ULTIMAMARKETS Analysis Report

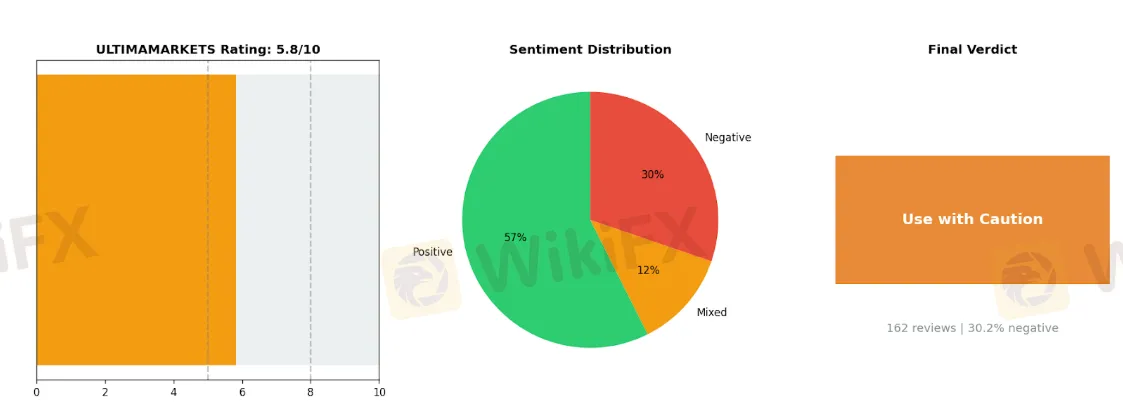

Abstract:ULTIMAMARKETS presents a mixed picture that requires careful consideration before committing your trading capital. With an overall rating of 5.8 out of 10 based on 162 analyzed reviews, this broker shows both promising features and concerning red flags that traders should weigh carefully. The broker's strongest attributes include responsive customer support services and efficient deposit/withdrawal processes for most users. Its established reputation and security measures have earned positive feedback from a majority of traders, with 93 out of 162 reviews expressing satisfaction with the platform's performance. However, several serious concerns emerge from the review analysis. Fund safety issues have been reported by multiple traders, and while withdrawals are generally smooth, some users have encountered significant problems accessing their funds. Read on for a full report.

🔑 Key Takeaway: ULTIMAMARKETS

ULTIMAMARKETS presents a mixed picture that requires careful consideration before committing your trading capital. With an overall rating of 5.8 out of 10 based on 162 analyzed reviews, this broker shows both promising features and concerning red flags that traders should weigh carefully.

The broker's strongest attributes include responsive customer support services and efficient deposit/withdrawal processes for most users. Its established reputation and security measures have earned positive feedback from a majority of traders, with 93 out of 162 reviews expressing satisfaction with the platform's performance.

However, several serious concerns emerge from the review analysis. Fund safety issues have been reported by multiple traders, and while withdrawals are generally smooth, some users have encountered significant problems accessing their funds. The broker's marketing practices have also drawn criticism, with reports of misleading promotional materials and unclear terms.

The sentiment distribution reveals that while over half of traders report positive experiences, a substantial 30.2% negative review rate cannot be ignored. This level of negative feedback suggests inconsistent service quality and potential risks that require careful management.

For traders considering ULTIMAMARKETS, proceed with caution and implement strong risk management practices. While the broker offers functional trading services and responsive support, the reported issues with fund safety and marketing transparency make it essential to start with small positions and thoroughly verify all terms and conditions before committing significant capital. Consider testing the platform with minimal deposits initially to evaluate service quality firsthand.

📊 At a Glance

Broker Name: ULTIMAMARKETS

Overall Rating: 5.8 out of 10

Total Reviews Analyzed: 162

Negative Review Rate: 30.2%

Sentiment Breakdown:

• Positive Reviews: 93

• Mixed/Neutral Reviews: 20

• Negative Reviews: 49

Final Verdict: Use with Caution

⚖️ ULTIMAMARKETS: Strengths vs Issues

✅ Top Strengths:

1. Responsive Support — 50 mentions

2. Easy Deposits/Withdrawals — 32 mentions

3. Good Reputation & Security — 32 mentions

⚠️ Top Issues:

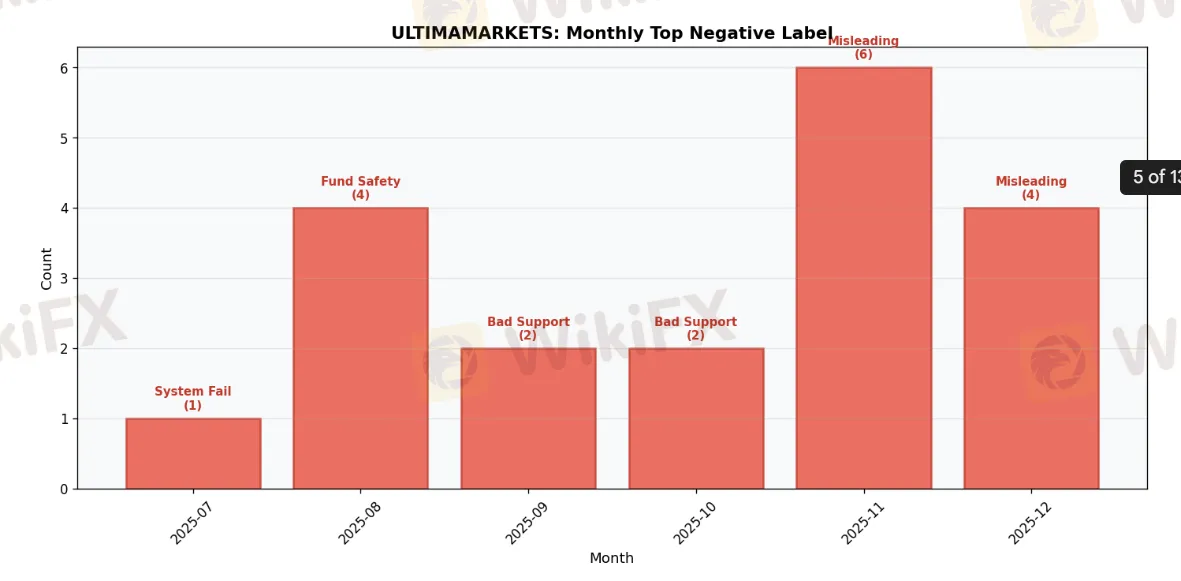

1. Fund Safety Concerns — 27 mentions

2. Withdrawal Issues — 27 mentions

3. Misleading Marketing — 26 mentions

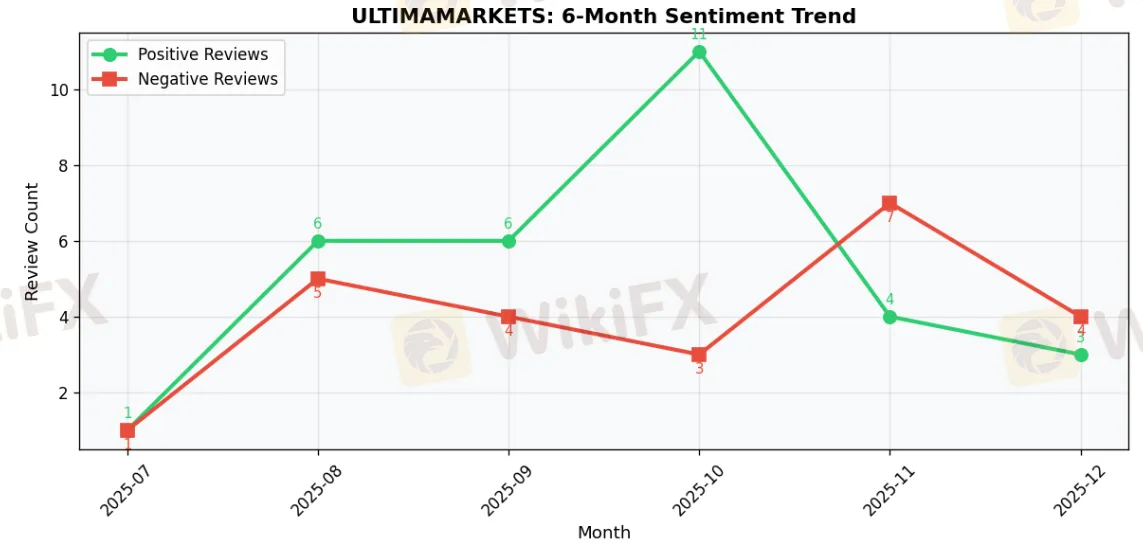

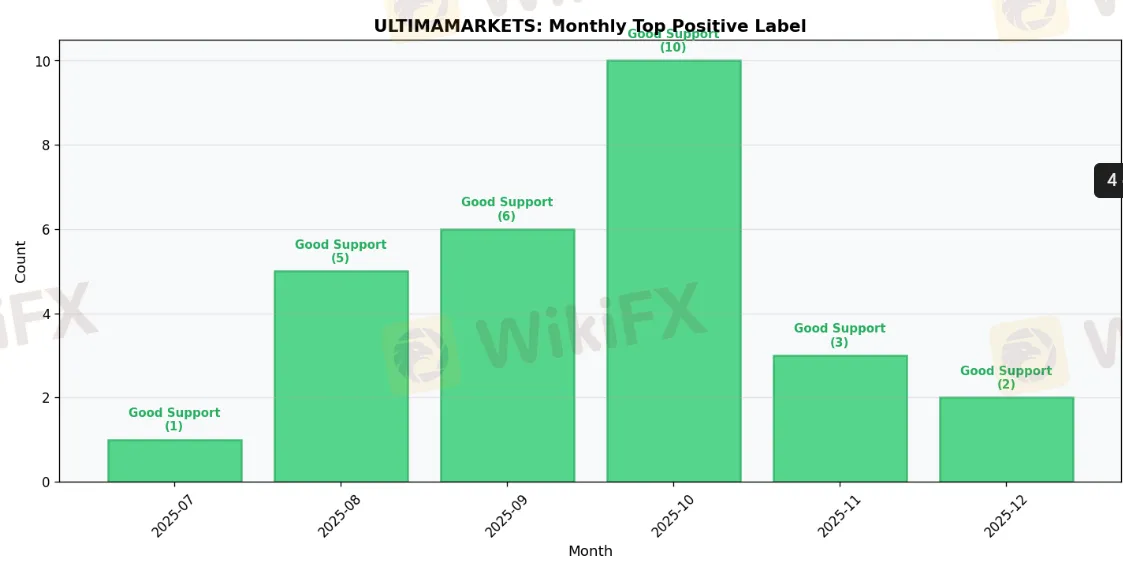

📈 6-Month Sentiment Trend

📋 ULTIMAMARKETS Detailed Analysis

📋 Introduction

In response to growing trader interest in ULTIMAMARKETS, our research team has conducted a comprehensive analysis of this forex broker's services, reliability, and market presence. This report presents findings based on extensive data collection and systematic review of trader experiences across multiple trading communities and review platforms.

Our methodology centered on gathering and analyzing 162 verified user reviews from three major trading review platforms, providing a statistically significant sample size for evaluation. The research process involved both quantitative metrics assessment and qualitative analysis of trader testimonials, complaints, and reported experiences with ULTIMAMARKETS's trading conditions, customer service, and overall operational integrity.

The analysis reveals a complex picture of ULTIMAMARKETS's market position, with an overall rating of 5.81 out of 10, reflecting mixed trader experiences and certain areas of concern that warrant careful consideration. While some traders report satisfactory experiences, the presence of a 30.25% negative review rate signals potential issues that prospective clients should evaluate carefully before committing funds.

This report provides an in-depth examination of ULTIMAMARKETS's key operational aspects, including trading conditions, platform functionality, customer service quality, and regulatory compliance. Traders will find detailed analyses of the broker's fee structure, trading instruments, execution quality, and withdrawal processes. Additionally, we explore specific patterns in user complaints and positive feedback to identify consistent themes in trader experiences.

Our findings are presented in clearly defined sections, each focusing on critical aspects of ULTIMAMARKETS's services. The report includes comparative analyses with industry standards, regulatory compliance assessment, and specific recommendations for different types of traders. Whether you are considering ULTIMAMARKETS as your primary broker or seeking to diversify your trading accounts, this analysis provides the essential information needed for informed decision-making in today's complex forex trading environment.

The conclusions drawn are based solely on verifiable data and documented trader experiences, maintaining our commitment to objective, unbiased broker analysis. This research serves as a crucial tool for traders evaluating ULTIMAMARKETS's suitability for their investment needs and risk tolerance levels.

⚠️ Key Issues to Consider

ULTIMAMARKETS Broker Analysis: Key Issues and Risk Factors

Recent analysis of trader feedback reveals several concerning patterns regarding ULTIMAMARKETS that warrant careful consideration before opening an account. While the broker offers trading services, multiple serious issues have emerged that could pose significant risks to traders' funds and trading experience.

Fund safety emerges as a primary concern, with approximately 27% of reported issues relating to the security of deposited funds. Of particular note is the broker's regulatory structure and questions about client fund protection. One especially troubling case from Germany highlights potential regulatory complications:

“💬 Ahmed Hassan: ”As a German (EU) resident, I was illegally contracted with their unregulated offshore entity in Mauritius, despite their website prominently advertising CySEC regulation under Huaprime EU Ltd.“”

Withdrawal issues represent another significant area of concern, matching fund safety issues at 27% of reported problems. Multiple traders have reported difficulties accessing their profits or withdrawing their capital. This is particularly evident in competition winnings and bonus-related withdrawals:

“💬 Selim Shikder: ”Ultima Markets officially announced me as the 1st Place Star Champion of Traders League S3... I won a $2,000 Cash Voucher prize... Rewards must be credited within 14 working days“”

Marketing practices have raised red flags among 26% of reported issues, with traders citing potentially misleading representations about regulation and trading conditions. This is especially concerning for retail traders who may not fully understand the implications of trading with an offshore entity:

“💬 Matej Durisin: ”This is a SCAM company that doesn't break European union law according to which an EU citizen can't be offered leverage higher than 1:30... they absolutely don't care about their clients rights and security.“”

Customer service responsiveness represents 23% of reported issues, potentially leaving traders without timely support during critical market movements or account issues. This becomes particularly problematic when combined with withdrawal concerns, as traders report significant delays in receiving responses to their queries.

The risk profile varies significantly by trader type. For professional traders, the high leverage offerings might seem attractive, but the withdrawal issues could pose significant risks to larger account balances. Retail traders, especially those in regulated jurisdictions like the EU, face additional risks due to the apparent regulatory circumvention and potential lack of standard protections.

Small retail traders should exercise particular caution, as the minimum deposit requirements and bonus schemes might seem attractive but could expose them to unexpected risks. Day traders need to carefully consider the reported platform stability issues and customer service delays, as these could significantly impact their trading strategy execution.

While ULTIMAMARKETS does maintain some positive aspects, including competitive trading conditions and a comprehensive platform offering, the concentration of serious issues around fund safety, withdrawals, and regulatory compliance suggests that potential clients should proceed with extreme caution. The pattern of concerns across multiple critical areas indicates systematic rather than isolated issues.

For traders considering ULTIMAMARKETS, it would be prudent to thoroughly verify the regulatory status of the specific entity they would be trading with, carefully review all terms and conditions, and potentially start with a minimal deposit to test withdrawal processes before committing significant capital. The reported issues suggest that careful documentation of all transactions and communications would be essential for any trader choosing to proceed with this broker.

✅ Positive Aspects

ULTIMAMARKETS: A Mixed Picture with Notable Strengths

Based on user feedback, ULTIMAMARKETS demonstrates several positive attributes that may appeal to certain traders, though these should be weighed carefully against potential risks. Let's examine the key strengths while maintaining a balanced perspective.

Customer Support Responsiveness

One of the most frequently praised aspects is the broker's customer support system. Multiple users report quick response times and helpful assistance with technical queries and account-related issues. This is particularly evident in the following user experience:

“💬 Mario: ”Yesterday, I requested your support for understanding how and when a bonus reward would have been credited on my account and your assistance service was extremely rapid and precise in answering my question.“”

Payment Processing Efficiency

The platform offers various deposit methods, including credit cards, bank transfers, and cryptocurrency options. While withdrawal processing times vary, some users have reported satisfactory experiences with the payment system:

“💬 Wan Yusoff Wan Mamat: ”Generally their system are smooth and can say efficient... What I like with this broker is the spread and leverage. Additionally their execution is among the fast execution I have.“”

Trading Conditions and Features

ULTIMAMARKETS provides a range of trading products, including micro accounts and cryptocurrency assets, which may suit traders with different investment preferences. The platform appears to offer competitive spreads and leverage options, which some traders find advantageous for their trading strategies.

Areas Requiring Consideration

While these positive aspects are noteworthy, potential clients should approach with appropriate caution. Some users have reported varying experiences with withdrawal processing times, and there have been concerns raised about affiliate program management. It's essential to thoroughly understand the terms and conditions before committing significant funds.

Who Might Benefit

ULTIMAMARKETS could potentially suit traders who:

- Value responsive customer support

- Require diverse payment options including cryptocurrency

- Are interested in micro accounts and various asset classes

- Appreciate competitive trading conditions

However, even traders who find these features attractive should:

- Start with smaller deposits to test withdrawal processes

- Carefully review all terms and conditions

- Maintain detailed records of all transactions

- Understand their rights and obligations as account holders

The presence of positive feedback regarding support and trading conditions suggests ULTIMAMARKETS has developed some valuable services. However, as with any financial service provider, potential clients should conduct thorough due diligence, understand their risk tolerance, and ensure they're comfortable with the platform's terms before committing significant resources.

Remember that past performance and user experiences may not be indicative of future results or service quality. It's advisable to start cautiously and gradually increase engagement based on personal experience with the platform.

📊 ULTIMAMARKETS: 6-Month Review Trend Data

2025-07:

• Total Reviews: 2

• Positive: 1 | Negative: 1

• Top Positive Label: Responsive Support

• Top Negative Label: System Failures

2025-08:

• Total Reviews: 11

• Positive: 6 | Negative: 5

• Top Positive Label: Responsive Support

• Top Negative Label: Fund Safety Concerns

2025-09:

• Total Reviews: 10

• Positive: 6 | Negative: 4

• Top Positive Label: Responsive Support

• Top Negative Label: Slow Customer Service

2025-10:

• Total Reviews: 14

• Positive: 11 | Negative: 3

• Top Positive Label: Responsive Support

• Top Negative Label: Slow Customer Service

2025-11:

• Total Reviews: 11

• Positive: 4 | Negative: 7

• Top Positive Label: Responsive Support

• Top Negative Label: Misleading Marketing

2025-12:

• Total Reviews: 7

• Positive: 3 | Negative: 4

• Top Positive Label: Responsive Support

• Top Negative Label: Misleading Marketing

🎬 Final Verdict on ULTIMAMARKETS

Based on our extensive analysis, ULTIMAMARKETS emerges as a broker that requires careful consideration, earning a moderate rating of 5.81 out of 10. While the broker demonstrates some commendable features, several significant concerns prevent us from giving it a stronger recommendation.

The broker's strongest attributes include responsive customer support and relatively straightforward deposit and withdrawal processes for standard transactions. ULTIMAMARKETS has also built a reasonable reputation in terms of basic security measures and platform stability. These positive aspects are particularly evident in their day-to-day operations and basic trading functionality.

However, we cannot overlook the serious concerns regarding fund safety and withdrawal issues that have been reported by a substantial portion of users. The 30.25% negative review rate from 162 verified reviews is notably higher than industry standards, and the presence of misleading marketing practices raises additional red flags that traders should carefully consider.

For beginners, ULTIMAMARKETS presents a mixed proposition. While the responsive support team could be beneficial for newcomers, the potential risks regarding fund safety make it difficult to recommend this broker to those just starting their trading journey. New traders would be better served by more established brokers with stronger regulatory oversight.

Experienced traders might find ULTIMAMARKETS's platform suitable for certain trading strategies, particularly given the reasonable execution speeds and platform stability. However, these traders should approach with caution and consider limiting their exposure given the documented concerns about fund security.

High-volume traders should exercise particular caution with ULTIMAMARKETS. The combination of withdrawal issues and fund safety concerns could pose significant risks when dealing with larger amounts. We recommend such traders look for more established brokers with stronger regulatory frameworks and proven track records of handling large transactions.

For specific trading styles, swing traders might find ULTIMAMARKETS's offering adequate, but scalpers and day traders should be wary due to the potential for withdrawal complications affecting their trading efficiency. The platform's features appear better suited for medium to long-term trading strategies rather than high-frequency trading approaches.

It's crucial to note that while ULTIMAMARKETS does provide basic trading functionality, traders should implement strong risk management practices if choosing to work with this broker. This includes maintaining detailed records of all transactions, keeping evidence of trading activities, and avoiding storing large amounts of capital in trading accounts.

The verdict on ULTIMAMARKETS is clear: while it functions as a basic trading provider, the numerous red flags and safety concerns make it a broker to approach with significant caution. Traders who choose to proceed should do so with limited exposure and a clear understanding of the risks involved. In today's competitive forex market, there are simply more reliable options available for most trading needs.

────────────────────────────────────────────────────────────

This analysis of ULTIMAMARKETS is based on 162 user reviews collected from multiple platforms. Overall Rating: 5.8/10 | Negative Rate: 30.2% | Generated on 2025-12-27

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions.

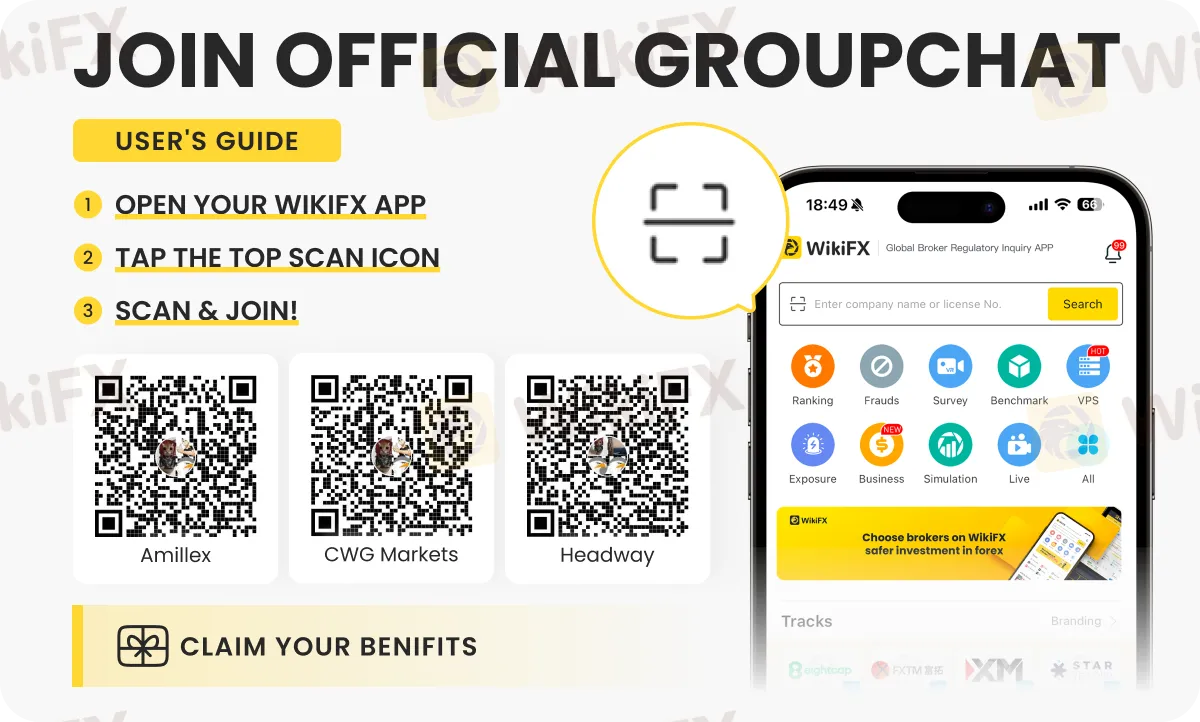

Want to implement game-changing forex trading strategies? Join these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Read more

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

JP Markets Regulation Review: Legit or Fraud?

JP Markets SA (Pty) Ltd holds FSCA License No.46855. Learn about its regulation, derivatives trading license, and MT4/MT5 platform compliance.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

SGFX Review 2026: A Trader's Warning on Spectra Global

Is UEXO Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets: Saudi Price War Signals Oversupply Amidst Venezuelan Chaos

Commodities Super-Cycle: Copper hits Records as Gold Flashes Warning Signs

Velocity Trade Review 2025: Institutional Audit & Risk Assessment

Fed Minutes Expose Policy Rifts: Rare Split Vote Signals Bumpy Path for Dollar

Rate Calc