Understanding Broker Regulation and Licenses

Abstract:Mastering forex broker regulation ensures you avoid pitfalls and select trustworthy platforms. We’ll cover regulator types, license details, the distinction between licensed and registered, and practical steps.

Introduction to Forex Broker Regulation

Forex broker regulation is the cornerstone of safe trading in the world's largest financial market, valued at $7.5 trillion daily. Without proper oversight, brokers can manipulate trades, delay withdrawals, or vanish overnight.

In 2025 alone, global regulators reported more than 10,000 complaints against unregulated firms, resulting in massive losses for retail traders. This guide equips you with essential knowledge about forex broker regulation, from top regulators and their licenses to how to spot scams.

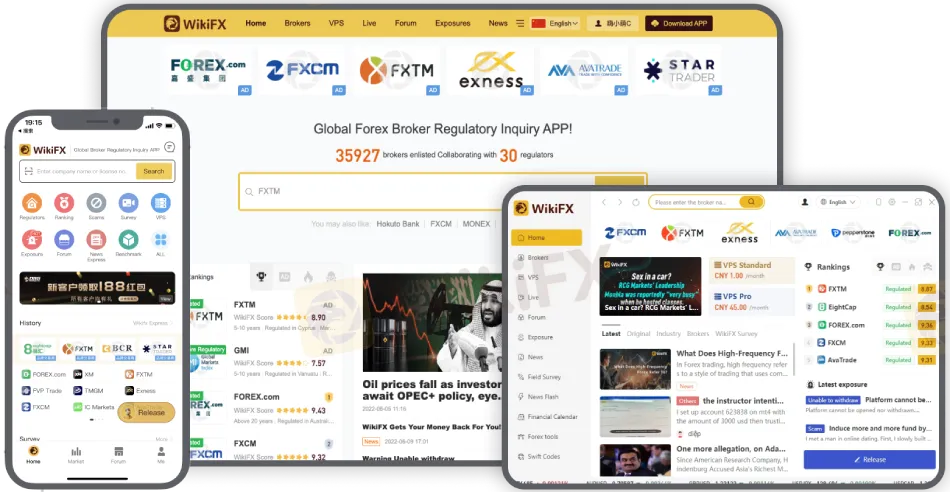

Whether you‘re a beginner in the Philippines or a seasoned global trader, understanding forex broker regulation prevents costly mistakes. We’ll explore types of regulators, what licenses cover, the distinctions between licensed and registered, and verification methods—including the powerful WikiFX app for quick regulatory checks.

Recent trends indicate stricter enforcement: leverage caps have been tightened to 1:30 in key regions, and compensation funds have been expanded. Tools like the WikiFX app complement official checks for faster insights.

Prioritizing forex broker regulation isn‘t optional; it’s your shield against the 70% of retail traders who lose money annually. Lets dive in.

Why Regulation Protects Traders in 2026

Strong forex broker regulation mandates segregated client accounts, ensuring your funds stay separate from thebrokerss operations. If a firm fails, you reclaim your money via independent custodians.

Top regulators enforce annual audits, anti-money laundering (AML) compliance, and transparent pricing. Compensation schemes kick in during insolvency—FCA offers up to £85,000 per client, while ASIC mandates swift dispute resolution.

2026 brings heightened scrutiny post-2025 scandals, including offshore broker collapses. Expect AI-driven monitoring for market abuse and bans on high-risk bonuses. Unregulated platforms lure with 1:500 leverage but lack recourse, amplifying losses.

In the Philippines, SEC oversight focuses on local stability, protecting against fly-by-night operators. Forex broker regulation also covers negative balance protection, preventing debt beyond deposits.

Always choose Tier-1 regulated brokers to sleep soundly—your capital deserves it.

Top Types of Forex Regulators Worldwide

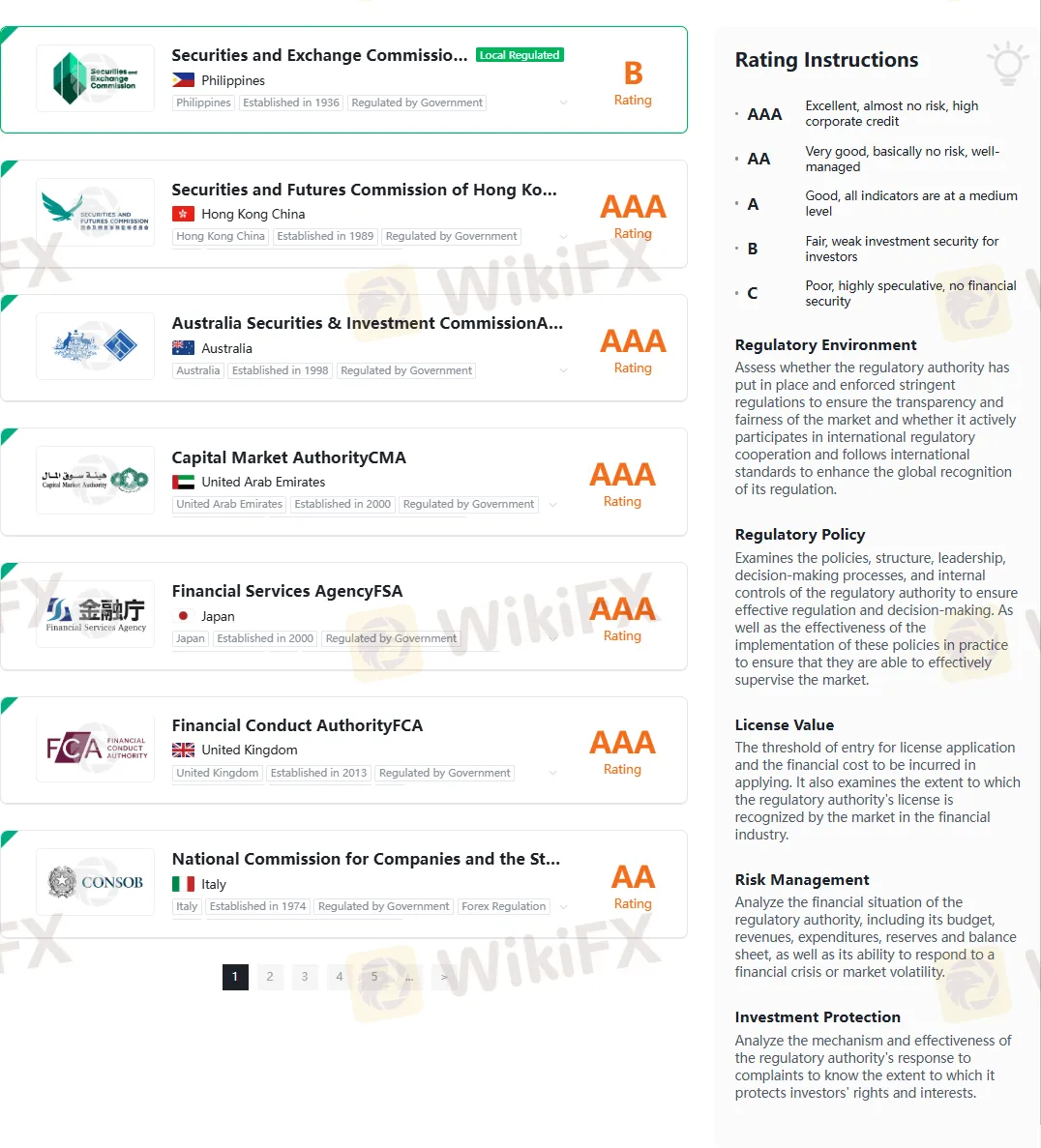

Forex broker regulation varies by tier, reflecting the strength of oversight and trader protections. Tier 1 offers the gold standard; Tier 3 signals caution.

Tier 1 Regulators (Highest Safety)

- FCA (UK): Regulates 10,000+ firms with rigorous reporting and £85K FSCS compensation. Covers retail Forex/CFDs.

- ASIC (Australia): Enforces AFSL licensing, client fund segregation, and AFCA mediation.

- CFTC/NFA (USA): Strict for US residents; FIFO execution, no proprietary trading.

- BaFin (Germany): EU-compliant with passporting across 27 states.

Tier 2 Regulators (Solid Protection)

- CySEC (Cyprus): MiFID II adherent; €20K ICF fund.

- FSCA (South Africa): Focuses on emerging markets with growing enforcement.

- DFSA (Dubai): Bridges Middle East and global standards.

Tier 3/Offshore Regulators (Approach with Caution)

- SVG FSA (St. Vincent): Low barriers, minimal audits.

- FSC (Belize/Mauritius): Incorporation-focused, weak enforcement.

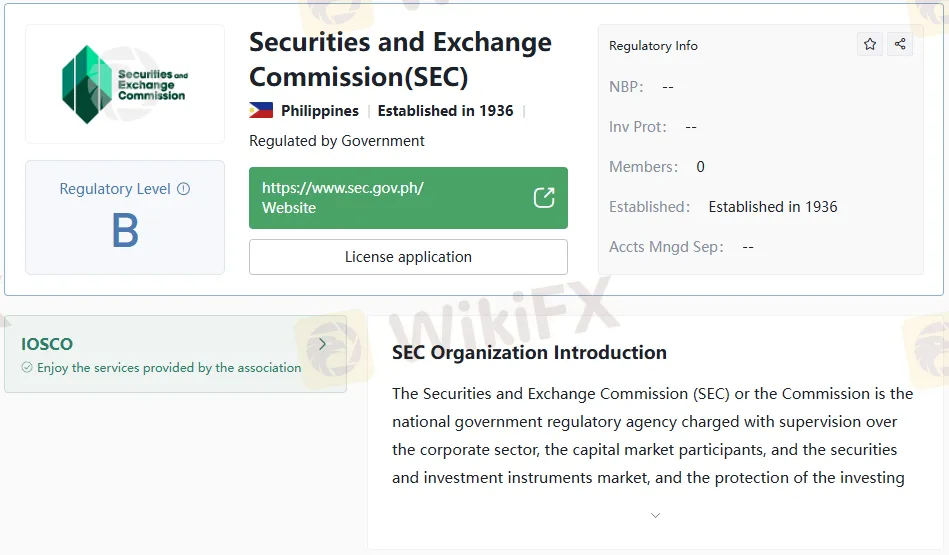

For Filipinos, the SEC (Philippines) regulates securities brokers, while BSP handles e-money; check both for local compliance.

| Regulator | Tier | Country | Compensation | Leverage Cap | Risk Level |

| FCA | 1 | UK | £85K | 1:30 AM | Low |

| ASIC | 1 | Australia | Segregated | 1:30 AM | Low |

| CySEC | 2 | Cyprus | €20K | 1:30 AM | Medium |

| SEC-PH | 2 | Philippines | Dispute aid | Varies | Medium |

| FSC Belize | 3 | Belize | None | 1:500+ | High |

This table highlights why forex broker regulation tiers matter—stick to Tier 1 for peace of mind. WikiFX app rates these instantly with real-time regulatory sync.

What Each License Covers: Detailed Breakdown

Forex broker regulation licenses define exact protections—know them to assess brokers accurately.

FCA Full Authorization: Mandates AML/KYC, quarterly reporting, negative balance protection, and public warnings on risky products. Covers retail CFDs/Forex; excludes crypto derivatives without add-ons.

ASIC AFSL: Requires two-yearly audits, no inducement bonuses, and segregated accounts at Australian banks. AFCA resolves disputes for clients free of charge up to AUD 1M.

CySEC CIF License: Investor Compensation Fund (€20K max), transaction transparency to ESMA, and leverage limits under ESMA rules.

CFTC/NFA Compliance: Rule 2-36 for Forex; bans hedging/payment-for-order-flow. US residents get NFA BASIC for verification.

BaFin License: Full MiFID II, including best execution and product intervention powers.

Tier 2 examples, like FSCA, require capital adequacy and annual reviews. Offshore VFSC (Vanuatu) licenses cover registration only—no fund safeguards or audits.

Prioritize these 10 licenses in 2026:

- FCA (UK)

- ASIC (AU)

- CFTC/NFA (US)

- CySEC (EU)

- BaFin (DE)

- DFSA (UAE)

- FSCA (ZA)

- SEC (PH)

- MAS (Singapore)

- IIROC (Canada)

ASIC Professional Registers. Multi-licensed brokers like IG excel here. The WikiFX app displays license scopes in a single search. Always match license scope to your trading style.

Licensed vs. Registered Brokers: Key Differences

Forex broker regulation distinguishes “licensed” from “registered”—a critical nuance scammers exploit.

Licensed brokers hold full authorization to solicit/execute client trades under strict oversight. Registered ones merely notify regulators, lacking enforcement.

| Aspect | Licensed Brokers | Registered Brokers |

| Oversight | Full audits, reporting | Notification only |

| Client Funds | Segregated + compensation fund | Often commingled, no protection |

| Examples | XM (CySEC licensed), IG (FCA) | US Introducing Brokers (NFA) |

| Risk Level | L w—recourse available | High—limited accountability |

| Verification | Official public database | Basic listing, no details |

XM‘s CySEC license ensures ICF coverage; NFA-registered IBs route client funds to FCMs but don’t custody them. WikiFX app flags these distinctions via risk scores and clone detectors. Red flag: Claims like “FCA registered” without FRN (Firm Reference Number)—demand full status.

Step-by-Step: Verify Broker Licenses Online

Verify a forex broker's regulation in minutes to sidestep fraud. The WikiFX app streamlines this as your first-line tool, syncing data from 30+ regulators, including FCA, ASIC, and NFA. Download free on iOS/Android for instant broker profiles, licenses, and scam alerts.

WikiFX Verification Workflow:

- Open the WikiFX app, search for the broker name (e.g., AvaTrade).

- Review “Licenses” tab: Regulator, status (active/expired), numbers—synced real-time.

- Check the 0-10 rating (the regulation is the most important factor), risk exposure, and complaints.

- View relationship diagrams for clones/affiliates; download credit reports.

- Cross-check with official sites if score <8.

Follow these official steps next:

- Gather Broker Details: Note exact name, claimed license number (e.g., FRN 123456), regulator, and expiry from their website/footer/terms.

- Access Official Regulator Site:

- FCA: register.fca.org.uk

- ASIC: connectonline.asic.gov.au

- CySEC: cysec.gov.cy

- SEC Philippines: sec.gov.ph

- Conduct Precise Search: Enter name/number; confirm “active/authorized” status, permissions (e.g., “dealing in investments”), and no warnings.

- Cross-Verify Extras: Check that the address matches and that the directors are listed. WikiFX app excels here with field surveys and fake broker lists.

- Document Proof: Screenshot results; test withdrawal policy separately.

Philippines example: WikiFX app scans SEC CMC; clones fail instantly. Pro tip: Re-verify quarterly—WikiFX sends alerts.

Pro Checklist:

- License active?

- Permissions match Forex?

- No enforcement actions?

- WikiFX score 8+?

Download our free forex broker regulation verification PDF. WikiFX app makes it effortless—your ultimate broker escort.

Common Pitfalls and Red Flags

Even savvy traders fall for traps in forex broker regulation. Watch these 7 red flags—WikiFX app exposes most via its scam list and clone detectors:

- Fake regulator sites (e.g., “fca-uk.org” vs. fca.org.uk).

- Expired licenses—WikiFX flags instantly.

- Offshore “Tier-1” boasts without Tier-1 proof.

- Vague claims: “Fully regulated” sans specifics.

- Cloned sites mimicking legit brokers (WikiFX relationship diagrams reveal).

- Pressure to deposit fast.

- Unverifiable license numbers.

Unregulated brokers topped 2025 blocklists. The WikiFX app provides field survey and complaint data—verify first!

Conclusion: Secure Your Trades Now

Forex broker regulation is your ultimate safeguard—prioritize Tier-1 licenses, verify rigorously with the WikiFX app, and trade protected.

Grab your free 2026 Forex License Verification Checklist PDF now! [Download here]. Explore our full series on safe brokers. Download the WikiFX app today and stay scam-free.

Read more

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

Forex Brokers: Stay Safe with Regulation Guide

New to forex? Learn key regulation basics—check FCA, ASIC, CFTC rules, verify licenses easily with the WikiFX App, spot scam signs, and use our checklist to pick safe brokers. Protect your money and trade confidently!

The Safest Way to Select Forex Brokers

Safest forex broker selection: Check regulation, spot scams, read reviews, and verify licenses via the WikiFX app. Avoid fraud—trade securely today!

Top Forex Brokers Offering Free Demo Accounts

Access demo accounts from top forex brokers. Practice trading risk‑free and explore platforms before investing.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

MultiBank Group Analysis Report

Pepperstone Analysis Report

Rate Calc