FX SmartBull Review: Is It Legit or a Scam? Find Out in This 2-Min Review.

Abstract:Is FX SmartBull applying B-book trades instead of real trades? Does the United Arab Emirates-based forex broker imply unfair charges on profits earned on the trading platform? Does it disapprove the withdrawal request without giving valid reasons? Is your FX SmartBull withdrawal application rejected due to a trading abuse claim by the broker? These are some raging complaints against the broker’s alleged suspicious forex trading activities. In this FX SmartBull review article, we have investigated some complaints. Read on!

Is FX SmartBull applying B-book trades instead of real trades? Does the United Arab Emirates-based forex broker imply unfair charges on profits earned on the trading platform? Does it disapprove the withdrawal request without giving valid reasons? Is your FX SmartBull withdrawal application rejected due to a trading abuse claim by the broker? These are some raging complaints against the brokers alleged suspicious forex trading activities. In this FX SmartBull review article, we have investigated some complaints. Read on!

Overview of FX SmartBull - Accounts, Platforms & Other Details

FX SmartBull, which has been operating for over three years, presents a wide range of trading opportunities to traders across forex, commodities, indices and cryptocurrencies. As per the information available on its website, the brokers products are available for traders across 10+ countries. Traders can leverage the advanced MetaTrader 5 (MT5) platform across desktop, iPhone and Android smartphones. As a trader, you can choose from Classic, Variable, Standard and ECN accounts.

Elaborating on the Top Forex Trading Complaints Against FX SmartBull

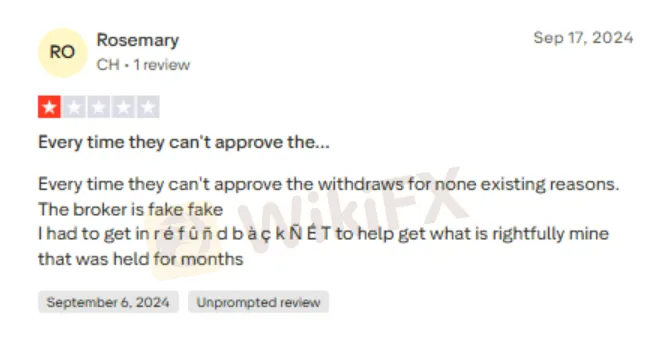

FX SmartBull Withdrawal Application Rejection Without Existing Reasons

A trader alleged that FX SmartBull constantly rejects applications concerning fund withdrawals from the trading platform for reasons that do not exist. As a trader, it is your right to ask the broker for the legitimate reasons the withdrawal application is denied. By not receiving any reason, the trader was understandably frustrated and sought assistance from a legal firm, which helped him recover the stuck funds. Here is the traders full FX SmartBull review you should read.

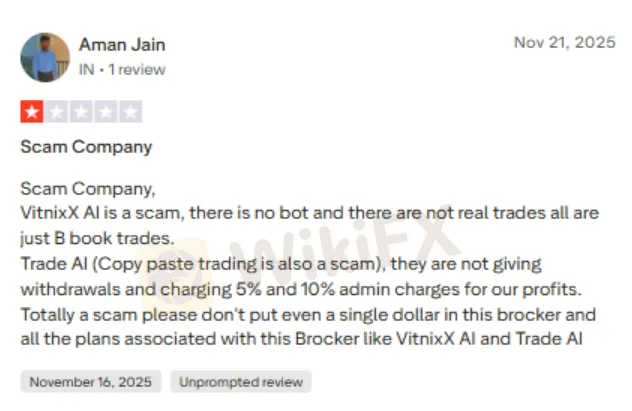

Traders Allege Illegitimate Charges on Profit Amounts

This complaint talks about the trader who has categorically declared that FX SmartBull does not allow withdrawal access to its clients. Further adding to the statement, the trader exposed the brokers habit of charging a certain portion of the profit amount. Also, the trader alleged that FX SmartBull implies B-book trades, instead of real trades. Reacting to the overall trading experience, the trader shared a small but critical complaint that the broker must look into for sustainable business. Take a look at what the trader said.

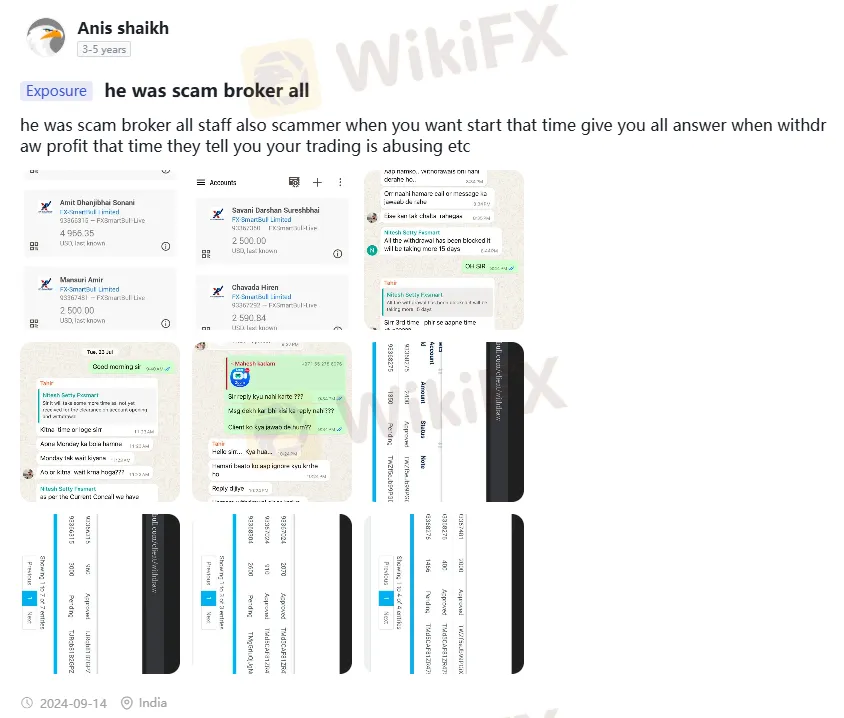

All Good During Deposits, Not So During Withdrawals, the Trader Alleged

A trader pointed out significant contradictions while depositing and withdrawing funds from the FX SmartBull platform. While depositing, the broker‘s officials will answer traders’ queries. However, as the withdrawal time comes, the very same officials react differently. They even claim trading abuse to reject withdrawal applications, as per the complaint statement. Check out the screenshot below, containing a series of conversations between the trader and the broker official.

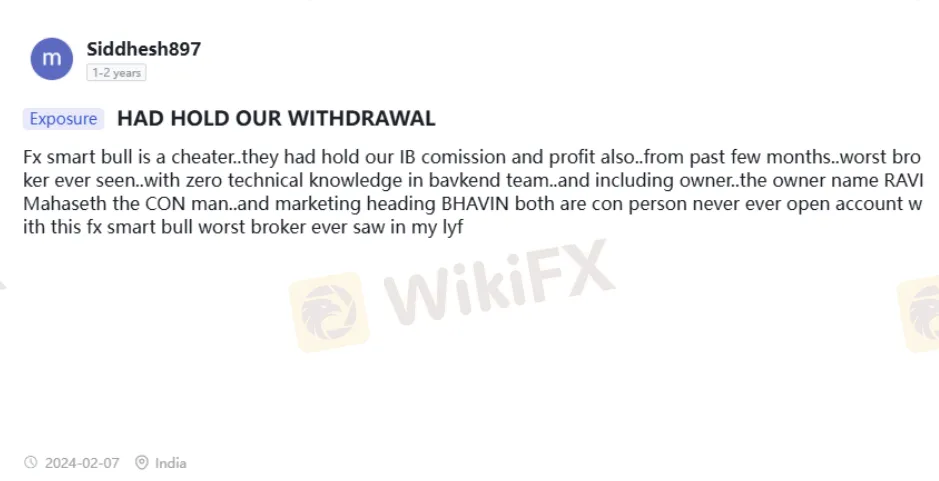

The ‘Scammer’ Remark for FX SmartBull

This complaint has come from an individual who appears to be an introducing broker. The complaint is about the broker‘s non-payment of IB commission and profits. The individual, while giving FX SmartBull a ’Scammer‘ tag, also called out the broker’s backend team for no technical knowledge. Check out this explosive FX SmartBull review below.

FXSmartBull WikiFX Review: Regulation Status & Score

After reading the complaints, you must be asking: Is FXSmartBull real or fake? To know the answer, the WikiFX team conducted a thorough review into the brokers operation by gathering data concerning its regulation. While gathering data, the team found FX SmartBull to be an unregulated entity, raising considerable risks for traders investing through this platform. As a result, the WikiFX team could only give the broker a score of 2.04 out of 10.

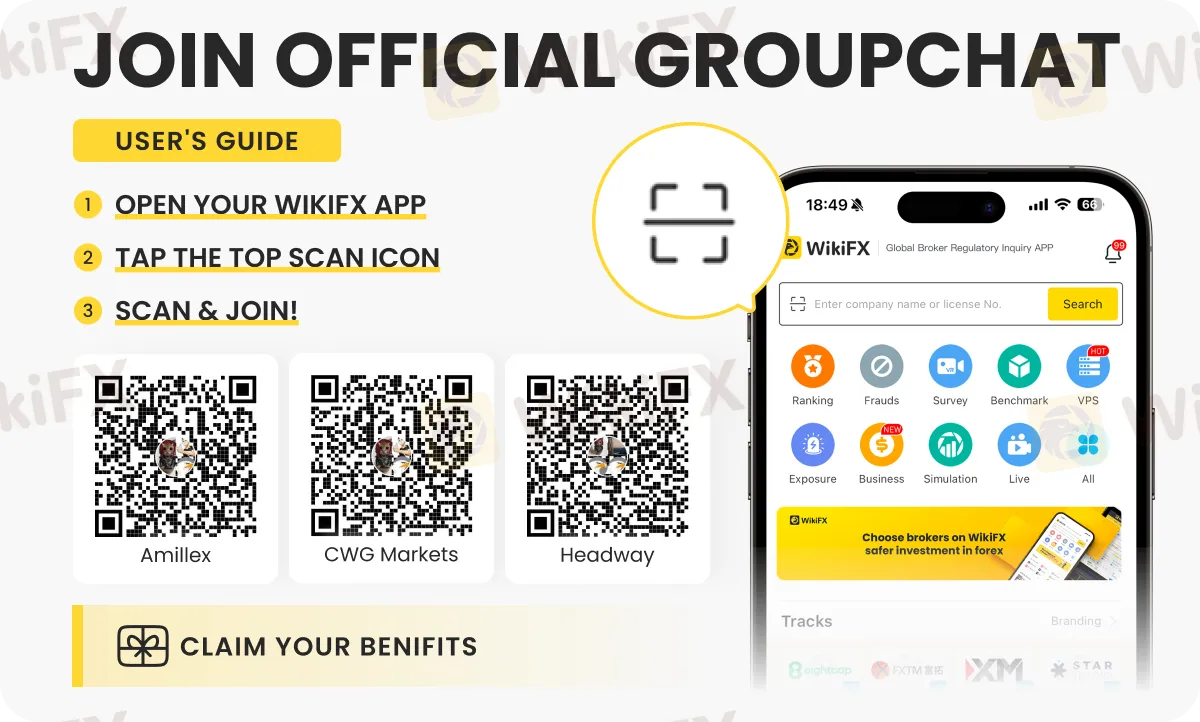

A smart forex portfolio demands smart trading strategies. Learn these strategies on our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.

Read more

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

Trading Pro Review: Pros, Cons, and Scam Alerts

Trading Pro Review for 2026 with updated data on licenses, leverage, and user complaints from Malaysia, Indonesia, and beyond. Read our verdict now.

AMarkets Review: Why This Broker Lacks Regulation

AMarkets Review 2026 shows no regulation, hidden risks, and unsafe trading conditions. Don’t risk your funds—choose a regulated broker today.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Rate Calc