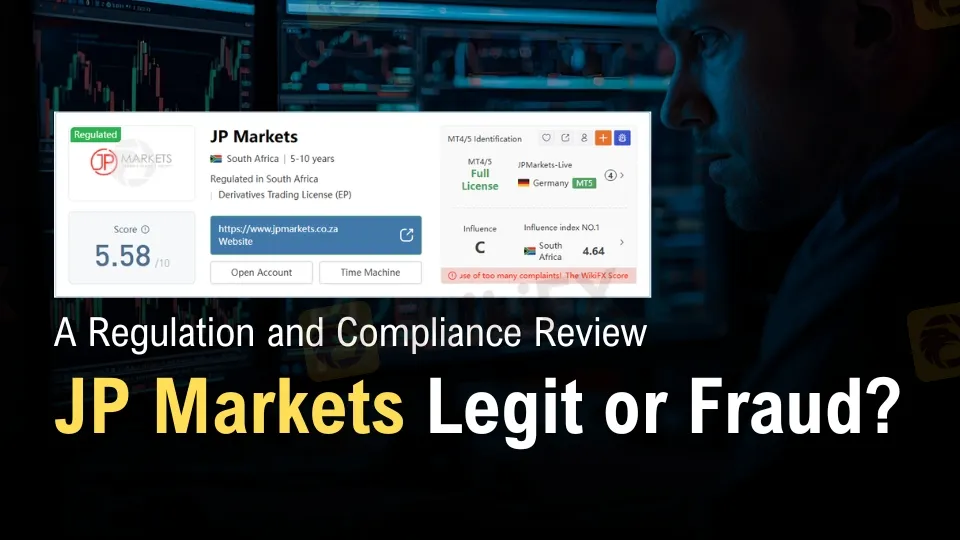

JP Markets Regulation Review: Legit or Fraud?

Abstract:JP Markets SA (Pty) Ltd holds FSCA License No.46855. Learn about its regulation, derivatives trading license, and MT4/MT5 platform compliance.

JP Markets Review: Regulatory Standing

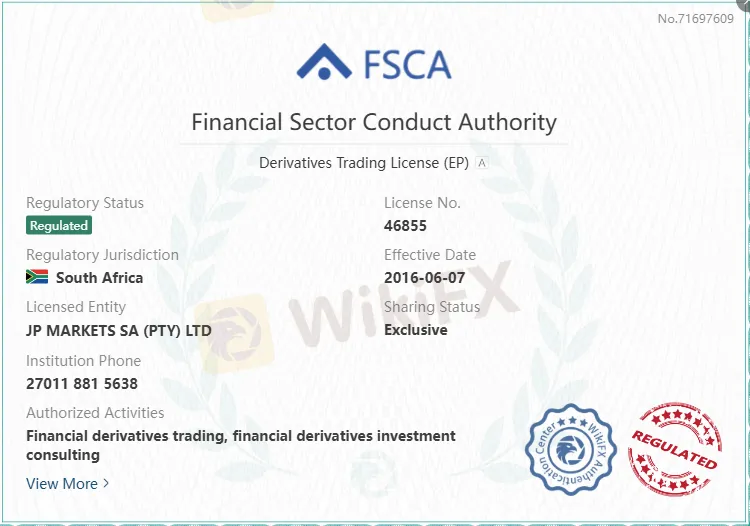

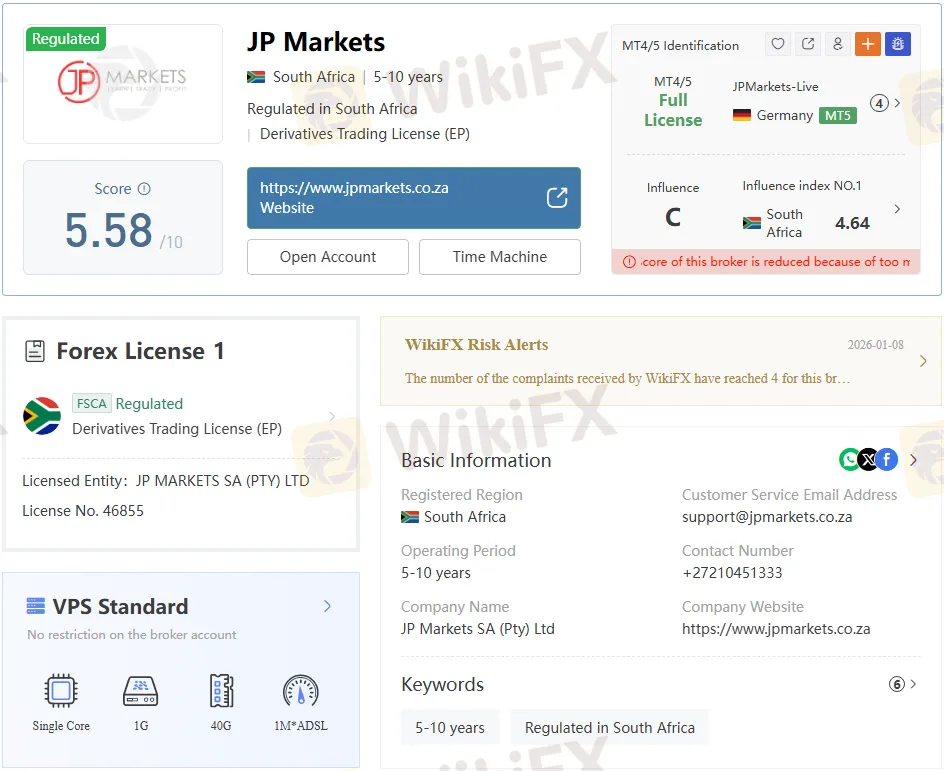

JP Markets SA (Pty) Ltd is a South African broker founded in 2016. It operates under the Financial Sector Conduct Authority (FSCA) with license number 46855, authorizing it to provide financial derivatives trading and investment consulting. The firm holds a Derivatives Trading License (EP) and is registered exclusively in South Africa.

The brokers regulatory status is marked as “Exceeded” in some references, which suggests that while the license remains valid, certain compliance thresholds may have been surpassed. This nuance is important for traders evaluating whether JP Markets is fully aligned with FSCA oversight.

Domain and Licensing Transparency

- Company Website: jpmarkets.co.za

- Registered Entity: JP Markets SA (Pty) Ltd

- Effective Date of License: 7 June 2016

- Regulatory Jurisdiction: South Africa

- Contact Numbers: +27 21 045 1333 / +27 11 881 5638

- Customer Service Email: support@jpmarkets.co.za

- Office Address: No.4 Century Falls Road, Century City, Cape Town, 7441

This transparency in licensing and contact details is a positive indicator compared to offshore brokers that often obscure their registration data.

Trading Platforms and Technology

JP Markets provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MT5: Full license, available on PC, web, and mobile. Suitable for experienced traders.

- MT4: Supported, with one server, positioned as beginner-friendly.

- Execution Speed: Average of 256.75 ms.

- Server Location: South Africa, with a ping of around 163 ms.

The broker emphasizes MT5 as its flagship platform, offering advanced technical and fundamental analysis tools.

JP Markets Instruments

JP Markets offers a broad range of tradable instruments:

- Forex

- Stocks

- Indices

- Commodities

- Cryptocurrencies

- Bonds

- Options

- ETFs

This multi-asset coverage is wider than many regional competitors, positioning JP Markets as a full-service broker within South Africas retail trading landscape.

Account Types and Features

JP Markets provides several account structures tailored to different trading styles:

| Account Type | Minimum Deposit | Leverage | Spread | Commission | Notes |

| VIP | R5,000 | Up to 1:500 | From 0.5 pips | $3 | Tight spreads, professional conditions |

| JPM Micro 300 | R100 | Up to 1:500 | From 3 pips | None | 300% bonus, higher spreads |

| Premium | R100 | Up to 1:2000 | From 1 pip | None | High leverage, no commission |

| Islamic | R100 | Up to 1:500 | From 1.5 pips | None | Swap-free, Shariah compliant |

| Zero Stop-Out | R100 | Up to 1:500 | From 3 pips | None | Stop-out at 0%, riskier conditions |

| JPM Bonus 300 | R100 | Up to 1:500 | From 2 pips | None | 300% deposit bonus |

| 25% Drawdown Bonus | R100 | Up to 1:500 | From 2 pips | None | Cushion against drawdowns |

The Premium account stands out with leverage up to 1:2000, far higher than most regulated brokers. While attractive to aggressive traders, such leverage significantly increases risk.

Fees and Spreads

- VIP Account: Spreads from 0.5 pips, $3 commission.

- Premium Account: Spreads from 1 pip, no commission.

- Islamic Account: Spreads from 1.5 pips, swap-free.

- Zero Stop-Out: Spreads from 3 pips.

- JPM Bonus 300: Spreads from 2 pips.

Compared to competitors, JP Markets offers competitive spreads on VIP accounts but less favorable conditions on bonus-linked accounts.

Deposit and Withdrawal Options

JP Markets supports payments through:

- Capitec Pay

- OZOW

- Paystack

- Skrill

- Alphapo

However, the broker does not disclose processing times or fees, which may concern traders seeking clarity on transaction costs. Competitors often provide detailed timelines and fee structures, giving them an edge in transparency.

Customer Support and Accessibility

- Support Channels: Live chat, contact form, email, phone.

- Availability: 24/5.

- Social Media Presence: Facebook, X (Twitter), Instagram, LinkedIn, WhatsApp, YouTube, TikTok.

- Regional Restrictions: Services limited to South Africa, Namibia, Swaziland, and Lesotho.

This regional focus narrows JP Markets global reach but strengthens its positioning as a domestic broker.

Pros and Cons

Pros

- FSCA-regulated with license number 46855

- MT5 platform with full license

- Wide range of instruments including forex, stocks, and commodities

- Multiple account types including Islamic account

- Minimum deposit as low as R100

- Strong local presence and transparency in contact details

Cons

- Regulatory status marked as “Exceeded”

- Limited regional availability

- Lack of detailed payment processing information

- Higher spreads on bonus accounts

- Limited global competitiveness compared to international brokers

Competitor Context

Compared with larger global brokers, JP Markets offers higher leverage (up to 1:2000) but less international coverage. Competitors such as IG or Saxo Bank provide broader regulatory footprints across multiple jurisdictions, while JP Markets remains confined to South Africa and neighboring regions.

For traders seeking ultra-high leverage and localized support, JP Markets may be appealing. For those prioritizing global access and multi-jurisdictional regulation, competitors may offer stronger safeguards.

Bottom Line

JP Markets SA (Pty) Ltd is a licensed FSCA broker with a derivatives trading license and a clear regulatory footprint in South Africa. Its offering includes MT4/MT5 platforms, multiple account types, and leverage options up to 1:2000.

While the broker demonstrates legitimacy through its FSCA license and transparent contact details, traders should weigh the risks of high leverage and the limitations of regional restrictions. The “Exceeded” regulatory status also warrants careful consideration.

Verdict: JP Markets is legitimately regulated but best suited for traders comfortable with high leverage and operating within Southern Africa. Those seeking broader international protections may find stronger alternatives elsewhere.

Read more

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

Tradiso Review: A Tale of Blocked Funds and Capital Loss for Traders

Experiencing difficulties in moving funds out of your Tradiso forex trading account? Did your capital vanish from your account? Did you fail to receive a positive response from the customer support team on your trading queries? Many traders have expressed their disappointment over these alleged manipulative trade practices employed by the forex broker. In this Tradiso review article, we will let you explore several complaints users have made against the broker. Take a look!

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc