Baazex Forex Scam Exposed: Trader Loses $6K

Abstract:Baazex, an offshore-regulated forex broker, is a confirmed scam. A trader deposited funds, earned profits, but had $5940.69 + $75.88 stolen under a fake policy violation. Stay safe: check WikiFX exposure before trading. Avoid Baazex today!

Baazex is presenting itself as a global forex and CFD broker, but serious red flags around forex scams and withdrawals now surround this brand. A recent exposure involving a Vietnamese victim shows how quickly profits can be erased and accusations of “policy violations” used as a weapon to seize client funds.

Baazex Case: Trader From Vietnam Loses Over $6,000

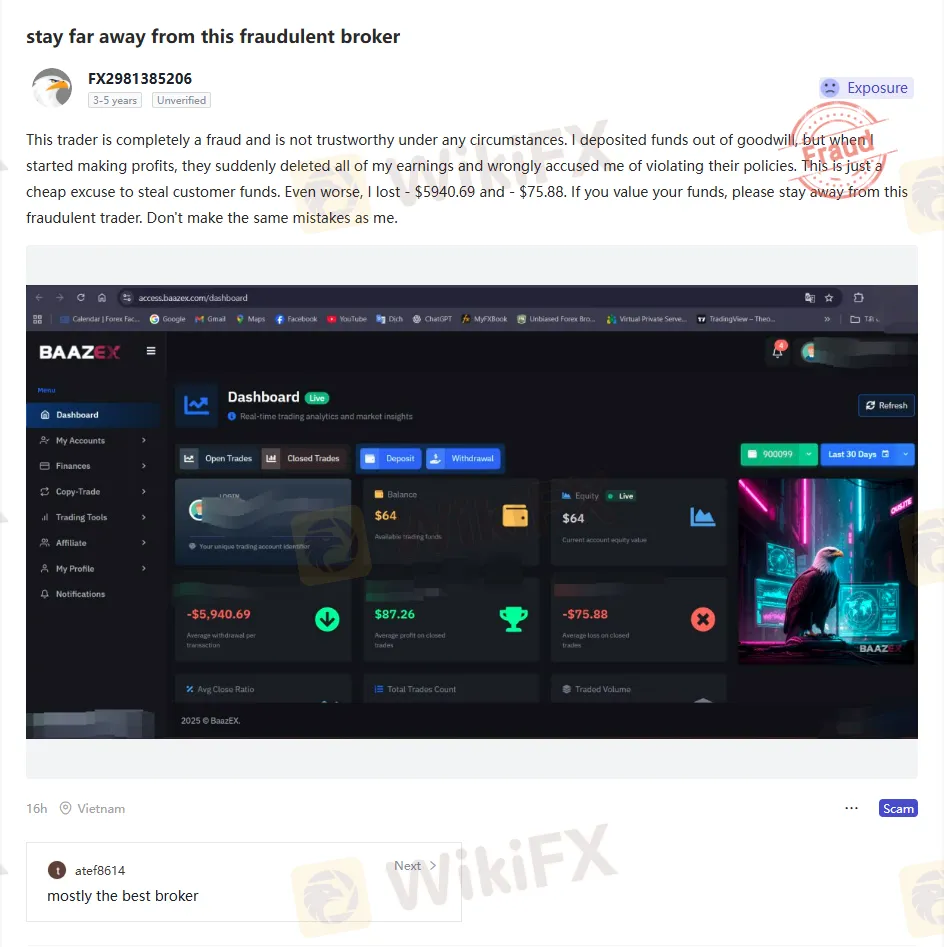

According to a public exposure on WikiFX, a trader reports that Baazex is “completely a fraud and not trustworthy under any circumstances.” The victim explains that they deposited funds in good faith, traded, and began earning profits before the nightmare began.

Once profits grew, Baazex suddenly deleted all earnings in the account. The broker then accused the trader of violating internal policies, without transparent evidence or an honest investigation. In total, the victim states they lost -$5,940.69 and -$75.88, describing the allegation as a cheap excuse to steal customer funds and warning others: “If you value your funds, please stay away from this fraudulent trader. Dont make the same mistakes as me.”

Offshore Regulated: Why Baazex Is High-Risk

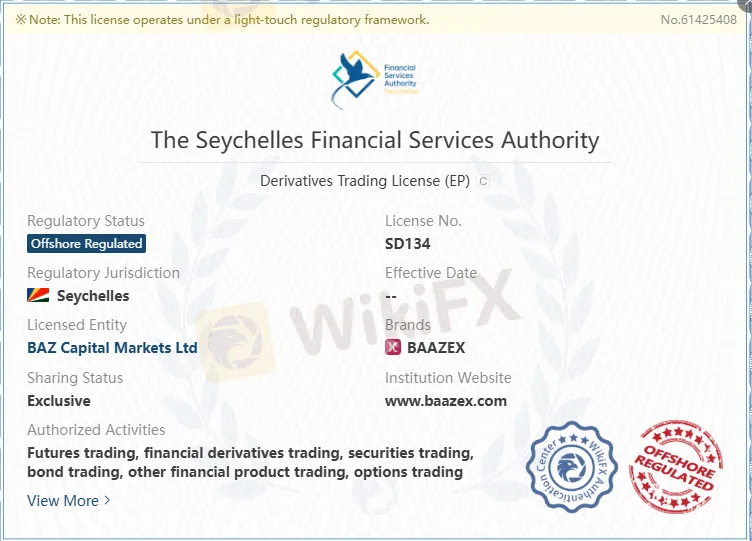

Baazex operates under BAZ Capital Markets Ltd, a company registered in Seychelles and “regulated” by the Seychelles Financial Services Authority (FSA) under Securities Dealers License SD134. Offshore regulation of this type is not equivalent to top-tier oversight by authorities such as the FCA, ASIC, or CySEC and generally provides weaker investor protection and softer enforcement.

While Baazexs own website promotes this FSA authorization as proof of safety, offshore regimes often lack strict rules on fund segregation, compensation schemes, and transparent dispute resolution. This environment makes it far easier for a broker to engage in a forex trading or investment scam, and much harder for victims to recover lost money when problems arise.

How Baazex Markets Itself vs. How It Behaves

On its official pages, Baazex highlights tight spreads from 0.1 pips, leverage up to 1:400, more than 1,500 trading instruments, and fast execution with no commission. The broker advertises access to forex, indices, shares, futures, commodities, and cryptocurrencies via MetaTrader 5 (MT5), positioning itself as a modern multi-asset broker.

WikiFXs broker profile notes that Baazex has several years of operating history and targets both novice and experienced traders by promoting low spreads, high leverage, and a user‑friendly platform. However, exposures and user feedback reveal a very different picture, in which alleged profit cancellations, blocked withdrawals, and vague “policy violations” undermine any claim of transparency or fairness.

Key Facts About Baazex (At a Glance)

| Aspect | Baazex Claim / Fact | Risk for Traders |

| Brand & Entity | Baazex, operated by BAZ Capital Markets Ltd (Seychelles) | Offshore structure makes enforcement and legal recourse more difficult. |

| Regulation Status | Seychelles FSA, license SD134 (offshore regulated) | Offshore regulated, weaker investor protection vs. major onshore regulators. |

| Products Offered | Forex, indices, commodities, shares, futures, crypto | Wide product range used to attract both beginners and high‑risk seekers. |

| Leverage & Spreads | Up to 1:400 leverage, tight spreads from 0.1 pips | High leverage plus offshore rules increase loss and manipulation risk. |

| Platform | MT5 and web-based trading | Platform branding can create a false sense of safety for new traders. |

| User Exposure (Vietnam) | Profits deleted, accused of policy breach, loss >$6,000 | Clear forex scam alert: earnings wiped and funds effectively confiscated. |

This gap between marketing promises and reported behavior is typical of many forex scams and should immediately trigger caution for any potential client.

Why This Pattern Looks Like a Forex Trading Scam

Several elements in the Vietnam case match common tactics used in forex scams. First, the trader was allowed to trade and generate profits, which built trust and encouraged continued activity before any issue was raised. Second, only after the account became profitable did Baazex allegedly erase all earnings and invoke an unspecified policy violation, without clear documentation, an independent audit, or a fair appeal process.

Third, instead of resolving the dispute or providing transparent transaction logs, the brokers actions resulted in complete losses of -$5,940.69 and -$75.88, effectively converting trading profits and the balance into broker revenue via confiscation. This type of behavior—profits being removed retroactively, withdrawals blocked, and vague “terms” used as justification—is a classic sign of a forex investment scam, especially when combined with offshore regulation.

Using the WikiFX App to Check Baazex Before Depositing

The Baazex exposure from Vietnam is published on WikiFX, a broker information and rating platform that collects regulatory data, user reviews, and scam alerts. By searching for “Baazex” in the WikiFX App, traders can quickly see its offshore regulatory status, historical reviews, and any public complaints or exposures associated with this broker.

WikiFX‘s database allows users to confirm whether a license actually exists, which regulator issued it, and whether that regulator is offshore or top‑tier, which is critical for avoiding a forex scam. Before sending money to any broker—especially one like Baazex—traders worldwide, including in Vietnam, should install the WikiFX App, review exposures, and compare safety scores rather than relying on the broker’s marketing claims.

Brief Broker Review: Is Baazex Worth the Risk?

From a purely product perspective, Baazex offers multiple account types, high leverage, and a wide range of instruments across forex, indices, commodities, and shares. On paper, these features might attract traders seeking flexibility and low-cost trading conditions.

However, when you factor in its offshore-regulated status, the lack of stronger onshore oversight, and public reports of deleted profits and alleged fund seizures, the overall risk profile becomes extremely high. No attractive spread, leverage level, or platform feature can compensate for the possibility that your profitable trades may later be canceled and your balance wiped out via obscure “policy” explanations.

How Traders in Vietnam Can Protect Themselves

Traders in Vietnam should treat any offshore-regulated broker, including Baazex, with extreme caution and assume a higher baseline risk of scams, manipulation, or withdrawal issues. Whenever you see marketing that emphasizes high leverage, ultra-tight spreads, and quick profits, but gives little or no emphasis to regulation and investor protection, consider it a potential scam alert rather than a true opportunity.

Before opening an account or funding a wallet, verify the broker inside the WikiFX App, check the regulatory license, and read exposure reports like the one describing the -$5,940.69 and -$75.88 loss. If you already have funds with Baazex and experience similar treatment—deleted profits, blocked withdrawals, or sudden accusations—you should document every detail, capture screenshots, and file a complaint through WikiFX exposure and your local authorities as quickly as possible.

Final Warning: Avoid Baazex to Stay Safe

The Vietnam case shows that Baazex is willing to delete client profits and hide behind vague policy claims, behavior consistent with a serious forex trading scam. Combined with its offshore regulated status in Seychelles and growing negative feedback, Baazex is not a broker that safety‑conscious traders should trust with their savings.

Use the WikiFX App as your first line of defense whenever you evaluate a broker, particularly in the high‑risk world of forex and CFD trading. If you value your funds and peace of mind, avoid Baazex, share this exposure with other traders in Vietnam, and always perform deep due diligence before depositing into any platform that could turn out to be the next forex scam.

Read more

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

When traders ask, "Is GLOBAL GOLD & CURRENCY CORPORATION Legit?" They want a clear answer about whether their capital will be safe. After looking into this company carefully, the answer is clear: GLOBAL GOLD & CURRENCY CORPORATION (GGCC) is an extremely risky broker that shows many signs of being unsafe and illegitimate. The company operates without proper regulation, has been officially warned by financial authorities, and has received many serious complaints from users. Read on!

GLOBAL GOLD & CURRENCY CORPORATION Regulation: A Complete Guide to Its Unregulated Status and Risks

When choosing a forex broker, the most important thing to check is whether it has proper regulation. This article answers a key question: Is GLOBAL GOLD & CURRENCY CORPORATION (GGCC) regulated? After looking at detailed data and public records, the answer is clear: GGCC operates without a valid financial services license from any trusted authority. This broker is registered in Saint Lucia and shows warning signs that should make any potential investor very careful. Checking a broker's license isn't just paperwork - it's the most important step to protect your capital from unnecessary risks.

Headway Scam Alert: Saudi Arabia & Iraq Traders Defrauded

Headway defrauded Saudi & Iraq traders: fake excuses, profit thefts, bonus vanishes, and slippage. Read scam exposure & protect your funds now!

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

Before investing in the GLOBAL GOLD & CURRENCY CORPORATION (GGCC) platform, you need to know about the serious risks. This is not a safe broker for anyone who wants to protect their capital. All the evidence shows this is a very risky company with no proper oversight and many user complaints. This warning is your most important protection. Read on as we share more details.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc