How to Use a Buy Limit Order in Forex Trading

Abstract:A buy limit is an order to purchase a currency pair at a specified price or lower. Learn how to use this tool to automate entries and improve your forex trading strategy.

Introduction

In the fast-paced world of foreign exchange (forex) trading, success often hinges on precision and strategy. Traders must execute their plans with discipline, entering and exiting positions at optimal price points to maximize potential gains while managing risk. One of the most fundamental tools for achieving this precision is the buy limit order. A buy limit is a type of pending order that instructs a broker to automatically purchase a currency pair at a specific price that is below the current market price. This allows traders to set their desired entry point in advance and wait for the market to “come to them,” rather than constantly monitoring charts.

The primary purpose of a buy limit order is to buy into a currency pair after its price has dipped, based on the trader's analysis that the price will rebound and move higher after hitting that lower entry point. It is a strategic tool for traders who believe an asset is temporarily overpriced and want to purchase it at a discount. Understanding how to correctly place, manage, and integrate buy limit orders into a broader trading plan is a crucial skill. It distinguishes reactive trading from proactive, strategy-driven execution, forming a cornerstone of disciplined market participation for both novice and experienced traders.

What is a Buy Limit Order?

A buy limit order is an instruction given to a trading platform to execute a buy trade at a predetermined price that is lower than the current market price. It is one of several “pending order” types, meaning it is not executed instantly like a market order. Instead, it remains inactive until the market price drops to the level specified by the trader.

The core logic behind a buy limit is rooted in the “buy low, sell high” principle. Traders use this order type when their analysis suggests that a currency pair, despite being in a potential uptrend, will experience a temporary price drop (a pullback or retracement) before continuing its upward trajectory. By setting a buy limit, the trader aims to enter the market at the bottom of this dip, securing a more favorable entry price than if they had bought at the prevailing market rate .

For example, if the EUR/USD currency pair is currently trading at 1.0850, but a trader's analysis identifies a strong support level at 1.0800, they might place a buy limit order at 1.0800. If the market price falls to this level, the order is automatically triggered, and a long (buy) position is opened. If the price never reaches 1.0800 and instead continues to rise, the order remains unfilled.

How Buy Limit Orders Work in Trading

The mechanics of a buy limit order are straightforward. When a trader places this order, they specify two key parameters: the currency pair they wish to trade and the exact entry price . This order is then sent to the broker's server and held until the market conditions are met.

In forex trading, price is quoted with two figures: the bid price and the ask price. The bid is the price at which a trader can sell the base currency, while the ask is the price at which they can buy it. A buy limit order is triggered when the ask price falls to the level of the specified limit price . Once triggered, the order is filled at that price or, in some cases, a better (lower) one if available, though this is less common in liquid markets.

