Beware: Fake Emails Are Posing as IOSCO to Extract Upfront Fees

Abstract:IOSCO warns of fake emails posing as officials to extract “release” fees. See how the scam works and what proves a message is not from IOSCO.

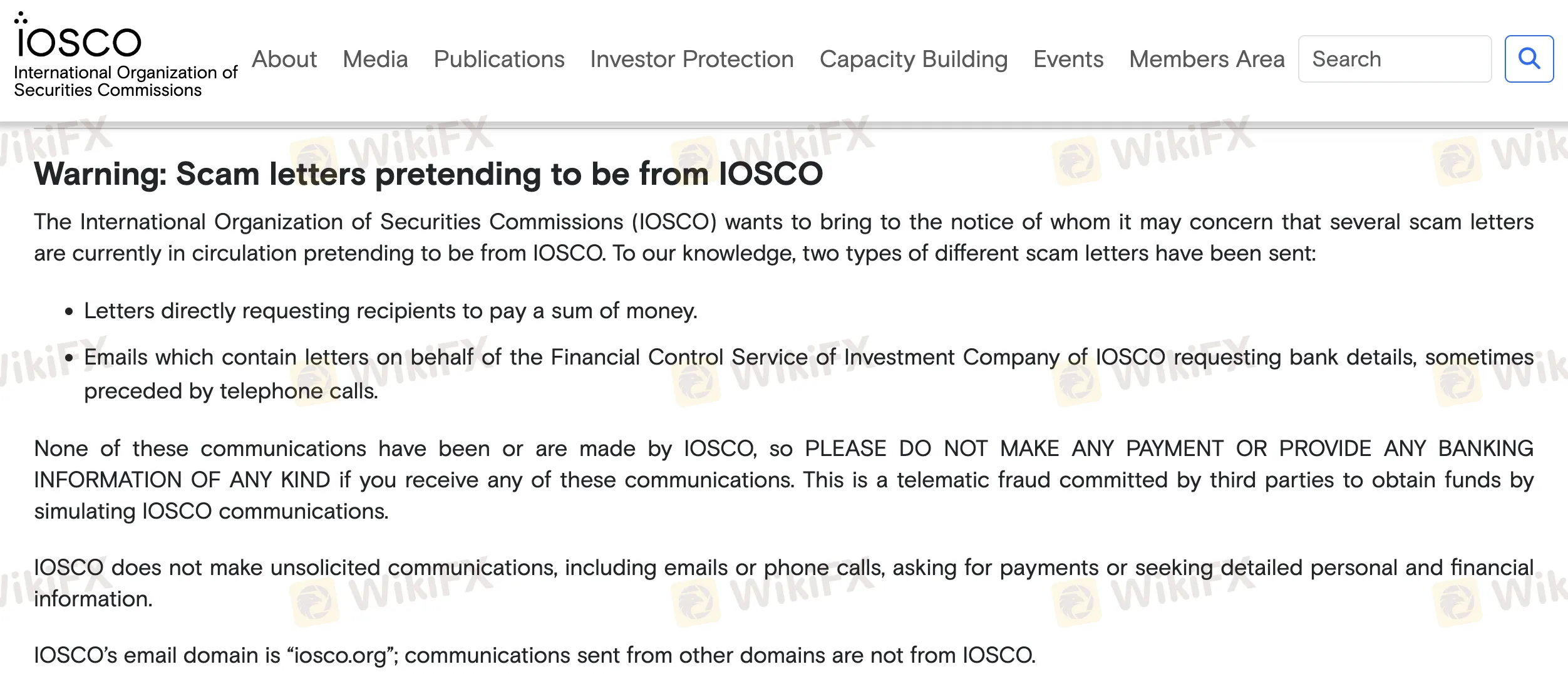

The warning

The International Organization of Securities Commissions (IOSCO) has raised the alarm over a new round of frauds in which criminals present themselves as commission staff and pressure investors to pay “processing” or “release” charges. The approaches include letters that directly ask for money and emails that claim to come from invented departments—one recent example cited a so-called “Financial Control Service of Investment Company of IOSCO”—and then request bank details or copies of personal documents. IOSCO stresses it does not charge fees to unlock funds, does not solicit payments, and communicates only from addresses ending in @iosco.org.

Background: what IOSCO actually is

IOSCO is the global association of securities regulators. It develops common standards for market integrity and investor protection and helps authorities cooperate across borders. It does not license brokers, hold client money, resolve individual disputes, or ask investors to pay for “certificates,” “clearances,” or “fund releases.”

Any message invoking IOSCO and demanding money or sensitive data should be treated as a red flag.

How the hook targets online traders

The pitch is tailored to people active in online markets, including forex and CFDs. Victims are told a final “compliance step” or “clearance” is required before their money can be released, or that a certificate must be issued urgently—if they pay first. Because the notes borrow IOSCO‘s name and tone, and sometimes mimic official formatting, they can look convincing to retail traders who are used to KYC requests and platform notifications. IOSCO’s advisory is unequivocal: if the message asks for money or sensitive data, it isnt from them.

Not just the header: domains and branding tricks

The brand-copying doesnt stop at logos. IOSCO also cautions that web addresses— even financial-sounding endings like .forex, .markets, or .trading—do not prove a website or broker is authorised. For forex and CFD traders, that matters: a polished domain name and a familiar platform template can still sit behind an unregulated operation or a straight impersonation. The takeaway is simple: never infer legitimacy from a URL alone.

Why the scam keeps working

These messages exploit familiar habits: uploading documents, responding quickly to platform prompts, and ticking compliance boxes. By copying the cadence of genuine requests—“final verification,” “funds release,” “account unfreeze”—fraudsters nudge recipients into paying a fee or handing over banking details. The rule of thumb holds: real oversight bodies don‘t ask you to pay to unlock money that is already yours, and they won’t email from look-alike domains.

Read more

Scam Warning: Be Aware of Those Brokers That May Endanger Your Funds

When choosing a forex or CFD broker, regulatory compliance, transparency, and trustworthiness should always come first. Unfortunately, many traders fall victim to unregulated brokers or poorly monitored platforms that put their funds at risk. In this article, we’ll highlight several brokers with low WikiFX scores and serious complaints from traders worldwide. If you’re looking for a safe trading environment, you should be extremely cautious with the following names.

QuoMarkets Exposed: High Slippage, Profit Withholding & Other Scams

Failed to receive unlimited leverage as promised by QuoMarkets? Witnessing higher slippage and a subsequent drop in your trading account balance? Does the forex broker withhold your profits? These have become typical of the way QuoMarkets runs its operations. In this article, we have exposed the forex broker on all these points. Keep reading different QuoMarkets reviews.

Nostro Exposed: Payout Delays & Server Downtime Plague Traders

Have you gone through a scam in your forex trading account balance with Nostro? Do you witness constant server downtime and losses thereafter? Has the customer support team been unresponsive to your queries? Many forex traders have faced these issues and therefore criticized the broker on review platforms. In this Nostro review article, we have pointed out their specific concerns that were not addressed by the India-based forex broker. Keep reading!

Galileo FX Review 2025: About Its Regulation, Reviews & Risks

Galileo FX is a trading robot that runs on platforms like MetaTrader 4 and MetaTrader 5. Check its regulation and decide if it’s a good choice for your investment or not?

WikiFX Broker

Latest News

Assembly of 100 Authoritative Judges Marks Commencement of Second SkyLine Guide Thailand!

QuoMarkets Exposed: High Slippage, Profit Withholding & Other Scams

Nostro Exposed: Payout Delays & Server Downtime Plague Traders

Is OspreyFX Safe and Legit? OspreyFX Login & Regulation

Life Savings Wiped Out: RM900,000 Lost to Scam Syndicate WEALTH EXPLORER

Is Jefferies A Regulated Broker? A Broker’s Review

MondFx Broker Review! 5 Shocking Truth You Must Know!

WikiFX Broker Review | CMC Markets: Is It Trustworthy?

The resilient stock market may be keeping the economy out of a recession

Slowdown Signals: Are Leading Indicators Flashing Red?

Rate Calc