Your Complete MultiBank Group Crypto Trading Guide (2025)

Abstract:Many traders ask us: can you trade crypto with MultiBank Group? The answer is yes. You can access the exciting cryptocurrency market through a special tool called a Contract for Difference, or CFD. This guide will teach you everything you need to know about MultiBank Group crypto trading. We will show you the basics of their crypto CFDs and how to make your first trade. Our goal is to give you the knowledge and confidence to explore these markets safely and effectively. We'll explain the platform's features, available coins, and the important risk management strategies you need to succeed.

Many traders ask us: can you trade crypto with MultiBank Group? The answer is yes. You can access the exciting cryptocurrency market through a special tool called a Contract for Difference, or CFD. This guide will teach you everything you need to know about MultiBank Group crypto trading. We will show you the basics of their crypto CFDs and how to make your first trade. Our goal is to give you the knowledge and confidence to explore these markets safely and effectively. We'll explain the platform's features, available coins, and the important risk management strategies you need to succeed.

Understanding What is Available

To trade with confidence, you need to understand what the MultiBank Group crypto offering includes. Unlike buying coins from a crypto exchange, trading with MultiBank Group uses CFDs. This difference is important because it changes your entire trading strategy, risk level, and how you interact with the market. Let's break down this model so you have a clear foundation before you start.

What are Crypto CFDs?

A Contract for Difference (CFD) is a financial tool that lets you guess the future price movement of an asset without actually owning it. When you trade MultiBank Group crypto CFDs, you are making an agreement to exchange the difference in value of a cryptocurrency from when the contract opens to when it closes.

Here's how it works:

• Go Long (Buy): If you think the price of Bitcoin will go up, you would open a “buy” position. Your profit or loss depends on how much the price increases.

• Go Short (Sell): If you believe the price of Bitcoin will fall, you can open a “sell” position. This lets you potentially make money from a falling market, which is not easy when holding actual coins.

• The Role of Leverage: CFDs are leveraged products. This means you can open a larger position with a smaller initial deposit, called margin. While this can increase potential profits, it also increases potential losses, making risk management very important.

• No Digital Wallet Needed: Since you don't own the actual cryptocurrency, you avoid the technical difficulties and security risks of managing a digital wallet, private keys, and cold storage.

Benefits of a Regulated Broker

Trading crypto with a globally recognized and regulated broker like MultiBank Group offers clear advantages over using unregulated exchanges. MultiBank Group is regulated by over 10 top financial authorities, including the Australian Securities and Investments Commission (ASIC) and Germany's Federal Financial Supervisory Authority (BaFin). This strong regulatory framework provides security and trust that is often missing in the decentralized crypto space. Key benefits include the security of your funds in a protected environment, the ability to trade on both rising and falling markets, and the convenience of accessing crypto alongside forex, indices, and commodities on a single, powerful platform.

Why Choose MultiBank Group?

When deciding where to trade crypto, choosing the right broker is as important as your trading strategy. MultiBank Group has established itself as a strong choice for traders looking to access the crypto markets. The platform's combination of advanced technology, competitive conditions, and strong commitment to security creates a complete trading environment. Let's look at the specific features that make it a preferred choice for your crypto trading journey.

Strong Platform and Tools

The foundation of any successful trading experience is a stable and powerful platform. MultiBank Group provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are known for their reliability, advanced charting capabilities, and extensive library of technical indicators. Traders can conduct detailed technical analysis using built-in tools or add custom indicators and expert advisors (EAs) to automate their strategies. This level of customization and analytical power is crucial for navigating the fast-paced crypto markets.

Must-Read MultiBank Group Article- www.wikifx.com/en/newsdetail/202510306634566743.html

Competitive Trading Conditions

Profitability in trading is directly affected by costs. MultiBank Group focuses on providing competitive conditions to maximize your potential returns. This includes tight spreads on major crypto pairs, which reduces the cost of entering and exiting a trade. Additionally, the broker is known for its fast and reliable execution speeds, ensuring that your orders are filled at the prices you expect with minimal slippage—a critical factor in volatile markets. To give you a concrete idea, here are some example spreads you might encounter:

| Crypto Pair | Typical Spread (Example) |

| BTC/USD | $15 |

| ETH/USD | $1.2 |

*Spreads are variable and subject to market conditions. *

Security and Regulation

We cannot overstate the importance of security when dealing with financial markets. MultiBank Group's multi-regulatory framework is a cornerstone of its offering. By following the strict standards set by financial authorities worldwide, the broker ensures that client funds are held in segregated accounts, separate from the company's operational funds. This provides a significant layer of protection for your capital and reinforces the broker's commitment to transparency and trustworthiness.

Ready to explore these benefits firsthand? You can view all available crypto instruments.

A Step-by-Step Guide

Now that we've covered the basics, let's walk through the practical process of placing your first crypto trade. This section is designed to be a direct, hands-on guide, showing you exactly what to expect as you navigate the platform. We will guide you from setting up your account to closing your first position, explaining each step along the way.

Step 1: Account Setup

The first step is to create and verify your trading account. The process is streamlined and entirely digital. You'll need to provide some personal information and upload identification documents to comply with Know Your Customer (KYC) regulations. This is a standard security procedure required by all regulated brokers.

The quickest way to start is by visiting the [MultiBank Group crypto trading page] (https://multibankfx.com/products/cryptocurrencies) and clicking “Open an Account”. Follow the on-screen instructions to complete the registration form and submit your documents for verification.

Step 2: Funding Your Account

Once your account is verified, you'll need to deposit funds to use as trading capital. MultiBank Group offers a variety of convenient deposit methods, including bank wire transfers, credit/debit cards, and several popular e-wallets. Choose the method that works best for you and follow the instructions in the client portal to fund your account. Your funds will be held in the currency your account is denominated in, such as USD or EUR.

Step 3: Finding Crypto Instruments

With your account funded, it's time to open your trading platform (MT4 or MT5). The primary window for finding instruments is the “Market Watch” panel, typically located on the left side of the screen. If you don't see crypto pairs listed, right-click within the panel and select “Show All” to display all available instruments.

To trade multibank group bitcoin, for example, you would look for the symbol BTC/USD. To analyze its price action, right-click on the symbol and select “Chart Window” to open a new price chart.

Step 4: Analyzing and Placing Order

With the chart open, you can perform your technical analysis. Once you've decided on a direction (buy or sell), you can place your trade. Click the “New Order” button on the toolbar or right-click on the chart and select “Trading” -> “New Order”. This will open the order window, where you'll define your trade parameters:

• Volume: This is your trade size, measured in lots. Start with a small volume (e.g., 0.01 lots) to manage risk as you learn.

• Stop Loss: This is a crucial risk management tool. Set a price at which your trade will automatically close to limit potential losses.

• Take Profit: Set a price at which your trade will automatically close to lock in profits if the market moves in your favor.

• Order Type: For immediate execution at the current price, select “Market Execution”.

Once your parameters are set, click “Buy by Market” if you expect the price to rise, or “Sell by Market” if you expect it to fall.

Step 5: Monitoring and Closing

Your open position will now appear in the “Terminal” window at the bottom of the platform, under the “Trade” tab. Here, you can monitor its real-time profit or loss. You can close your trade at any time by clicking the “X” on the far right of the position line. Otherwise, the trade will close automatically if the price hits your Stop Loss or Take Profit level.

In-Depth Look at Assets

A key part of evaluating a broker is understanding the range and nature of the assets they offer. MultiBank Group provides access to a carefully selected group of the most popular and liquid cryptocurrencies, allowing you to speculate on the key players in the digital asset space. Furthermore, it's important to understand specific platform terminology, such as “wallet integration,” to avoid common misconceptions.

Major and Minor Crypto Pairs

The MultiBank Group crypto CFD offering focuses on the cryptocurrencies that command the most market attention and trading volume. This ensures better liquidity and tighter spreads for traders. You can trade these cryptocurrencies against the US Dollar, the most common pairing in the market.

The list of popular crypto CFDs includes:

• Bitcoin (multibank group bitcoin): BTC/USD

• Ethereum: ETH/USD

• Ripple: XRP/USD

• Litecoin: LTC/USD

• Bitcoin Cash: BCH/USD

• Solana: SOL/USD

• Cardano: ADA/USD

This selection gives you exposure to both the foundational cryptocurrencies and prominent “altcoins,” providing diverse opportunities to capitalize on market trends.

