JFD Review: Pros, Cons and Regulation

Abstract:JFD review covers pros, cons, and regulation. Learn about CySEC and VFSC licenses, trading platforms, fees, and broker safety for global traders.

JFD Review Overview

Founded in 2011, JFD Brokers (operating as JFD Group Ltd and JFD Overseas Ltd) positions itself as a multi-asset brokerage with a regulatory footprint in both Europe and offshore jurisdictions. Headquartered in Cyprus, the broker has expanded its services to cover forex, commodities, stocks, indices, cryptocurrencies, and ETFs/ETNs, offering more than 1,500 tradable instruments.

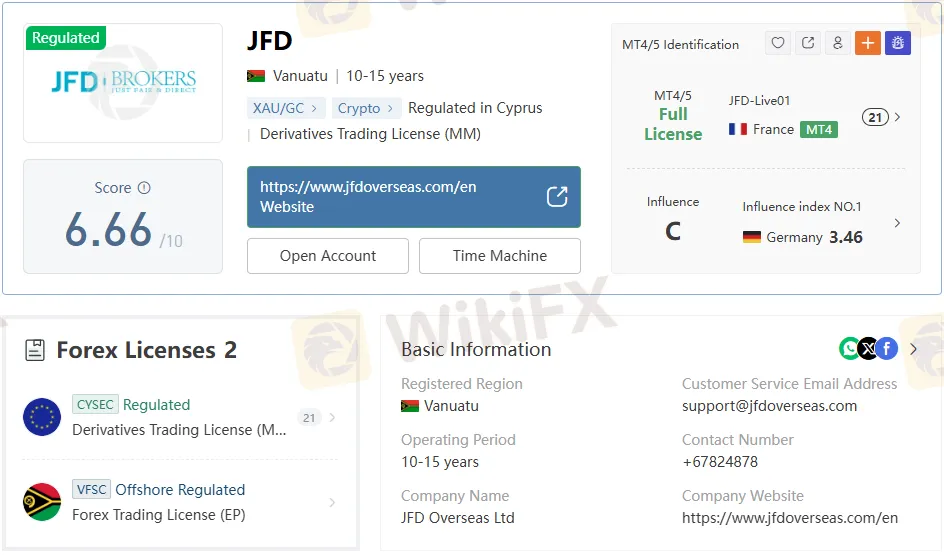

This JFD review examines the brokers regulatory standing, trading platforms, fees, and overall safety profile. With CySEC oversight in Cyprus and a VFSC license in Vanuatu, JFD operates under a dual framework that blends EU regulatory standards with offshore flexibility.

JFD Regulation and Safety

CySEC License

JFD Group Ltd holds a Cyprus Securities and Exchange Commission (CySEC) license (No. 150/11), effective since August 2011. This license authorizes activities including derivatives trading, investment consulting, asset management, and securities trading. Importantly, CySEC regulation allows JFD to passport services across 20 EU member states, reinforcing its legitimacy within Europe.

VFSC License

JFD Overseas Ltd also holds a Vanuatu Financial Services Commission (VFSC) license (No. 17933), issued in January 2023. While this provides authorization for forex, futures, securities, bonds, and options trading, it is categorized as offshore regulation. Offshore licenses typically operate under lighter frameworks, which may raise questions about investor protection compared to EU standards.

Transparency and Domain Registration

The brokers primary domain, jfdbrokers.com, was registered in September 2011 and is set to expire in September 2025. Domain records confirm active status with restrictions on transfer and renewal, signaling operational continuity.

Trading Platforms and Technology

JFD supports MetaTrader 4+ (MT4+) and MetaTrader 5+ (MT5+), alongside Stock3, a German social trading platform.

- MT4: Enhanced with exclusive JFD add-ons, suitable for beginners.

- MT5: Advanced features for experienced traders, supporting desktop, web, and mobile.

- Stock3: Web-based, designed for traders seeking community-driven insights.

Execution speed averages 187 milliseconds, with multiple servers in Cyprus ensuring stability. Leverage options extend up to 1:400 for professional clients, while retail accounts are capped at lower levels under EU rules.

Instruments Available

JFD offers access to nine asset classes:

- Forex

- Commodities

- Stocks

- Cryptocurrencies

- Precious metals

- Indices

- ETFs/ETNs

- Bonds

- Mutual funds

This breadth of instruments places JFD in line with larger competitors, though some brokers may offer broader derivatives coverage.

Account Types and Features

JFD operates a single account system with the following conditions:

- Minimum deposit: 500 EUR/USD/GBP/CHF

- Margin call level: 100%

- Stop-out level: 50%

- Negative balance protection: Available for EU accounts, not for offshore accounts

- Segregated funds: Client money held in top-tier institutions

A demo account is available for testing strategies and platform functionality.

JFD Fees and Costs

Trading Commissions

- CFDs, FX & Metals: Commission-based structure

- US stocks: $0.05 per share, minimum $3

- EU stocks: 0.15% of order volume, minimum €3

- Spanish stocks: 0.20% of order volume, minimum €6

Financing and Swaps

Overnight financing applies to CFDs on stocks and cash indices, calculated at 3.25% plus the benchmark rate.

Deposit and Withdrawal Fees

- Bank transfer (Sofort): 1.8% + fixed fee

- Online payments (Skrill, Neteller): 0.25 EUR + 1.7–3.25%

- Credit cards: 1.95–2.95%

- Withdrawals: Credit card refunds incur €0.25 authorization + €2 refund fee; Skrill/Neteller withdrawals cost 1–2% (capped at $30).

Inactivity Fee

Accounts inactive for three months incur a €20 monthly fee.

Compared to competitors, JFDs fees are higher than discount brokers but remain competitive against mid-tier European firms.

JFD Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Offshore VFSC license offers weaker investor protection |

| Over 1,500 instruments across 9 asset classes | Restrictions in China and the United States |

| MT4+/MT5+ with exclusive add-ons | High deposit/withdrawal fees (up to 3.25%) |

| Segregated client funds | Inactivity fee of €20 after 3 months |

Competitor Context

Compared to brokers like Pepperstone or IC Markets, JFDs regulatory standing in Cyprus provides credibility, but its reliance on VFSC for offshore operations may deter risk-averse traders. Fee structures are heavier than low-cost competitors, though JFD compensates with platform enhancements and broader asset coverage.

Bottom Line

This JFD review highlights a broker that blends European regulation with offshore flexibility, offering a wide range of instruments and established trading platforms. While fees are relatively high and offshore licensing may concern cautious investors, CySEC oversight and segregated client funds provide a measure of safety.

For traders seeking access to multiple asset classes under a regulated EU framework, JFD presents a legitimate option. However, cost-sensitive traders may find better value with competitors offering lower commissions and fees.

Read more

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

JP Markets Regulation Review: Legit or Fraud?

JP Markets SA (Pty) Ltd holds FSCA License No.46855. Learn about its regulation, derivatives trading license, and MT4/MT5 platform compliance.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

SGFX Review 2026: A Trader's Warning on Spectra Global

Is UEXO Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets: Saudi Price War Signals Oversupply Amidst Venezuelan Chaos

Commodities Super-Cycle: Copper hits Records as Gold Flashes Warning Signs

Velocity Trade Review 2025: Institutional Audit & Risk Assessment

Fed Minutes Expose Policy Rifts: Rare Split Vote Signals Bumpy Path for Dollar

Rate Calc