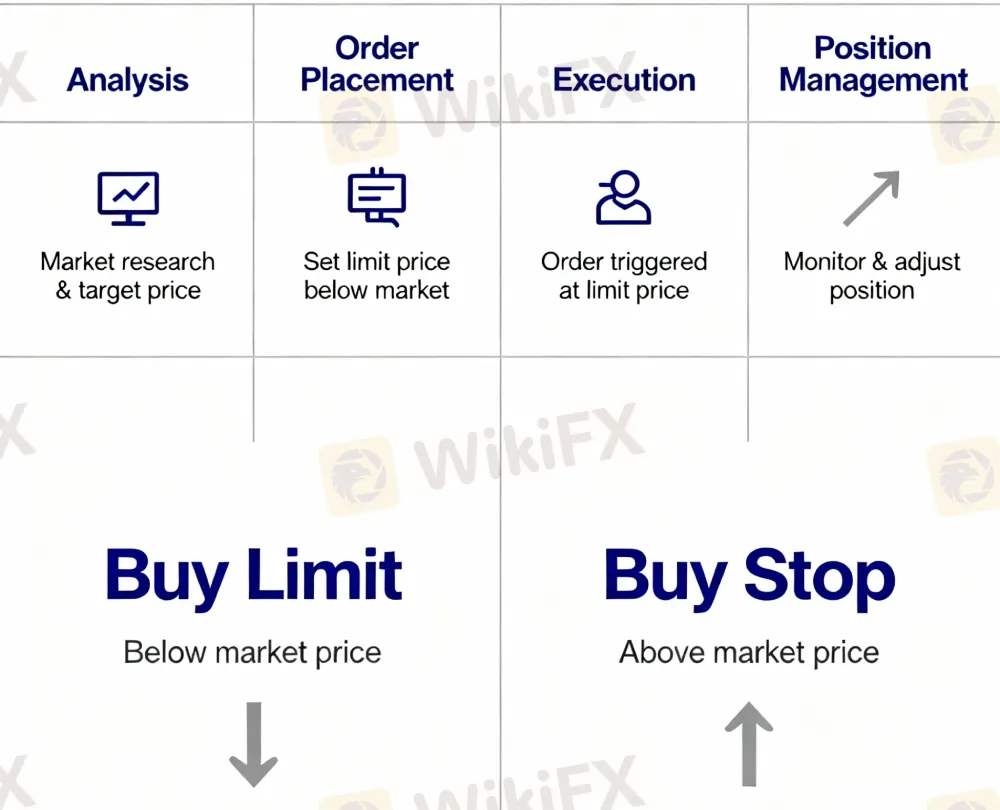

Here is a breakdown of the process:

- Analysis: The trader identifies a potential buying opportunity at a price below the current market rate, often at a technical level like a support zone, trendline, or Fibonacci retracement level .

- Order Placement: The trader accesses their trading platform, selects the desired currency pair, chooses “Buy Limit” as the order type, and inputs their target entry price. They will also set other parameters, such as position size (lot size), and optionally, a Stop Loss and Take Profit level .

- Execution: The order sits pending on the server. If the market's ask price drops to the limit price, the broker executes the trade automatically.

- Position Management: Once the position is open, it is managed like any other live trade, subject to the pre-set Stop Loss and Take Profit levels or manual intervention by the trader.

A crucial aspect to understand is the difference between a buy limit and a buy stop order. While both are pending buy orders, a buy stop is placed above the current market price and is used to enter a trade when the price breaks through a resistance level, capitalizing on upward momentum. A buy limit, in contrast, is counterintuitive to momentum; it anticipates a price reversal from a lower level.

Strategic Advantages of Using Buy Limits

Employing buy limit orders offers several distinct advantages that can enhance a trading strategy and promote disciplined habits.

- Improved Entry Price: The most significant benefit is the ability to enter the market at a more favorable price. Buying at a lower level increases the potential profit margin if the market moves as anticipated and can provide a better buffer against minor adverse price movements.

- Automation and Discipline: Buy limits eliminate the need for constant screen monitoring. Traders can conduct their analysis, set their orders, and let the market do the work. This removes the emotional temptation to jump into a trade prematurely or hesitate and miss an entry.

- Trading Pullbacks and Retracements: This order type is perfectly suited for strategies that involve buying during pullbacks in an uptrend. It allows traders to systematically enter at points where the price is expected to find support and resume its upward movement.

- Enhanced Risk-to-Reward Ratio: By securing a lower entry price, the distance to a logical stop-loss level (e.g., just below a support zone) is often reduced. At the same time, the distance to a profit target can be increased. This combination naturally improves the trade's risk-to-reward ratio, a critical component of long-term profitability.

Key Risks and How to Mitigate Them

Despite their benefits, buy limit orders are not without risks. The primary danger is that the trader's analysis is incorrect and the price continues to fall after the order is triggered.

- Catching a “Falling Knife”: The most common risk is that what appears to be a temporary dip is actually the beginning of a sustained downtrend or a support level break. If a buy limit is placed at a support level and that level fails, the trader is immediately entered into a losing position as the price continues to decline.

- Mitigation: Always use a Stop Loss order in conjunction with a buy limit. A stop loss placed just below the entry point will automatically close the position if the market moves against the trade beyond a certain threshold, limiting potential losses . Additionally, traders should wait for confirmation signals—such as bullish candlestick patterns—at the support level before committing to a trade.

- Missed Trading Opportunities: Another risk is that the price pullback is not deep enough to trigger the buy limit order. The market might reverse just short of the specified entry price and then move strongly in the anticipated direction, leaving the trader behind.

- Mitigation: While frustrating, a missed trade is better than a bad one. To reduce the chances of this happening, traders can set their limit orders slightly above a key support level rather than exactly on it. This creates a small buffer zone and increases the probability of the order being filled, though it comes at the cost of a slightly less optimal entry price.

A Step-by-Step Guide to Placing a Buy Limit Order

Placing a buy limit order is a standard feature on virtually all modern trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The process is generally similar across different brokers.

- Open the 'New Order' Window: In your trading platform, select the currency pair you wish to trade and open the new order ticket.

- Select 'Pending Order': Instead of 'Instant Execution' or 'Market Execution', change the order type to 'Pending Order'.

- Choose 'Buy Limit': From the dropdown menu of pending order types, select 'Buy Limit'.

- Specify the Entry Price: In the at price' field, enter the exact price at which you want the order to be triggered. This price must be below the current market ask price .

- Set Position Size: Enter the volume of the trade (e.g., 1.0 for a standard lot, 0.1 for a mini lot).

- Set Stop Loss and Take Profit (Recommended): It is highly advisable to enter your Stop Loss and Take Profit levels at this stage. The Stop Loss should be set at a price below your entry price, and the Take Profit should be set above it.

- Place the Order: Click the 'Place' button. The order will now appear in your terminal's 'Trade' tab as a pending order, waiting for the price to reach your specified level.

Advanced Strategies and Final Insights

Beyond simple support-level entries, buy limit orders can be integrated into more complex strategies. Traders can place a series of buy limit orders at successively lower levels within a broad support zone—a technique known as scaling in. This allows a trader to build a position at an average price, reducing the risk of entering their full position at a single, potentially flawed, entry point.

Expert traders emphasize that the effectiveness of a buy limit order depends entirely on the quality of the underlying analysis. It is not the order itself that creates profit, but the strategic reason for placing it at a specific level. Successful use requires a deep understanding of market structure, support and resistance, and price action. By combining this technical analysis with the disciplined execution that buy limit orders provide, traders can significantly elevate their approach from reactive speculation to a structured, professional trading methodology.

Read more

Understanding Leverage in Forex: The Double-Edged Sword

The use of leverage can be extreme in foreign exchange markets, with the ratio usually remaining as high as 100:1. This implies that one can trade up to $100,000 in value for every $1000 of the trading account balance. However, forex brokers can take it even further, as there is no maximum leverage in forex. It purely depends on the broker and the guidelines of regulators across regions. While it is indeed a critical tool for a successful trading journey, it can easily be a double-edged sword by piling up losses because of misconceptions. In this article, we have discussed these. Take a look!

How to Verify if a Forex Broker is Legit or not?

Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in this article we’ll let you know the steps to verify if a broker is legit or not ?

Top 5 Forex Trading Mistakes to Avoid

Posting impressive forex trading profits requires attention to detail and impeccable discipline. Jumping straight into trading without meaningful preparation can dent your hard-earned capital. Despite being a profitable investment avenue, some traders face mountains of losses owing to common forex trading mistakes they commit. In this article, we have discussed the forex mistakes to avoid. Read on and implement these lessons when trading.

Scalping vs Swing Trading: Which Forex Strategy Suits You Better?

Confused about which to choose between scalping and swing trading? The basic difference between the two is this - While scalping involves quick trades meant to earn small profits, usually within minutes, swing trading focuses on larger price movements over a few days or even weeks. Keeping this in mind, we have shared the definition of scalping and swing trading, their pros and cons, and other critical insights. Keep reading to learn about which is better - forex scalping vs swing trading.

WikiFX Broker

Latest News

Malaysia Investor Alert List is Out! Check the list to Avoid Scam

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Top Forex Regulatory Bodies You Need to Know

Think Your Broker is Safe? 5 Secrets Only WikiFX Can Uncover

Fidelity Global Innovators to High Risk in Jan 2026

RM8.7 Million Lost to Scam Promising US$3 Million Returns Abstract: 57 Malaysians have collectively

WTO hikes global trade forecast for 2025 — but next year doesn't look so good

Why Forex Trading? Top 10 Reasons to Start Now

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

AssetsFX Review 2025: Is This Broker Safe or a Red Flag?

Rate Calc