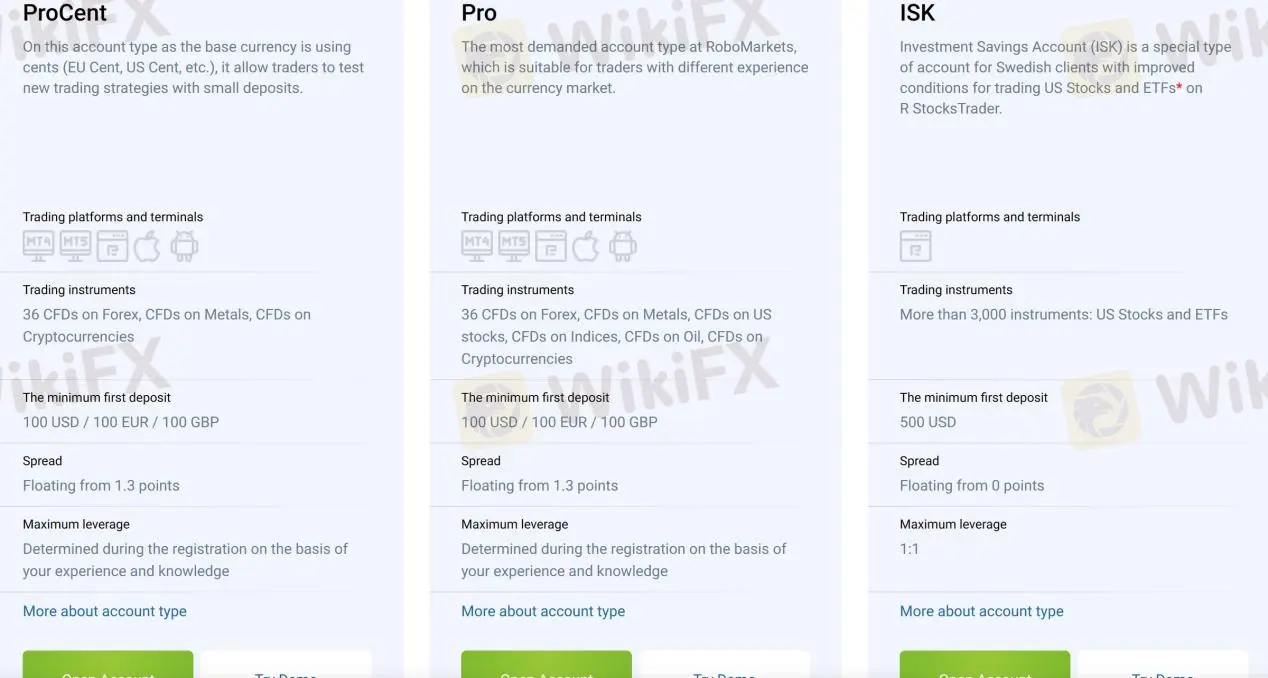

To meet different investors' investment needs and trading experience, RoboMarkets offers six different account types, namely Prime, ECN, R Stocks Trader, Pro Cent, Pro and ISK account. The minimum initial deposit for the ISK account is $500, while $/€/£100 for other five account types.

RoboMarkets offers a variety of account types to cater to the diverse needs and preferences of investors. The Prime account is designed for experienced traders and offers access to interbank liquidity, competitive spreads, and fast execution. The ECN account is also suited for experienced traders and provides direct market access with no dealing desk intervention. The R Stocks Trader account is specifically tailored for trading real stocks, allowing investors to buy and sell shares of popular companies directly.

The Pro Cent account is ideal for beginner traders or those looking to test their strategies with smaller amounts, as it allows trading with micro-lots and offers low minimum deposit requirements. The Pro account is suitable for more advanced traders, providing access to enhanced trading conditions and a wider range of instruments. Lastly, the ISK account is designed for trading Icelandic Króna (ISK) currency pairs and requires a higher minimum deposit compared to the other account types.

All account types come with the option to open a demo account, allowing traders to practice and familiarize themselves with the platform before trading with real funds. With this range of account types, RoboMarkets aims to accommodate traders of different levels of experience and investment preferences.

RoboMarkets, as a regulated broker, adheres to the regulatory guidelines set by CySEC and ensures that retail clients are provided with maximum leverage of 1:30. This limitation is implemented to protect clients from excessive risk exposure. The leverage offered for different asset classes is tailored to their respective risk levels, with Equities having a maximum leverage of 1:5, Commodities at 1:10, Major forex pairs at 1:30, and Minor forex pairs and indices at 1:20. It's worth noting that professional traders who meet the eligibility criteria can apply for higher leverage of up to 1:300.

However, it's important for traders to understand the risks associated with using leverage. While leverage can amplify potential profits, it also magnifies losses, and traders should carefully consider their risk tolerance and employ proper risk management strategies when utilizing leverage in their trading activities.

RoboMarkets offers competitive spreads and commissions across its different account types. The Prime, ECN, and ISK accounts feature floating spreads starting from 0 points, providing traders with tight spreads and potentially lower trading costs. While the commissions for the Prime and ECN accounts are unspecified, they are likely to be applied on a per-trade basis.

On the other hand, the Pro Cent and Pro accounts have floating spreads starting from 1.3 points, which still offer favorable trading conditions. These account types do not charge any commissions, allowing traders to execute their trades without incurring additional costs.

For the R Stocks Trader account, the spread starts from $0.01, which can be beneficial for traders focusing on stock trading.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| RoboMarkets | From 0 points | Unspecified commissions |

| Z.com Trade | From 0.5 pips | No commissions |

| AETOS | From 0.8 pips | No commissions |

| Equiti | From 0.0 pips | No commissions |

Please note that the spread and commission values may vary depending on market conditions and account types offered by each broker. It's always recommended to check with the respective brokers directly or their official websites for the most up-to-date and accurate information regarding spreads and commissions.

