Olymptrade Review: Regulation and Risk

Abstract:Olymp Trade is an online broker claiming VFSC oversight, but registry checks show no valid license; traders face elevated regulatory and fraud risk.

Olymp Trade review: Is it regulated and safe?

Olymp Trade markets itself as a multi-asset broker with zero-commission stock entries and forex spreads from 0, but public registry checks and third‑party risk monitors indicate no currently valid regulation, placing users at heightened risk of unprotected losses and dispute difficulties.

Key findings

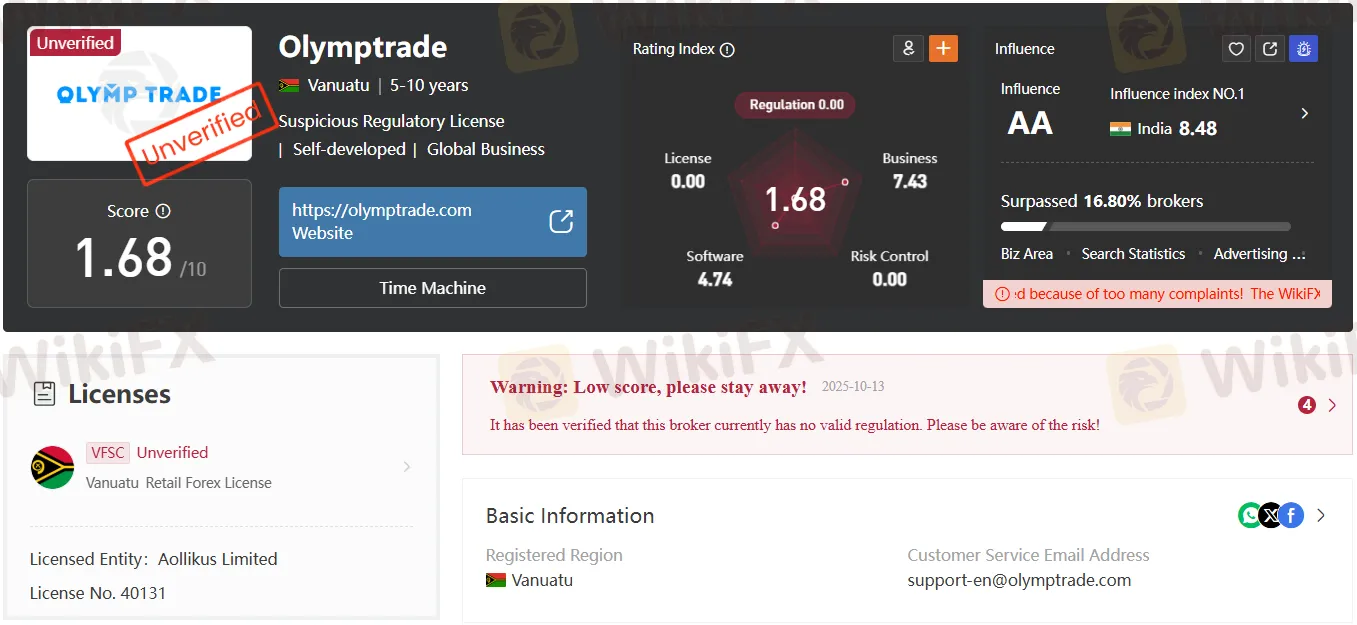

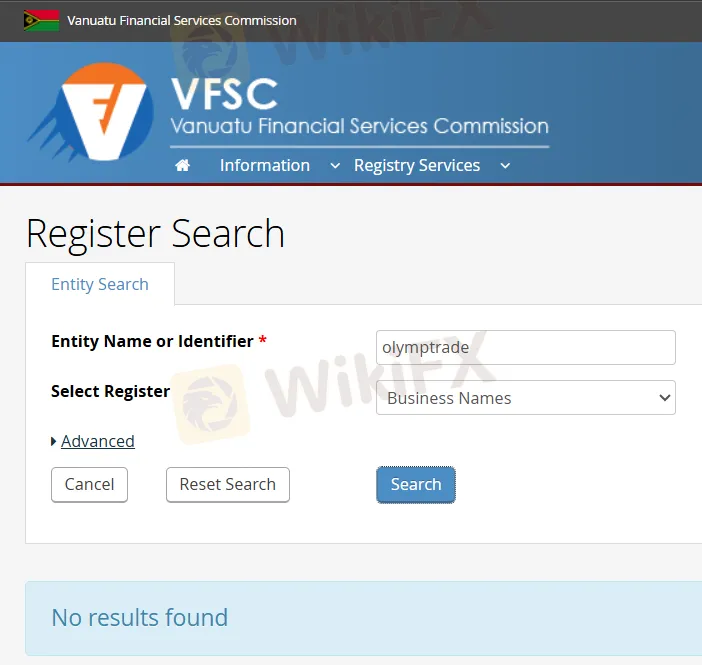

Olymp Trade states it is “licensed and regulated by the Vanuatu Financial Services Commission (VFSC)” and highlights client protections such as deposit insurance and a compensation fund, yet the brokers VFSC business‑name query returns no results and external monitors flag an unverified regulatory status.

Broker snapshot

- Brand and origin: Olymp Trade, established in 2014, registered in Vanuatu with a listed office at 1276, Govant Building, Kumul Highway, Port Vila.

- Trading offer: In‑house platform on desktop, mobile, and PWA; forex and select stocks; no MT4/MT5; minimum deposit of $/€10; demo and Islamic accounts available.

- Pricing claims: Forex from 0 spread with commissions from 0.6 pips; zero commission on stock order entry; inactivity fee $10 after 180 days of no activity.

- Regulatory red flags: VFSC search shows no matching entity; third‑party rating labels the license “unverified” with a low score and warns of too many complaints.

Regulation status

Olymp Trades materials reference a VFSC “Retail Forex License” No. 40131 for Aollikus Limited with an effective date of 2023‑01‑06, but the status is marked “Unverified,” and a VFSC registry search for “olymptrade” returns “No results found,” which conflicts with a clean, active authorization.

Risk assessment

- No valid, verifiable oversight means clients may lack recourse to a statutory complaints scheme, segregated client money audits, and capital adequacy controls commonly mandated by tier‑1 regulators.

- A third‑party monitor assigns a 1.68/10 score, calls the license “unverified/suspicious,” and explicitly warns to stay away due to complaints, indicating elevated operational and conduct risk.

- Marketing emphasis on a compensation fund and deposit insurance is not backed by a regulator listing in the VFSC public search results, increasing the risk that promised protections cannot be enforced.

Products and platforms

Olymp Trade focuses on spot forex and a limited selection of stocks, with over 100 assets cited broadly across majors, minors, and exotics, but it does not support cryptocurrencies, commodities, indices, ETFs, bonds, options, or futures in the current specification.

Its proprietary platform covers desktop, mobile, and a web PWA, targeting beginners; industry‑standard terminals MT4/MT5 are not supported, which limits third‑party tooling and independent order‑execution analytics.

Accounts, deposits, and fees

Account information is sparse in official summaries, beyond a $/€10 minimum and availability of demo and Islamic accounts, suggesting limited transparency versus multi‑tier account structures used by established brokers.

Deposits are accepted via bank cards, e‑payments, and crypto; withdrawals require submitting a request from the account area with a minimum of $/€10, but processing times and payout channels are not detailed in the overview.

A $10 monthly inactivity fee applies after 180 days without funding or trading, and forex pricing is presented as “zero spread with commissions from 0.6 pips,” while stock opening trades cite zero commission with commission assessed on closing profitable trades.

Pros and cons

- Pros: Low entry threshold at $/€10, demo access for practice, 24/7 support, and simple in‑house platform UX for first‑time traders.

- Cons: Unverified regulation, no MT4/MT5, limited instruments beyond basic forex and some stocks, and incomplete public detail on account tiers and execution policies.

Independent checks and signals

A domain record shows olymptrade.com registered on 2014‑04‑14 with renewal to 2026‑04‑14, consistent with the brands 2014 launch narrative, but this does not substitute for regulatory validation.

The risk monitors “VFSC Unverified” tag tied to Aollikus Limited (License No. 40131) and its explicit 2025‑10‑13 warning strengthen the case that regulatory coverage is currently absent or not recognized by the cited authorities.

Expert view and user awareness

From a compliance perspective, a broker that cannot be located in the VFSCs business‑name registry and is flagged unverified by an industry monitor presents a high‑risk profile for custody and best‑execution outcomes.

For beginners attracted by $10 entry and slick apps, the central trade‑off is convenience versus the absence of a regulator capable of auditing client‑fund segregation, leverage controls, negative‑balance protection, and dispute resolution under administrative law.

Safety checklist

- Verify any claimed license directly in the stated regulators public registry rather than relying on badges or images within marketing material.

- Avoid funding accounts with significant sums until regulator listings, legal entity names, and license numbers match across public sources.

- Prefer brokers with transparent execution statistics, published best‑execution reports, and support for independent platforms that allow third‑party analytics.

Bottom line

Olymp Trade offers a low‑cost, beginner‑friendly platform and minimal entry requirements, but the lack of a verifiable, current license in the VFSC search and unverified ratings create a material consumer‑protection gap that overshadows its pricing and UX claims.

Until a valid authorization can be confirmed in the regulators registry, traders should treat the broker as unregulated and consider safer alternatives with recognized oversight.

Read more

Aron Markets (Aron Group) Broker Review 2025: Is It a Safe Choice Amid Low Ratings and No License?

Is Aron Markets safe? Offshore registration, no valid oversight, 1:1000 leverage. Read pros/cons, account types, and user experiences.

FCA Warning list 2025: Unauthorised firms to Avoid

Pay attention, Traders and Investors! Here is the UK FCA Warning List 2025. In this list, you will find unauthorised firms that you need to beware of. Check the full FCA Warning List below

Traders Report Fund Scam & High Slippage at TD365: Read What They are Saying

Finding it hard to log in to your TD365 forex trading account? Have you been facing losses due to the broker’s trade manipulation tactics? Do you face high slippage issues at TD365? These issues have become so rampant that many of its traders have gone online to criticize the Bahamas-based forex broker. In this article, we have discussed various complaints. Read on to know about them.

Foul Play Exposed in TRADE REPUBLIC: Fund Scam, Poor Customer Support & Server Issues Hit Traders

Is TRADE REPUBLIC customer support service the worst you have come across? Are you constantly losing trades due to the broker at fault? Do you always face server issues, inhibiting you from opening and closing forex positions through this platform? Many have been facing these trading issues at the Germany-based forex broker. Some of them have expressed their issues on broker review platforms. In this article, we have shared their reviews of TRADE REPUBLIC.

WikiFX Broker

Latest News

【WikiEXPO Global Expert Interviews】Sergei Grechkin:AI, Risk, and the Future of Forex

Evonik CEO Kullmann Calls For End Of CO₂ Cult: Wake-Up Call For Europe's Economy

Stand a Chance to Earn $10 for Each Broker Review – Join Now!

FCA Warning list 2025: Unauthorised firms to Avoid

Traders Report Fund Scam & High Slippage at TD365: Read What They are Saying

What Are Mule Accounts? Understanding the Financial Crime

Trucking Industry Advised To Audit All Drivers To Limit CDL Liability

ASIC Warns of Offshore Outsourcing Risks

For Many, This Recession Will Feel Like A Depression

Olymptrade Review: Regulation and Risk

Rate Calc