What “Wallet Integration” Means

You may see the term “MultiBank Group wallet integration” and wonder if you need to set up a crypto wallet. To be perfectly clear: you do not. This is a common point of confusion for those new to MultiBank Group crypto CFDs. Since you are trading contracts based on the price and not the actual coins, there is no asset for you to store.

The term “MultiBank Group wallet integration” refers to the broker's internal, institutional-grade infrastructure. It describes the secure systems MultiBank Group uses to manage its own liquidity, hedge its exposure, and interact with the broader crypto market. This is a backend process that is entirely separate from your trading account. For you, the trader, the key takeaway is a significant benefit: your funds remain secure in your regulated, fiat-denominated trading account. You are shielded from the technical risks, hacking threats, and complexities of managing your own private crypto wallet.

Essential Risk Management

Trading cryptocurrencies, even via CFDs, carries a significant level of risk due to their inherent volatility. A disciplined approach to risk management is not just recommended; it is essential for long-term success. Acting as a responsible broker, we believe in empowering you with the knowledge to trade safely. This section outlines the core risks and provides practical techniques to manage them effectively.

Volatility and Leverage

The crypto market is known for its rapid and substantial price swings. This volatility is what creates trading opportunities, but it is also the primary source of risk. When combined with leverage, the effects are magnified. Leverage allows you to control a large position with a small amount of capital, which can lead to amplified profits if the market moves in your favor. However, it can also lead to equally amplified losses if the market moves against you. It is a powerful tool that must be handled with extreme caution and a clear understanding of the potential downside.

Practical Risk Techniques

A structured approach to managing risk can protect your capital and help you trade more objectively. We strongly advise incorporating these techniques into your trading plan:

1. Always Use a Stop Loss: This is your most important risk management tool. A Stop Loss order automatically closes your trade at a predetermined price, capping your potential loss on any single trade.

2. Trade with a Plan: Before entering any trade, you should know your exact entry price, your Stop Loss level (maximum acceptable loss), and your Take Profit target (desired profit). Do not trade on impulse.

3. Position Sizing: A cardinal rule is to never risk more than a small, predefined percentage of your trading capital on a single trade. Many professional traders risk only 1-2% of their account balance per trade. This ensures that a string of losses will not wipe out your account.

4. Stay Informed: While technical analysis is key, major news events, regulatory changes, and shifts in market sentiment can cause significant price movements. Keep up with the factors driving the crypto market.

5. Start with a Demo Account: We highly recommend that new traders practice on a demo account. This allows you to get comfortable with the MultiBank Group crypto platform and experience market volatility without risking real money.

Conclusion: Start with Confidence

This guide has walked you through exactly how the MultiBank Group crypto offering works, from the core concept of CFDs to the step-by-step process of placing your first trade. By choosing a secure, regulated broker, you gain access to the dynamic crypto markets within a protected framework. By leveraging powerful platforms like MT4 and MT5 and applying the sound risk management principles we've discussed, you can develop a clear strategy and approach the markets with greater confidence. The tools and knowledge are now at your disposal.