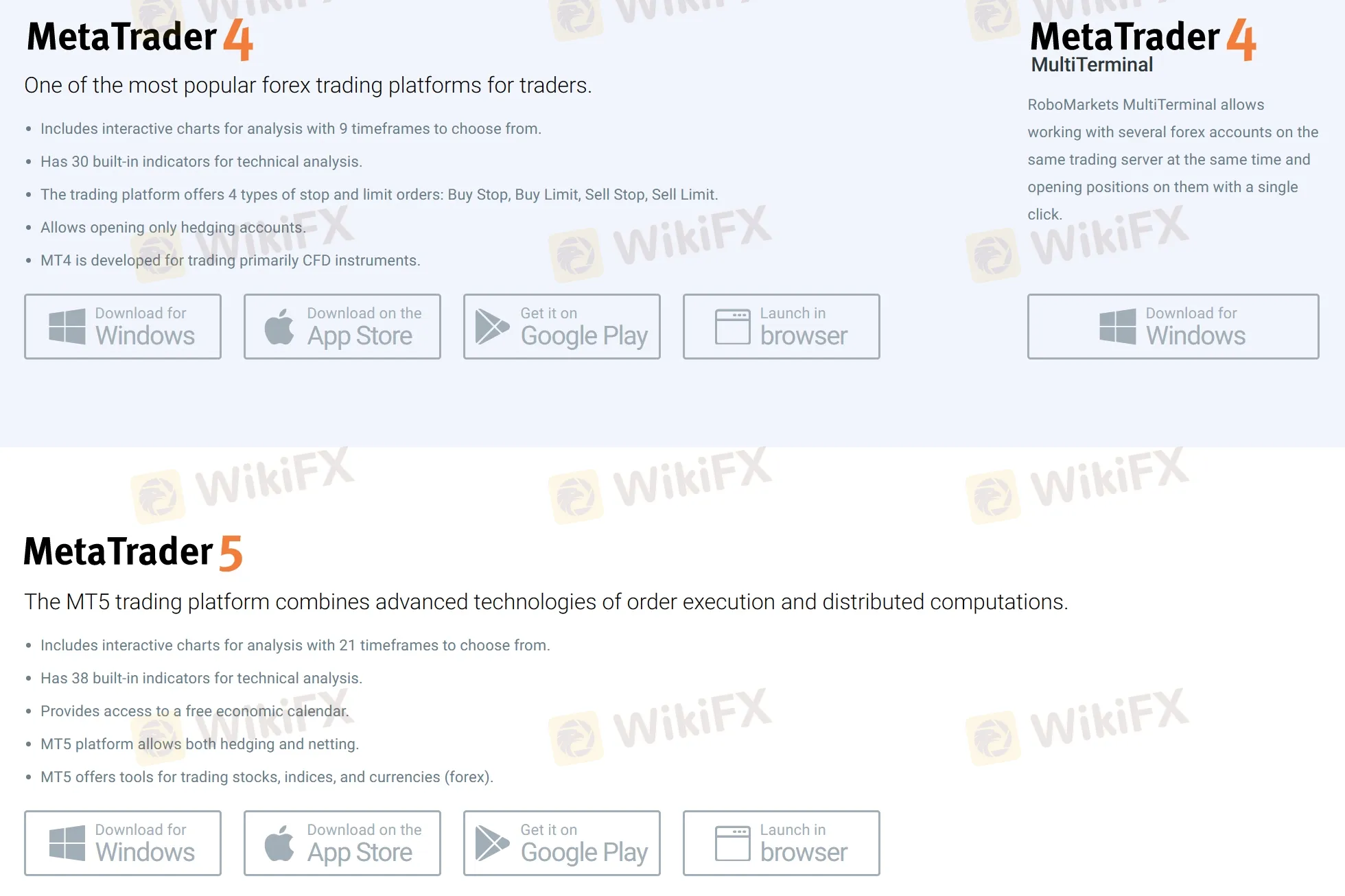

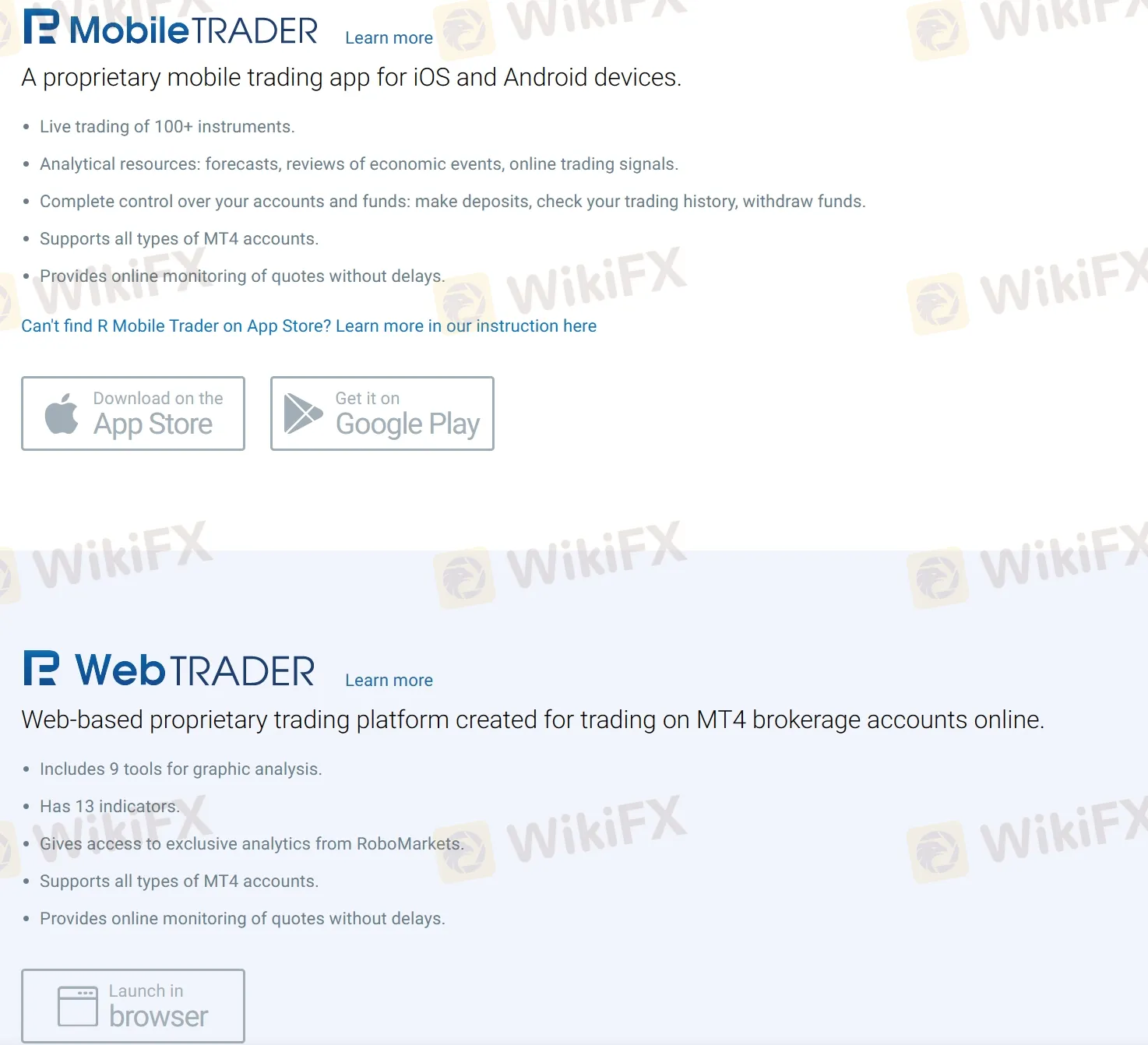

RoboMarkets provides traders with a range of powerful and user-friendly trading platforms to cater to different preferences and trading styles. One of the most popular choices is MetaTrader4 (MT4), a widely recognized platform known for its robust features and extensive trading tools. MT4 offers a user-friendly interface, advanced charting capabilities, customizable indicators, and automated trading options through Expert Advisors (EAs). Traders can access a wide range of financial instruments and execute trades efficiently.

In addition to MT4, RoboMarkets also offers MetaTrader5 (MT5), the successor to MT4. MT5 retains many of the features of its predecessor while introducing enhanced functionality, including more advanced analytical tools, additional order types, and the ability to trade on multiple markets from a single platform. MT5 is particularly suitable for traders looking for a wider range of instruments and advanced trading capabilities.

For those who prefer web-based trading platforms, RoboMarkets provides R WebTrader, which offers convenient access to the markets through a web browser without the need for software installation. R WebTrader provides a user-friendly interface, real-time market quotes, and a variety of trading tools, making it accessible to traders on the go.

Mobile traders can take advantage of R MobileTrader, which offers a fully functional trading experience on iOS and Android devices. With R MobileTrader, traders can monitor their accounts, place trades, and access real-time market information from anywhere at any time, ensuring flexibility and convenience in their trading activities.

Furthermore, RoboMarkets caters to traders interested in stock trading with their dedicated R StocksTrader platform. This platform is designed specifically for trading stocks, providing access to a wide range of global stock markets. Traders can analyze stock prices, place orders, and manage their stock portfolio through the intuitive and user-friendly interface of R StocksTrader.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| RoboMarkets | MetaTrader 4, MetaTrader 5, R WebTrader, R MobileTrader, R StocksTrader |

| Z.com Trade | MetaTrader 4, MetaTrader 5 |

| AETOS | MetaTrader 4, AETOS WebTrader, AETOS Mobile Trader |

| Equiti | MetaTrader 4, Equiti WebTrader, Equiti Mobile Trader |

RoboMarkets provides a range of useful trading tools to assist traders in making informed decisions and enhancing their trading experience. One of these tools is the Trading Strategy Builder, available in the R StocksTrader platform. This tool allows traders to create and test their own trading strategies using a simple and intuitive interface. Traders can set their preferred parameters, test the strategy on historical data, and optimize it for better performance, all without requiring programming skills.

Another valuable tool offered by RoboMarkets is the Forex profit calculator. This calculator allows traders to estimate their potential profits or losses based on various factors such as trade size, currency pair, and leverage. It helps traders plan their trades more effectively by providing them with an overview of the potential outcomes.

RoboMarkets also provides comprehensive financial charts to assist traders in technical analysis and market research. These charts offer a wide range of indicators, drawing tools, and timeframes, allowing traders to analyze price movements, identify trends, and make informed trading decisions. The charts are highly customizable, enabling traders to adapt them to their individual preferences and trading strategies.

These trading tools offered by RoboMarkets empower traders with the necessary resources to develop and implement their trading strategies effectively. Whether it's creating and testing strategies, calculating potential profits, or conducting technical analysis, these tools provide valuable insights and enhance traders' overall trading capabilities.

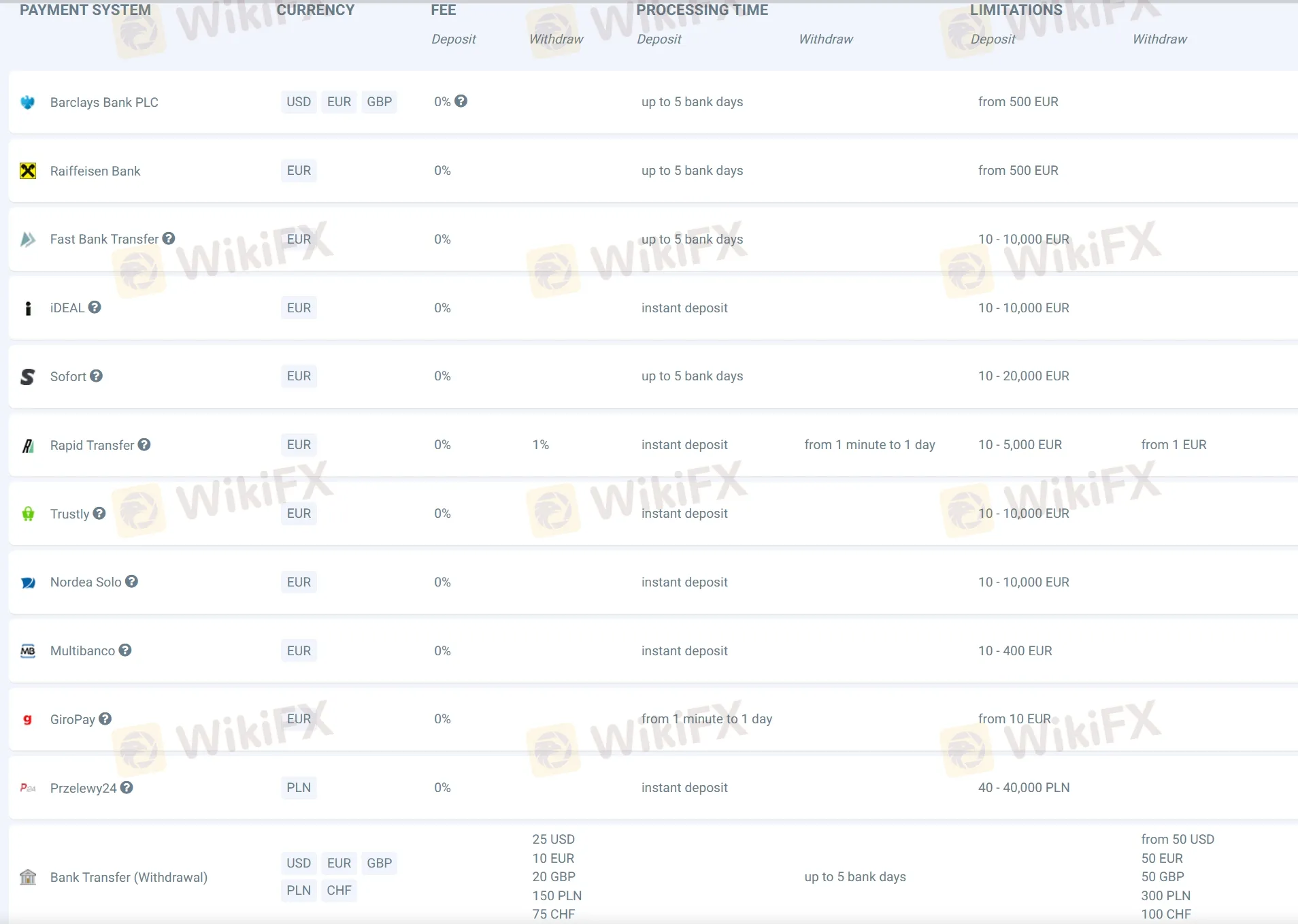

RoboMarkets provides a wide range of convenient payment options to facilitate smooth deposits and withdrawals for its clients. Traders can choose from more than 20 payment systems, including bank payments, e-payments such as PayPal, Skrill, and Neteller, as well as bank cards like Visa and MasterCard. This variety ensures flexibility and accessibility for traders worldwide.

| RoboMarkets | Most other | |

| Minimum Deposit | $/€/£100 | $/€/£100 |

The minimum deposit requirement at RoboMarkets is $10, allowing traders with different budget sizes to start trading. Opening an account, on the other hand, requires a slightly higher minimum deposit of $/€/£100, which may vary depending on the account type selected. No commissions for all deposits. The processing time for deposits is typically instant, ensuring that deposited funds are quickly available for trading.

When it comes to withdrawals, RoboMarkets sets a minimum withdrawal amount of $1, providing flexibility for traders to withdraw their funds as needed. The broker offers free withdrawals of funds twice a month, allowing traders to manage their finances efficiently. Withdrawals require 1 minute to 1 day for processing, depending on the specific circumstances.

Users can get in touch with 24/7 multilingual customer support through various channels, including online contact form, email: info@robomarkets.com, live chat, and English telephone: +357 25 123275.

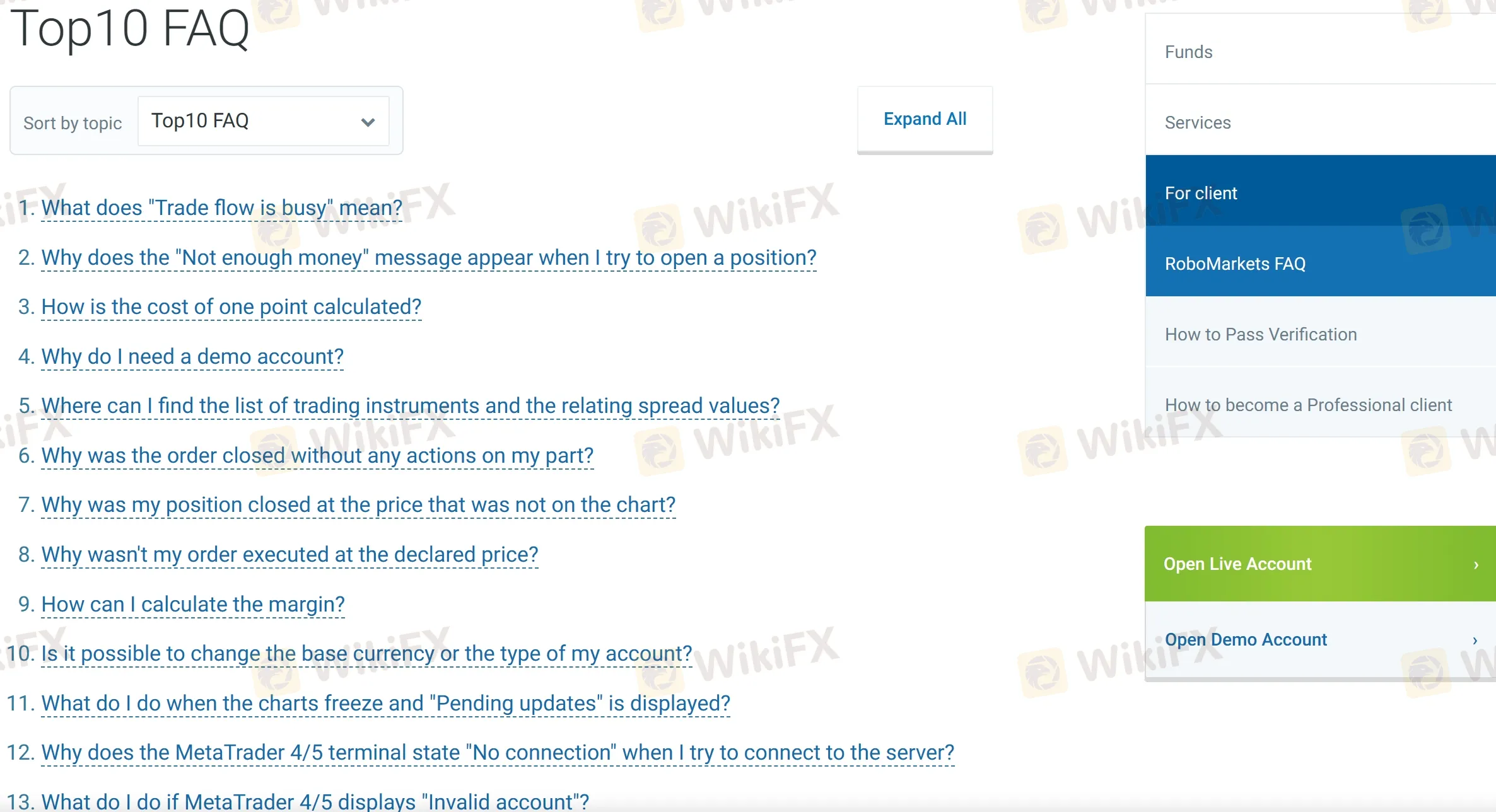

In addition to direct support channels, RoboMarkets also offers a comprehensive FAQ section. This resource serves as a valuable self-help tool, addressing common questions and providing basic information on various aspects of trading with RoboMarkets. Traders can find answers to frequently asked questions, helping them navigate through the platform and enhance their trading experience.

RoboMarkets also maintains an active presence on various social media platforms, including Twitter, Facebook, Instagram, and YouTube. By following the broker on these networks, traders can stay updated with the latest news, educational content, market analysis, and promotional offers. The social media channels serve as additional communication channels, allowing traders to interact with the broker and engage with the trading community.

| Pros | Cons |

| • 24/7 availability for customer support | N/A |

| • Multilingual support for global clients | |

| • Multiple communication channels | |

| • Live chat feature for instant assistance | |

| • FAQ section offered | |

| • Active presence of social media |

Note: These pros and cons are subjective and may vary depending on the individual's experience with RoboMarkets' customer service.

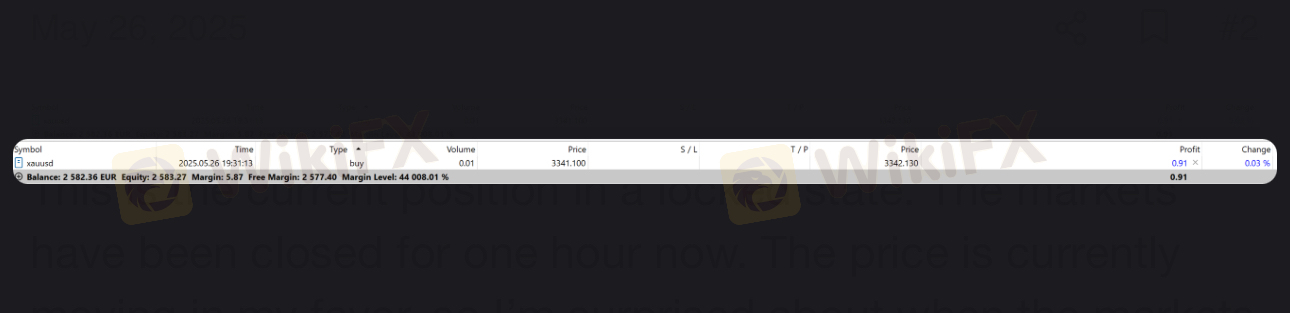

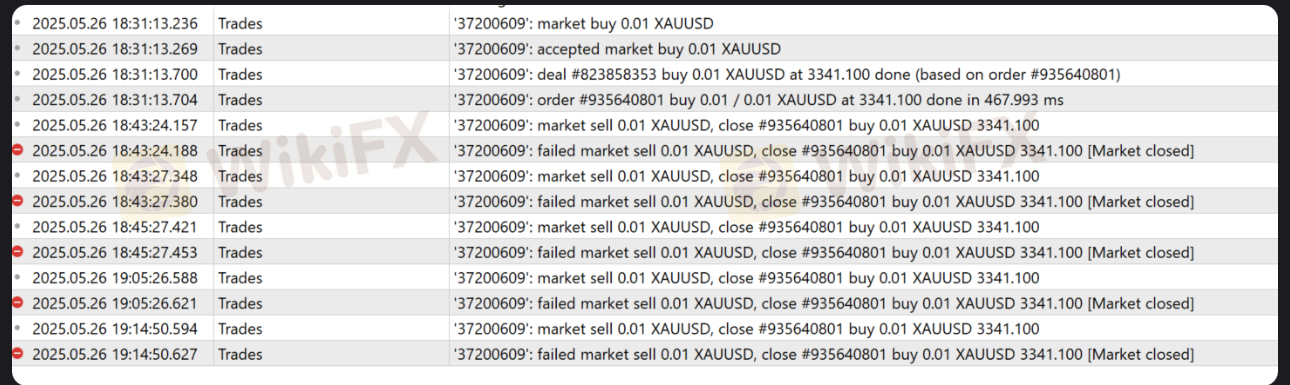

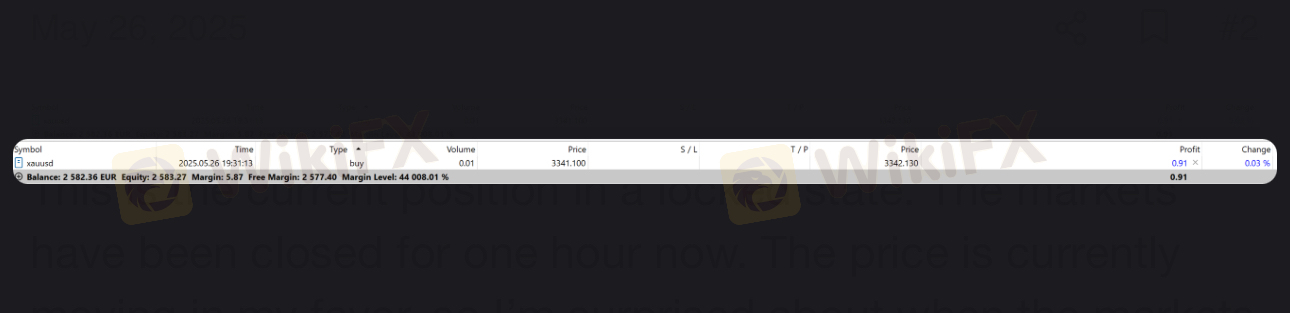

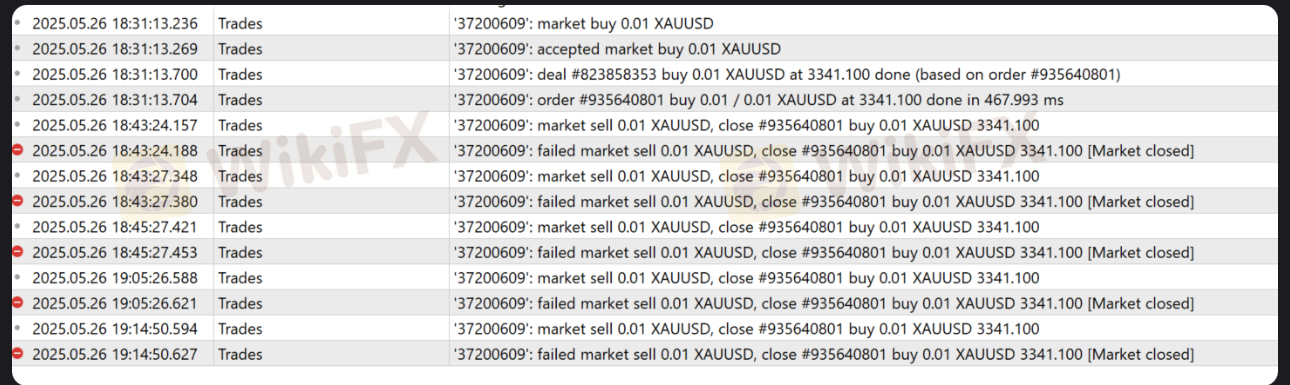

On our website, you can see that a report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

In conclusion, RoboMarkets is a regulated broker that offers a wide range of financial instruments and multiple trading account types and platforms, providing traders with flexibility and choice. The broker's commitment to security and transparency is a definite advantage, and their customer service is commendable with 24/7 multilingual support.

However, it is important to note the reported difficulty with withdrawals. Traders should carefully consider these factors and conduct thorough research before deciding to trade with RoboMarkets.

| Q 1: | Is RoboMarkets a regulated broker? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC, License No. 191/13). |

| Q 2: | Does RoboMarkets offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does RoboMarkets offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MetaTrader 4, MetaTrader 5, R WebTrader, R MobileTrader, and R StocksTrader. |

| Q 4: | What is the minimum deposit required to open an account with RoboMarkets? |

| A 4: | The minimum initial deposit to open an account is $/€/£100. |

| Q 5: | Is RoboMarkets suitable for beginner traders? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

RoboMarkets secures Dubai SCA licence and adds 1,300 US stocks, boosting broker services with local authority insight.

WikiFX

WikiFX

RoboMarkets adds 1,160+ assets to R StocksTrader, including US, UK, Swiss stocks, and UCITS ETFs, with zero-commission trading and improved conditions.

WikiFX

WikiFX

RoboMarkets alerts clients about Walmart's 3-for-1 stock split on Feb 26, 2024. Key updates for traders include account adjustments and order cancellations.

WikiFX

WikiFX

The CySEC decided to sanction Robomaket and forbid it from offering non-monetary rewards. This move underscores the growing efforts of financial regulators to ensure the integrity and security of trading platforms and safeguard the interests of traders.

WikiFX

WikiFX

More

User comment

13

CommentsWrite a review

2025-09-09 08:43

2025-09-09 08:43

2025-08-26 22:23

2025-08-26 22:23