The U.S Dollar had a difficult year & technical analysis is revealing something unexpected...

Abstract:What has happened to the U.S. dollar in 2025, and what can we expect in 2026?

The U.S Dollar Index measures the dollars strength against six major currencies, mainly the Euro (EUR). Recent price action on the DXY (U.S Dollar Index) shows that this has been a weaker year for the dollar, with some small gains the last half of the year.

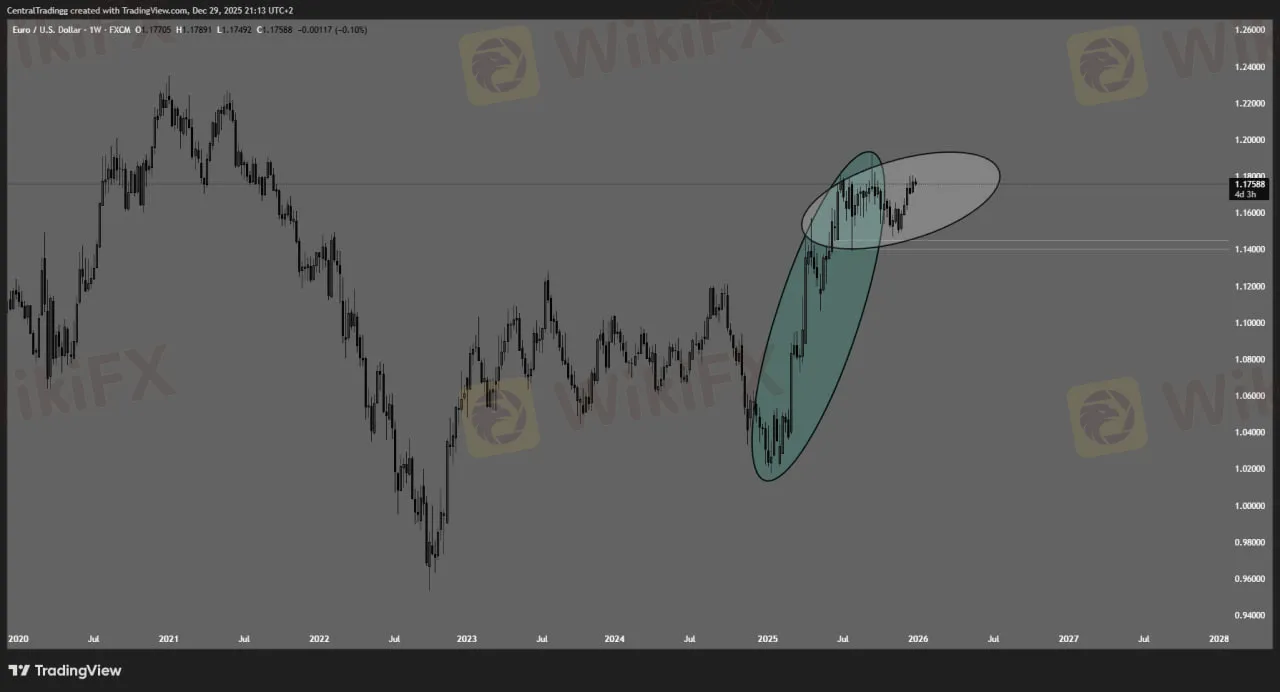

Studying the price action above we can quickly note that it might be hinting at a further continuation of this downtrend on the DXY into 2026. The same observation can be made on the EUR/USD chart (Euro vs U.S Dollar) where we can see a bullish year for the Euro and a hint at a continuation of this trend.

So what does this mean for us as traders? Simply put, if we see the continuation then betting against the dollar in the coming year can put you in a favourable position. Keep in mind that confirmation is key, and waiting for a confirmation on the trend (like a break of the recent lows on the DXY) should play a massive role in your decision-making.

At WikiFX, we always recommend verifying broker reliability before trading precious metals or any asset class. Use our free regulatory query tool to check your brokers license status, user complaints, and risk exposure history – especially during volatile periods when scam platforms often resurface.Stay informed and trade safely.WikiFX – Your Trusted Forex & Precious Metals Broker Review Platform

Read more

Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

U.S Dollar Gains Against Other Majors.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Chinese Yuan makes new highs marking an historic performance.

Performance like this hasn't been seen since 2021

EUR/USD Weekly Forecast: Wavers Ahead of US NFP Data

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc