LMS Forex Broker Review (2026): Is LMS Legit or a Scam?

Abstract:LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10. Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10.

Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

LMS Broker Overview

LMS is a forex and CFD broker that claims to provide online trading services across multiple asset classes, including forex, commodities, indices, and cryptocurrencies. However, based on available public information and third-party risk assessments, LMS raises serious safety and credibility concerns.

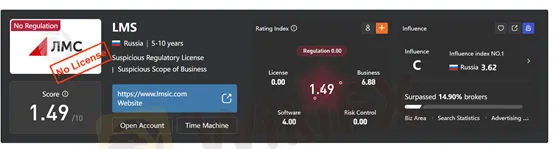

According to WikiFX, LMS has received a very low score of 1.49/10, indicating extremely high trading risk and weak operational transparency.

WikiFX Risk Assessment

- WikiFX Score: ⭐ 1.49 / 10

- Risk Level: Very High

- Regulatory Status: No valid regulation detected

- Investor Protection: None

A WikiFX score below 2.0 usually suggests:

- Missing or invalid regulatory licenses

- Poor transparency of company background

- High potential risk to client funds

Regulation & Safety – Major Red Flags

Regulation is one of the most critical factors when evaluating a forex broker. Unfortunately, LMS does not appear to hold any valid license from reputable financial regulators such as:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA / CFTC (USA)

Why this matters:

- No fund segregation requirements

- No investor compensation scheme

- No legal dispute protection

- No oversight of trading practices

Trading with an unregulated broker like LMS significantly increases the risk of fund loss, withdrawal issues, and unfair trading conditions.

LMS Broker Key Information

| Category | Details |

| Broker Name | LMS |

| Broker Type | Forex & CFD Broker |

| WikiFX Score | 1.49 / 10 |

| Regulation | Unregulated |

| Tradable Assets | Forex, indices, commodities, crypto (claimed) |

| Trading Platform | Web-based / proprietary platform |

| Minimum Deposit | Not clearly disclosed |

| Leverage | High leverage claimed (exact ratio unclear) |

| Demo Account | Not clearly stated |

| Customer Support | Limited transparency |

Trading Platform & Conditions

LMS appears to offer a proprietary or web-based trading platform rather than widely recognized platforms such as MT4 or MT5.

Concerns:

- Platform functionality cannot be independently verified

- No clear information on spreads, commissions, or execution model

- Lack of transparency on slippage and liquidity providers

Such opacity makes it difficult for traders to accurately assess real trading costs and execution quality.

LMS vs Regulated Brokers (Comparison Table)

| Feature | LMS | Regulated Broker (FCA/ASIC) |

| Regulation | None | Strong regulation |

| WikiFX Score | 1.49/10 | 7.0 – 9.5/10 |

| Fund Segregation | No | Yes |

| Investor Protection | No | Yes |

| Transparency | Low | High |

| Legal Accountability | Weak | Strong |

| Withdrawal Safety | High Risk | Protected |

Pros & Cons

Pros

- Claims to offer multiple trading instruments

- Web-based access without software installation

Cons

- Extremely low WikiFX score (1.49/10)

- No valid financial regulation

- No investor protection mechanisms

- Unclear trading conditions and fees

- High risk of withdrawal or fund security issues

Frequently Asked Questions (FAQ)

Q1: Is LMS a regulated forex broker?

No. LMS does not appear to be licensed or regulated by any recognized financial authority.

Q2: What does a WikiFX score of 1.49/10 mean?

A score this low indicates very high risk, weak transparency, and a lack of regulatory protection. Such brokers are generally not recommended.

Q3: Is LMS safe for beginners?

No. Beginners should avoid unregulated brokers like LMS and instead choose brokers regulated by authorities such as FCA, ASIC, or CySEC.

Q4: Can I trust LMS with my funds?

Due to the lack of regulation and investor safeguards, fund security cannot be guaranteed.

Q5: What should I do if I already deposited money with LMS?

- Stop depositing additional funds

- Keep all transaction records

- Attempt withdrawal immediately

- Seek advice from financial regulators or professional recovery services

Final Conclusion: Is LMS Worth the Risk?

Based on regulatory status, transparency issues, and a WikiFX score of just 1.49/10, LMS is a high-risk forex broker. Traders are strongly advised to avoid LMS and choose well-regulated alternatives that provide proper investor protection and legal oversight.

Read more

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Did your forex trading experience with FXNovus become bad after a short profitable spell on small trades? Did you make tax payments on your failed withdrawal request, as the funds did not arrive? Did the customer support team fail to return your hard-earned profits on the FXNovus trading platform? Feel that the South Africa-based forex broker debited illegitimate fees from your trading account? You are not alone! Many traders have voiced these trading concerns while sharing the FXNovus review. In this article, we have highlighted these concerns in greater detail. Read on!

Capital.com Expands into Kenya with Local Licence

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

Nearly 400 investors have urged the Labuan FSA to take stricter measures against a company accused of running an illegal forex trading scheme, which has reportedly caused losses exceeding RM104 million.

Is eToro Regulation Safe for Traders?

eToro is regulated by ASIC, FCA, CySEC, MAS & ADGM, though some users report withdrawal delays and offshore risks.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Fed

War Risk Premium Explosions: Gold Hits

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

Rate Calc