ACY SECURITIES Legitimacy Check: A Regulated Broker or a High-Risk Partner?

Abstract:When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

The ACY Securities Problem

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 “Exposure” reports filed. This creates a big problem for people who might want to use this broker.

The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut through all the confusion and give traders a clear risk assessment if they're thinking about using ACY Securities.

Understanding Official Status

To start our investigation, we need to first look at ACY Securities official, legal identity. A broker's legitimacy comes from its regulatory standing and company history. As a careful trader, we can verify these facts that form the foundation for any assessment of trustworthiness.

Based on public records and regulatory data, ACY Securities seems to be a well-established company. Here are the key details of its corporate and regulatory status:

· Primary Regulator: Australian Securities and Investments Commission (ASIC).

· Company Name: ACY Securities Pty Ltd.

· License Types: Market Making (MM) & Straight Through Processing (STP).

· Operating History: 10-15 years, established in Australia.

· Other Regulation: Financial Sector Conduct Authority (FSCA) in South Africa (Derivatives Trading License).

· Software: Holds full licenses for both MT4 and MT5 platforms.

The ASIC regulation is very important. ASIC is considered a top-level regulator, known for its strict oversight and requirements for financial service companies. This regulation requires that brokers, such as ACY, follow capital rules, keep client money separate from company money, and provide access to an outside dispute resolution system. In theory, this framework is designed to offer strong protection for traders.

Adding to this picture of legitimacy, a WikiFX on-site inspection conducted at ACY's Australian office returned a “Great” rating, suggesting that the company maintains a real physical presence and operational base. This official status, backed by a top-tier license and a long history, stands in sharp contrast to the user experiences we will examine next.

Looking at the Warning Signs

While the regulatory paperwork looks solid, the user-generated evidence tells a completely different story. The WikiFX platform documents 182 “Exposure” reports against ACY Securities, with 156 formal complaints contributing to a score reduction. These are not small problems; they are serious claims that damage the broker's reputation and make fair trading possible and fund withdrawals increasingly difficult.

To understand the nature of the risks, we have organized the most common and severe complaints into clear themes.

Profit Withholding & “Arbitrage”

A repeating and deeply concerning theme is the claim that ACY Securities punishes profitable traders by taking away their earnings for unclear reasons. A detailed case from April 2025 shows this pattern. A trader, after choosing ACY for its long history as an Australian broker, was told that their profits were being withheld. The broker accused the trader of “violating rules” by doing “scalping arbitrage operations.”

ACY's explanation was that the trader's orders were placed at the same time as accounts in Japan that had supposedly admitted to arbitrage. The broker concluded this was “collusion” and offered to return only the initial deposit, wiping out all profits. The trader's requests for proof—such as IP addresses or specific trade data to support the collusion claim—were denied. The broker's resolution offer was even more alarming: the account could be restored, but only if the trader deposited additional funds. When the trader refused, their backend account was hidden. This case highlights a disturbing practice where “arbitrage” or “scalping” becomes a convenient label to cancel the profits of successful traders without providing concrete evidence.

Severe Withdrawal Issues

The ability to withdraw funds is the ultimate test of a broker's integrity. On this front, ACY Securities faces many complaints. Users report that withdrawals are impossible, endlessly delayed, or subject to unreasonable conditions.

One user reported in late 2019 that a withdrawal request was processed, and the funds were taken from their trading account. However, after several days of waiting, the broker unilaterally canceled the withdrawal and returned the funds to the trading account. The user, continuing to trade under the assumption that the platform was working, subsequently lost the entire amount.

Another complaint from December 2023 details a user being told they must complete “hundreds of transactions” before being allowed to withdraw their funds.

Other reports describe a pattern where any withdrawal attempt is met with excuses, from incorrect information to claims of “forex controls.”

A particularly revealing complaint notes that ACY Securities internally considers any withdrawal over $5,000 to be a “large” amount requiring personal approval from the “boss,” a policy that gives the broker enormous power to block substantial profit-taking.

Platform & Price Manipulation

Claims of platform manipulation suggest that the trading environment itself may be compromised. These are among the most serious accusations, as they imply deliberate actions by the broker to cause client losses.

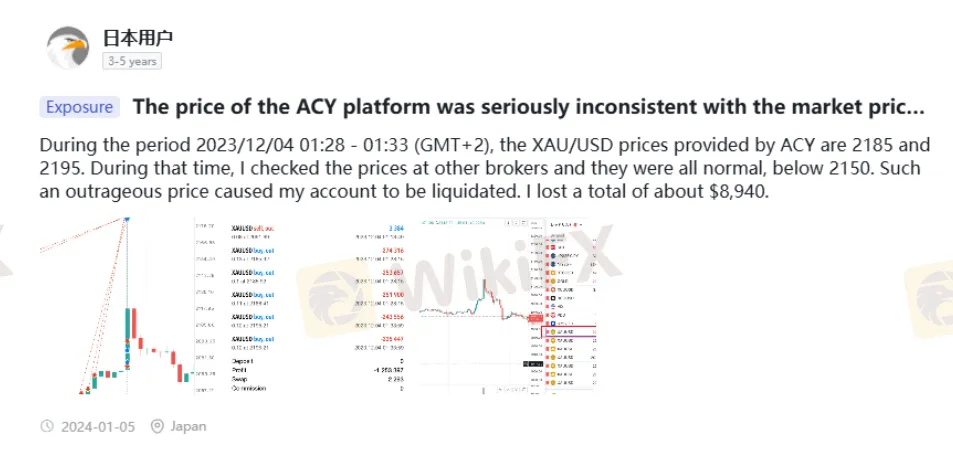

A significant incident was reported in January 2024 by a trader in Japan. During a period of market volatility, the price of XAU/USD (Gold) on ACY's platform supposedly spiked to an outrageous 2185-2195. The trader confirmed that quotes from other brokers at the same time remained below 2150. This artificial price spike on ACY's platform triggered a malicious liquidation of the trader's account, resulting in a loss of approximately $8,940.

Further complaints from early 2024 describe a pattern where the broker's backend system would directly close traders' locked (hedged) positions. Closing one side of a locked position without the client's consent exposes the remaining position to market risk, often leading to a forced liquidation. Multiple users reported this issue, indicating a potential systematic problem rather than an isolated glitch.

Regulatory Warnings & Blacklists

Beyond individual user complaints, ACY Securities has also appeared on the warning lists of several international financial regulators. This indicates that the broker may be operating in certain areas without the required authorization, a major red flag.

· Spain (CNMV): Issued a warning against ACY Securities on February 5, 2024.

· France (AMF): Blacklisted the broker on July 13, 2023.

· Malaysia (SCM): Placed ACY Securities on its Investor Alert List on January 1, 2022.

While ACY is regulated in Australia and South Africa, these warnings from European and Asian regulators suggest a pattern of seeking clients in regions where it lacks a license. This raises serious questions about its global compliance standards and business ethics.

The Regulated but Risky Paradox

How can a broker be regulated by a top-tier authority like ASIC and, at the same time, be the subject of such severe and numerous claims? This is the “Regulated but Risky” paradox, and understanding it requires looking deeper into the broker's business model.

ACY Securities holds a Market Maker (MM) license. In a market-making model, the broker can act as the counterparty to its clients' trades. This creates a direct conflict of interest: when a client wins a trade, the broker can potentially lose capital, and vice versa. While not all market makers operate unethically, this model provides a financial incentive to see clients lose.

This built-in conflict of interest offers a logical explanation for many of the complaints we have analyzed. The frequent accusations of “arbitrage” or “abnormal trading” are classic tactics used by some market makers to justify canceling the profits of highly successful traders, particularly those who use scalping or high-frequency strategies. Because these traders profit from small, rapid price movements, their success can represent a direct and consistent drain on the market maker's capital. By canceling these profits, the broker protects its own bottom line.

The complaint that ACY considers withdrawals over $5,000 as “large” and subject to special approval further supports this theory. It suggests a business model where cash flow is tightly controlled, and large outflows (i.e., client profits) are examined and potentially blocked.

Therefore, while ASIC regulation ensures that ACY Securities meets certain operational standards, such as maintaining minimum capital and keeping funds separate, it does not and cannot regulate a broker's internal risk management policies or prevent it from having terms and conditions that are highly unfavorable to certain profitable trading styles. The regulation provides a safety net against outright collapse or theft in the traditional sense, but it offers little protection against disputes over profitability when the broker itself is the counterparty.

