ACY Securities Complete Review 2026: A Trader's Guide to Trading Terms, Risks and Warning Signs

Abstract:ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.

A Broker with Mixed Reviews

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capitals safety.

ACY Securities Quick Overview

For traders who need a fast summary, the following table shows the main advantages and disadvantages associated with ACY Securities. The “Cons” column is heavily influenced by documented user feedback and regulatory actions, which we believe are important factors when evaluating any broker.

| ACY Securities: Pros | ACY Securities: Cons |

| Regulated in Top-Level Area: Authorized by the Australian Securities and Investments Commission (ASIC). | Mostly Negative User Feedback: A very high number of complaints (182 on WikiFX) claiming serious issues. The WikiFX score is clearly reduced because of these complaints. |

| Wide Range of Trading Options: Access to over 2200+ instruments, including Forex, Indices, Metals, and Share CFDs. | Serious Withdrawal & Profit Issues: Regular user reports of being unable to withdraw funds, having profits held back, and being accused of “arbitrage” to deny payouts. |

| Strong Trading Platforms: Offers the industry-standard MT4 and MT5 platforms, plus their own LogixTrader. | Regulatory Warnings: Has received warnings from international regulators, including ESMA (Spain), AMF (France), and SCM (Malaysia), marking it as an unauthorized company in those areas. |

| High Leverage Available: Offers leverage up to 1:500 on certain accounts, appealing to high-risk traders. | Customer Support Problems: Reports of unresponsive or unhelpful customer service when dealing with important issues like closed orders or fund disputes. No 24/7 support is advertised. |

| Multiple Account Types: Provides Standard, ProZero, and Basic accounts to meet different trader needs. | High-Risk Label: Tagged with “High potential risk” by third-party review platforms due to the number of complaints and concerning practices. |

Trust and Safety Analysis

The most important factor for any trader is the safety of their funds. This section goes beyond simply listing regulations to carefully analyze the patterns of risk associated with ACY Securities, providing a deep look into the nature and seriousness of the problems other traders have reported.

Understanding Regulatory Status

On the surface, ACY Securities' regulatory profile looks strong. It holds a Market Making (MM) license from the Australian Securities and Investments Commission (ASIC), a highly respected top-level regulator known for its strict investor protection measures. The broker is also registered with the FSCA in South Africa, although some third-party platforms have noted this license status as “exceeded,” suggesting possible compliance issues.

However, this is where the clear picture ends. A major warning sign is the series of warnings issued against ACY Securities by other international bodies. These include:

· ES CNMV (Spain): Issued a warning on February 5, 2024.

· FR AMF (France): Blacklisted the firm on July 13, 2023.

· MY SCM (Malaysia): Placed ACY on its Investor Alert List as of January 1, 2022.

These warnings show that ACY Securities may be operating or seeking clients in these areas without the required authorization. While its Australian regulation is valid, operating without a license in other regions is a serious compliance violation and raises questions about the company's overall operational integrity.

The Pattern of Complaints

The huge number of user complaints against ACY Securities is alarming. With around 182 exposure reports on platforms like WikiFX alone, a clear and troubling trend appears. These are not minor complaints about high spreads; they are consistent claims of practices that directly threaten traders' capital safety. We have combined these firsthand accounts into several key themes.

· Withdrawal Problems: This is the most common and serious complaint. Users report that withdrawal requests are systematically delayed, rejected for unclear reasons such as “wrong information,” or ignored completely. In some cases, traders claim they were told they must deposit additional funds and complete a high volume of new trades before their original withdrawal request would even be considered. This practice effectively holds client funds hostage.

· Profit Withholding & “Arbitrage” Accusations: A clear pattern involves profitable traders being denied their earnings. A well-documented case involves a trader from Taiwan who, after building up profits, was accused of “scalping arbitrage” and working together with unrelated accounts in Japan. The broker allegedly refused to provide any proof of this cooperation and offered to return only the initial deposit, removing all profits. The trader noted that ACY considers any withdrawal over $5,000 to be “large” and subject to special approval, which can be randomly denied.

