User Reviews

More

User comment

19

CommentsWrite a review

2025-03-11 20:59

2025-03-11 20:59

2024-10-18 16:22

2024-10-18 16:22

Score

Above 20 years

Above 20 yearsRegulated in Australia

Market Making License (MM)

Self-developed

Global Business

Australia Forex Execution License (STP) Revoked

High potential risk

Capital Ratio

Influence

Add brokers

Comparison

Quantity 14

Exposure

Score

Regulatory Index9.54

Business Index8.00

Risk Management Index0.00

Software Index8.58

License Index9.52

ASIC Regulated

Market Making License (MM)

FCA Regulated

Market Making License (MM)

FSA Regulated

Market Making License (MM)

SFC Regulated

Market Making License (MM)

SFC Revoked

Market Making License (MM)

CIRO Regulated

Derivatives Trading License (EP)

NFA Regulated

Derivatives Trading License (AGN)

ASIC Revoked

Forex Execution License (STP)

Single Core

1G

40G

More

Sanction

Danger

Sanction

More

Company Name

Interactive Brokers Hong Kong Limited

Company Abbreviation

InteractiveBrokers

Platform registered country and region

Hong Kong

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 94% Japanese brokers $12,403,101(USD)

Stay away from it. They rejected my withdrawal of $7000 and ran away.

The money in the account can’t be withdrawn, even if it’s delayed, it’s still asked me to pay the different fees. I can’t get the money. It is ok, but I will not give you any penny, and I want to find other people to be victimized by myself. Serious fraud.

Fraudulent platform, intentionally not allowing withdrawals. Up to now, I have intentionally locked my account and not allowed me to access it. Currently, this floor has signs of fraud.

The chart was manipulated. I wanted to make the withdrawal, while IB gave no access to it, suffering huge losses.

I’ve never encountered with such situation. I don’t know whether it is a scam.

This forex trading platform operates fake activities to induce customers to participate. After the customer makes profit, they say that they have to pay 20% of the tax and tax must be paid separately and cannot be deducted from the account. I already deposit all my money and there is no more left for paying tax. This regulation was not stated before activities. This is fraud.

The platform gives no access to withdrawal with excises including wrong bank information, inadequate credit score and even unpaid individual tax. I have paid all fees, but the withdrawal is still unavailable.

Many clients have complained about the poor customer service of this broker and so their queries remain unanswered by the broker.

The withdrawal hasn’t been received yet for 7 days.No one replies to the email.

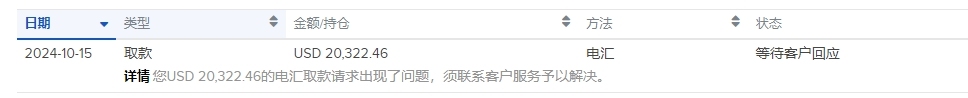

According to the requirements, I submitted a lot of documents. They froze and closed my account on the grounds that my account was not compliant. I went to withdraw the remaining funds and confirmed the withdrawal over the phone. Until now, customer service, all consultation forms, and emails have not been replied to. It's really disappointing. This is how they treat us Chinese customers on such a big platform.

I requested to withdraw the deposited money but I couldn't because the floor required a 3-month VIP upgrade. I sent a message to the customer base asking how to withdraw money but was not informed about this issue.

A client has complained about the very poor customer service of this broker and also claimed they do not allow transfer and steals people's money.

Unable to withdraw money, always fail to pass the review, contact them and ignore it

I beg you all in the name of God, dont ever trade with Interative Brokers. They are worse than the devil… They wont give me my $7000, i worked hard to earn that amount trading almost 24hours, i asked for withdrawal, they begin stupid stories… They claim they are regulated by cysec… Amy Parker one of the top people in interactive option, was with iOption that went bankrupt before, she knows all about this crime they are committing… She ran with people’s money @ iOption… If you have money there, better take out your funds, they wont even give you. and if you know anyone that wants to deposit with this thief broker, advise them not to ever… Because you will be trading for this company and not yourself… you will make money and they wont give you. Devil is nicer than this company, thats how bad they are…

| Quick IB Review Summary | |

| Founded | 1978 |

| Registered | Hong Kong |

| Regulation | ASIC, FCA, FSA, SFC, CIRO |

| Market Instruments | 150 markets, stocks/ETFs, options, futures, spot currencies, bonds, mutual funds |

| Demo Account | ✅ |

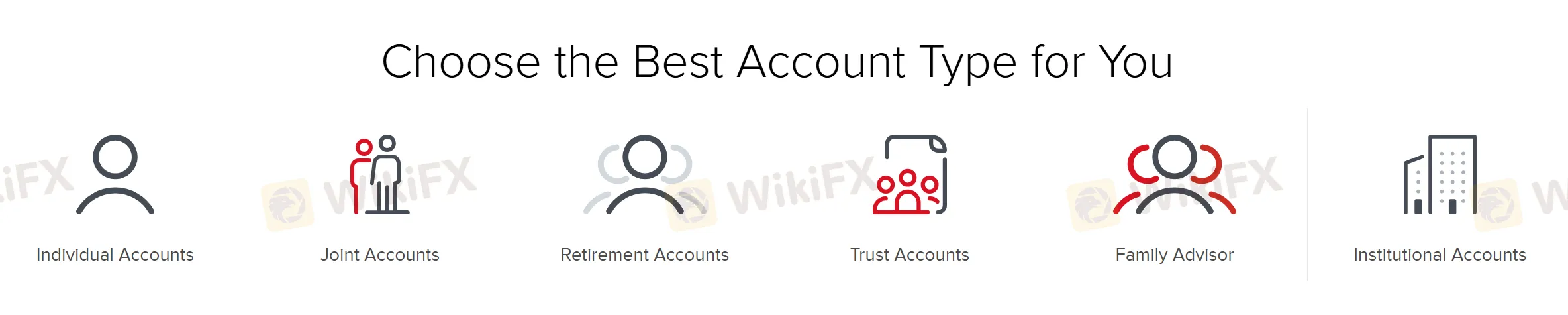

| Account Type | Individual, Joint, Retirement, Trust, Family, Institutional |

| Min Deposit | $0 |

| Leverage | Up to 1:400 |

| Spread | From 0.1 pips |

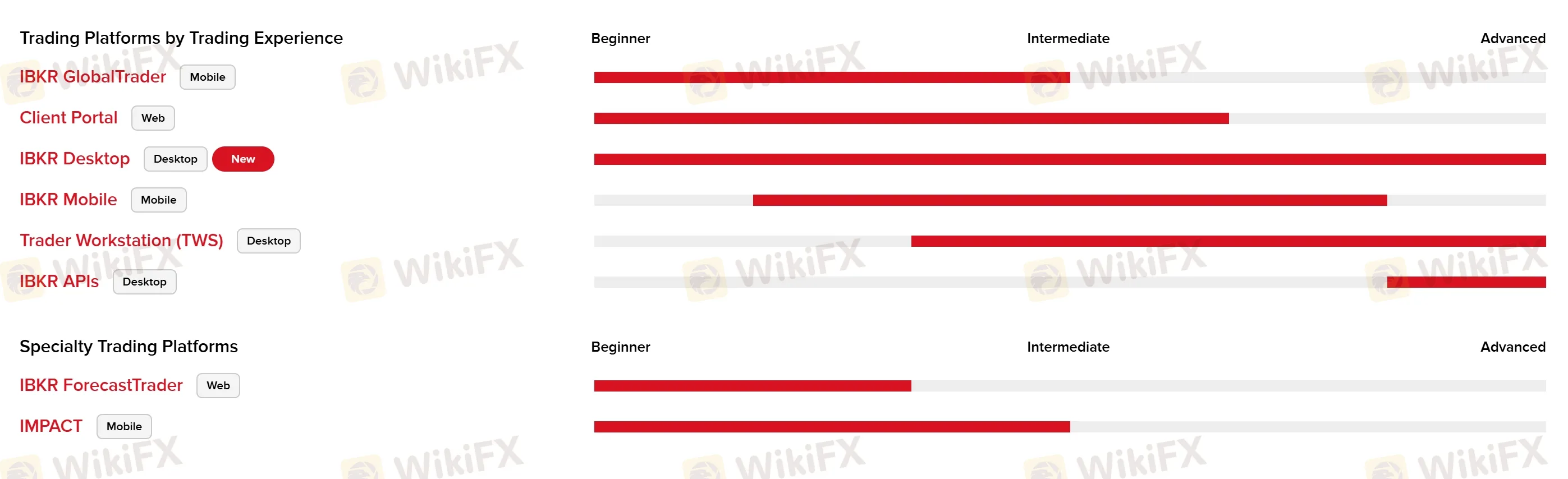

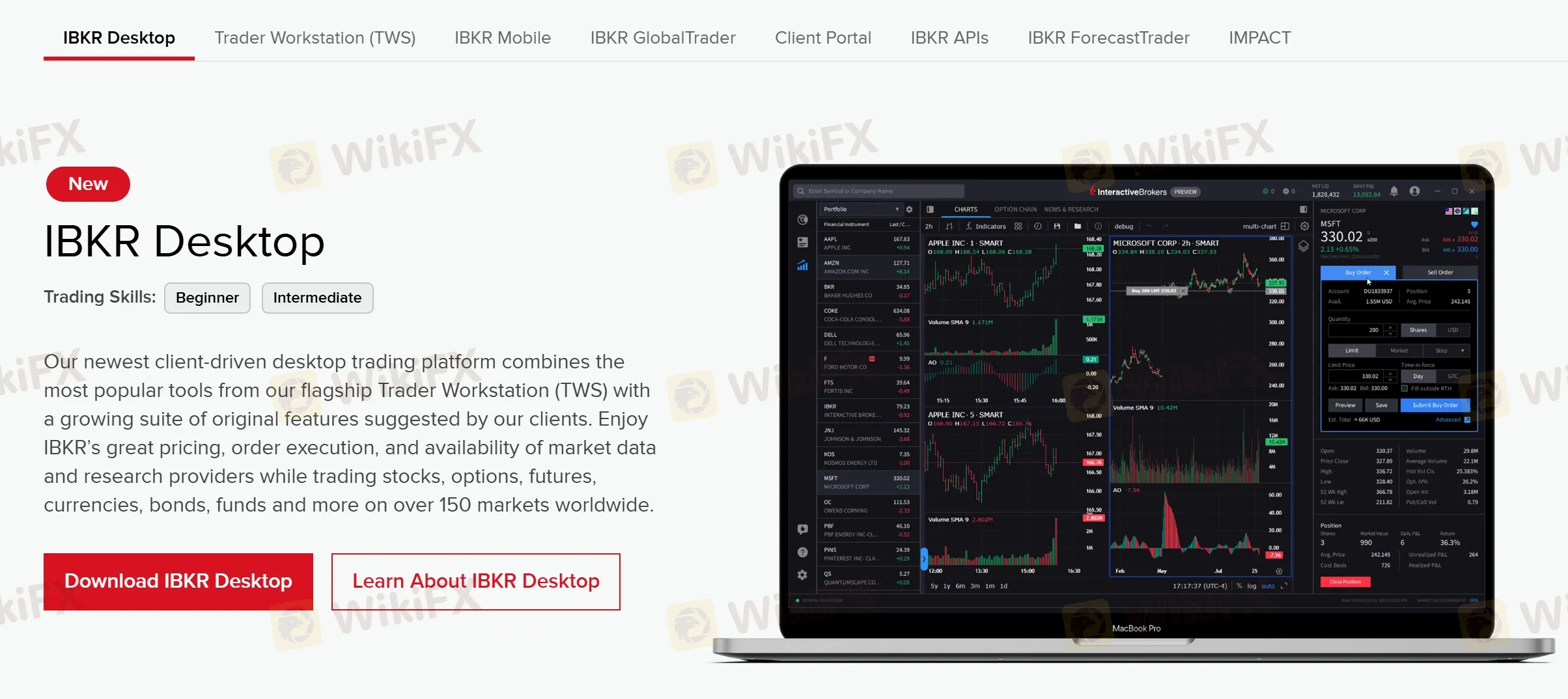

| Trading Platform | IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), IMPACT (Mobile) |

| Inactivity Fee | ❌ |

| Customer Support | Live chat, phone, email, FAQs |

IB, or Interactive Brokers, is a discount brokerage firm founded in the United States in 1978. It is headquartered in Greenwich, Connecticut, and has offices in several other countries, including the United Kingdom, Hong Kong, and Australia. The company provides electronic brokerage services to individual and institutional clients, offering a range of financial products, including 150 markets including stocks/ETFs, options, futures, spot currencies, bonds, and mutual funds. Interactive Brokers is regulated by several financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada).

Interactive Brokers (IB) has many advantages, including low commissions, access to a wide range of financial products, and a highly customizable trading platform. Additionally, IB is known for its advanced research tools and competitive pricing.

However, complex trading platforms are not suitable for all investors.

Below is a table outlining the pros and cons of Interactive Brokers (IB):

| Pros | Cons |

| • Wide range of trading instruments | • Complex platform and steep learning curve |

| • Advanced trading platform with many features | |

| • Low trading fees and commissions | |

| • Access to international markets and exchanges | |

| • Multiple account types to choose from | |

| • Strong regulatory oversight and safety of client funds |

Note: This table is based on general observations and may not represent the experience of every individual user.

Interactive Brokers is a well-established and reputable broker. The company is publicly traded and regulated by multiple top-tier financial authorities around the world, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | INTERACTIVE BROKERS AUSTRALIA PTY LTD | Market Making (MM) | 000453554 |

| Financial Conduct Authority (FCA) | Interactive Brokers (UK) Ltd | Market Making (MM) | 208159 |

| Financial Services Agency (FSA) | インタラクティブ・ブローカーズ証券株式会社 | Retail Forex License | 関東財務局長(金商)第187号 |

| Securities and Futures Commission of Hong Kong (SFC) | Interactive Brokers Hong Kong Limited | Dealing in futures contracts & Leveraged foreign exchange trading | ADI249 |

| Canadian Investment Regulatory Organization (CIRO) | Interactive Brokers Canada Inc. | Market Making (MM) | Unreleased |

Furthermore, the broker has a long history of providing high-quality services to its clients, with a track record of financial stability and reliability. Therefore, based on these factors, it can be concluded that IB is a legitimate broker.

How Are You Protected?

Interactive Brokers (IB) provides a range of security measures to protect its clients' funds and personal information. Some of the key security measures include:

| Protection Measure | Detail |

| Regulatory Oversight | ASIC, FCA, FSA, SFC, CIRO |

| Account Protection | SIPC protection (up to $500,000) and additional third-party insurance coverage (up to $30 million) |

| Two-Factor Authentication | adding an extra layer of security to their accounts |

| Secure Login System | a proprietary security measure that requires users to have a security device to log in to their accounts |

| Privacy Policy | outlines how it collects and uses customer data |

| Secure Website | uses SSL encryption on its website to protect user data and prevent unauthorized access |

| Cybersecurity Measures | firewalls, intrusion detection systems, and encryption, to protect against cyber threats |

It's important to note that while no investment platform can completely eliminate risk, IB's measures are designed to mitigate risk and protect its clients as much as possible.

Our Conclusion on IB Reliability:

Based on the information provided, Interactive Brokers is a reliable broker with a strong focus on client protection and security measures. It is regulated by multiple authorities and has a history of being in the industry for several decades.

IB offers 150 markets across multiple asset classes, including:

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Spot Currencies | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Interactive Brokers (IB) offers various types of accounts for different trading needs, including Individual, Joint, Retirement, Trust, Family, and Institutional accounts.

While the margin rates that IB offers are the same for all customers, local regulators may impose different or higher rates. Regulatory requirements for margin deposits in a given jurisdiction will take precedence over those set by the IB if they are greater.

And since high-risk leverage is regulated differently in different countries, your ability to use it will vary based on the trading instrument you use and the law where you live. As a result, IB provides a convenient online tool to let you quickly and easily view all applicable margins, allowing you to select the optimal trading conditions.

For customers who come under the jurisdiction of the Australian Securities and Investments Commission (ASIC), the maximum leverage available on Forex trades is 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads:

Commissions:

A tiered commission of $0.0035 per share for a monthly volume of fewer than 300,000 shares, $0.002 per share for a monthly volume of 300,001-3,000,000 shares, $0.0015 per share for a monthly volume of 3,000,001-20,000,000 shares, and $0.0015 per share for a monthly volume of 20,000,000 shares. $0.001 per share for a monthly volume of 20,000,001-100,000,000 shares and $0.0005 per share for a monthly volume of 100,000,000 shares or more. The minimum commission is $0.35, and the maximum commission is 1% of the trading volume. The commission for metals trading is 0.15 basic points of the volume, with a minimum of $2.