A Balanced Perspective

To ensure a comprehensive and objective analysis, we must also consider the evidence that supports ACY Securities. While overwhelmingly negative, there are positive reviews and a range of product offerings that should be acknowledged.

What Do Supporters Say?

A small fraction of the user reviews—approximately 5 positive reports versus 182 exposures on WikiFX—paint a different picture. These users praise the broker for specific qualities. The key positives mentioned include:

· Transparency and Clean Pricing: Some traders feel the broker's pricing is fair and without manipulation.

· Fast and Stable Execution: A few users, including one trading during a sharp market move, noted that spreads remained stable and execution was fast, preventing unwarranted stop-outs.

· Responsive Customer Support: Positive reviews often mention specific individuals or teams, such as “Bahaa” and the Arabic-speaking support group, for their clear communication and effective problem-solving.

· Low Spreads and Competitive Fees: The low spreads are a frequently cited benefit among satisfied clients.

It is crucial to frame this feedback in context. The volume of positive reviews is dwarfed by the volume of serious complaints. However, it indicates that for certain types of traders or those interacting with specific support teams, the experience can be satisfactory.

Broker Offerings at a Glance

ACY Securities provides a competitive range of services, accounts, and platforms that are attractive on paper. The broker offers access to over 2,200 instruments, including forex, metals, indices, commodities, and a large selection of share CFDs.

Here is a comparison of their main account types:

| Account Type | Minimum Deposit | Spreads From | Commission | Max Leverage |

| Standard | $100 | Variable | From $0 | Up to 1:5000 |

| ProZero | $200 | 0.0 Pips | From $3/Lot Per Side | Up to 1:5000 |

| Basic | $50 | Variable | From $0 | Up to 1:5000 |

The broker supports the industry-standard MT4 and MT5 platforms, alongwith its proprietary ACY Trading Platform, which enables ultra-high leverage of up to 1:5000. This diverse offering caters to a wide range of trading preferences and strategies.

To see the full details of these account types and explore their platform features, you can cross-reference this information on the official ACY Securities website.

The Final Verdict

After a thorough investigation into ACY Securities' regulatory status, user complaints, business model and offerings, we can now provide a final answer to the question: Is ACY SECURITIES legit and is it safe for you? The answer is complex and carries a strong warning note.

Summary of Findings

· Legitimacy: Yes, ACY Securities is a legally registered and regulated entity. It is not a phantom or clone firm. Its primary regulation by ASIC in Australia confirms it operates within a recognized legal framework. On paper, it is a legit broker.

· Safety & Trustworthiness: However, the evidence points to significant and severe operational risks for traders. The overwhelming number of complaints regarding profit withholding, withdrawal denial and potential platform manipulation cannot be ignored. These are not isolated incidents but a consistent pattern of behavior reported by traders globally. This, combined with official warnings from regulators in Spain, France and Malaysia, severely undermines the broker's trustworthiness in practice.

Final Recommendation

While ACY Securities is technically a legitimate broker, the sheer volume and severity of the ACY SECURITIES scam allegations make it a high-risk partner for any serious trader.

The evidence strongly suggests that certain types of traders are at a particularly high risk. Traders who use scalping, high-frequency, or arbitrage-style strategies appear to be the primary targets of the broker's profit confiscation policies. The conflict of interest inherent in its Market Maker license seems to manifest in punitive actions against consistently profitable clients.

For any trader whose priority is the safety of their capital and the absolute certainty that they can withdraw their profits without dispute, the risks associated with ACY Securities appear to far outweigh the benefits of its low spreads or high leverage. The fundamental trust between a trader and a broker—the trust that profits are safe—is deeply compromised here.

The positive reviews often highlight specific account managers. If you are still considering this broker, we advise you to directly question their policies on scalping and withdrawals by engaging with their team via the official ACY Securities website.

Ultimately, the decision is yours. We have presented the evidence documented across the web. Before committing any funds, we strongly encourage you to weigh the official regulatory status against the vast number of negative trader experiences and visit the official ACY Securities website to read their terms and conditions in full.

Read more

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX Review: High-Risk Forex Broker Warning

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

ACY Securities Complete Review 2026: A Trader's Guide to Trading Terms, Risks and Warning Signs

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc