United Broker Exposure: Withdrawal Issues and Unjust Fees Reported

Abstract:Is your fund withdrawal request pending with the United broker for a long time? Has the UK-based forex broker still not resolved your withdrawal issues? Does the broker demand multiple fee payments every time you seek withdrawals? Is the United customer support team inept in handling your trading queries efficiently? You are not alone! Many traders have made their displeasure known on several broker review platforms such as WikiFX. In this United review article, we have investigated several complaints against the broker. Take a look!

Is your fund withdrawal request pending with the United broker for a long time? Has the UK-based forex broker still not resolved your withdrawal issues? Does the broker demand multiple fee payments every time you seek withdrawals? Is the United customer support team inept in handling your trading queries efficiently? You are not alone! Many traders have made their displeasure known on several broker review platforms such as WikiFX. In this United review article, we have investigated several complaints against the broker. Take a look!

Investigating the Top Forex Trading Complaints Against United

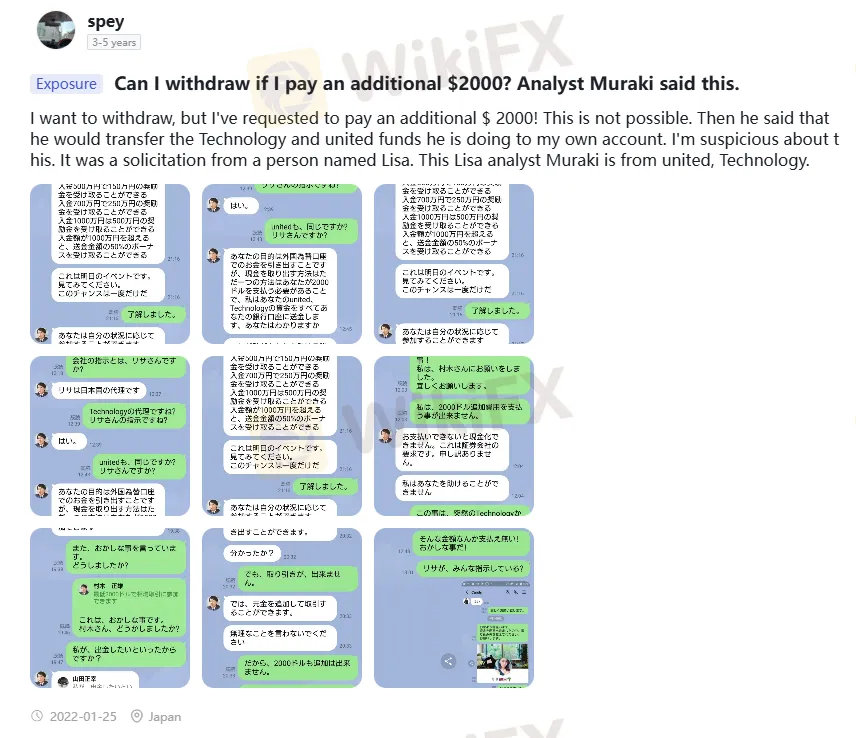

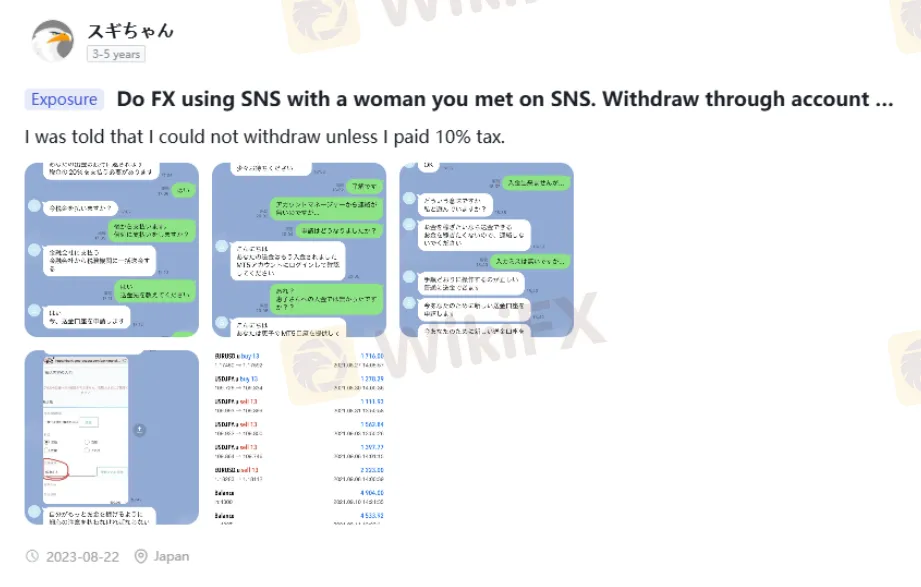

Additional Payment Demands When Raising United Fund Withdrawal Requests

As we move into the complaint section against United, we see numerous traders criticizing the additional payment demand made by the broker upon fund withdrawals. Traders, understandably, are frustrated and not agreeing to the demand. Even if someone agrees, the withdrawal still remains pending, causing more issues for the trader. The additional payment demands include taxes, margins, fines, etc. Here are multiple United reviews where traders witnessed numerous fund withdrawal hassles.

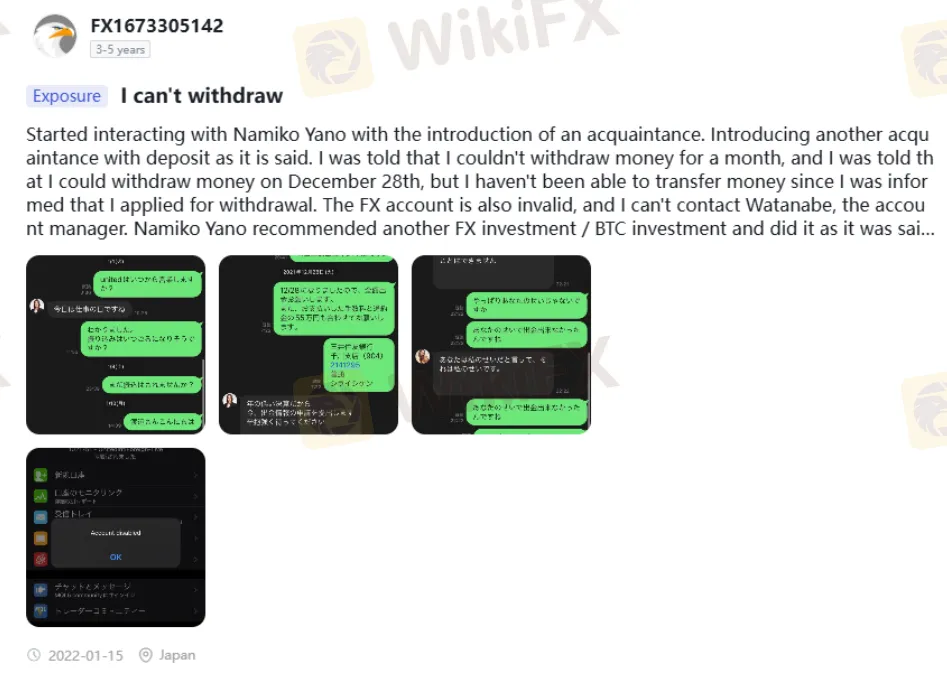

Withdrawal Blocked After Introductions, Invalid Forex Account & Unresponsive Support Team

This complaint talks about multiple traders being introduced through the broker‘s officials on the United trading platform. At first, a trader was informed that accessing fund withdrawals is not possible for a month. However, as per the United review shared by the trader, the withdrawal request was not processed even on the due date of the fund credit date. Later, the trader found the United forex trading account to be invalid. The trader’s repeated attempts to contact the account manager failed, too, leaving him with no choice but to share this negative United review. Check it out!

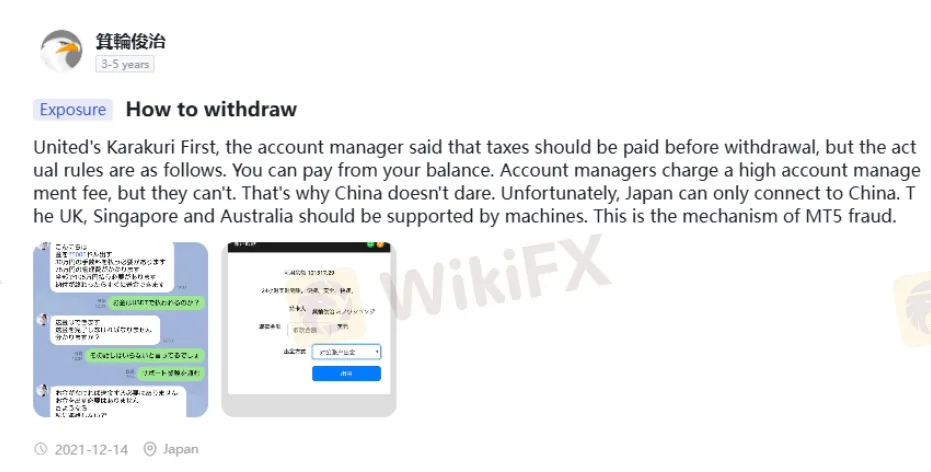

Examining the High Account Management Fee Demand Complaint

There is one more blame on United besides the illegitimate tax payment demand by its officials. Yes, you read it right! As per a trader, the officials charge a very high account management fee, breaching the trading norms and raising suspicion for the broker. Read out the complaint in this screenshot to understand it even better.

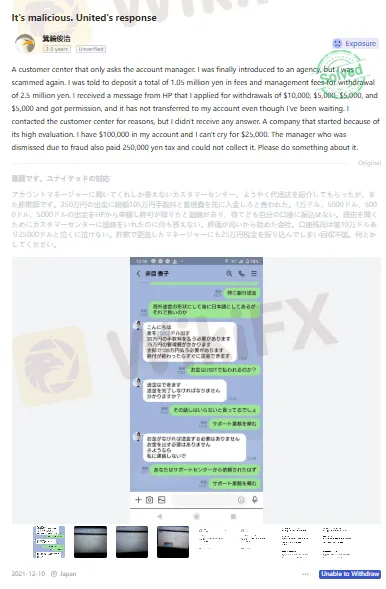

The Malicious United Response on Withdrawals

A trader reported a peculiar forex trading issue on WikiFX, the worlds leading forex regulation inquiry app. As per the complaint, the trader was told to deposit a hefty fee of 1.05 million yen for withdrawals worth 2.5 million yen. The fee amount, allegedly, accounts for approximately 42% of the withdrawal amount. The trader stated to have received messages concerning withdrawal applications of $10,000, $5,000, $5,000 and $5,000. However, the trader failed to receive any of these. Here is the United Review explaining this malicious response.

United Review by WikiFX: Regulation & Score Status

After examining the complaints, the WikiFX team conducted a full-scale investigation into the brokers regulation status. Upon investigation, the broker was found to be an unregulated entity. As a result, the team gave it a very poor score of 1.50 out of 10.

Explore in-depth industry insights on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - to consolidate your forex journey.

Read more

Leo Review: Allegations of Profit Reversals & Weak Customer Support

Is your forex trading experience with Leo no short of a financial disaster? Does the Hong Kong-based forex broker deliberately cancel your profits when asking for withdrawals? Do you frequently encounter the issue of a NIL forex trading account balance? Does the Leo customer support team fail to resolve your trading queries? In this Leo review article, we have investigated many complaints against the broker. Take a look!

HIJA MARKETS User Reputation: Is It Safe or a Scam? An Evidence-Based Analysis

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

HIJA MARKETS Regulation: A Complete Guide to Understanding Its Unregulated Status

s Hija Markets regulated? After checking official regulatory databases, we can confirm that Hija Markets is not a regulated broker. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia. However, being registered as a business is very different from having a financial license that allows them to handle your capital for trading. Without a license from a recognized financial authority, there is no regulatory oversight, no protection for your capital, and no required process for resolving disputes. This article will explain the evidence behind this conclusion, show you the serious risks involved, and give you a clear guide on how to check this information for any broker. Before choosing any broker, especially one with warning signs like these, an important first step is to check its profile on a verification platform, such as WikiFX, to get the complete picture.

OANDA Expands CFD Trading to US and European Traders

OANDA enhances its CFD offering in Australia, adding US and European share CFDs for traders through the new OANDA One sub-account.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc