How to Spot and Avoid Financial Scams

Abstract:Financial scams have grown more deceptive across digital platforms. Learn to recognize key scam types, detect warning signs, and protect your money confidently.

Introduction

Financial scams are deliberate acts of deceit designed to steal money, personal data, or both, often disguised as legitimate financial opportunities. With the expansion of digital platforms, scammers now exploit social media, email, and instant messaging to reach a global audience. They craft professional websites, impersonate licensed advisors, and manipulate trust using persuasive language, fake success stories, and emotional pressure.

Understanding exactly how these scams work is your best protection. The sections below detail the most common scam types, their inner workings, and the subtle warning signs professionals use to identify them early.

Defining Financial Scams

A financial scam involves any fraudulent scheme in which an individual or organization deceives others to secure money or confidential information. These scams often mimic legitimate financial services—using convincing visuals, technical jargon, and falsified documentation—to appear trustworthy.

They thrive on three psychological levers:

- Trust: Displaying fake endorsements or pretending to be licensed experts.

- Urgency: Insisting that an opportunity will vanish unless acted upon immediately.

- Complexity: Using confusing terms to discourage questions or delay critical thinking.

Why Awareness Is Critical

Scammers succeed when potential victims react emotionally rather than rationally. Public awareness shifts control back to the consumer by instilling cautious, informed decision-making. The more you recognize patterns of fraud, the less likely you are to fall victim to them—and the more capable you become of protecting others through shared knowledge.

The Main Types of Financial Scams

Forex Trading Scams

Foreign exchange markets are legitimate, but scammers exploit their technical nature to disguise false investment platforms. These operators often advertise “guaranteed daily profits” or use automated trading bots to feign legitimacy. Victims typically deposit money into controlled accounts, see simulated “profits” appear on dashboards, and are then asked to deposit even more. When withdrawal requests are made, access is suddenly restricted, or fees are demanded before funds can be released.

Common Tricks:

- Fake brokers use polished websites and false regulatory claims.

- “Mentorship programs” that double as multi-level recruitment schemes.

- Testimonials from fabricated clients showing doctored profit screenshots.

Warning Signs: Overly confident profit promises, cryptic contract terms, and vague contact details.

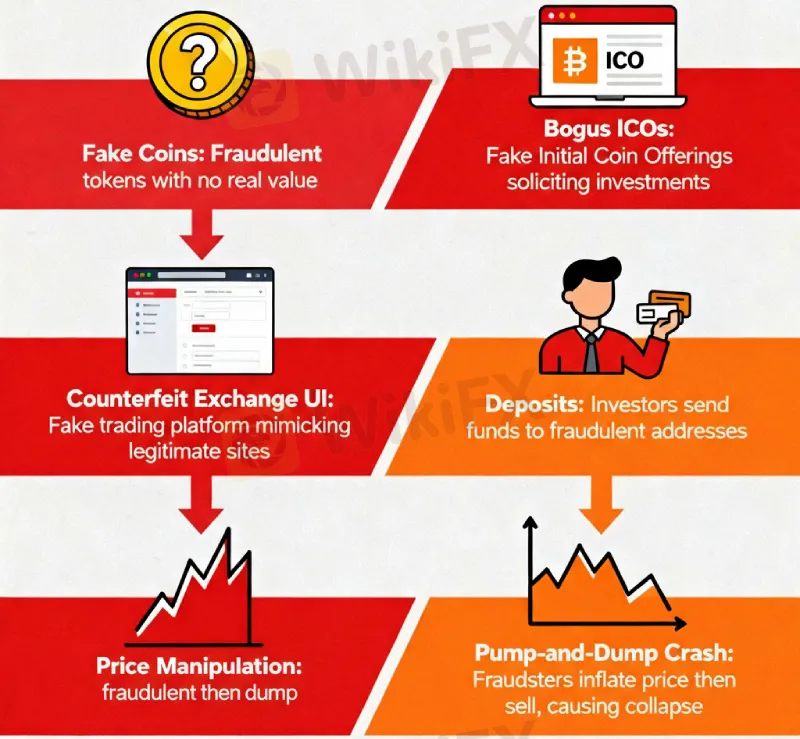

Cryptocurrency Fraud

The digital asset boom has become fertile ground for innovative scams. Criminals create fake coins, bogus Initial Coin Offerings? (ICOs), or counterfeit crypto trading exchanges. Some even replicate the interface of real platforms, convincing users to deposit genuine funds. Others conduct “pump and dump” schemes, manipulating hype to raise a coins value before selling off their own holdings, leaving investors with worthless tokens.

Common Variants:

- Rug pulls: Developers abandon a project after raising funds.

- Phishing theft: Fake wallets or links capture login credentials and private keys.

- Social media coins: Influencers push unverified tokens with empty promises.

