Common Questions About Exnova: Safety, Fees, and Risks (2025)

Abstract:If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an "A" ranking in Influence according to our data, with significant traffic coming from Mexico, Brazil, Colombia, and Indonesia.

If you are browsing social media or trading forums in regions like Latin America or Southeast Asia, you have likely come across ads for a broker named Exnova. They are currently experiencing a surge in popularity, holding an “A” ranking in Influence according to our data, with significant traffic coming from UAE, Argentina, Bolivia, Brazil.

However, popularity does not always equal safety. While their marketing is slick and their platform looks modern, the underlying safety metrics tell a much more concerning story. Currently, Exnova holds a WikiFX Score of 1.43 out of 10, a rating that signals “Danger” in our system. Before you deposit your hard-earned capital, we need to look past the advertisements and analyze the regulatory reality and user feedback.

Is Exnova actually regulated?

No. Exnova is currently unregulated.

According to the latest data, Exnova is not regulated by any valid financial authority. The company claims registration in St. Kitts and Nevis (established in 2022).

Why does “St. Kitts and Nevis” registration matter?

It is crucial for traders to understand the difference between registration and regulation.

- Registration simply means a company has filed paperwork to exist as a business entity (like a coffee shop or a clothing store).

- regulation means a financial authority (like the FCA in the UK or ASIC in Australia) actively monitors the broker to prevent fraud.

Because Exnova lacks this oversight, they are not legally required to separate your money from their own company funds (Segregation of Funds). If the broker goes bankrupt or decides to close down, there is no compensation scheme to refund your deposit. Furthermore, unregulated brokers typically do not offer Negative Balance Protection, meaning if a trade goes badly, you could theoretically owe the broker money.

What problems are users reporting?

While Exnovas marketing suggests a seamless trading experience, the user feedback paints a specialized narrative of “easy deposits, impossible withdrawals.” In the last three months alone, there have been 11 severe complaints lodged against this broker.

The “Withdrawal Purgatory”

A recurring theme in the feedback, particularly from traders in Latin America and the Philippines, is the inability to access funds after making a profit. Users report that small deposits are accepted instantly, but as soon as a withdrawal request is made, communication stops.

For example, a user from the Philippines reported that after depositing and trading without issues, their account was suddenly blocked and emails were ignored the moment they tried to withdraw a mere $10 from a $3,000 balance. This is a classic tactic used by low-trust entities to freeze capital under the guise of “security checks.”

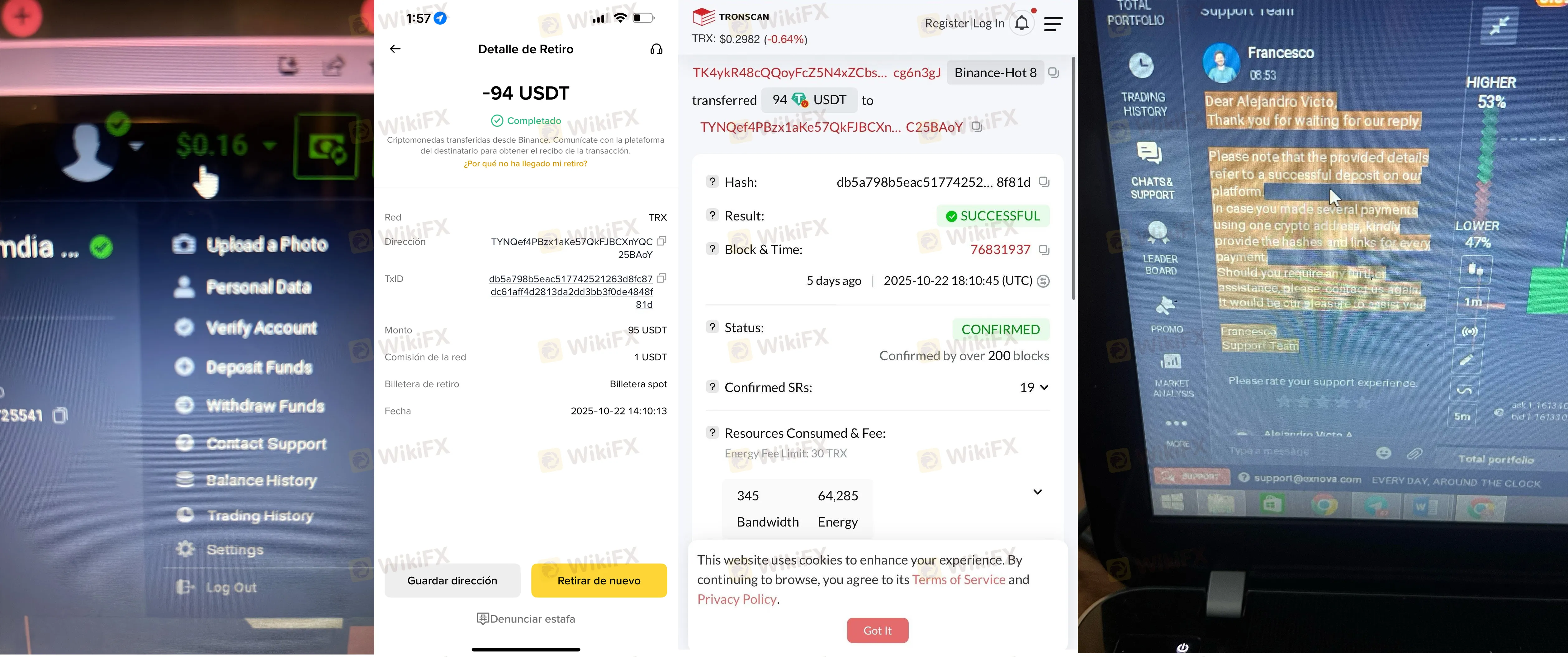

Crypto Deposit Disappearances

Another specific technical issue involves cryptocurrency deposits. A registered case from Bolivia detailed a transfer of 94 USDT via the TRC20 network. While the blockchain confirmed the transaction was successful, the funds never arrived in the Exnova trading account. Support allegedly failed to resolve the issue despite proof of payment (TxID).

In unregulated environments, crypto deposits are high-risk because they are irreversible. If the broker claims they “never received it”—despite blockchain proof—you have no legal recourse to force them to credit your account.

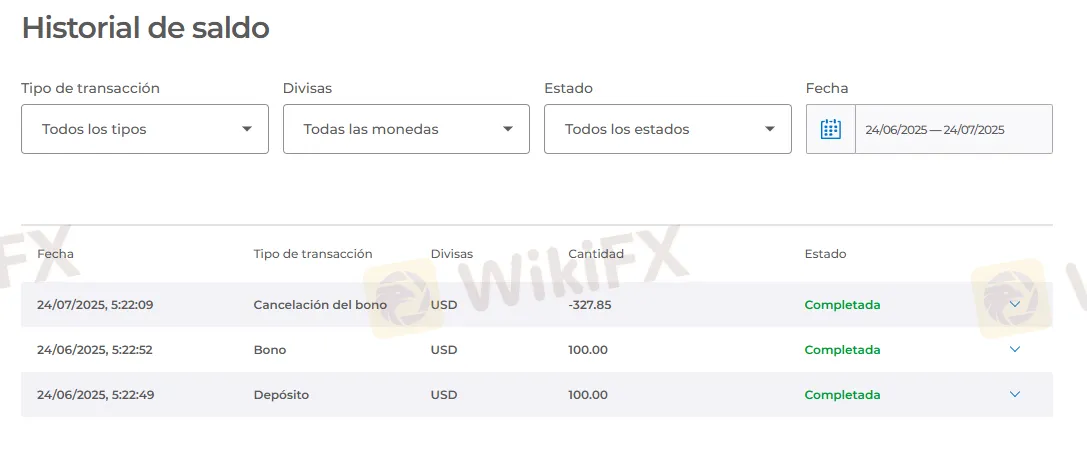

The Bonus Trap

A user from Ecuador reported losing money due to “bonuses.” Unregulated brokers often offer a “100% Welcome Bonus” to lock in your funds. The terms and conditions usually state that you cannot withdraw any money until you trade a massive volume (often impossible to achieve). In this specific case, the user claimed that after making a profit, the broker cancelled the bonus and emptied the account, labeling the user a “thief” (ladrones) in their complaint.

What trading conditions does Exnova offer?

Transparency is usually the first casualty with unregulated brokers. Exnova does not publicly disclose clear documentation regarding their standard spreads, maximum leverage, or commission structures in a verifiable format.

- ### The Platform Experience

It is worth noting that not all feedback is negative regarding the software. A few users (specifically from India) have mentioned that the interface is smooth and good for analyzing equities. However, a pretty interface is often used as a “honey trap” by illicit brokers. A functional app does not guarantee that the backend financial processing is legitimate.

- ### Hidden Costs

Without a regulatory requirement to publish “Key Information Documents” (KID), traders are often subject to widening spreads during news events. Since we have no data on their liquidity providers, Exnova likely operates as a “B-Book” broker, meaning they profit directly when you lose money.

- ### Leverage Concerns

While specific ratios aren't listed, user feedback hints at dissatisfaction with leverage limits on certain assets. However, high leverage in an unregulated environment is dangerous, as it accelerates losses without the safety net of balance protection.

Bottom Line: Should you trust Exnova?

We strongly recommend avoiding Exnova.

Despite its “A” rank for influence and high visibility in online advertising, the fundamentals are dangerous. The combination of a 1.43 WikiFX Score, a lack of valid regulation, and a consistent pattern of complaints regarding blocked withdrawals and missing crypto deposits makes this a high-risk entity.

The risks outweigh the benefits of their modern-looking app. Your capital is safer with brokers who are accountable to strict financial authorities.

Markets change fast. To verify the current license status of any broker before you hit “send” on a deposit, search for Exnova on the WikiFX App to see if their regulatory status has improved or worsened.

Read more

Common Questions About MIFX: Safety, Fees, and Risks (2025)

If you are looking into the Indonesian forex market, you have likely crossed paths with MIFX (Monex Investindo Futures). They are significantly influential in Southeast Asia, particularly Indonesia, with a footprint expanding into Malaysia and Vietnam. But popularity doesn't always equal safety.

VenturyFX Review 2025: Safety, Features, and Reliability

VenturyFX is a relatively new brokerage established in 2023 with its headquarters located in Mauritius. While the broker serves clients internationally, notably in regions such as Brazil/Colombia/Spain/Mexico, it currently operates without valid regulatory oversight. The broker holds a WikiFX Score of 1.37, which is considered low and indicates a high-risk environment for traders.

XCMARKET Review 2025: Unregulated Status and SCA Warning in the UAE

An in-depth review of XCMARKET. While it offers MT5 and diverse assets, the broker operates without a license and faces an official warning from the UAE's SCA.

B2Broker Review: Pros and Cons Explained

B2broker or B2Prime Review details the company background, offices, domains, and WikiFX score. Understand regulation and risk alerts.

WikiFX Broker

Latest News

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Why You’re a Millionaire on Demo but Broke in Real Life

Fake Government Aid Scams Are Wiping Out Elderly Savings

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

Common Questions About MIFX: Safety, Fees, and Risks (2025)

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Rate Calc