IBKR GlobalTrader, Client Portal, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR Event Trader, and IMPACT are different trading platforms and tools offered by Interactive Brokers (IB) to its clients.

Overall, IB offers a variety of trading platforms and tools that cater to the needs of different types of traders and investors. These platforms provide access to a wide range of markets and instruments, advanced trading tools, real-time market data, and research resources. Additionally, the IBKR APIs enable clients to customize and automate their trading strategies.

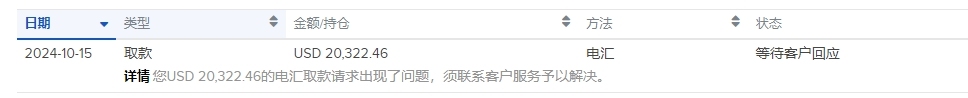

There are several major options for traders to deposit and withdraw funds from their accounts, including bank wire transfers, ACH, BPAY, EFT, online bill payment and more.

Note that the availability of deposit and withdrawal methods may vary depending on your location and account type.

Minimum deposit requirement

The minimum deposit requirement for Interactive Brokers (IB) varies depending on the account type and the location of the account holder. For example, the minimum deposit for a US-based individual account is $0 for IBKR Lite and $0 for IBKR Pro, while for a non-US-based individual account, the minimum deposit is $0 for IBKR Lite and $10,000 for IBKR Pro. However, the minimum deposit for other account types, such as institutional accounts or margin accounts, may be higher.

IB minimum deposit vs other brokers

| IB | Most other | |

| Minimum Deposit | $0 | $/€/£100 |

Interactive Brokers offers a variety of educational resources for traders, including webinars, courses, videos, and articles.

The education section of their website includes topics such as trading basics, options trading, technical analysis, and trading strategies. They also offer a wide range of educational videos on their YouTube channel.

In addition, Interactive Brokers offers a simulated trading account that allows traders to practice trading with virtual funds before risking real money. This is a useful tool for beginners who are learning to trade.

In conclusion, Interactive Brokers is a reputable and reliable broker that offers a wide range of investment products and trading platforms to its clients. The broker is known for its low commission rates and competitive pricing structure, making it a good choice for active traders and investors.

IB also provides a high level of security and protection to its clients, through various measures such as SIPC and excess SIPC insurance, and two-factor authentication. The broker also offers educational resources, customer support, and a variety of account types to meet the needs of different traders.

However, IB may not be the best fit for beginners due to its complex trading platforms and sophisticated tools.

Overall, Interactive Brokers is a good choice for experienced traders and investors who are looking for a reliable broker with low commissions and a wide range of investment products.

| Q 1: | Is IB regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, and CIRO. |

| Q 2: | Does IB offer industry-standard MT4 & MT5? |

| A 2: | No. Instead, it offers IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), and IMPACT (Mobile). |

| Q 3: | What is the minimum deposit for IB? |

| A 3: | There is no minimum initial deposit with IB. |

| Q 4: | Is IB a good broker for beginners? |

| A 4: | No. Beginners may find IB's trading platforms are difficult to uderstand. It is more suitable for experienced traders. |

Interactive Brokers (also known as 盈透证券) is a prominent brokerage with significant global influence, holding an AAA Influence Rank and a WikiFX score of 8.29. Established in 2002 and headquartered in Hong Kong, the broker serves clients across major markets including Australia, the US, China, and the UK.

WikiFX

WikiFX

Interactive Brokers will soon allow retail investors to fund brokerage accounts with stablecoins, offering faster, on-chain transfers for U.S. clients.

WikiFX

WikiFX

Interactive Brokers adds Brazil’s B3 Exchange, giving investors worldwide seamless access to trade Brazilian equities and expand emerging market opportunities.

WikiFX

WikiFX

Interactive Brokers UAE equities access unlocks Abu Dhabi Securities Exchange (ADX) trading and Dubai Financial Market (DFM), Interactive Brokers opportunities for global investors. Trade AED-supported stocks with low fees from one platform in the UAE’s booming market.

WikiFX

WikiFX

More

User comment

19

CommentsWrite a review

2025-03-11 20:59

2025-03-11 20:59

2024-10-18 16:22

2024-10-18 16:22