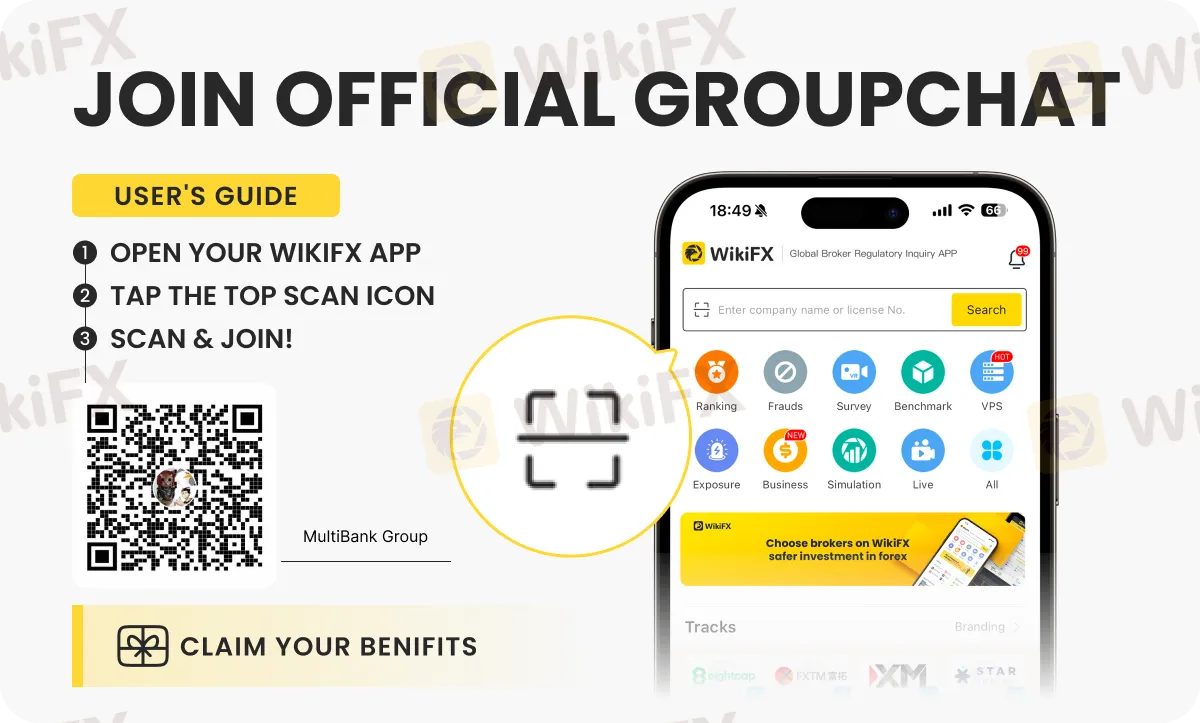

Join official MultibankGroup Broker community!

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Read more

KVB Global Exposed: High Slippage, Hidden Transaction Fees & Fund Scams

Does the MT4 platform provided by KVB Global minimize your actual profit? Does the broker deny your withdrawal request and instead tell you to deposit more? Have you faced hidden charges on blockchain transactions by the KVB Group? Have you witnessed massive fund scams while trading with the KVB broker? You need to act fast and even take legal assistance to recover your stuck funds. Several traders have alleged that KVB Global is involved in illegitimate trading activities. Check out their complaints in this KVB Global review.

Pocket Broker Review: Traders Furious Over Withdrawal Denials, Account Blocks & Price Manipulation

Does Pocket Broker ask you to verify the payment method repeatedly as you request fund withdrawals? Does the South Africa-based forex broker disallow you the same despite multiple verifications? Does your Pocket Broker forex trading account get blocked without any reason? Do the prices shown on the Pocket Broker login vary from real market prices? These are forex investment scams that Pocket Broker has been allegedly involved in. Read on to find more details.

Is MH Markets Safe or a Scam? Regulation and Fund Security Explained

Is MH Markets a real broker or a potential scam? This is the most important question for any trader thinking about using this platform. Let's give you a straight answer right away. MH Markets is a working broker, not a complete fake scam. Read on to learn more about this crucial due diligence you need to do as a trader.

Spec FX Broker Review 2025: Regulated or Not?

Spec FX Broker Review 2025 defines the broker’s regulation status, licenses, account types, and trading platforms in a neutral, data-driven overview.

WikiFX Broker

Latest News

Forex24 Faces CySEC Fine for Late Compliance Filing

"Our Business Has Died": Texas Services Sector Sentiment Slumps Further In October

One Wrong Move Wiped Out a Government Retiree’s Lifetime Savings

INTERPOL, AFRIPOL Crack Down on Africa Terror Finance

Forex Scam Checker Philippines: Verify Brokers with WikiFX

MH Markets Review 2025: Trading Platforms, Pros and Cons

Mekness Review: Traders Report Alleged Fund Scams & Account Blocks

Octa FX in Pakistan: The Complete Guide to Local Payments, Regulation, and Support

D Prime to Exit Limassol Office Amid Doo Group Restructure

WikiFX Elites Club Committee Concludes Voting! Inaugural Lineup Officially Announced

Rate Calc