Forex Brokers: Stay Safe with Regulation Guide

Abstract:New to forex? Learn key regulation basics—check FCA, ASIC, CFTC rules, verify licenses easily with the WikiFX App, spot scam signs, and use our checklist to pick safe brokers. Protect your money and trade confidently!

Introduction

In the volatile world of forex trading, understanding broker regulation is crucial to safeguard your capital and ensure fair practices. Bodies such as the UK‘s Financial Conduct Authority (FCA), Australia’s ASIC, and the USs CFTC enforce strict standards to protect traders from fraud and mismanagement. Regulated brokers must segregate client funds, undergo regular audits, and provide transparent execution, fostering trust and ethical trading. This oversight minimizes risks like insolvency or manipulation, empowering traders with recourse through compensation schemes. Dive into how regulation works and secures your funds for confident trading.

What Is Forex Broker Regulation?

Forex broker regulation refers to oversight by governmental or self-regulatory bodies that license brokers, enforce operational standards, and protect retail traders worldwide. Its primary purpose is to ensure fair practices, transparency, and client fund safety through rules on capital adequacy, leverage limits, and reporting. Globally, governmental regulators like the FCA, ASIC, and CFTC dominate, while self-regulatory organizations such as the US National Futures Association (NFA) supplement enforcement.

These regulators require brokers to register, meet minimum capital requirements (e.g., £75,000 for FCA limited licenses), and undergo regular audits. Traders benefit from fair environments where disputes are handled by ombudsmen or courts, unlike unregulated territory ripe for scams. Selecting strictly regulated brokers cuts manipulation risks and ensures order, since unlicensed outfits often lead to losses.

In practice, regulation mandates risk disclosures, segregated accounts, and leverage caps (e.g., 1:30 under FCA), promoting long-term trader confidence.

Why Regulation Protects Your Funds

Regulation protects funds with strict capital rules, forcing brokers to maintain ample reserves against risk. Independent audits verify solvency and compliance, reducing insolvency threats. Risk management policies, such as leverage caps and margin calls, curb excess exposure.

Key mechanisms include segregated client accounts, in which trader funds are ring-fenced from broker operational funds at tier-1 banks such as Barclays. Risk disclosure statements educate on potential losses, while compensation schemes reimburse up to defined limits if brokers fail. Regulators monitor for fraud through transaction surveillance and whistleblower programs, imposing fines or revocations for violations.

This framework deters manipulation, such as stop-hunting or fake quotes, as seen in CFTC enforcement actions. Overall, these protections create a secure ecosystem, with segregated accounts enabling swift withdrawals even in crises.

Top Regulators: FCA, ASIC, CFTC

FCA (UK)

The Financial Conduct Authority (FCA) supervises UK forex brokers with stringent consumer protections, including segregated funds at tier-1 banks and participation in the FSCS, which covers up to £85,000-£120,000 per client. Compliance mandates include leverage limits of 1:30, negative balance protection, and transparent pricing. Well-regarded brokers under FCA oversight include Pepperstone (FRN 684312), IG, and Forex.com. The FCA is recognized globally for its strict auditing requirements and comprehensive warning lists.

ASIC (Australia)

Australias ASIC requires forex brokers to hold a minimum capital of $1 million, maintain segregated client funds in tier-1 banks, and participate in investor compensation schemes. They emphasize mandatory risk warnings and require AFSL licensing, which can be verified via ASIC Connect. Representative ASIC-regulated brokers include Eightcap and IC Markets. ASIC is known for proactive enforcement against misleading promotions.

CFTC (USA)

The Commodity Futures Trading Commission (CFTC), with NFA support, regulates US forex through RFED registration, 50:1 major-pair leverage, and anti-fraud monitoring. It enforces capital rules and disclosures; brokers like OANDA comply. CFTCs strength lies in civil penalties and market integrity.

FCA prioritizes retail safeguards, ASIC operational resilience, and CFTC leverage controls, all of which enhance fair global trading.

Spotting Unregulated Brokers Fast

Unregulated forex brokers often hide licensing details or flaunt obscure “regulators” without verifiable registries. Warning signs include unrealistic profit guarantees (e.g., “100% returns”), high-pressure sales, and withdrawal delays. Poor transparency, such as missing company addresses or fine-print fees, signals scams exploiting novice trust.

Quick checks: For FCA, search the Financial Services Register at register.fca.org.uk using firm name or FRN. ASIC verification via ASIC Connect (asic.gov.au) matches AFSL numbers. CFTC uses NFAs BASIC tool. Scam brokers mimic legitimacy but fail official lookups, often operating offshore without oversight.

Red flags also encompass hidden spreads, inactivity fees, or bonuses with impossible terms. Always cross-verify claims independently to avoid fund losses.

Segregated Accounts Explained

Segregated accounts separate client deposits from a brokers operational funds, keeping them in dedicated bank accounts at reputable institutions. This prevents brokers from using trader money for business expenses or trading against clients. Regulators like FCA and ASIC mandate this for all licensed firms.

In insolvency, segregated funds remain untouched, enabling quick returns to traders via bankruptcy proceedings. Benefits include greater transparency through audit reports, faster withdrawals without liquidity issues from brokers, and reduced risk of misuse. Regular reconciliations ensure balances match client records.

This practice builds trust, as clients know their capital is insulated from broker failures.

Compensation Schemes for Traders

Compensation schemes reimburse traders if regulated brokers fail due to insolvency or misconduct. The UKs Financial Services Compensation Scheme (FSCS) covers eligible retail clients up to £85,000-£120,000 per person for unauthorized firms unable to pay claims. Eligibility requires FCA authorization and no professional status waiver; the claims process is automatic upon proof of eligibility.

CySECs Investor Compensation Fund (ICF) protects EU clients up to €20,000 per client for covered services if a member defaults financially. It applies post-CySEC ruling, excluding money laundering cases, and calculates based on verified claims.

These schemes, funded by levies on firms, boost confidence by providing a safety net, though they dont cover market losses. Traders must confirm their eligibility via the regulator's websites.

License Verification with WikiFX App

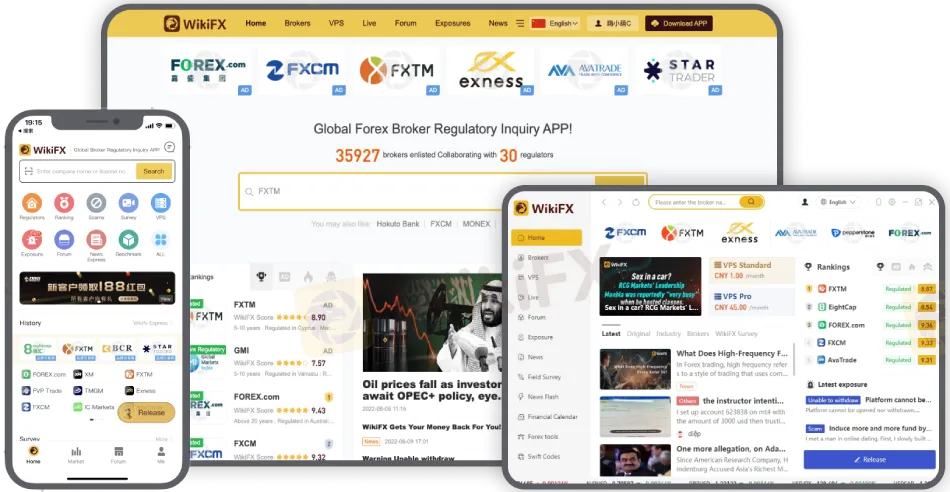

The WikiFX App offers a user-friendly platform for verifying forex broker licenses globally by aggregating data from regulators. Download from App Store or Google Play, then search by broker name for instant profiles.

Step-by-step: 1) Enter broker name (e.g., AvaTrade); 2) Review “Licenses” tab for regulator details, status (active/expired), and numbers. 3) Check rating system (0-10 scale) based on regulation, complaints, and risk. 4) View risk alerts, complaints, and platform verification. 5) Cross-reference with official sites like the FCA Register.

Key features include multi-jurisdiction scans, credit reports, and scam exposure, enabling quick global checks. WikiFX enhances transparency, helping to efficiently avoid fakes.

Steps to Verify Broker Safety Now

Follow this ordered checklist to assess any broker:

- Locate license details: Note regulator (FCA/ASIC/CFTC), license number, and entity name from the footer/terms.

- Check official registry: FCA - register.fca.org.uk (search firm/FRN); ASIC - asic.gov.au/connect (AFSL); CFTC/NFA - nfa.futures.org/basic.

- Review history/reputation: Scan Trustpilot, WikiFX ratings, and regulator warnings for complaints or bans.

- Confirm fund protections: Verify segregated accounts policy and compensation eligibility (e.g., FSCS/ICF).

- Use tools like WikiFX: App-search broker for license stack, risks, and alerts.

- Test operations: Check spreads, withdrawals (demo/small deposit), and customer support.

- Examine extras: Ensure negative balance protection, audits, and no red flags, such as guarantees.

Final tips: Avoid offshore clones; prioritize Tier-1 regulators; re-verify periodically. Trade responsibly on verified platforms for safety.

Conclusion

Forex regulation by bodies such as the FCA, ASIC, and CFTC ensures client funds are protected through segregation, audits, and compensation up to £120,000 or €20,000. Continuous verification using registries and WikiFX helps prevent scams and supports secure trading. Choose a licensed broker today—follow these steps now for peace of mind.

Read more

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Understanding Broker Regulation and Licenses

Mastering forex broker regulation ensures you avoid pitfalls and select trustworthy platforms. We’ll cover regulator types, license details, the distinction between licensed and registered, and practical steps.

The Safest Way to Select Forex Brokers

Safest forex broker selection: Check regulation, spot scams, read reviews, and verify licenses via the WikiFX app. Avoid fraud—trade securely today!

Top Forex Brokers Offering Free Demo Accounts

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

MultiBank Group Analysis Report

Pepperstone Analysis Report

Rate Calc