User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| CHUKYO Review Summary | |

| Founded | 1943 |

| Registered Country/Region | Japan |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Shares, Commodities, ETFs, Crypto, Mutual Funds, Loans, Insurance, Defined Contribution Pension |

| Demo Account | ❌ |

| Leverage | Not mentioned |

| Spread | Not mentioned |

| Trading Platform | Chukyo Direct Net Version, Chukyo Investment Trust Direct, Chukyo Business Direct, Chukyo Forex WEB |

| Min Deposit | 500 USD (for Foreign Currency Time Deposits) |

| Customer Support | Phone: 52-211-0345 |

THE CHUKYO BANK, Ltd. is a Japanese financial institution that was established in 1943. It's headquartered in Nagoya and operates primarily in Japan.

The bank provides a variety of financial services to both individual and corporate clients, such as banking, credit card services, and loan guarantees. However, it lacks regulation by any well-known financial institution.

| Pros | Cons |

| Deep understanding of the Japanese market | Lack of regulation |

| Convenient online banking | Website and services only in Japanese |

| Can provide customized financial advice | There are no MT4 or MT5 platforms available |

| Complex fee structure |

CHUKYO is not regulated by other well-known regulatory authorities.

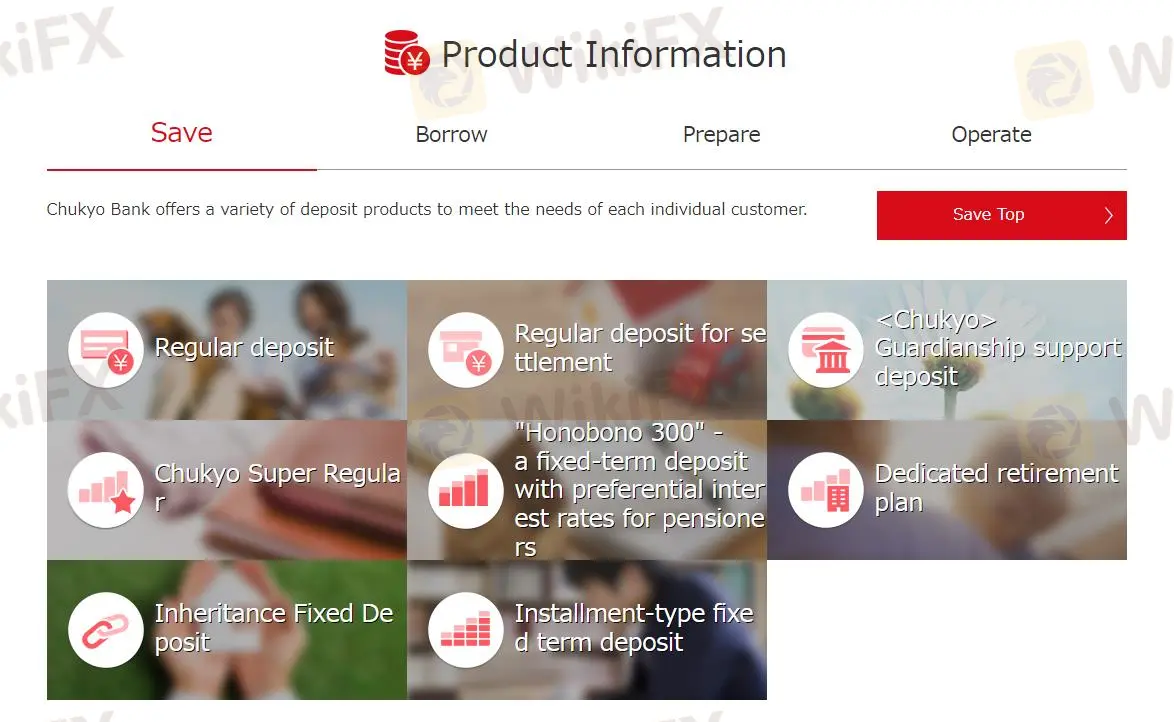

CHUKYO provides a full suite of financial services, encompassing investment products, lending options, insurance coverage, and retirement planning.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Metals | ❌ |

| Commodities | ✔ |

| ETFs | ✔ |

| Crypto | ✔ |

| Energies | ❌ |

| Futures | ❌ |

| Mutual Funds | ✔ |

| Loans | ✔ |

| Insurance | ✔ |

| Defined Contribution Pension | ✔ |

CHUKYO offers personal accounts for savings, borrowing, and investment, including online platforms like Chukyo Direct Net Version and Chukyo Investment Trust Direct.

For corporate customers, CHUKYO provides full business solutions ranging from management and fundraising to accountancy and international business support. Online platforms such as Chukyo Business Direct and Chukyo Forex WEB frequently offer these services.

Compare with other trading institution, the fees structure of CHUKYO is relatively complex.

Domestic Transfers

Within the same branch fees start from 330 yen for transfers under 30,000 yen. To other banks fees can go up to 880 yen depending on the destination.

ATM Fees

220 yen for transfers under 30,000 yen using the Chukyo Direct Net Version. And 440 yen for transfers over 30,000 yen via the same method.

Other Fees

A 440-yen fee is charged for remittances within the banks branches when remittance, reissuance of documents needs 1,100 yen. As for loan-related fees, partial early repayments or interest rate changes may range from free to 55,000 yen, depending on the specific situation.

| Trading Platform | Supported | Available Devices | Suitable for which type of traders |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

| <Chukyo> Direct Net Version | ✔ |

| Individual customers |

| Bank Pay | ✔ |

| Individual customers using smartphones |

| <Chukyo> Business Direct | ✔ |

| Businesses |

| <Chukyo> Foreign Exchange WEB | ✔ |

| Businesses involved in international trade |

The minimum deposit for Chukyo Bank's Foreign Currency Time Deposits is 500 USD, with a flexible range of 1 to 12 month periods.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Foreign Currency Time | 500 USD (or equivalent) | 1 per USD/EUR/Australian dollar | same day |

| Ordinary Deposits | None | \ | same day |

| Ordinary Deposits for Payments | None | \ | same day |

| Savings-Type Fixed Deposits | Varies based on product type | \ | same day |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Foreign Currency Time | Varies based on deposit amount | 1 per USD/EUR/Australian dollar | same day |

| Ordinary Deposits | None | \ | same day |

| Ordinary Deposits for Payments | None | \ | same day |

| Savings-Type Fixed Deposits | Varies based on deposit amount and term | \ | same day |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment