IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

Abstract:When choosing a broker, every trader's biggest concern is safety and trust: is it regulated? For IEXS, the answer isn't simply YES or NO. While the company says it's regulated by trusted authorities, looking closer shows a complicated and worrying situation with mixed evidence and serious risks. What they claim on the surface doesn't match up with official warnings, license problems, and many bad user experiences. This article gives you a detailed, fact-based look into IEXS regulations, breaking down their official licenses, what their trading platform is really like, and real stories from traders who have used it. Our goal is to give you the facts so you can make a smart decision about keeping your money safe.

The Main Question: Is IEXS Regulated?

When choosing a broker, every trader's biggest concern is safety and trust: is it regulated? For IEXS, the answer isn't simply YES or NO. While the company says it's regulated by trusted authorities, looking closer shows a complicated and worrying situation with mixed evidence and serious risks. What they claim on the surface doesn't match up with official warnings, license problems, and many bad user experiences. This article gives you a detailed, fact-based look into IEXS regulations, breaking down their official licenses, what their trading platform is really like, and real stories from traders who have used it. Our goal is to give you the facts so you can make a smart decision about keeping your money safe.

Breaking Down Their Regulation Claims

IEXS says it's a regulated company, listing licenses from both the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA). However, the real status of these licenses needs a much closer look. Understanding what these labels actually mean is important for figuring out how much protection traders really get.

ASIC “Appointed Representative” Status

IEXS has a license from ASIC (No. `001301063`), but it's listed as an “Appointed Representative” (AR). This is a very important difference. An AR doesn't have a full license by itself; instead, it works under the regulatory protection of a main, fully licensed company. This setup has risks. The oversight from the regulator is indirect, and the AR's compliance and operating standards depend on the main license holder. If the main company has problems or ends the relationship, the AR's regulatory standing could be immediately damaged.

Most worrying, this claimed regulatory protection is directly contradicted by an official alert. On August 13, 2025, ASIC put `IEXS Global (iexs.com)` on its Investor Alert List. This action by a top-level regulator is a serious red flag, suggesting that the authority has found potential harm to consumers or unauthorized activities connected with the brand, regardless of its AR status.

FCA “Exceeded” Status

In the United Kingdom, IEXS has an “Investment Advisory License” from the FCA (No. `923324`). However, this license is marked with an “Exceeded” status. From a compliance viewpoint, this is one of the most serious warnings a regulator can give short of completely canceling the license. An “Exceeded” status means that the company is likely doing activities beyond what it's allowed to do. For a license limited to “Investment Advisory,” this could mean the company is doing execution, handling client money, or other brokerage services that it's not authorized for. This status basically undermines the authority and protection that an FCA license is supposed to provide, since the company is not operating within the agreed regulatory limits.

Official Warnings and Contradictions

The problems with the licenses are made worse by a series of official risk warnings and tags connected with the IEXS profile. These alerts show a picture of a high-risk environment that's very different from the image of a stable, regulated broker. A summary of these warnings includes:

· Suspicious Overrun: This tag supports the “Exceeded” status of the FCA license, pointing to activities that go beyond regulatory permissions.

· High potential risk: A general but clear warning to potential users about the high level of risk connected with the platform.

· Too many complaints: The platform's score has been actively lowered due to a high number of user complaints, showing a pattern of problems rather than isolated incidents. A total of 12 formal complaints have been filed.

· ASIC Investor Alert List: As mentioned, this is a direct warning from a major global regulator, advising the public to be careful of the company.

These official alerts, combined with the problematic nature of the licenses themselves, suggest that any claims of strong regulation should be treated with extreme doubt.

A Deep Look into User Experiences

Regulatory data provides one layer of analysis, but the first-hand experiences of users offer a real-world look into the operational reality of the broker. The 12 complaints filed against IEXS show consistent and severe problems across several key areas, mainly affecting traders in India and Thailand. These accounts move beyond abstract risks to detail concrete financial losses and operational failures.

Widespread Withdrawal Problems

A recurring and deeply concerning theme among user complaints is the inability to withdraw funds. Multiple verified users from Thailand describe a nightmarish scenario where withdrawal requests are endlessly delayed, blocked without clear reason, or met with complete silence from customer support. Users express feelings of powerlessness, with one stating, “It feels like my capital is trapped, and I've completely lost control over my own assets.” Another notes, “A broker that can't even guarantee basic withdrawals is impossible to trust.” This failure to process withdrawals is a fundamental breach of trust and the most significant red flag for any financial service provider.

Severe Slippage and Execution Problems

Many complaints detail catastrophic slippage and poor platform performance, especially during volatile market news. These are not minor differences but massive deviations that lead to substantial, unexpected losses. Specific, data-backed examples include:

· Extreme Slippage on Stop-Loss: An Indian trader reported a 130-pip slippage on a USD/JPY stop-loss, turning a managed risk into a ₹270,000 loss. Another user trading USD/INR saw a 32-pip slippage that wiped out ₹21,000.

· Catastrophic Event Slippage: During a non-farm payroll report, a trader's GBP/CHF position experienced a 200-pip slippage, leading to the liquidation of a ₹700,000 position.

· Platform Freezes: Users consistently report the platform freezing or becoming unresponsive during critical moments. One trader described the system halting for seven minutes during an interest rate announcement, causing a 45-pip slippage and a ₹1,35,000 loss. Another reported a 40-second freeze while trying to close a profitable EUR/INR trade, which ultimately resulted in a loss.

These incidents directly contradict IEXS's marketing, which reportedly includes WhatsApp ads in Hindi promoting “zero slippage trading.”

Questionable Spreads and Hidden Fees

Another major point of contention is the inflation of spreads. One user provided a detailed account of trading EUR/USD, where spreads advertised as low as 1.2 pips would spike ninefold, from a typical 1.8 pips to 17.2 pips, during the release of Indian CPI data. This user calculated that the inflated spread on a single two-lot trade cost them an extra $296. This practice, described by the user as a “spread scam,” uses the volatility of news events to extract additional, non-transparent costs from traders.

While these user reports are alarming, you can review the spreads and account types IEXS officially promotes on its website to draw your own comparison.

The Counter-Argument: Positive Feedback

To provide a balanced perspective, it is important to note that not all feedback is negative. A few positive and neutral reviews exist. Some unverified users claim that negative reviews are part of a “malicious smear campaign,” stating their own withdrawal experiences have been timely and without issue. One verified user from India reported that USDT withdrawals were “quite fast,” processed in 45 minutes, though large amounts required profile verification. Other neutral comments point to less severe issues, such as slow customer service, difficult-to-understand English accents from support staff, or problems with bank transfer withdrawals. While this positive feedback exists, it is vastly outnumbered by the detailed, verified complaints documenting severe financial harm.

Looking at Trading Conditions

Beyond regulation and user reviews, a broker's trading infrastructure and account terms provide further insight into its quality and reliability. An objective analysis of IEXS's offerings reveals a mix of competitive features and concerning inconsistencies.

Account Types and Trading Costs

IEXS offers two primary account types: a Standard (STD) account and a DMA account. The advertised conditions present a stark contrast, but the details contain conflicting information, which is another red flag for operational clarity.

| Feature | Standard Account | DMA Account |

| Spreads | From 1.8 pips (EURUSD) | From 0.1 pips |

| Minimum Deposit | $200 | $10,000 |

| Commission | Not Specified | Not Specified |

Leverage, Platforms and Instruments

IEXS offers a maximum leverage of 1:1000. While this may be attractive to traders seeking to maximize their market exposure, such high leverage dramatically increases the risk of rapid and total account loss. It is a tool that should be handled with extreme caution.

The broker provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their robust charting tools and support for automated trading. IEXS offers a wide range of tradable instruments, including Forex, Metals, Energies, Indices, Stocks, and Cryptocurrencies, catering to a diverse set of trading strategies.

Traders interested in high-leverage options or the MT4/MT5 platforms can explore the full range of products IEXS offers directly on its website.

Technical Performance Metrics

Technical performance data provides an objective measure of a platform's stability and execution quality. The “Environment” scores for IEXS present a major contradiction that validates many of the user complaints.

· Transaction Speed: AA

· Transaction Cost: AA

· Trading Slippage: AA

· Rollover Cost: C

· Software Disconnected: D

The most glaring inconsistency lies between the “Trading Slippage” score and user experiences. The platform scores an “AA” for slippage, indicating excellent performance in tested conditions. Yet, the overwhelming majority of user complaints focus on severe, loss-inducing slippage. Conversely, the “Software Disconnected” score is a very poor “D.” This objective data point directly supports the numerous user reports of the platform freezing, lagging, or disconnecting during critical trading periods. This suggests that while the platform may perform well under ideal conditions, it fails catastrophically under real-world market stress, which is precisely when reliability matters most.

Conclusion: A Final Verdict

After a thorough analysis of IEXS regulation claims, user experiences, and technical data, a clear verdict emerges. While IEXS holds licenses, their status as an “Appointed Representative” and, more critically, an “Exceeded” entity raises serious doubts about their regulatory compliance and the protection offered to clients. These doubts are amplified to a critical level by the inclusion of IEXS on ASIC's official Investor Alert List—a direct warning from a top-tier regulator.

The evidence from user experiences is even more damning. The consistent, verified pattern of withdrawal failures, catastrophic slippage, and platform freezes represents a significant and demonstrable risk to traders' capital. These are not isolated incidents but a documented trend of operational failure that has resulted in substantial financial losses for its clients. The technical data, particularly the poor score for software disconnections, corroborates these user claims.

In light of this evidence, the risks associated with trading on the IEXS platform appear to be substantial and well-documented. The broker's marketing claims and the few positive reviews are overshadowed by the weight of official warnings and severe, verified user complaints. We advise traders to exercise extreme caution.

Ultimately, traders must conduct their own due diligence. We have presented the evidence based on available data. If you still wish to proceed, we strongly advise you to start with minimum capital you are willing to lose and carefully read all terms and conditions on its official website.

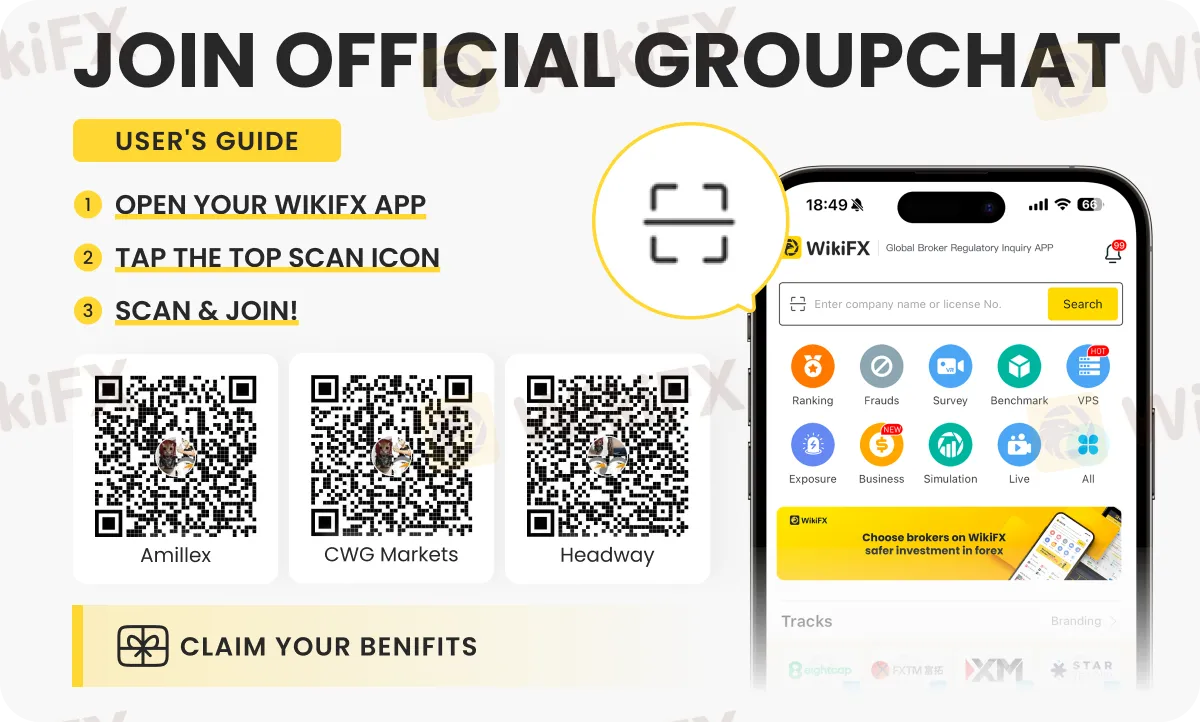

Want the latest forex news and updates? Look forward to joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

Does WealthFX Generate Wealth or Losses for Traders? Find Out in This Review

The name WealthFX sounds appealing for all those wishing for a rewarding forex journey. However, behind the aspiring name are multiple complaints against the Comoros-based forex broker. These trading complaints dampen the broker’s reputation in the forex community. In this WealthFX review article, we have shared some of these complaints here. Take a look!

FXPrimus Review: Is FXPrimus Regulated and Reliable for 2025?

FXPrimus is a CySEC-regulated forex broker offering MT4, MT5, and WebTrader with flexible leverage and diverse trading instruments since 2009.

IG Japan to Halt Crypto ETF CFDs as FSA Tightens Rules

IG Japan will end cryptocurrency ETF CFDs after new FSA guidance, forcing traders to close positions by January 31, 2026, under stricter crypto rules.

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Does FONDEX charge you spreads more than advertised to cause you trading losses? Does this situation exist even when opening a forex position? Do you witness customer support issues regarding deposits and withdrawals at FONDEX broker? Does the customer support official fail to explain to you the reason behind your fund loss? In this article, we have shared FONDEX trading complaints. Read on!

WikiFX Broker

Latest News

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Amillex Withdrawal Problems

IEXS Review 2025: A Complete Expert Analysis

IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

Oil and gas giant Wood plc sold to Dubai engineering firm

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Rate Calc