· Harmful Account Actions: Multiple reports describe punitive actions taken directly against user accounts. These include the platform allegedly closing locked (hedged) positions without permission, causing forced liquidations. One user claimed their account was liquidated despite the margin level being above the 50% stop-out limit.

Others have reported that the broker deleted work order records and communication logs when disputes were raised, making it impossible to prove their case.

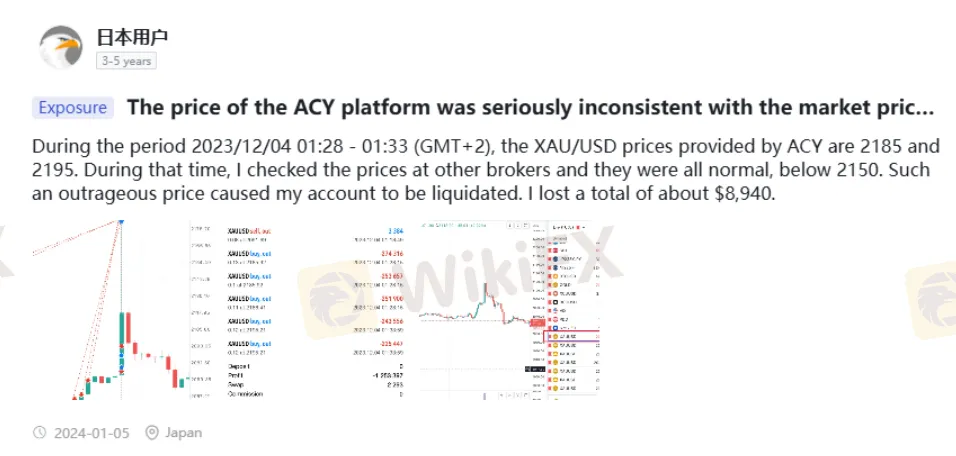

· Pricing and Execution Issues: There are specific claims of off-market pricing leading to catastrophic losses. In one incident, a user reported that ACY's price for XAU/USD (Gold) jumped to 2195, a level wildly out of sync with the broader market, which was trading below 2150 at the time. This unusual price spike triggered an immediate liquidation of their account.

These firsthand accounts raise serious questions about the broker's practices. To verify the broker's current regulatory status and see the latest user feedback in real-time, you can check its profile on independent review platforms before visiting the official ACY Securities website.

ACY Securities Trading Conditions

While the risks are significant, it is also important to understand the trading conditions ACY Securities offers on paper. This section provides a factual overview of its accounts, platforms and available markets, allowing for a direct comparison with other brokers.

Account Types

ACY Securities offers three primary account levels designed to meet different trading styles and capital levels.

| Feature | Standard Account | ProZero Account | Basic Account |

| Minimum Deposit | $100 | $200 | $50 |

| Spreads From | Variable | 0.0 pips | Variable |

| Commission | From Zero | From $3/lot per side | From Zero |

| Max. Leverage | Up to 1:5000 | Up to 1:5000 | Up to 1:5000 |

Each account is designed for a different type of trader. For a complete breakdown of all features and to decide which account may suit your strategy, you can explore them in detail on the official ACY Securities website.

Trading Platforms

ACY provides access to the most popular trading platforms in the industry, ensuring a familiar environment for most traders.

· MetaTrader 4 (MT4): The long-standing industry standard, MT4 is known for its user-friendly interface, strong charting tools, and vast ecosystem of Expert Advisors (EAs) for automated trading. It is an excellent choice for both new and experienced traders.

· MetaTrader 5 (MT5): The successor to MT4, MT5 offers more advanced features, including additional timeframes, more technical indicators, and access to a wider range of markets beyond forex, such as stocks and futures.

· ACY Trading Platform: This is ACY's own web-based platform. While less-known than the MetaTrader suite, it provides a convenient, no-download-required trading experience directly from a browser.

All platforms are available on Desktop, Web, and Mobile (iOS and Android). The broker also supports Copy Trading, which allows less experienced traders to automatically copy the strategies of seasoned professionals.

Market Instruments

One of ACY's strengths is its extensive range of tradable instruments, with over 2200+ options available across various asset classes. This allows for significant portfolio diversification.

· Forex: Over 60 currency pairs, including majors, minors, and exotics.

· Share CFDs: An impressive selection of over 2,200+ company shares from global exchanges.

· Indices: More than 20 major global indices, such as the S&P 500, NASDAQ, and DAX.

· Metals: Precious metals including Gold (XAU) and Silver (XAG).

· Commodities & Energies: A range of soft commodities and energies like US Oil (WTI) and UK Oil (Brent).

Fees, Spreads and Leverage

Understanding the cost of trading is important. Here, we break down the fee structure, spreads, and leverage offered by ACY Securities.

Spreads and Commissions

The cost structure varies significantly between account types, a common industry practice.

· Standard Account: This account is commission-free. The broker's fee is built into the spread, which is variable based on the trading environment. This model is simpler for beginners but is generally more expensive for active traders.

· ProZero & Basic Accounts: These accounts operate on an ECN-style pricing model. ProZero offers raw spreads starting from 0.0 pips, which means traders get direct market pricing. In exchange, a fixed commission is charged per trade. The ProZero account charges from $3 per lot per side ($6 round turn). On the other hand, the spread remains variable in the Basic account, with commissions beginning from zero.

Understanding Leverage

ACY Securities advertises very high leverage, with some sources mentioning up to 1:5000. However, the available data is conflicting, with most MT4/MT5 accounts showing a maximum of 1:500. The actual leverage offered will depend on the client's location, the specific regulatory entity they are registered under, and the account type.

It is important to understand the risks involved. While high leverage can increase profits, it equally increases losses and can lead to a rapid loss of your trading capital. It is a high-risk tool that should be used with extreme caution and a solid understanding of risk management.

Deposit and Withdrawal Fees

ACY supports a standard range of funding methods, including VISA, MasterCard, Skrill, Neteller, and Bank Transfers. The minimum deposit for a Standard account is an accessible $100.

The official withdrawal policy states that traders receive three free withdrawals per calendar month. Any additional withdrawals within the same month are charged a $25 fee. While this policy appears clear and reasonable, it is vital to weigh it against the overwhelming user-reported issues regarding the actual processing of withdrawals, as detailed in our Trust and Safety analysis. An official policy is meaningless if it is not honored in practice.

Final Verdict: A High-Risk Choice

ACY Securities exists in a state of deep contradiction. On paper, it is a well-established, Australian-regulated broker with a comprehensive suite of platforms, a vast array of instruments, and account types suitable for various traders. These are all hallmarks of a competitive and legitimate operation.

However, the evidence presented by a large and growing number of its own users paints a completely different picture. The sheer volume and seriousness of complaints regarding fundamental issues—specifically the withholding of profits and the inability to withdraw funds—present a significant and undeniable risk. The patterns of “arbitrage” accusations against profitable traders, harmful account interventions, and off-market price spikes are not isolated incidents but a recurring theme. These claims strike at the very foundation of a broker's trustworthiness.

While a handful of positive reviews exist, they are vastly outnumbered by detailed, credible, and consistent negative accounts. Therefore, our ACY SECURITIES Pros and Cons recommendation is one of extreme caution. The potential benefits offered by ACY Securities, such as high leverage or a wide product range, may not be worth the documented risk to your capital. For traders prioritizing the security of their funds, we advise considering brokers with a cleaner and more consistent track record for reliability, transparency, and customer trust.

Ultimately, the decision to trade with any broker is a personal one. If, after weighing the serious risks highlighted in this review, you still wish to proceed, you can open an account via the official ACY Securities website.

Read more

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX Review: High-Risk Forex Broker Warning

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

ACY SECURITIES Legitimacy Check: A Regulated Broker or a High-Risk Partner?

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc