Fortex Review: Tech Vendor, Not Regulated

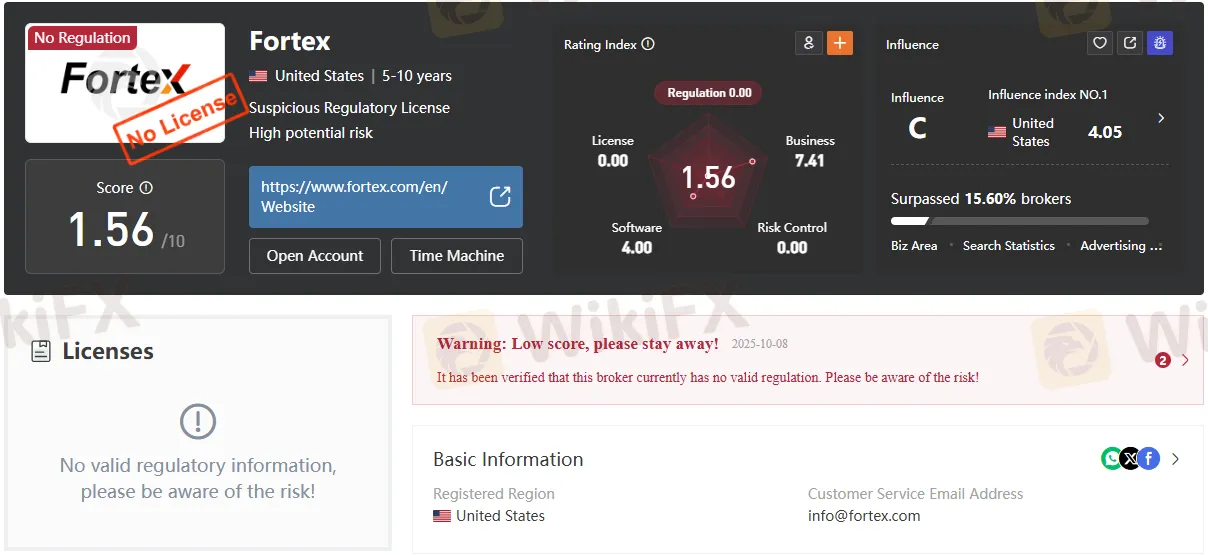

Abstract:Fortex operates without valid regulation, posing a high risk to traders; here’s what it is, how it works, and why an unlicensed status is a red flag for safety.

Who is Fortex

Fortex is presented as a financial trading technology provider offering middleware, APIs, ECN platform access, and connectivity products such as Fortex Bridge OMX, Fortex XCloud, Fortex 7, and AlgoX for multi-asset trading. It markets low-latency infrastructure colocated with Tier‑1 liquidity venues and claims sub‑1 ms round‑trip times across Equinix facilities, positioning itself as a liquidity and execution tech partner.

Why Unregulated Status Matters

The broker profile for Fortex shows no valid regulatory license, with a risk flag advising the public to stay away due to a verified absence of supervision by recognized authorities. Lack of licensing undermines transparency obligations, client fund protections, dispute resolution mechanisms, and standard audits expected from regulated intermediaries.

Headline Risk Indicators

Independent scoring places Fortex at 1.56/10 overall, with “Regulation 0.00,” “Risk Control 0.00,” and warnings highlighting “High potential risk” due to unlicensed operations. The profile includes a dated risk note indicating a low score and no valid regulation as of 2025‑10‑08, reinforcing that the regulatory gap is current.

Corporate Footprint and History

The materials list a Silicon Valley headquarters at Palo Alto Square, 3000 El Camino Real, Building 4, Suite 200, Palo Alto, CA 94306, and contact lines including info@fortex.com and support@fortex.com. A related corporate record shows FORTEX INC registered in Delaware (No. 7186231) established on 2018‑10‑25, with an agent address at 2035 Sunset Lake Road, Suite B‑2, Newark, DE 19702.

Claimed Products and Infrastructure

Fortex Bridge OMX is described as middleware connecting MetaTrader 4/5 to global liquidity through Equinix NY4, HK1, and LD4, touting hundreds of thousands of tickets per day and sub‑millisecond speeds. Fortex XCloud is positioned as high‑frequency, low‑latency connectivity hosted in dedicated data centers where Tier‑1 providers cross‑connect to a server grid for fast execution at scale.

Platform Suite and Trading Scope

The Fortex ECN platform stack—Fortex 7 and AlgoX—is marketed for currencies, commodities, CFDs, and equities, combining a visual interface with algorithmic automation capabilities. The broader proposition claims an end‑to‑end ECN ecosystem aggregating global liquidity pools through the cloud into user applications and strategy engines.

Pros and Cons

- Pros: multi‑year industry presence; live chat and multiple contact channels listed for support.

- Cons: no regulation, suspicious license warnings, and explicit risk alerts advising avoidance due to the absence of valid oversight.

Domain and Reach Signals

The fortex.com domain shows an effective date of 2001‑08‑07 with server location in the United States and registrar Network Solutions, LLC. Traffic heat lists the United States, Nigeria, Türkiye, India, and Canada among the most visited countries/areas for the domain, indicating global exposure despite regulatory gaps.

Experience and Expert Perspective

Based on the referenced dossier, the primary experiential signal is sustained marketing of institutional‑grade connectivity and ECN infrastructure, which would typically appeal to brokers, liquidity providers, and money managers. However, seasoned market participants prioritize licensing as a gating criterion; operating without recognized authorization materially heightens operational, counterparty, and recourse risk regardless of technical sophistication.

How Unregulated Risk Impacts Traders

Without recognized regulatory supervision, client funds may lack segregation mandates, capital adequacy assurances, and participation in compensation schemes. Dispute resolution becomes harder because standard ombudsman processes and statutory complaint channels depend on the firms license and jurisdictional remit.

Safety Checklist Before Engagement

- Verify licensing directly with top‑tier regulators and public registers; proceed only if a current, verifiable authorization exists.

- Treat marketing claims about speed, liquidity, and scale as secondary to legal status and investor protections when assessing counterparty risk.

Alternatives Often Considered

Comparison panes in the referenced material show users also researching larger, regulated brands with higher scores, such as XM, VT Markets, FP Markets, and AvaTrade. These alternatives are listed with significantly higher risk scores than Fortex, indicating stronger perceived oversight and controls in contrast to Fortexs 1.56/10 standing.

Bottom Line

Fortex advertises robust ECN technology and low‑latency infrastructure, but the absence of any valid regulatory license is a critical red flag that eclipses product claims. Given the verified unregulated status and low risk score, the prudent course is to avoid funding or trading until and unless recognized authorization is obtained and publicly confirmed.

Read more

FCA Warning ALERT List is Out! Checkout to Avoid Scam

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning Alert List- 10 October 2025, alerting forex traders and investors about unauthorized brokers. These firms are operating without the necessary FCA approval. Checkout the full FCA warning ALERT list below.

Zerodha Regulation Check: Risks for Traders

Zerodha operates without valid regulation, posing high risks for traders. Learn the implications, risks, and compliance gaps in this in-depth analysis.

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

Kazakhstan intensifies its crypto regulation, shutting down over 130 illegal exchanges and seizing nearly $17M to combat money laundering and protect consumers.

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

The attempts to bring back Lavish Chaudhary alias “Nawab”, who has been accused of a large forex trading fraud across five states, to India have intensified. The issuance of an Interpol order signals the imminent arrest of the BotBro owner. As per news reports, Nawab is operating from Abu Dhabi along with many of his associates. He also owns the Abu Dhabi Cricket-10 team and is allegedly driving forex trading operations across different countries.

WikiFX Broker

Latest News

The Offshore vs. Onshore Broker Dilemma: Who Can You Really Trust?

XM Revamps Trading Platform with AI

Do Content Creators Need a “License”? A Plain-English Guide to the Finfluencer Idea

Axiory Review Alert: What Traders Must Know

FBS Added AI tool for Rapid Forex Insights

Trading While Traveling – Is It Possible? Digital Nomad Traders Are Making It Reality

RM8.7 Million Lost to Scam Promising US$3 Million Returns Abstract: 57 Malaysians have collectively

Top Forex Regulatory Bodies You Need to Know

Fidelity Global Innovators to High Risk in Jan 2026

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Rate Calc