Warning Signs: Anonymous developers, grammatical errors in whitepapers, or unsolicited offers emphasizing exclusivity.

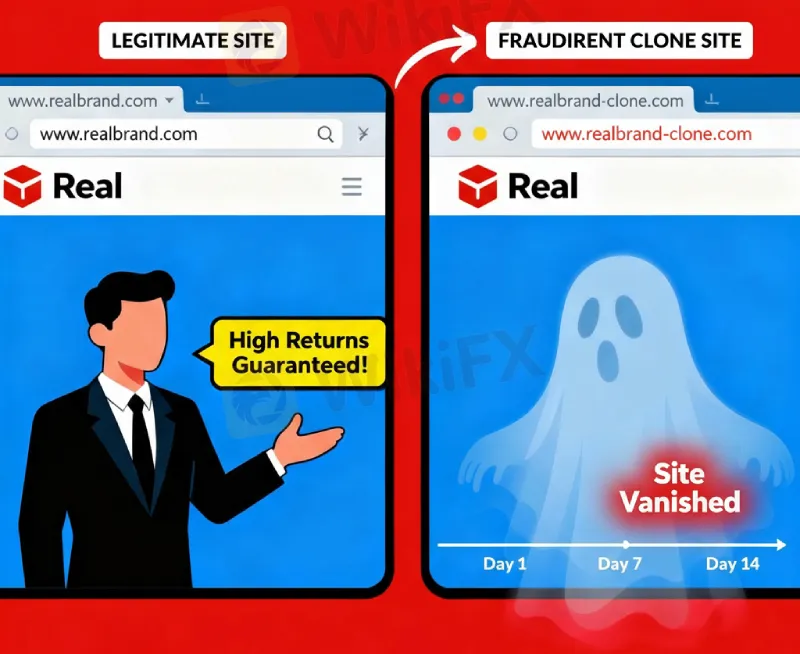

Clone Firms

Clone scams impersonate real companies by duplicating their branding, website design, and registration details. The resemblance is often meticulous—logos, disclaimers, and even customer service chat interfaces look identical. The fraudster contacts investors pretending to be legitimate representatives, offering high-return packages or “private trading access.”

What exposes these scams are subtle inconsistencies: slightly altered email domains, missing terms of service links, and untraceable telephone numbers. In many cases, these impostor sites exist only for a few weeks before disappearing completely, leaving victims with empty accounts.

Warning Signs: Website URLs with minor spelling changes (for example, “.co” instead of “.com”), calls discouraging direct company contact, or representatives pushing confidential “executive access” offers.

Romance Investment Scams

These emotionally charged scams combine social engineering with financial deception. The con artist builds comfort and trust through dating apps or social platforms, often over weeks or months. Once emotional dependence is established, the scammer introduces an investment “opportunity” — commonly in crypto or foreign exchange — promising shared financial success. They may even allow small returns initially, reinforcing the illusion. Eventually, the victim is persuaded to invest more substantial amounts, after which all communication ceases.

Psychological Triggers: Flattery, empathy, and shared long-term visions. The fraudster operationalizes affection as financial leverage.

Warning Signs: Quick emotional attachment, reluctance to meet in person, and investment discussions framed as “our future together.”

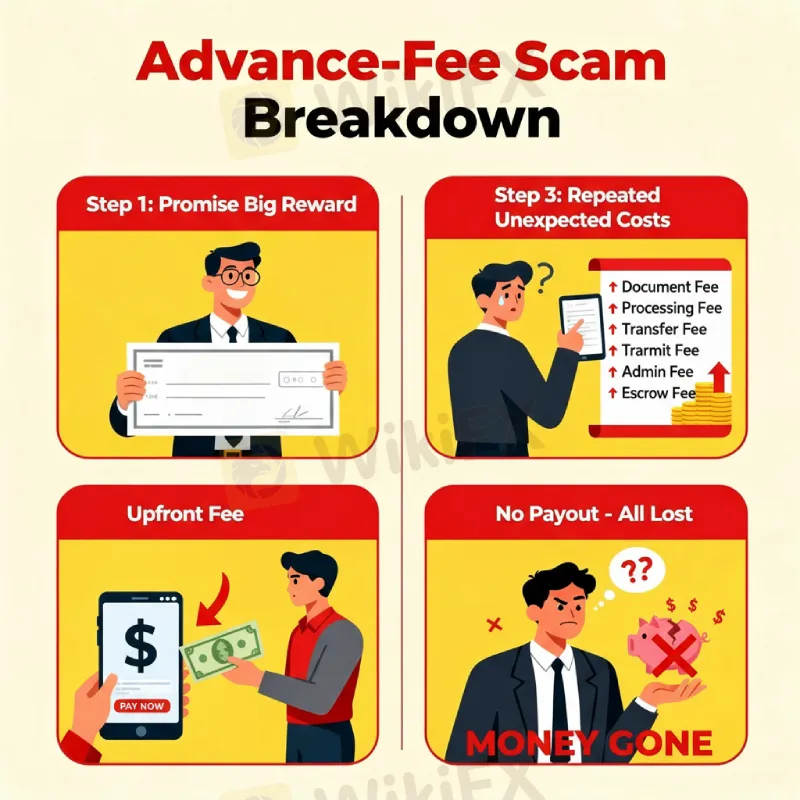

Advance Fee Fraud

A classic scheme where fraudsters claim the victim is end to a substantial reward—an inheritance, contract payment, or lottery win—and must pay preliminary “processing” or “tax” fees first. These promises prey on greed and optimism. Once the fee is paid, further “unexpected costs” appear until the victim realizes the reward was fabricated.

Typical Formats:

- Fake emails from government agencies or lawyers.

- Phony prize notifications and sponsorship offers.

- Job or loan approvals requiring upfront security deposits.

Warning Signs: Pressure for confidentiality, poor grammar, vague sender identities, and unrealistic offers requiring prepayment.

Social Media Investment Scams

Social media has become a fertile hunting ground for scammers posing as successful traders or financial coaches. They display images of luxury cars, screenshots of bank balances, and supposed testimonials to project instant credibility. Victims are persuaded to join private groups or “signal channels” on apps like WhatsApp or Telegram, where the scammer directs collective investments into untraceable accounts.

How They Operate: They use the illusion of community trust—people investing together—to normalize risk and silence skepticism. Many even fabricate conversations showing fake profits or withdrawals.

Warning Signs: Over-the-top lifestyle posts tied to “secret strategies,” membership fees for trading groups, or messages promising earnings without effort.

Protecting Yourself

- Verify legitimacy: Always confirm a platforms registration with a recognized financial or regulatory authority.

- Slow down: Time pressure is the scammers strongest weapon. Take time to research before committing funds.

- Document everything: Save contracts, messages, and transaction confirmations.

- Guard your personal data: Never share identification numbers, login details, or banking credentials online.

- Do not invest emotionally: Evaluate opportunities objectively and detached from any personal connection.

Reporting Financial Scams

If you suspect a scam, collect evidence such as emails, chat logs, payment records, and account details. Report it to financial watchdogs, law enforcement, or verified consumer protection agencies. Prompt reporting increases the likelihood of tracing stolen funds and protecting others from similar traps.

Final Insights

Financial scams are not only economic crimes—they are psychological manipulations that exploit human behavior. Every scheme depends on convincing victims to believe. The simplest defense is vigilance: question every claim, verify every source, and trust your own skepticism. True investments withstand research and patience; scams demand secrecy and speed.

When you remain informed, every scam you recognize is one you refuse to fund—and that awareness keeps the financial world safer for everyone.

Read more

How to Use a Buy Limit Order in Forex Trading

A buy limit is an order to purchase a currency pair at a specified price or lower. Learn how to use this tool to automate entries and improve your forex trading strategy.

Understanding Leverage in Forex: The Double-Edged Sword

The use of leverage can be extreme in foreign exchange markets, with the ratio usually remaining as high as 100:1. This implies that one can trade up to $100,000 in value for every $1000 of the trading account balance. However, forex brokers can take it even further, as there is no maximum leverage in forex. It purely depends on the broker and the guidelines of regulators across regions. While it is indeed a critical tool for a successful trading journey, it can easily be a double-edged sword by piling up losses because of misconceptions. In this article, we have discussed these. Take a look!

How to Verify if a Forex Broker is Legit or not?

Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in this article we’ll let you know the steps to verify if a broker is legit or not ?

Top 5 Forex Trading Mistakes to Avoid

Posting impressive forex trading profits requires attention to detail and impeccable discipline. Jumping straight into trading without meaningful preparation can dent your hard-earned capital. Despite being a profitable investment avenue, some traders face mountains of losses owing to common forex trading mistakes they commit. In this article, we have discussed the forex mistakes to avoid. Read on and implement these lessons when trading.

WikiFX Broker

Latest News

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

FXONET Exposed: Traders Report Scam Allegations & Major Capital Losses

RM66 Million Lost in Ponzi Scheme Allegedly Tied to Datuk Businessman

Traders Expose Major Flaws in Moomoo’s Operations: Payout Issues, Poor Support & More

AssetsFX Review 2025: Is This Broker Safe or a Red Flag?

Webull UK announces its new offer

Starmer meets Modi on his first visit to India

ScoreCM Faces Traders’ Wrath: Unprofessional Behavior & Withdrawal Delays Spoil Investment Mood

Spot Forex Trading Explained: Definition, How It Works and Key Factors to Know

How to Spot and Avoid Financial Scams

Rate Calc