Forex Broker Scams Surge Across Asia’s Trading Markets

Abstract:Investment scams tied to fake forex brokers and crypto exchanges are rising in Asia, exploiting weak KYC rules and targeting cross-border investors.

Fake Forex Brokers Exploit Asias Expanding Markets

Fraudulent investment platforms posing as legitimate forex brokers and cryptocurrency exchanges have become the most pressing financial threat across Asia. Investigators warn that these scams are no longer isolated incidents but part of a coordinated, transnational enterprise.

The schemes rely on advanced social engineering, luring victims through social media and encrypted messaging apps. Once contact is made, scammers present themselves as seasoned traders or financial mentors, offering “exclusive” access to high-yield opportunities.

Recent reports from Vietnam highlight the scale of the problem. In August 2025, authorities dismantled a billion-dollar crypto fraud tied to the Paynet Coin platform. Twenty individuals were arrested on charges ranging from asset misappropriation to multi-level marketing violations. Analysts say this case is only the tip of the iceberg, with dozens of similar operations still active across the region.

How Scam Brokers Build Trust and Extract Funds

Unlike traditional cybercrime, these forex scam brokers operate with corporate-style hierarchies. Researchers describe a distributed model where each actor has a defined role:

- Target Intelligence Teams mine stolen data from the dark web to identify wealthy or investment-minded individuals.

- Promoters craft convincing personas on TikTok, Telegram, and Facebook, posing as entrepreneurs or financial coaches.

- Payment Handlers open and manage bank accounts and digital wallets, exploiting gaps in KYC and KYB verification.

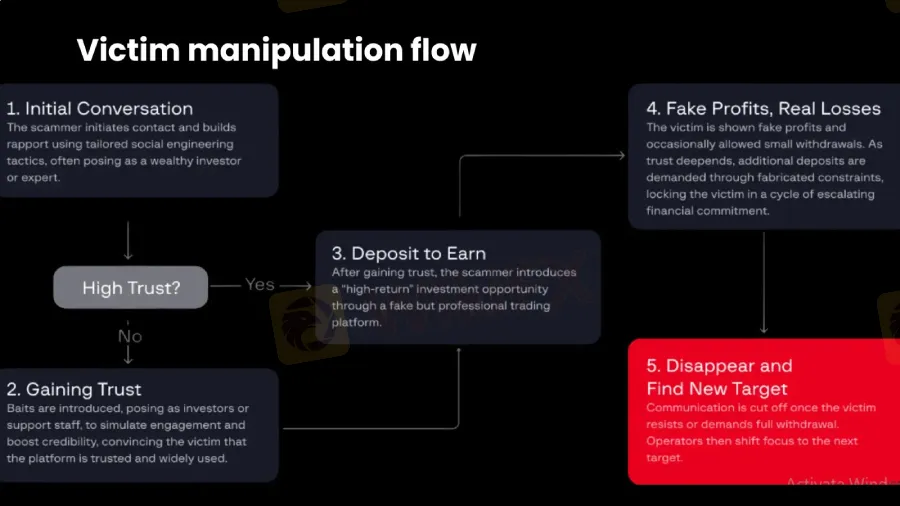

- Backend Operators design fake trading dashboards that display fabricated profits, reinforcing the illusion of legitimacy.The manipulation funnel follows a predictable pattern. Victims are first approached casually, often through a “friendly” introduction. If hesitant, they are shown fabricated testimonials or introduced to fake fellow investors. Once trust is secured, the platform displays simulated profits, sometimes even allowing small withdrawals to deepen credibility.

As deposits grow, withdrawal requests are delayed with excuses ranging from “system upgrades” to “compliance checks.” When victims demand full payouts, communication abruptly ends, and the fraudsters move on to new targets.

Technical analysis shows these scams are not isolated websites but interconnected networks sharing backend infrastructure. Invitation-only access codes tie each victim to a specific promoter, ensuring accountability within the fraud ecosystem.

Regulatory Crackdowns and Criminal Adaptation

Governments are tightening controls, but scam brokers are adapting just as quickly. Vietnams Circular 17/2024, effective July 2025, introduced stricter corporate account requirements, including biometric verification. While this has disrupted some operations, it has also fueled underground markets for forged documents, stolen IDs, and even AI-powered face-swap technology.

Archived scans of dismantled domains reveal recurring code structures and admin panels, suggesting a centralized backend supporting multiple scam brands. Analysts warn that generative AI is increasingly being integrated into fraud infrastructure, from automated chatbots to deepfake onboarding videos.

The sophistication of these operations underscores the urgent need for coordinated international enforcement. Financial regulators across Asia and beyond are calling for stronger KYC standards, cross-border intelligence sharing, and public awareness campaigns to blunt the impact of these scams.

Read more

Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

GKFX Review: Are Traders Facing Slippage and Account Freeze Issues?

Witnessing capital losses despite tall investment return assurances by GKFX officials? Do these officials sound too difficult for you to judge, whether they offer real or fake advice? Do you encounter slippage issues causing a profit reduction on the GKFX login? Is account freezing usual at GKFX? Does the United Kingdom-based forex broker prevent you from accessing withdrawals? You are not alone! In this GKFX review guide, we have shared the complaints. Take a look!

Major Complaints of MUFG Broker in 2025 You Shouldn’t Ignore

2025 is about to end, and if you still want to be a trader or investor and are looking for a broker to invest with. It is important to read real user complaints first. This will help you understand the kind of problems users are facing with MUFG broker. In this article, we will tell you about the major complaints users have reported about MUFG in 2025, so you know what to watch out for. Do not ignore this MUFG broker article and understand the problems.

Europol Cyber-Patrol Week Targets $55M Crypto Piracy

Europol’s Cyber-Patrol Week exposed $55M in illicit crypto tied to IPTV piracy, disrupting sites and strengthening EU intellectual property enforcement.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Rate Calc