TigerWit Broker Review: Is TigerWit Legit or a Scam?

Abstract:Is TigerWit a scam? Review of revoked licenses, unregulated status, MT4 claims, WikiFX complaints & trader withdrawal risks. Hundreds of traders are questioning whether TigerWit is safe in 2025.

Is TigerWit a scam? Review of revoked licenses, unregulated status, MT4 claims, WikiFX complaints & trader withdrawal risks. Hundreds of traders are questioning whether TigerWit is safe in 2025.

Once promoted as a UK-based broker, TigerWit is now flagged as unregulated, with multiple revoked licenses and over 100 investor complaints. This review examines TigerWits real regulatory status, trading conditions, and why many traders now label it a high-risk broker.

TigerWit is an online trading broker that claims to offer forex, precious metals, commodities, and indices trading through the popular MetaTrader 4 (MT4) platform. Although it presents itself as a UK-based company with several years of experience, there are significant concerns about its legitimacy, regulatory status, and real-world trading reliability. Below, we look at the facts to help you decide whether this broker is trustworthy or a potential scam.

What Is TigerWit? Broker Overview & Background

- Broker Name: TigerWit

- Founded: Around 2015 (≈ 5–10 years)

- Registered Address: Sea Sky Lane, Sandyport, Nassau, Bahamas (but claims UK base)

- Trading Access: FX, metals, commodities, indices via MT4

- Minimum Deposit: ~$50 (varies by source)

Regulatory Status: Major Red Flags

One of the most important factors when choosing a broker is regulation, because it protects traders‘ funds and enforces operational safeguards. TigerWit’s regulatory claims are highly problematic:

Revoked or Unverified Licenses

- It previously held licenses from:

- SFC (Hong Kong) — revoked

- ASIC (Australia) — revoked

- Its claimed regulatory status with the UK‘s FCA and Bahamas SCB is unverified or known as “clone/suspicious”, meaning these licenses either aren’t held by the company or are being misrepresented.

Unregulated Broker

- TigerWit currently does not have valid, recognized regulatory oversight from any top-tier financial authority.

- Without proper licensing, theres no mandatory protection of client funds (e.g., segregation, compensation schemes, dispute resolution).

Unregulated status is one of the strongest red flags for forex brokers. Legit brokers are almost always regulated by reputable authorities like the FCA, ASIC, CySEC, or similar.

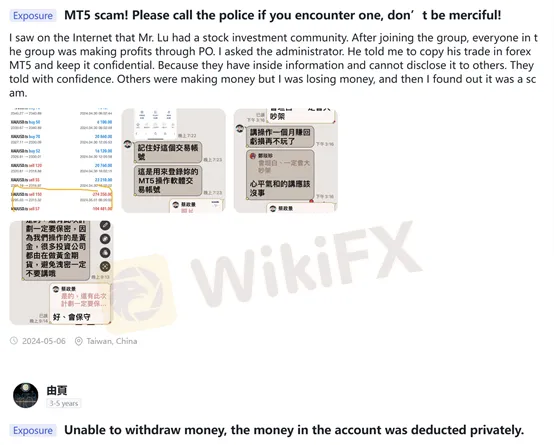

Customer Complaints & Operational Issues

A review of user feedback and industry reports reveals consistent complaints about TigerWits services:

Withdrawal Problems

- Many users report being unable to withdraw funds, with customer service unresponsive or nonexistent.

Account & Platform Issues

- Users have described the platform suddenly becoming inaccessible, accounts being frozen, or trading halted without clear explanation.

Forced Liquidation & Execution Problems

- Some traders report suspected forced liquidations and trading irregularities that could be disadvantageous to clients.

Volume of Complaints

- Independent review sites show over 100 complaints from traders reporting issues ranging from withdrawals to support failures — far outweighing positive feedback.

Pros and Cons of Trading with TigerWit

Despite these warnings, TigerWit lists some features typical of online brokers:

Pros (on paper)

- Access to MT4 platform

- Range of tradable instruments

- Demo accounts available

- Low minimum deposit options advertised

- Flexible leverage

Cons / Practical Issues

- No confirmed valid regulation

- Withdrawal and service failures

- No transparent or reliable fee structure

- Website and platform access issues

- High risk to client funds and security

TigerWit vs. Typical Regulated Brokers

| Feature | TigerWit | Typical Regulated Broker |

| Regulation | Unregulated / revoked or suspect | Fully regulated (FCA, ASIC, CySEC, etc.) |

| Client Fund Protection | None guaranteed | Segregated accounts, compensation schemes |

| Transparency | Opaque | Clear ownership, audited financials |

| Withdrawals | Many complaints | Generally smooth if compliant |

| Compliance Enforcement | No oversight | Regular audits and reporting |

| Trustworthiness | High risk | Lower risk |

| Recourse if Problems | Limited | Legal & regulatory recourse |

Key Differences Explained

- Regulated brokers must safeguard client funds in segregated bank accounts, submit to audits, and protect clients through dispute resolution systems.

- Unregulated brokers like TigerWit do not offer these protections, meaning if anything goes wrong — funds lost, platform shuts down, or fraud occurs — traders often have little to no recourse.

Conclusion: Legit or Fraud?

TigerWit currently poses a high risk to traders.

Given its lack of valid regulation, numerous user complaints, and evidence of operational and withdrawal issues, this broker should be treated with extreme caution.

While a broker might technically operate without being a “fraud” in the legal sense, the combination of misrepresented licenses, revoked oversight, and significant customer harm strongly suggests that TigerWit may behave like a scam or unsafe broker rather than a trustworthy trading partner.

Recommendations Before Trading

If you are considering TigerWit:

- Avoid depositing funds until its regulatory and operational issues are resolved.

- Check the regulation directly with the official regulator websites (FCA/ASIC/CySEC).

- Use brokers with transparent regulation and positive independent reviews.

Warning: If you have traded with TigerWit and experienced withdrawal issues, report the case to WikiFX and your local financial regulator immediately.

Read more

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

If you are looking for a new broker, you might have stumbled upon OtetMarkets (or Otet Markets). They are a relatively new face in the industry, having established themselves in 2023. With a modern website and promises of high leverage using top-tier software like MT5 and cTrader, they certainly look the part.

Gold and Silver Price Predictions and Trends 2026

Gold and Silver Forecast 2026 offers expert predictions, price insights, and market analysis to help shape your investment decisions.

Differences Between Cent and Standard Account Explained

Cent vs Standard account explained — compare lot sizes, risks, and benefits to find the right forex trading account for your goals.

FXPro Opens Trading on Medline’s Landmark IPO

Medline (MDLN.O) jumps 41% on its Nasdaq debut, sparking strong investor interest. Trade Medline shares easily with FXPro as the stock gains global attention.

WikiFX Broker

Latest News

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Phyntex Markets Review 2025: Safety, Fees, and User Complaints

Rate Calc