Titan Capital Markets Review 2025: Safety Warning and Scam Analysis

Abstract:Titan Capital Markets, established in 2021, presents itself as a financial service provider headquartered in Australia. However, a detailed analysis of its regulatory status and user feedback suggests significant risks. With a dangerously low WikiFX Score of 1.45, this broker has been flagged for regulatory irregularities and a high volume of investor complaints regarding withdrawal failures.

Titan Capital Markets, established in 2021, presents itself as a financial service provider headquartered in Australia. However, a detailed analysis of its regulatory status and user feedback suggests significant risks. With a dangerously low WikiFX Score of 1.45, this broker has been flagged for regulatory irregularities and a high volume of investor complaints regarding withdrawal failures.

Is Titan Capital Markets Legit?

When evaluating the safety of a broker, regulatory oversight is the most critical factor. Data indicates that Titan Capital Markets lacks a valid license for its current operations and has faced severe warnings from financial authorities.

Regulatory Status

Titan Capital Markets claims to be regulated in Australia, but the data reveals that its license is not sufficient for the services it provides. Furthermore, it has been blacklisted by other regulatory bodies.

| Regulator | Country | License No. | Status |

|---|---|---|---|

| ASIC (Australia Securities & Investment Commission) | Australia | 089 386 569 | Exceeded |

| SEC (Securities and Exchange Commission) | Philippines | N/A | Blacklisted |

What does “Exceeded” mean?

The status “Exceeded” regarding the ASIC license indicates that the company is operating outside the permitted scope of its license. While the entity “TITAN CAPITAL PTY LTD” holds a registration, it does not possess the necessary authorization to offer the specific financial services it is marketing to retail traders globally.

Philippines SEC Warning

In early 2024, the Philippines Securities and Exchange Commission (SEC) issued a public advisory against Titan Capital Markets. The regulator stated that the entity was operating without the necessary license to sell securities. The advisory explicitly mentioned that the broker's operations exhibited characteristics of a “Ponzi scheme,” where new investor funds were allegedly used to pay “fake profits” to earlier investors.

Titan Capital Markets Complaints and Exposure

Over the last several months, there has been a massive surge in complaints against this broker. Reports from users in India, the UAE, Maldives, Thailand, and Mauritius depict a collapse in services and untrustworthy behavior.

Withdrawal Failures and “Token” Conversion

The most common complaint involves the inability to withdraw funds. Numerous investors have reported that Titan Capital Markets stopped processing withdrawals for both principal and profit.

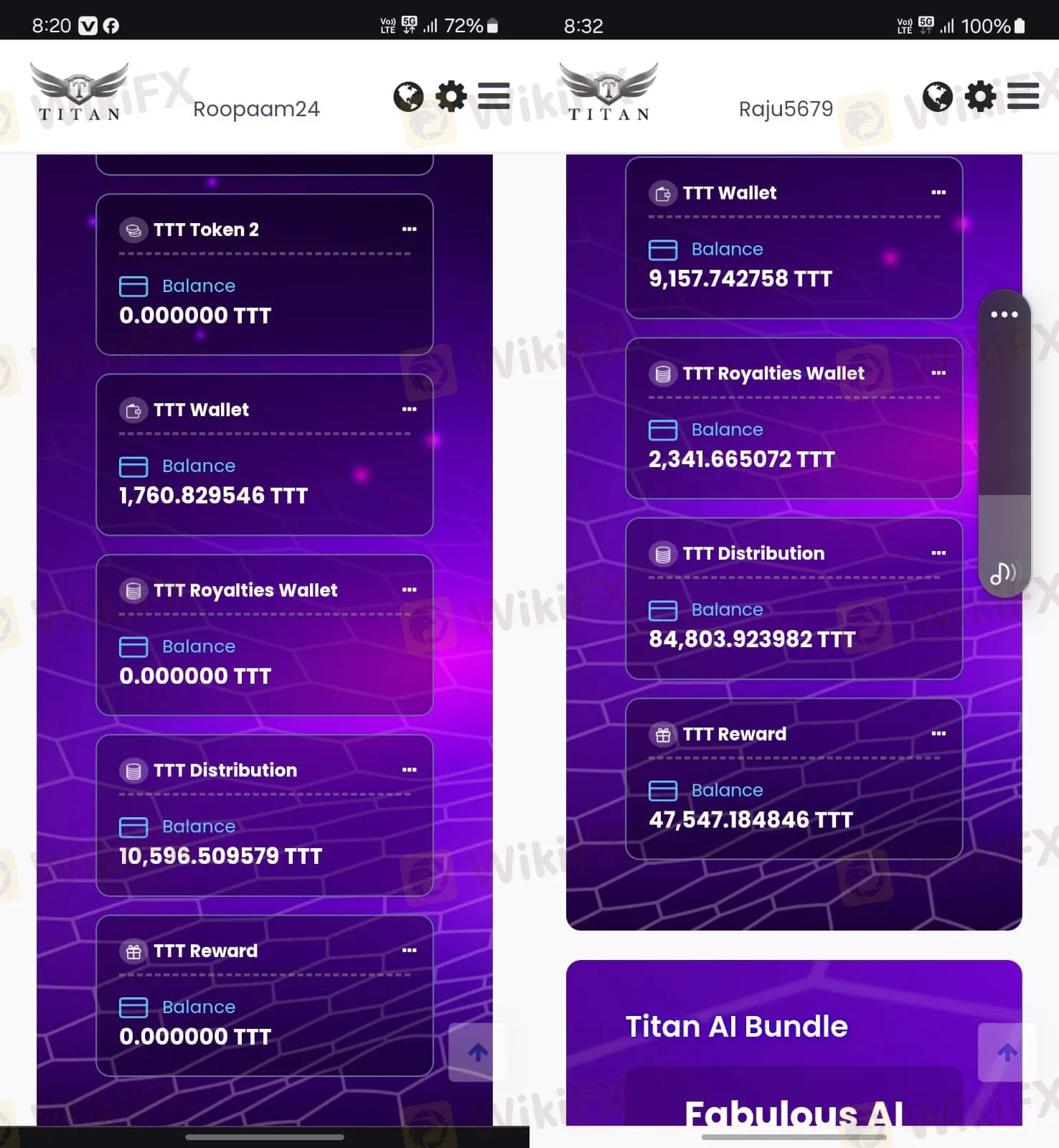

- Forced Tokenization: Multiple users cited that the company forcibly converted their funds into a cryptocurrency token named “TTT” (Titan Token) or moved funds to a “distribution wallet” without permission. Users report that these tokens cannot be withdrawn or have lost their value.

- “Tax” Demands: Some investors reported that when they attempted to withdraw, the broker demanded an additional “tax” payment (e.g., $566 USD in one case). Even after paying these fees, the withdrawals were not released, a tactic common in recovery scams.

Claims of Company Closure

Recent user reports from late 2024 and 2025 allege that the company has effectively “closed” or shut down its website services in certain regions. Users mentioned that communication channels were cut off, and accounts were blocked without notice. One user stated, “The company closed now... they forcibly kept the investor's dollars.”

Trading Conditions and Transparency

The review data for Titan Capital Markets effectively lacks standard trading information.

- Platform: There is no verified information regarding standard trading software like MT4 or MT5.

- Trading Costs: Data on spreads, commissions, and leverage is unavailable.

- Service Model: According to user complaints and regulatory disclosures, the company marketed “Investment Packages,” “Copy Trading,” and “AI Trading” with promises of monthly returns (ROI). This structure aligns more with high-yield investment programs (HYIP) than standard forex brokerage services.

Pros and Cons of Titan Capital Markets

Based on the available data, the disadvantages heavily outweigh any potential benefits.

Pros:

- Online customer support (Email available).

Cons:

- Regulatory Warning: Blacklisted by the Philippines SEC for Ponzi-like activities.

- License Issues: Operating beyond the scope of its Australian ASIC license.

- Withdrawal Blockage: Massive volume of complaints regarding stuck funds.

- Scam Tactics: Reports of forced token conversion and demands for “tax” payments.

- Low Score: Rated only 1.45/10.

Can You Trust Titan Capital Markets?

No, Titan Capital Markets is not safe. The combination of an “Exceeded” regulatory status in Australia and a “Blacklist” warning from the Philippines SEC provides a strong indication of illegitimacy.

The overwhelming volume of complaints regarding denied withdrawals, forced crypto-token conversions, and silent account suspensions confirms that investor funds are at extreme risk. Investors are strongly advised to avoid depositing money with this entity.

Protect Your Capital with WikiFX

Before investing with any broker, check their score and regulatory status on the WikiFX App. Use the app to access the latest “Exposure” lists to see if other traders are reporting scams, ensuring you avoid high-risk platforms like Titan Capital Markets.

Read more

Stockity Review 2025: Is It Safe to Trade or a Scam?

Stockity is an online brokerage firm established in 2022 and registered in the Marshall Islands. While it has established a marketing presence in regions such as Indonesia, South America (Argentina, Brazil, Colombia, Peru, Chile), and parts of Asia (India, Thailand), its regulatory standing raises significant concerns. With a WikiFX score of just 1.42 out of 10, Stockity is categorized as a high-risk entity due to the absence of valid regulatory licenses and multiple unresolved user complaints.

Strifor Review 2025: A Risk Analysis of This Unregulated Broker

Evaluating a broker’s safety requires a close look at its regulatory status, trading environment, and user feedback. Strifor is a brokerage firm established in 2022 with its headquarters in Mauritius. While it offers digital account opening and the popular MT5 platform, its low WikiFX score of 1.99 and regulatory status raise significant concerns.

QuoMarkets Review 2025: Safety, Features, and Reliability

QuoMarkets is a UAE-based brokerage established in 2022, offering completely digital account opening and access to the MetaTrader 5 (MT5) platform. While the broker provides support for multiple account types and cryptocurrency funding, it currently holds a low WikiFX Score of 3.09. This score reflects significant concerns regarding its regulatory status, with licenses marked as "Exceeded" or "Unverified" and explicit warnings from financial authorities.

Common Questions About InstaForex: Safety, Fees, and Risks (2025)

Finding a reliable broker is the most critical step in a trader's journey. With so many platforms promising high returns and low costs, it can be difficult to separate legitimate opportunities from dangerous traps. You are likely here researching InstaForex because their marketing caught your eye, but you want to ensure your capital is safe before depositing 1 cent.

WikiFX Broker

Latest News

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Rate Calc