Vietnam Forex Fraud Kingpin Arrested in Philippines

Abstract:Vietnam forex fraud suspect Le Khac Ngo arrested in Philippines as authorities uncover record-breaking cross-border investment scam.

Fugitive Behind Vietnams Largest Forex Scam Captured in Manila

Vietnamese fugitive Le Khac Ngo, 34, known online as “Mr. Hunter,” has been arrested in Manila following a coordinated operation between Interpol, Philippine security forces, and Vietnamese police. The high-profile arrest marks a major step in dismantling what investigators describe as the largest foreign exchange and stock investment fraud ever recorded in Vietnam.

According to the Hanoi Police Department, Ngo‘s extradition procedures are now underway in collaboration with the Philippine Department of Justice and Interpol’s Southeast Asia Bureau. Lieutenant General Nguyen Thanh Tung, Director of Hanoi Police, confirmed that Vietnamese authorities are preparing formal requests to bring the suspect back to face prosecution.

Ngos capture comes just months after his wife, Ngo Thi Theu, was detained through an Interpol alert in July. Both are believed to have spearheaded a multinational investment network that defrauded thousands of Vietnamese investors using sophisticated online trading platforms masked as legitimate foreign brokers.

Philippine law enforcement sources told local media that the operation involved extensive digital surveillance spanning several ASEAN countries. Ngo had reportedly been residing in a rented condominium in Quezon City under a false identity for months before his arrest earlier this week.

Inside the Record-Breaking Vietnam Forex Fraud Network

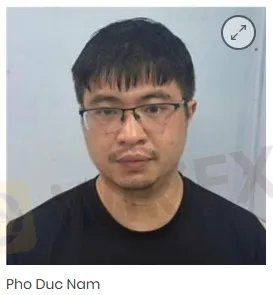

Vietnamese investigators report that Ngo and his business partner, Pho Duc Nam—known in forex circles as “Mr. Pips”—launched the fraudulent operation in late 2021. Working with a Turkish national who managed command centers in Phnom Penh, Cambodia, the trio built a network of shell companies operating 44 unlicensed offices across Vietnam.

Each office was staffed by teams of online brokers who promoted trading websites designed to mimic legitimate international platforms. Investors were initially guided through small, profitable trades to build trust. Once users expanded their deposits, the trading interfaces would suddenly display heavy losses, prompting many to invest further to recover funds.

Police estimate that more than 2,600 investors lost over VND1.1 trillion, equivalent to more than USD47 million. Authorities have since frozen assets linked to Ngos network valued at VND5.3 trillion, including villas, luxury cars, and bank accounts traced to Cambodia.

Investigators revealed that the group heavily relied on social media marketing to recruit victims. Nam and Ngo showcased opulent lifestyles—posting images of high-end vehicles, designer clothes, and foreign trips—to project financial success. Their social media presence drew in aspiring traders, particularly younger investors affected by pandemic-era economic uncertainty.

A Hanoi-based cybercrime analyst, Tran Duc Nam, commented that the operation‘s digital sophistication made it difficult to detect early on. “This network exploited gaps in Vietnam’s online trading oversight. Their use of foreign servers and multilingual marketing gave them the appearance of global credibility,” he said.

Vietnamese police are now probing more than 550 sales and support staff believed to have participated in the fraudulent promotion scheme. Preliminary reports suggest that some employees were unaware of the scam and believed they were representing legitimate investment firms.

Crackdown on Online Investment Scams Intensifies Across Southeast Asia

Authorities in Vietnam and neighboring countries have responded to Ngos arrest by accelerating efforts to curb online investment fraud. The Ministry of Public Security has announced an expansion of its cybercrime investigation unit, citing the growing number of cross-border scams that exploit social media and messaging platforms.

Earlier this year, Vietnams Ministry of Information and Communications revealed plans to restrict platforms such as Telegram after the company allegedly failed to respond to requests for cooperation in ongoing fraud investigations. Regulators noted that many investment scams originate from private messaging channels where victims are persuaded to join false “expert trading” groups.

Both Interpol and the ASEAN Cybercrime Operations Center have praised Vietnam‘s proactive role in regional cooperation. Cambodian and Thai officials reportedly provided technical assistance in tracing the online payments associated with Ngo’s scheme. Authorities say the case has now become a benchmark study for how transnational financial crimes evolve in digital-first economies.

Experts warn that the case underscores a larger regional challenge: the rise of unlicensed foreign exchange trading ecosystems that exploit economic volatility and social media trust. Financial consultant Pham Minh Hoang notes that Vietnams young investor demographic—motivated by fast-profit marketing—remains especially vulnerable. “Education and stronger investor protection laws will be crucial in preventing similar scams,” he added.

The arrest of Le Khac Ngo represents both a victory for Vietnam‘s law enforcement and a reminder of the global scope of financial deception in the digital era. As extradition proceedings move forward, authorities are expected to announce additional charges against accomplices connected to the network’s Cambodian operations.

For now, the Vietnamese police have reaffirmed their commitment to pursuing restitution for victims and tightening oversight of online trading platforms. The case is poised to become one of Southeast Asias most significant cross-border fraud prosecutions, further highlighting the need for shared digital investigation frameworks across the region.

Read more

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

World Forex Review: Does the Broker Deny Withdrawals and Scam Traders via Fake Bonuses?

Does World Forex prove to be a not-so-happy trading experience for you? Do you struggle to withdraw your funds from the Saint Vincent and the Grenadines-based forex broker? Do you witness hassles depositing funds? Failing to leverage the World Forex no deposit bonus, as it turned out to be false? These accusations are grabbing everyone’s attention when reading the World Forex review online. In this article, we have shared some of these. Read on!

Is Your Money Safe? The Capital.com Withdrawal Mystery Revealed

Are you trading with Capital.com? You need to read this report immediately. While this broker holds licenses in top jurisdictions, a disturbing pattern has emerged in our complaints center. Ordinary investors are reporting that their accounts are being frozen, withdrawals are being rejected, and—most alarmingly—users are being asked to pay more money just to get their own funds back. This report breaks down the facts, the regulatory cracks, and the stories of victims who are fighting to recover their savings.

Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Rate Calc